Answered step by step

Verified Expert Solution

Question

1 Approved Answer

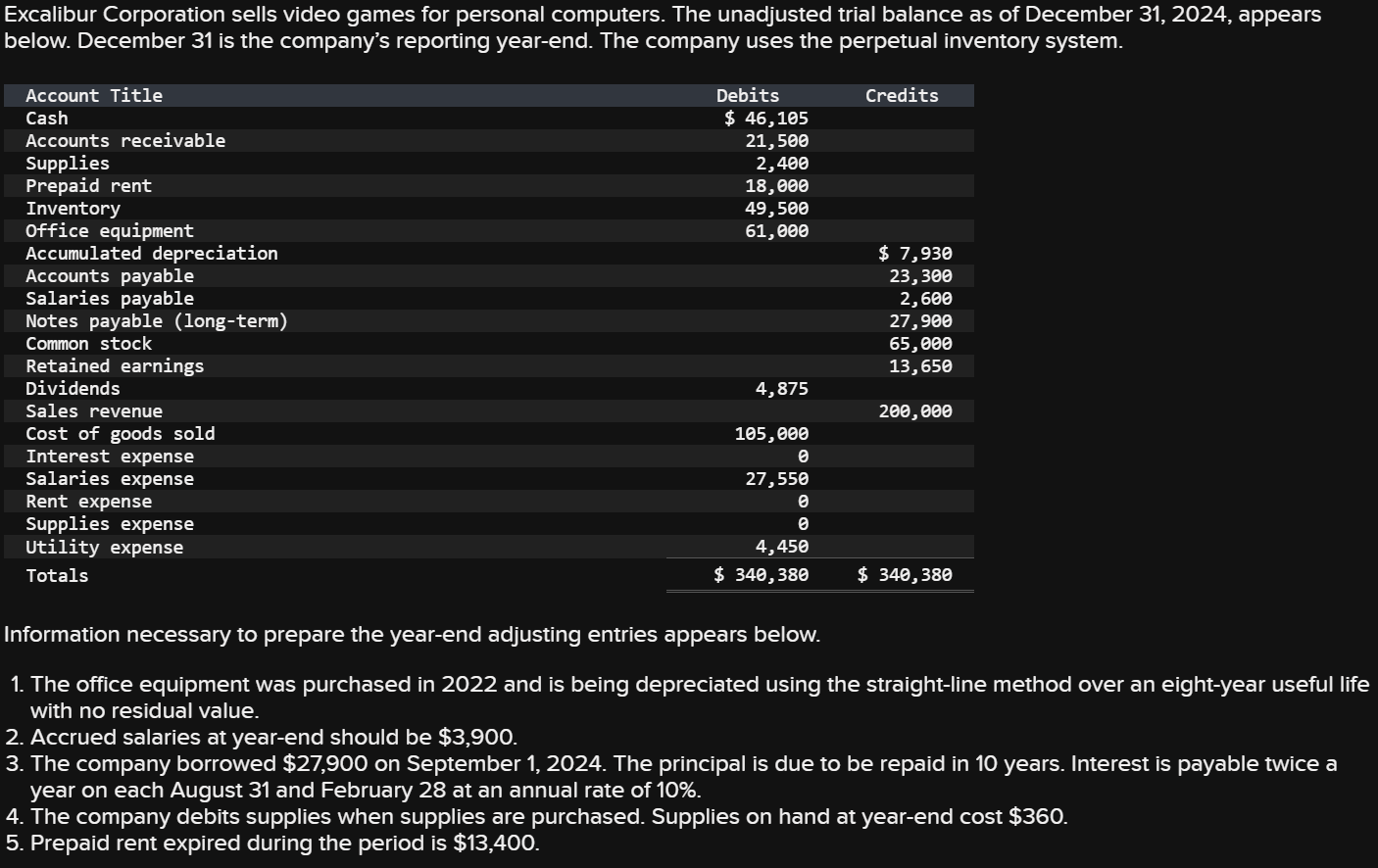

Excalibur Corporation sells video games for personal computers. The unadjusted trial balance as of December 31, 2024, appears below. December 31 is the company's reporting

