Answered step by step

Verified Expert Solution

Question

1 Approved Answer

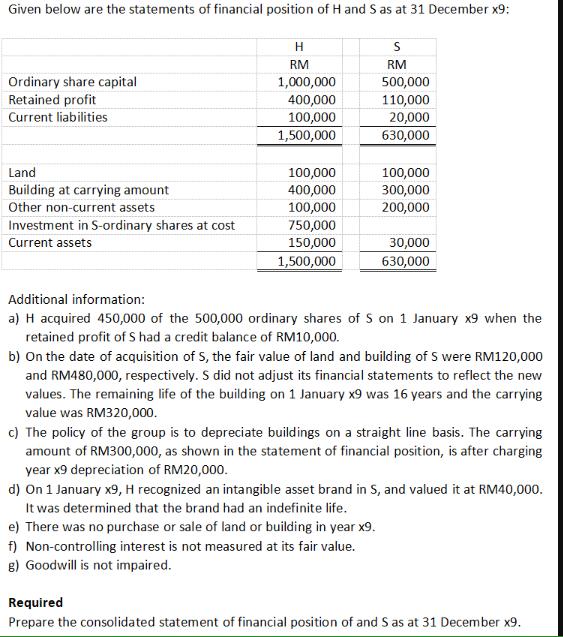

Given below are the statements of financial position of H and S as at 31 December x9: Ordinary share capital Retained profit Current liabilities

Given below are the statements of financial position of H and S as at 31 December x9: Ordinary share capital Retained profit Current liabilities Land Building at carrying amount Other non-current assets Investment in S-ordinary shares at cost Current assets H RM 1,000,000 400,000 100,000 1,500,000 100,000 400,000 100,000 750,000 150,000 1,500,000 S RM 500,000 110,000 20,000 630,000 100,000 300,000 200,000 e) There was no purchase or sale of land or building in year x9. f) Non-controlling interest is not measured at its fair value. g) Goodwill is not impaired. 30,000 630,000 Additional information: a) H acquired 450,000 of the 500,000 ordinary shares of S on 1 January x9 when the retained profit of S had a credit balance of RM10,000. b) On the date of acquisition of S, the fair value of land and building of S were RM120,000 and RM480,000, respectively. S did not adjust its financial statements to reflect the new values. The remaining life of the building on 1 January x9 was 16 years and the carrying value was RM320,000. c) The policy of the group is to depreciate buildings on a straight line basis. The carrying amount of RM300,000, as shown in the statement of financial position, is after charging year x9 depreciation of RM20,000. d) On 1 January x9, H recognized an intangible asset brand in S, and valued it at RM40,000. It was determined that the brand had an indefinite life. Required Prepare the consolidated statement of financial position of and S as at 31 December x9.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the stepbystep workings 1 Adjust retained earnings of S to fair value on acquisition date R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started