Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Example: Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 3.40%, the company's credit Question list risk

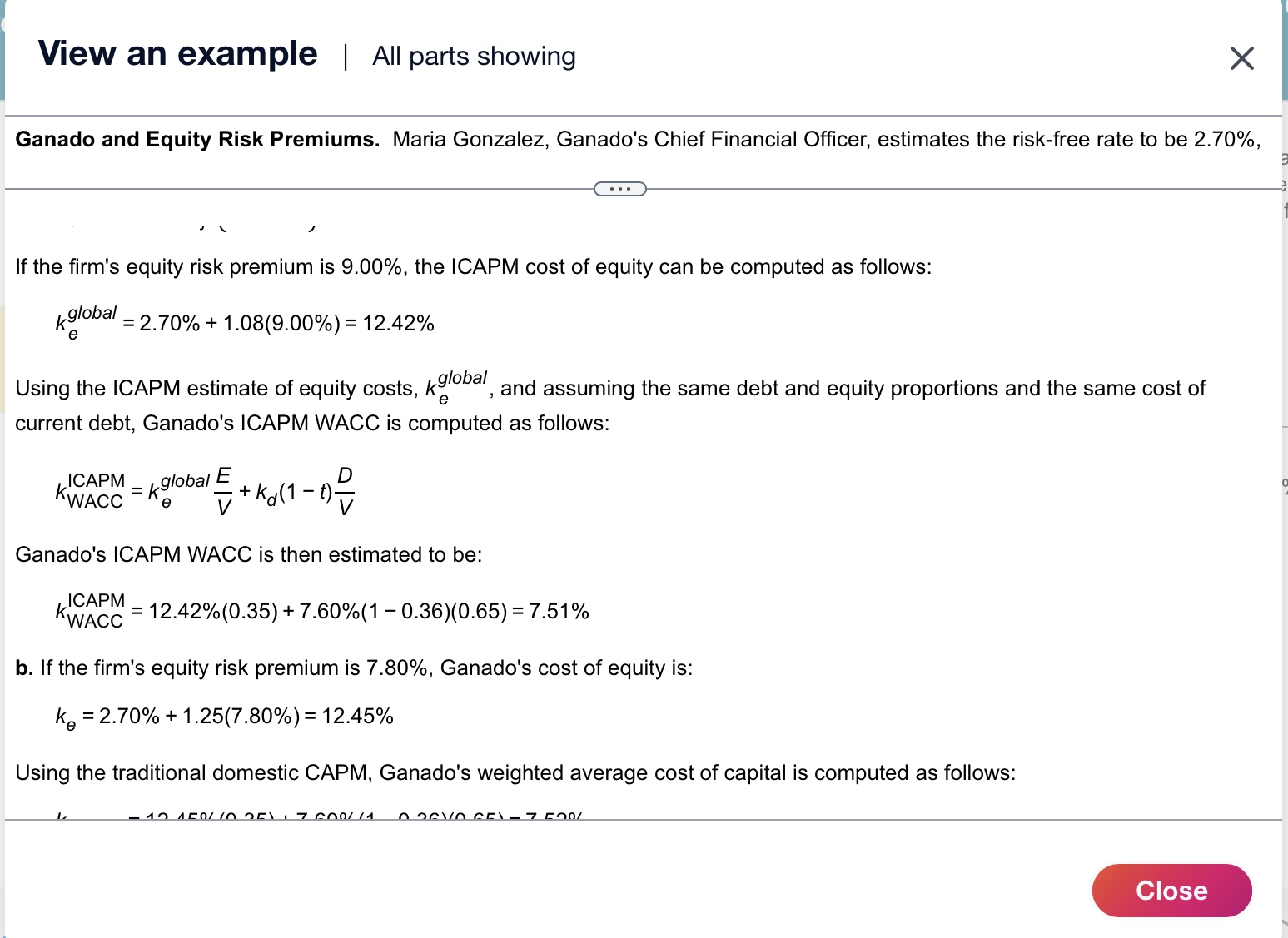

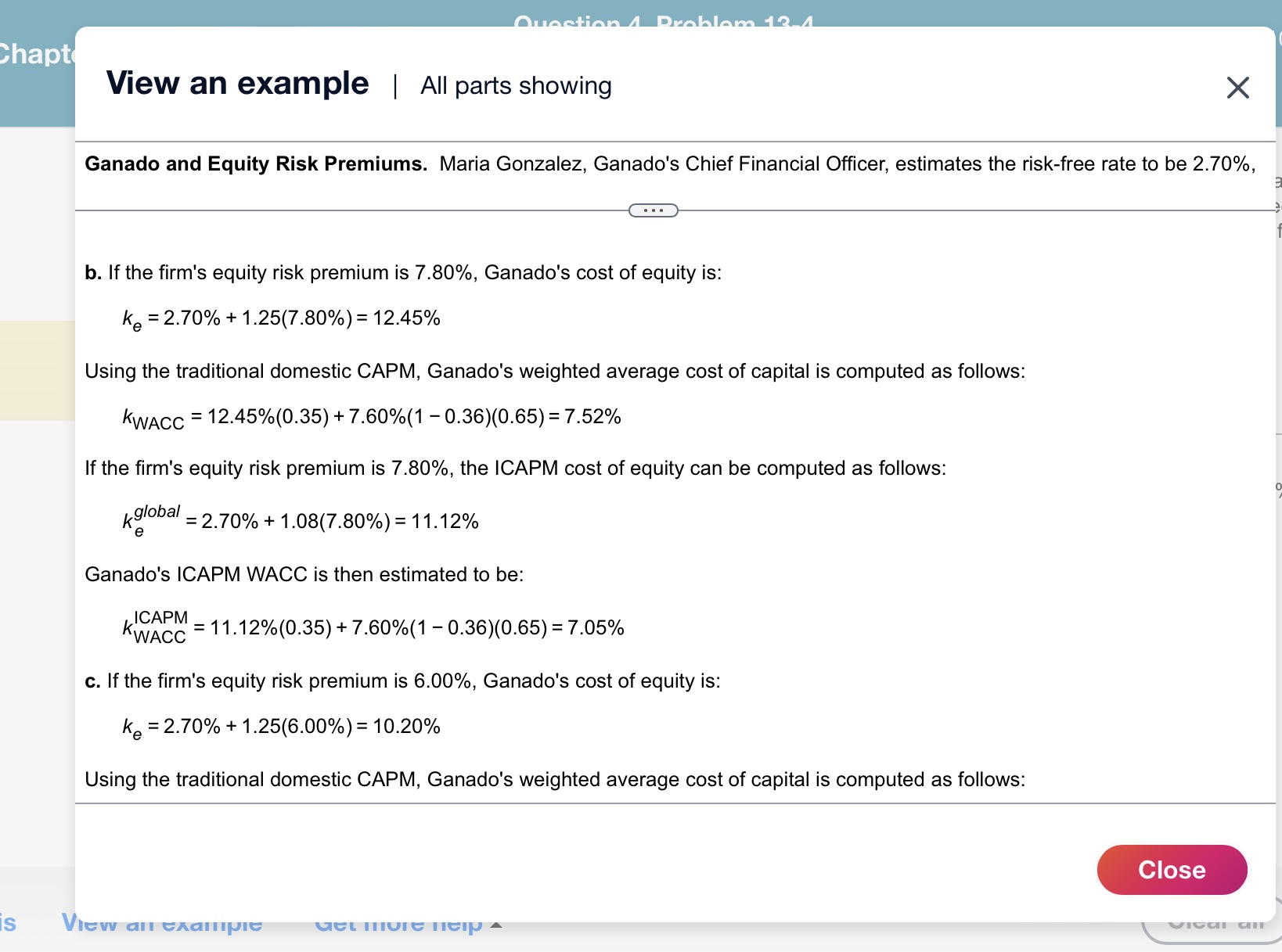

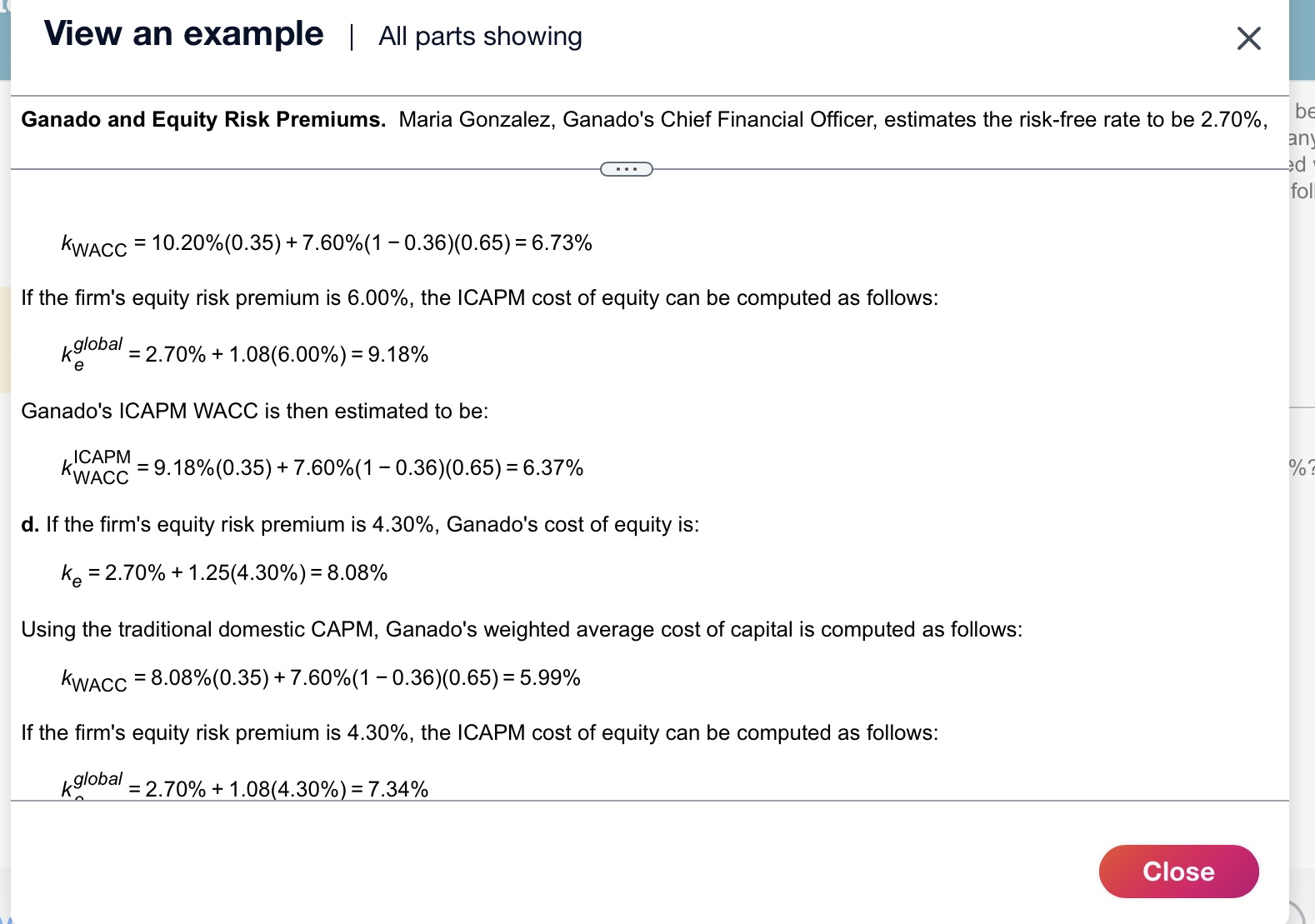

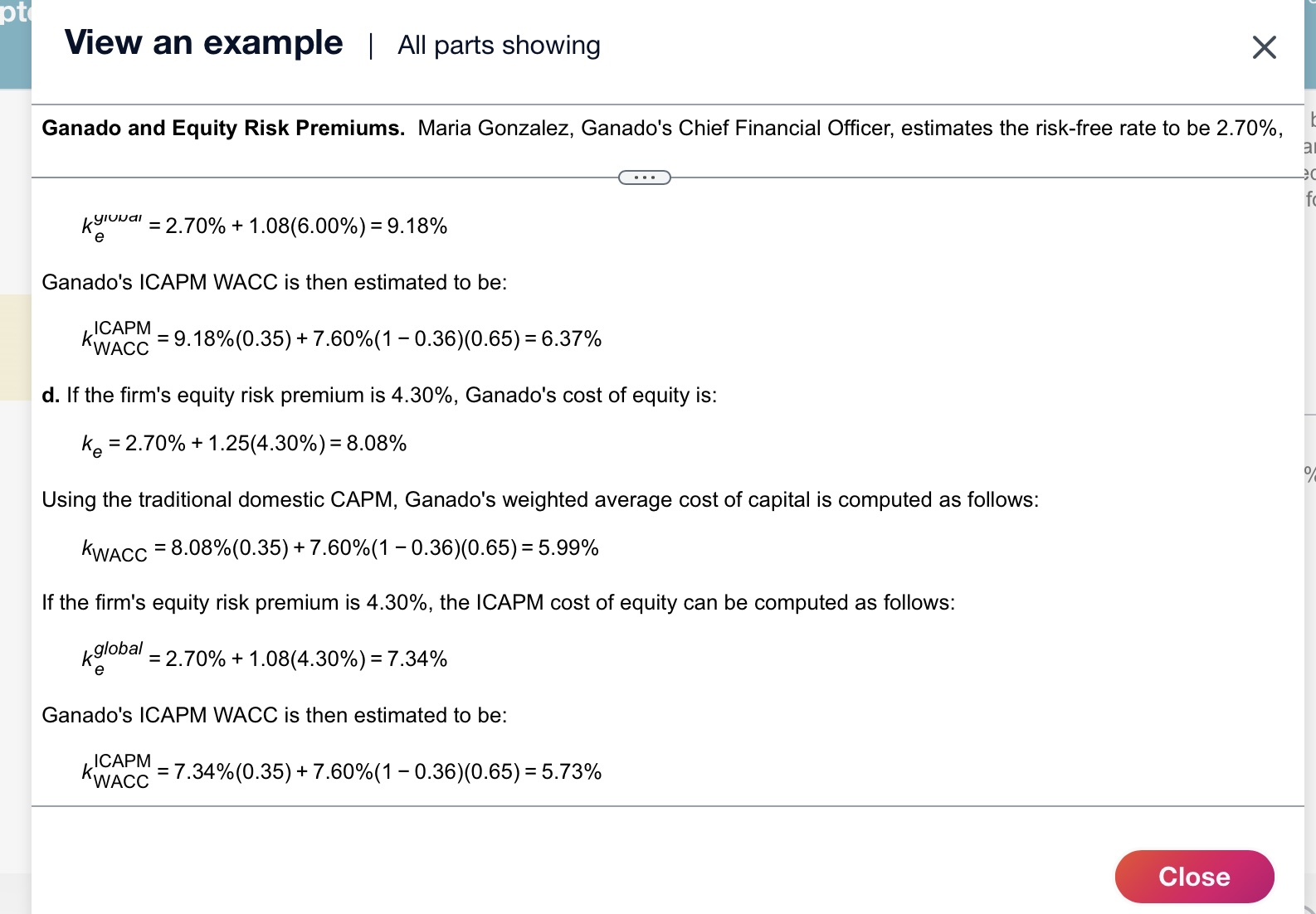

Example:

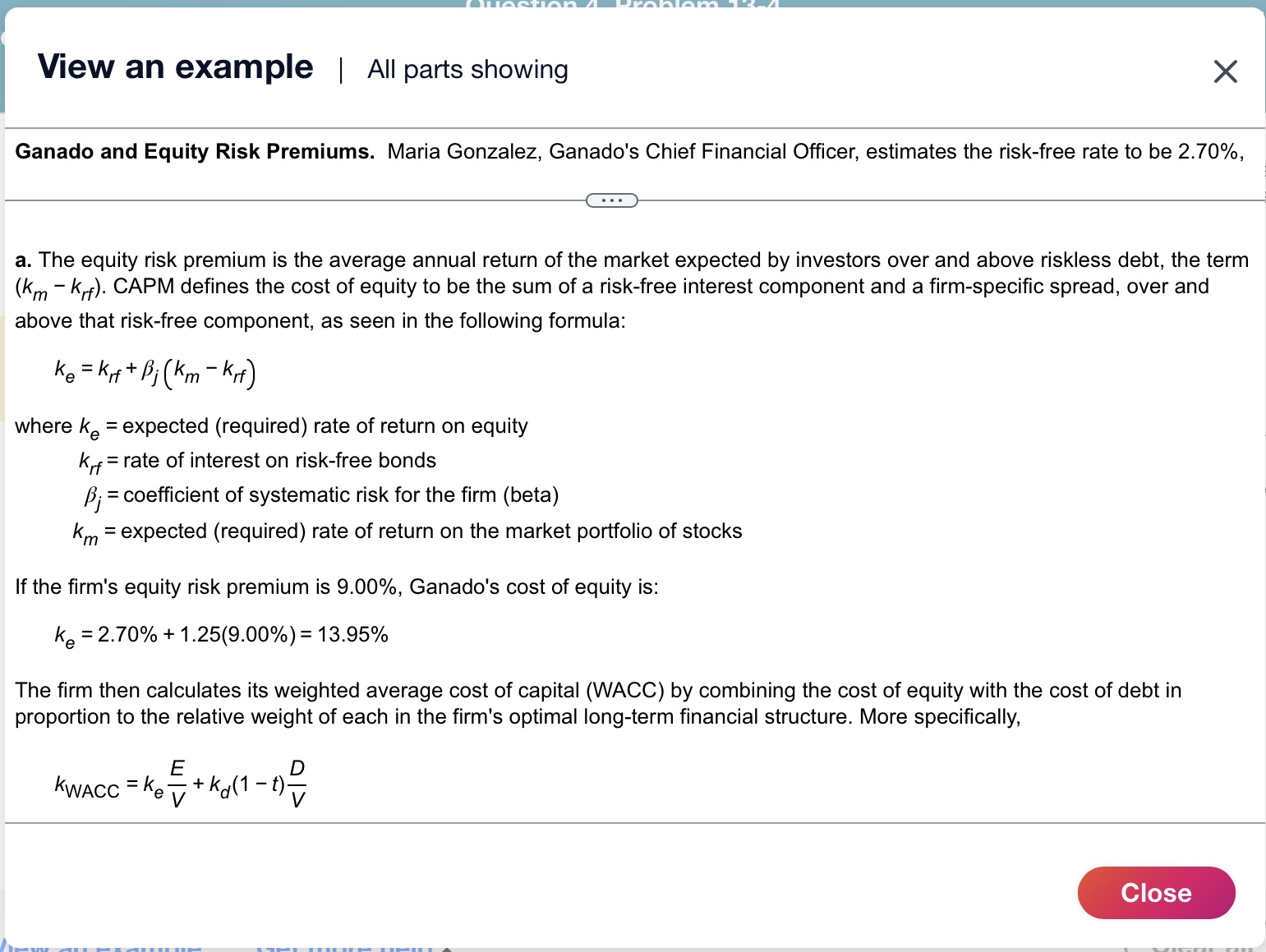

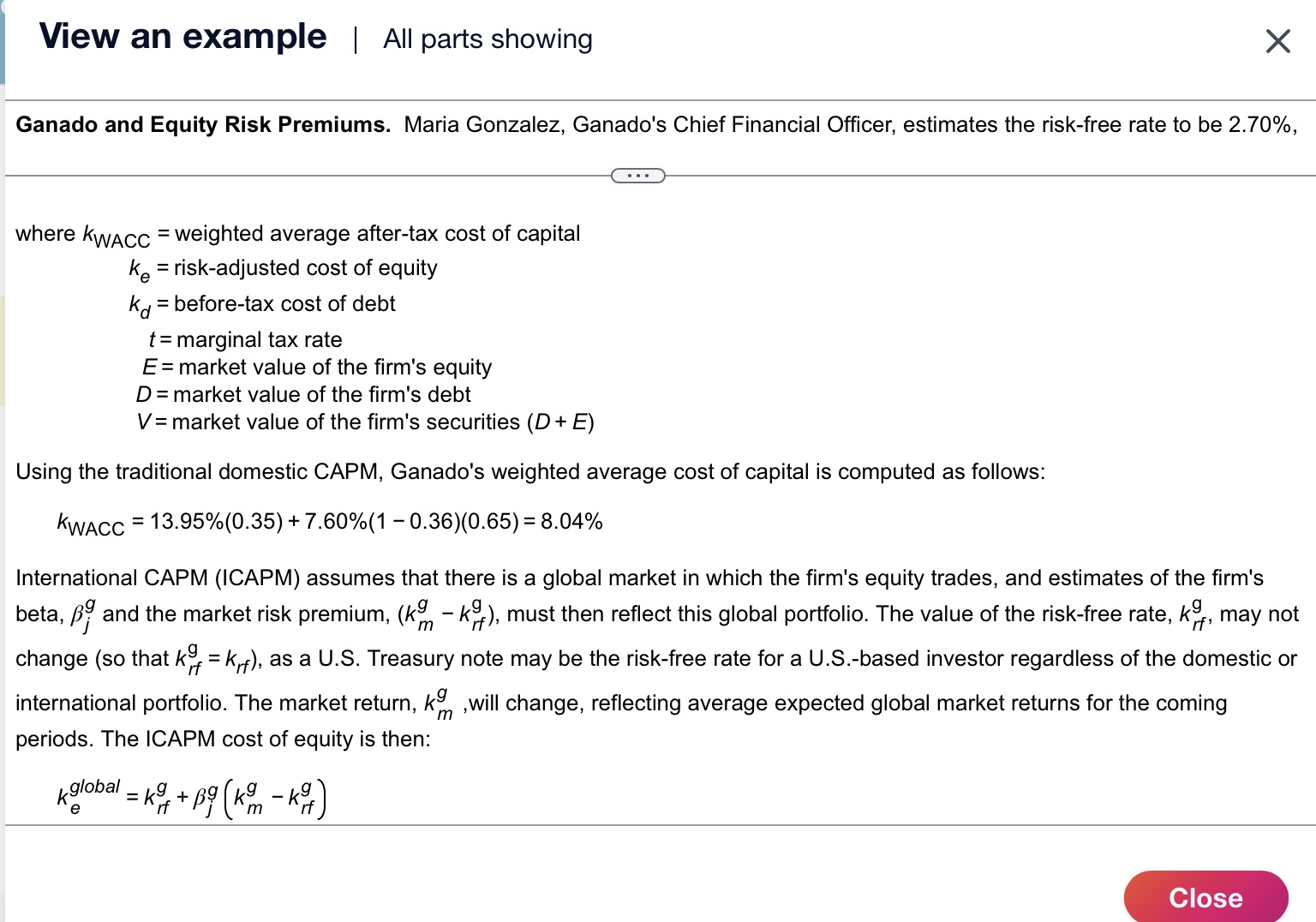

Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 3.40%, the company's credit Question list risk premium is 4.30%, the domestic beta is estimated at 1.17 , the international beta is estimated at 0.83 , and the company's capital structure is now 30% debt. The before-tax cost of debt estimated by observing the current yield on Ganado's outstanding bonds combined with bank debt is 8.50% and the company's effective tax rate is 42%. Calculate both the CAPM and ICAPM weighted average costs of capital for the following equity risk premium estimates. Question 1 a. 8.80% b. 7.70% c. 5.90% Question 2 d. 5.00% x/s Question 3 a. Using the domestic CAPM, what is Ganado's weighted average cost of capital if the firm's equity risk premium is 8.80% ? \% (Round to two decimal places.) Question 4 a. The equity risk premium is the average annual return of the market expected by investors over and above riskless debt, the term (kmkrf). CAPM defines the cost of equity to be the sum of a risk-free