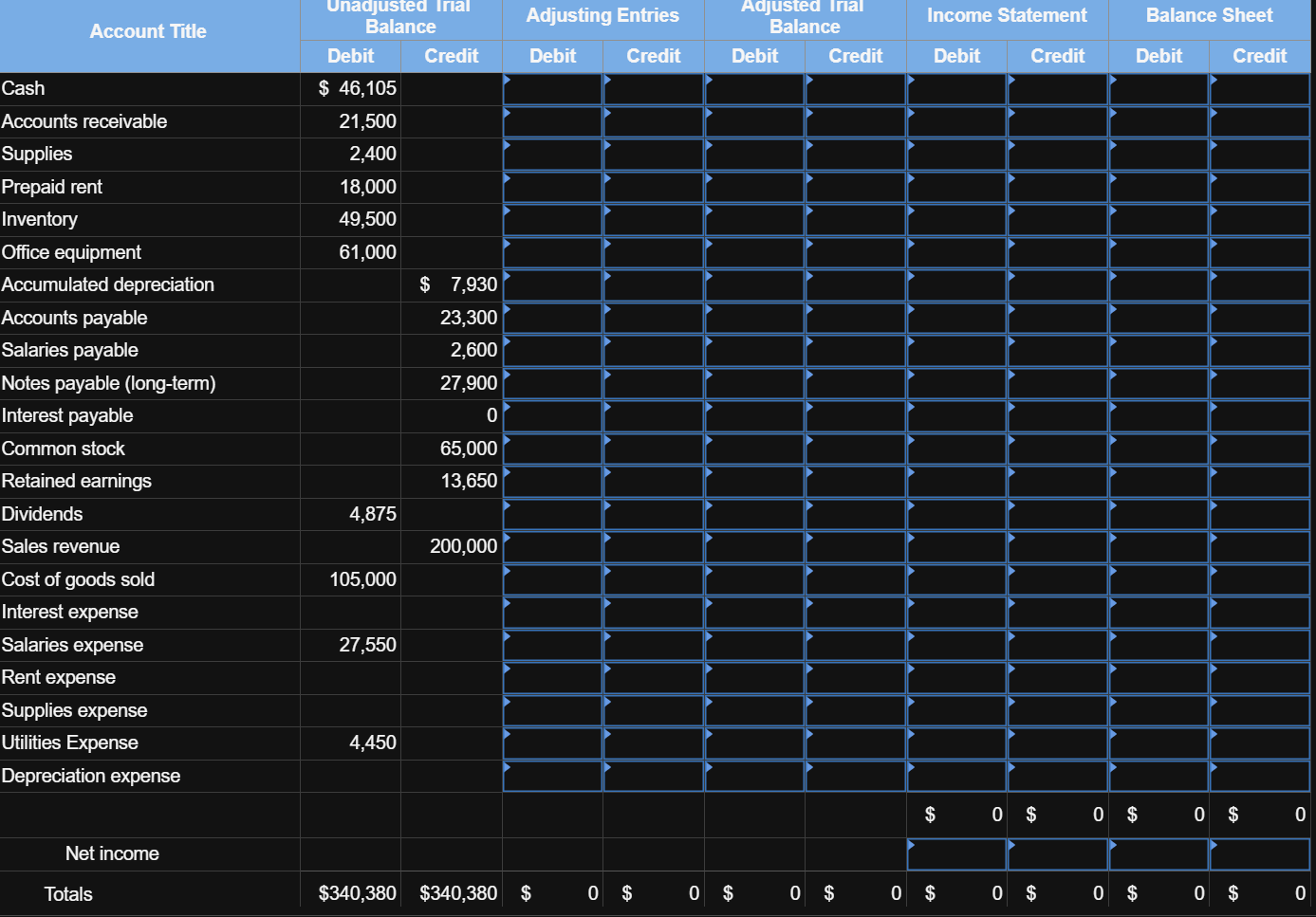

Excalibur Corporation sells video games for personal computers. The unadjusted trial balance as of December 31, 2024, appears below. December 31 is the company's reporting year-end. The company uses the perpetual inventory system. \begin{tabular}{|c|c|c|} \hline Account Title & Debits & Credits \\ \hline Cash & $46,105 & \\ \hline Accounts receivable & 21,500 & \\ \hline Supplies & 2,400 & \\ \hline Prepaid rent & 18,000 & \\ \hline Inventory & 49,500 & \\ \hline Office equipment & 61,000 & \\ \hline Accumulated depreciation & & $7,930 \\ \hline Accounts payable & & 23,300 \\ \hline Salaries payable & & 2,600 \\ \hline Notes payable (long-term) & & 27,900 \\ \hline Common stock & & 65,000 \\ \hline Retained earnings & & 13,650 \\ \hline Dividends & 4,875 & \\ \hline Sales revenue & & 200,00 \\ \hline Cost of goods sold & 105,000 & \\ \hline Interest expense & & \\ \hline Salaries expense & 27,550 & \\ \hline Rent expense & & \\ \hline Supplies expense & & \\ \hline Utility expense & 4,450 & \\ \hline Totals & $340,380 & $340,380 \\ \hline \end{tabular} Information necessary to prepare the year-end adjusting entries appears below. 1. The office equipment was purchased in 2022 and is being depreciated using the straight-line method over an eight-year useful life with no residual value. 2. Accrued salaries at year-end should be $3,900. 3. The company borrowed $27,900 on September 1,2024 . The principal is due to be repaid in 10 years. Interest is payable twice a year on each August 31 and February 28 at an annual rate of 10%. 4. The company debits supplies when supplies are purchased. Supplies on hand at year-end cost $360. 