Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pointe: 0 of 2 Save investment benker to purchase the needed oil for a delivery price in one year of $ 1 3 0 per

Pointe: of

Save

investment benker to purchase the needed oil for a delivery price in one year of $ per barrel

a Ignoring taxes, what will Specialty's profits be if oil prices in one year are as low as $ or as high as $ assuming that the firm does nol enter into the fompard contract?

b If the firm were to enter into the fonvard contract demonstrate how this would effectively lock in the firm's cost ol fuel loday, thus hedging the risk of fluctuating crude oil prices on the firm's profits for the next year

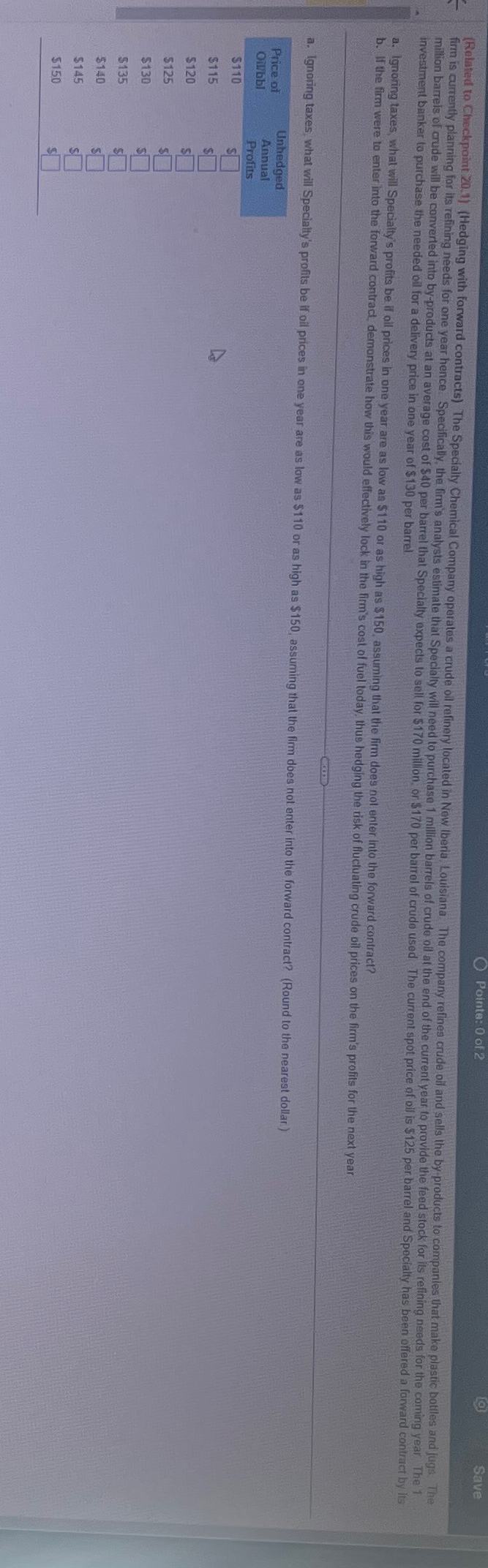

a Ignoring taxes, what will Specialty's profits be if oil prices in one year are as low as $ or as high as $ assuming that the firm does not enter into the forward contract? Round to the nearest dollar.

tabletablePrice ofOillbbtableUnhedgedAnnualProfits$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started