interest component and a firm-specific spread, over and above that risk-free component, as seen in the following formula: ke=krf+j(kmkrf) where ke= expected (required) rate of return on equity krf= rate of interest on risk-free bonds j= coefficient of systematic risk for the firm (beta) km= expected (required) rate of return on the market portfolio of stocks If the firm's equity risk premium is 9.00%, Ganado's cost of equity is: ke=2.70%+1.25(9.00%)=13.95% The firm then calculates its weighted average cost of capital (WACC) by combining the cost of equity with the cost of debt in proportion to the relative weight of each in the firm's optimal long-term financial structure. More specifically, kWACC=keVE+kd(1t)VD where kWACC= weighted average after-tax cost of capital ke= risk-adjusted cost of equity kd= before-tax cost of debt t= marginal tax rate E= market value of the firm's equity D= market value of the firm's debt V= market value of the firm's securities (D+E) Using the traditional domestic CAPM, Ganado's weighted average cost of capital is computed as follows: kWACC=13.95%(0.35)+7.60%(10.36)(0.65)=8.04% International CAPM (ICAPM) assumes that there is a global market in which the firm's equity trades, and estimates of the firm's beta, jg and the market risk premium, (kmgkrfg), must then reflect this global portfolio. The value of the risk-free rate, krfg, may not change (so that krfg=krf ), as a U.S. Treasury note may be the risk-free rate for a U.S.