Answered step by step

Verified Expert Solution

Question

1 Approved Answer

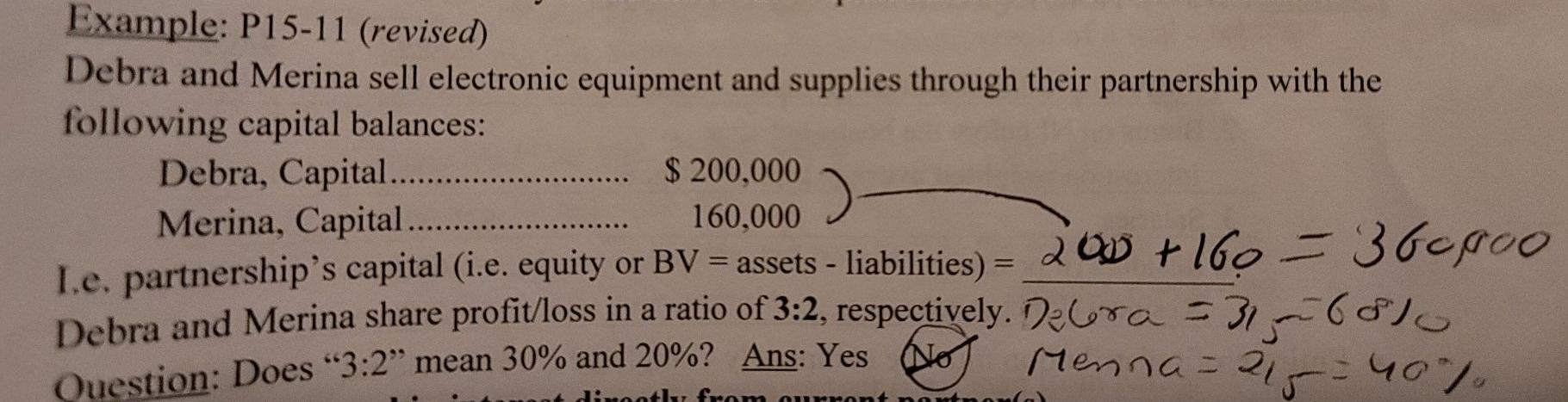

Example: P15-11 (revised) Debra and Merina sell electronic equipment and supplies through their partnership with the following capital balances: Debra, Capital........ $ 200,000 Merina, Capital

