Answered step by step

Verified Expert Solution

Question

1 Approved Answer

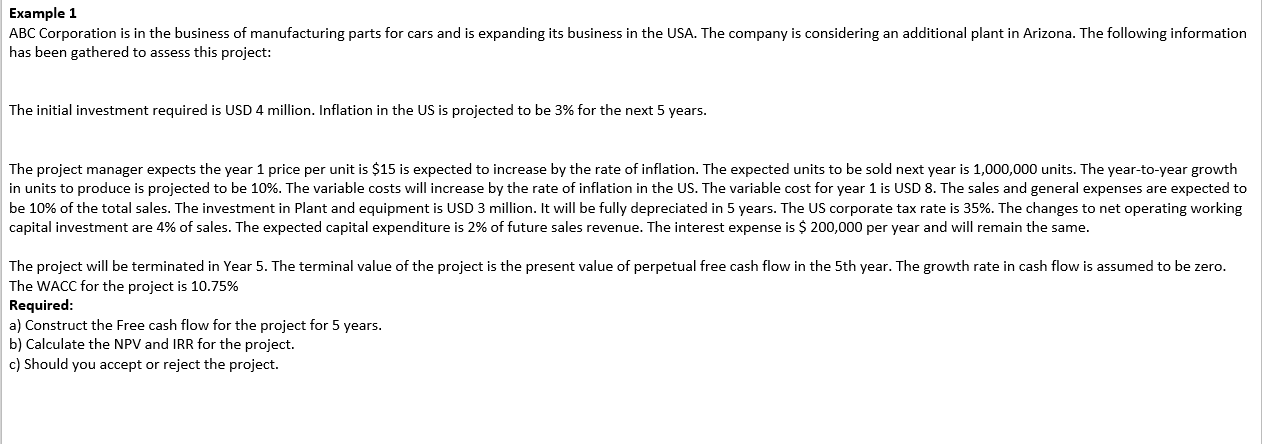

Example 1 has been gathered to assess this project: The initial investment required is USD 4 million. Inflation in the US is projected to be