-based investor regardless of the domestic or international portfolio. The market return, kmg, will change, reflecting average expected global market returns for the coming periods. The ICAPM cost of equity is then: keglobal=krfg+jg(kmgkrfg) View an example | All parts showing Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 2.70%, If the firm's equity risk premium is 9.00%, the ICAPM cost of equity can be computed as follows: keglobal=2.70%+1.08(9.00%)=12.42% Using the ICAPM estimate of equity costs, keglobal, and assuming the same debt and equity proportions and the same cost of current debt, Ganado's ICAPM WACC is computed as follows: kWACCICAP=keglobalVE+kd(1t)VD Ganado's ICAPM WACC is then estimated to be: kWACCICAPM=12.42%(0.35)+7.60%(10.36)(0.65)=7.51% b. If the firm's equity risk premium is 7.80%, Ganado's cost of equity is: ke=2.70%+1.25(7.80%)=12.45% Using the traditional domestic CAPM, Ganado's weighted average cost of capital is computed as follows: View an example | All parts showing Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 2.70%, b. If the firm's equity risk premium is 7.80%, Ganado's cost of equity is: ke=2.70%+1.25(7.80%)=12.45% Using the traditional domestic CAPM, Ganado's weighted average cost of capital is computed as follows: kWACC=12.45%(0.35)+7.60%(10.36)(0.65)=7.52% If the firm's equity risk premium is 7.80%, the