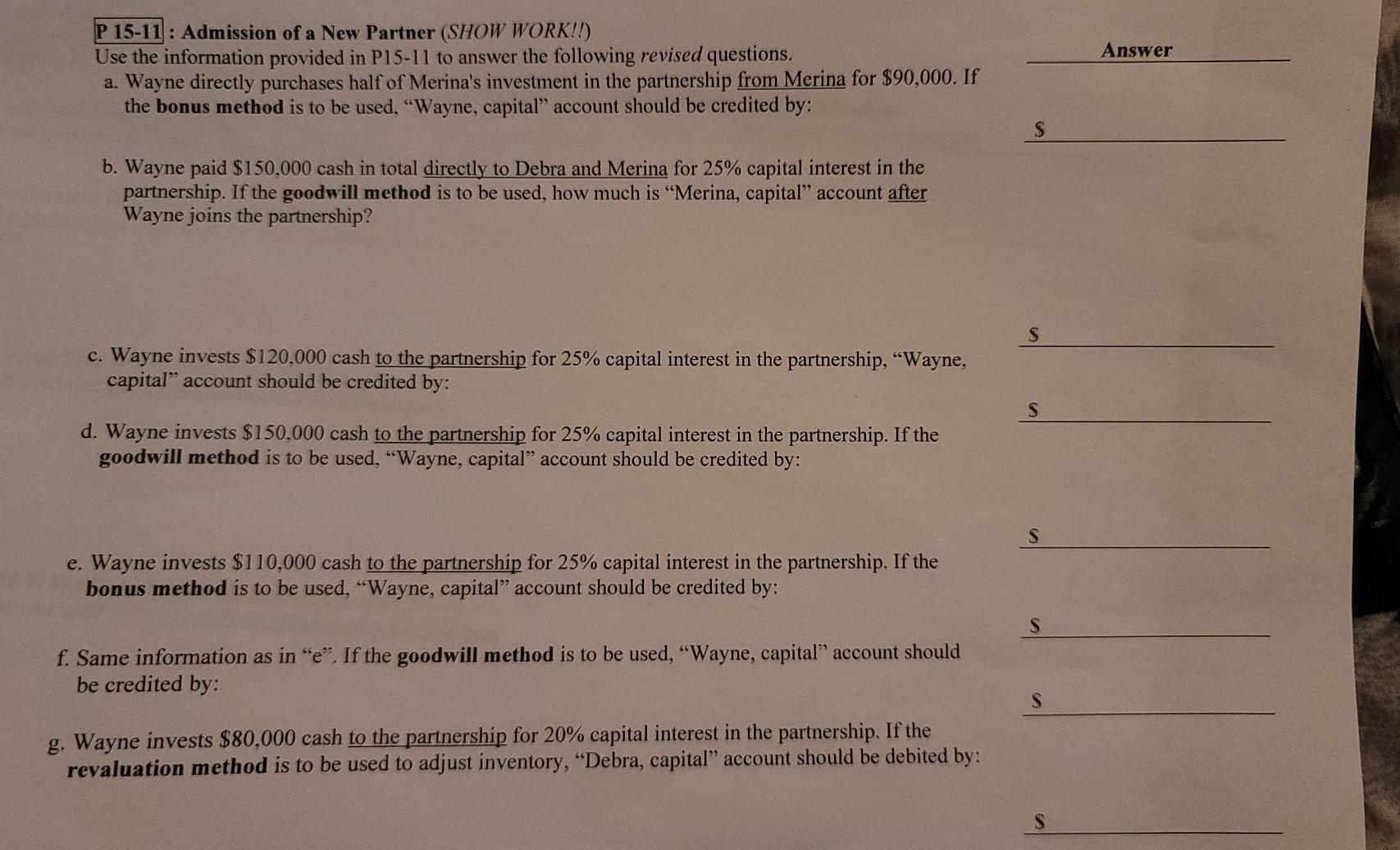

Example: P15-11 (revised) Debra and Merina sell electronic equipment and supplies through their partnership with the following capital balances: Debra, Capital........ $ 200,000 Merina, Capital ......... Le partnership's capital (i.e. equity or BV = assets - liabilities) = 200 + 16o 200 + 160 - 36000o Debra and Merina share profit/loss in a ratio of 3:2, respectively. Decora 531-(0) Question: Does "3:2 mean 30% and 20%? Ans: Yes No Menna=215- 215- 40% 160,000) diretk from aurront Answer P 15-11 : Admission of a New Partner (SHOW WORK!!) Use the information provided in P15-11 to answer the following revised questions. a. Wayne directly purchases half of Merina's investment in the partnership from Merina for $90,000. If the bonus method is to be used, "Wayne, capital account should be credited by: S b. Wayne paid $150,000 cash in total directly to Debra and Merina for 25% capital interest in the partnership. If the goodwill method is to be used, how much is "Merina, capital account after Wayne joins the partnership? S c. Wayne invests $120,000 cash to the partnership for 25% capital interest in the partnership, Wayne, capital account should be credited by: S d. Wayne invests $150,000 cash to the partnership for 25% capital interest in the partnership. If the goodwill method is to be used, Wayne, capital account should be credited by: S e. Wayne invests $110,000 cash to the partnership for 25% capital interest in the partnership. If the bonus method is to be used, Wayne, capital account should be credited by: f. Same information as in "e". If the goodwill method is to be used, "Wayne, capital account should be credited by: g. Wayne invests $80,000 cash to the partnership for 20% capital interest in the partnership. If the revaluation method is to be used to adjust inventory, "Debra, capital" account should be debited by

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started