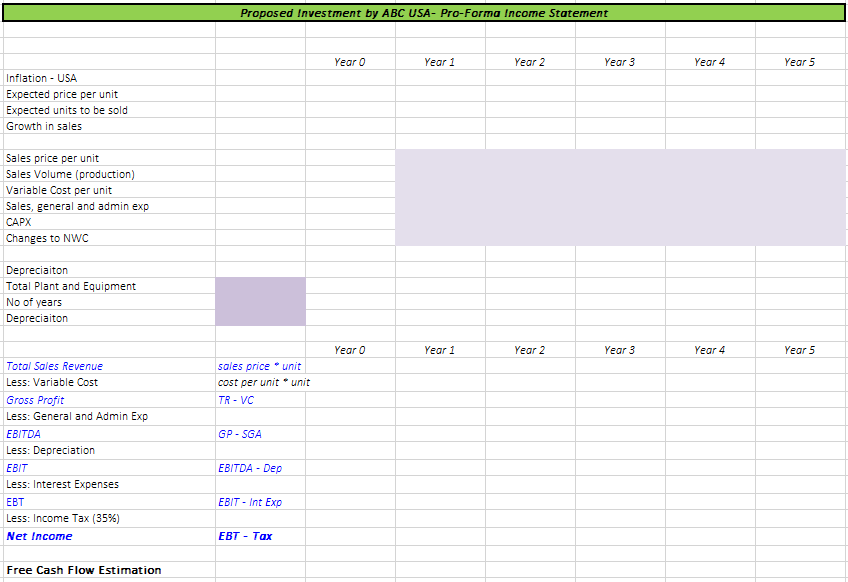

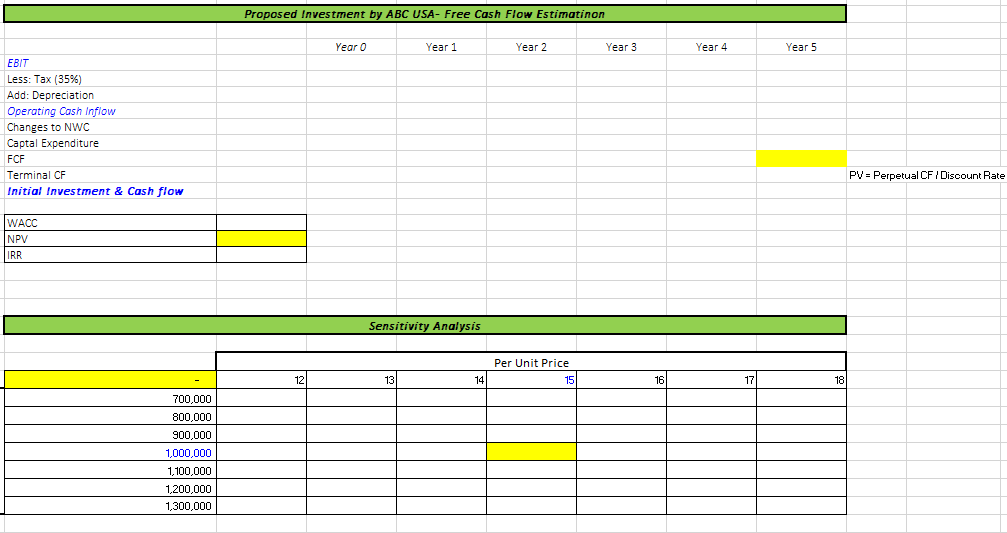

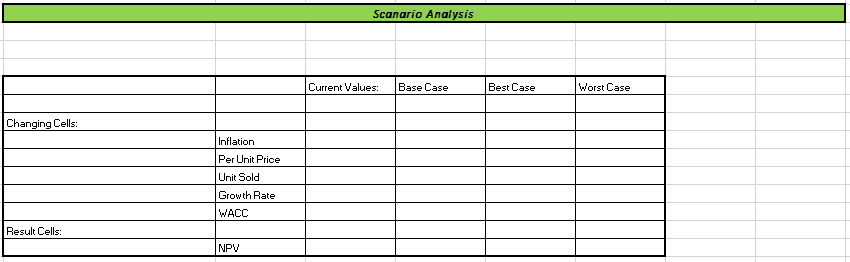

Example 1 has been gathered to assess this project: The initial investment required is USD 4 million. Inflation in the US is projected to be 3% for the next 5 years. The WACC for the project is 10.75% Required: a) Construct the Free cash flow for the project for 5 years. b) Calculate the NPV and IRR for the project. c) Should you accept or reject the project. Proposed Investment by ABC USA-Pro-Forma Income Statement Sales price per unit Sales Volume (production) Variable Cost per unit Sales, general and admin exp CAPX Changes to NWC Depreciaiton Total Plant and Equipment No of years Depreciaiton Free Cash Flow Estimation \begin{tabular}{|l|l|} \hline & \multicolumn{2}{|c}{ Proposed Inv } \\ \hline EBIT & \\ \hline Less: Tax (35\%) & \\ \hline Add: Depreciation \\ \hline Operating Cash Inflow & \\ \hline Changes to NWC \\ \hline Captal Expenditure \\ \hline FCF & \\ \hline Terminal CF & \\ \hline Initial Investment \& Cash flow & \\ \hline WACC & \\ \hline NPV & \\ \hline IRR & \\ \hline \end{tabular} Example 1 has been gathered to assess this project: The initial investment required is USD 4 million. Inflation in the US is projected to be 3% for the next 5 years. The WACC for the project is 10.75% Required: a) Construct the Free cash flow for the project for 5 years. b) Calculate the NPV and IRR for the project. c) Should you accept or reject the project. Proposed Investment by ABC USA-Pro-Forma Income Statement Sales price per unit Sales Volume (production) Variable Cost per unit Sales, general and admin exp CAPX Changes to NWC Depreciaiton Total Plant and Equipment No of years Depreciaiton Free Cash Flow Estimation \begin{tabular}{|l|l|} \hline & \multicolumn{2}{|c}{ Proposed Inv } \\ \hline EBIT & \\ \hline Less: Tax (35\%) & \\ \hline Add: Depreciation \\ \hline Operating Cash Inflow & \\ \hline Changes to NWC \\ \hline Captal Expenditure \\ \hline FCF & \\ \hline Terminal CF & \\ \hline Initial Investment \& Cash flow & \\ \hline WACC & \\ \hline NPV & \\ \hline IRR & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started