ICAPM cost of equity can be computed as follows: keglobal=2.70%+1.08(7.80%)=11.12% Ganado's ICAPM WACC is then estimated to be: kWACCICAPM=11.12%(0.35)+7.60%(10.36)(0.65)=7.05% c. If the firm's equity risk premium is 6.00%, Ganado's cost of equity is: ke=2.70%+1.25(6.00%)=10.20% kWACC=10.20%(0.35)+7.60%(10.36)(0.65)=6.73% If the firm's equity risk premium is 6.00%, the ICAPM cost of equity can be computed as follows: keglobal=2.70%+1.08(6.00%)=9.18% Ganado's ICAPM WACC is then estimated to be: kWACCICAPM=9.18%(0.35)+7.60%(10.36)(0.65)=6.37% d. If the firm's equity risk premium is 4.30%, Ganado's cost of equity is: ke=2.70%+1.25(4.30%)=8.08% Using the traditional domestic CAPM, Ganado's weighted average cost of capital is computed as f kWACC=8.08%(0.35)+7.60%(10.36)(0.65)=5.99% If the firm's equity risk premium is 4.30%, the ICAPM cost of equity can be computed as follows: knglobal=2.70%+1.08(4.30%)=7.34% View an example | All parts showing Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimate keyuual=2.70%+1.08(6.00%)=9.18% Ganado's ICAPM WACC is then estimated to be: kWACCICAPM=9.18%(0.35)+7.60%(10.36)(0.65)=6.37% d. If the firm's equity risk premium is 4.30%, Ganado's cost of equity is: ke=2.70%+1.25(4.30%)=8.08% Using the traditional domestic CAPM, Ganado's weighted average cost of capital is computed as fo kWACC=8.08%(0.35)+7.60%(10.36)(0.65)=5.99% If the firm's equity risk premium is 4.30%, the ICAPM cost of equity can be computed as follows: keglobal=2.70%+1.08(4.30%)=7.34% Ganado's ICAPM WACC is then estimated to be: kWACCICAPM=7.34%(0.35)+7.60%(10.36)(0.65)=5.73%

Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 3.40%, the company's credit Question list risk premium is 4.30%, the domestic beta is estimated at 1.17 , the international beta is estimated at 0.83 , and the company's capital structure is now 30% debt. The before-tax cost of debt estimated by observing the current yield on Ganado's outstanding bonds combined with bank debt is 8.50% and the company's effective tax rate is 42%. Calculate both the CAPM and ICAPM weighted average costs of capital for the following equity risk premium estimates. Question 1 a. 8.80% b. 7.70% c. 5.90% Question 2 d. 5.00% x/s Question 3 a. Using the domestic CAPM, what is Ganado's weighted average cost of capital if the firm's equity risk premium is 8.80% ? \% (Round to two decimal places.) Question 4 a. The equity risk premium is the average annual return of the market expected by investors over and above riskless debt, the term (kmkrf). CAPM defines the cost of equity to be the sum of a risk-free interest component and a firm-specific spread, over and above that risk-free component, as seen in the following formula: ke=krf+j(kmkrf) where ke= expected (required) rate of return on equity krf= rate of interest on risk-free bonds j= coefficient of systematic risk for the firm (beta) km= expected (required) rate of return on the market portfolio of stocks If the firm's equity risk premium is 9.00%, Ganado's cost of equity is: ke=2.70%+1.25(9.00%)=13.95% The firm then calculates its weighted average cost of capital (WACC) by combining the cost of equity with the cost of debt in proportion to the relative weight of each in the firm's optimal long-term financial structure. More specifically, kWACC=keVE+kd(1t)VD where kWACC= weighted average after-tax cost of capital ke= risk-adjusted cost of equity kd= before-tax cost of debt t= marginal tax rate E= market value of the firm's equity D= market value of the firm's debt V= market value of the firm's securities (D+E) Using the traditional domestic CAPM, Ganado's weighted average cost of capital is computed as follows: kWACC=13.95%(0.35)+7.60%(10.36)(0.65)=8.04% International CAPM (ICAPM) assumes that there is a global market in which the firm's equity trades, and estimates of the firm's beta, jg and the market risk premium, (kmgkrfg), must then reflect this global portfolio. The value of the risk-free rate, krfg, may not change (so that krfg=krf ), as a U.S. Treasury note may be the risk-free rate for a U.S.-based investor regardless of the domestic or international portfolio. The market return, kmg, will change, reflecting average expected global market returns for the coming periods. The ICAPM cost of equity is then: keglobal=krfg+jg(kmgkrfg) View an example | All parts showing Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 2.70%, If the firm's equity risk premium is 9.00%, the ICAPM cost of equity can be computed as follows: keglobal=2.70%+1.08(9.00%)=12.42% Using the ICAPM estimate of equity costs, keglobal, and assuming the same debt and equity proportions and the same cost of current debt, Ganado's ICAPM WACC is computed as follows: kWACCICAP=keglobalVE+kd(1t)VD Ganado's ICAPM WACC is then estimated to be: kWACCICAPM=12.42%(0.35)+7.60%(10.36)(0.65)=7.51% b. If the firm's equity risk premium is 7.80%, Ganado's cost of equity is: ke=2.70%+1.25(7.80%)=12.45% Using the traditional domestic CAPM, Ganado's weighted average cost of capital is computed as follows: View an example | All parts showing Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 2.70%, b. If the firm's equity risk premium is 7.80%, Ganado's cost of equity is: ke=2.70%+1.25(7.80%)=12.45% Using the traditional domestic CAPM, Ganado's weighted average cost of capital is computed as follows: kWACC=12.45%(0.35)+7.60%(10.36)(0.65)=7.52% If the firm's equity risk premium is 7.80%, the ICAPM cost of equity can be computed as follows: keglobal=2.70%+1.08(7.80%)=11.12% Ganado's ICAPM WACC is then estimated to be: kWACCICAPM=11.12%(0.35)+7.60%(10.36)(0.65)=7.05% c. If the firm's equity risk premium is 6.00%, Ganado's cost of equity is: ke=2.70%+1.25(6.00%)=10.20% kWACC=10.20%(0.35)+7.60%(10.36)(0.65)=6.73% If the firm's equity risk premium is 6.00%, the ICAPM cost of equity can be computed as follows: keglobal=2.70%+1.08(6.00%)=9.18% Ganado's ICAPM WACC is then estimated to be: kWACCICAPM=9.18%(0.35)+7.60%(10.36)(0.65)=6.37% d. If the firm's equity risk premium is 4.30%, Ganado's cost of equity is: ke=2.70%+1.25(4.30%)=8.08% Using the traditional domestic CAPM, Ganado's weighted average cost of capital is computed as f kWACC=8.08%(0.35)+7.60%(10.36)(0.65)=5.99% If the firm's equity risk premium is 4.30%, the ICAPM cost of equity can be computed as follows: knglobal=2.70%+1.08(4.30%)=7.34% View an example | All parts showing Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimate keyuual=2.70%+1.08(6.00%)=9.18% Ganado's ICAPM WACC is then estimated to be: kWACCICAPM=9.18%(0.35)+7.60%(10.36)(0.65)=6.37% d. If the firm's equity risk premium is 4.30%, Ganado's cost of equity is: ke=2.70%+1.25(4.30%)=8.08% Using the traditional domestic CAPM, Ganado's weighted average cost of capital is computed as fo kWACC=8.08%(0.35)+7.60%(10.36)(0.65)=5.99% If the firm's equity risk premium is 4.30%, the ICAPM cost of equity can be computed as follows: keglobal=2.70%+1.08(4.30%)=7.34% Ganado's ICAPM WACC is then estimated to be: kWACCICAPM=7.34%(0.35)+7.60%(10.36)(0.65)=5.73% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started