5. Prepaid rent expired during the period is $13,400. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[t]{2}{*}{ Account Title } & \multicolumn{2}{|c|}{\begin{tabular}{l} Unadjusted Irial \\ Balance \end{tabular}} & \multicolumn{2}{|c|}{ Adjusting Entries } & \multicolumn{2}{|c|}{\begin{tabular}{l} Adjusted Irial \\ Balance \end{tabular}} & \multicolumn{2}{|c|}{ Income Statement } & \multicolumn{2}{|c|}{ Balance Sheet } \\ \hline & Debit & Credit & Debit & Credit & Debit & Credit & Debit & Credit & Debit & Credit \\ \hline Cash & $46,105 & & P & & & & & & & \\ \hline Accounts receivable & 21,500 & & p & & & & & & & \\ \hline Supplies & 2,400 & & p & & & & & & & \\ \hline Prepaid rent & 18,000 & & P & & & & & & & \\ \hline Inventory & 49,500 & & P & & & & & & & \\ \hline Office equipment & 61,000 & & p & & & & & & & \\ \hline Accumulated depreciation & & $7,930 & P & & & & & & & \\ \hline Accounts payable & & 23,300 & p & & & & & & & \\ \hline Salaries payable & & 2,600 & P & & & & & & & \\ \hline Notes payable (long-term) & & 27,900 & p & & & & & & & \\ \hline Interest payable & & 0 & & & & & & & & \\ \hline Common stock & & 65,000 & p & & & & & & & \\ \hline Retained earnings & & 13,650 & p & & & & & & & \\ \hline Dividends & 4,875 & & P & & & & & & & \\ \hline Sales revenue & & 200,000 & & & & & & & & \\ \hline Cost of goods sold & 105,000 & & p & & & & & & & \\ \hline Interest expense & & & P & & & & & & & \\ \hline Salaries expense & 27,550 & & P & & & & & & & \\ \hline Rent expense & & & P & & & & & & & \\ \hline Supplies expense & & & p & & & & & & & \\ \hline Utilities Expense & 4,450 & & P & & & & & & & \\ \hline Depreciation expense & & & & & & & & & & \\ \hline & & & & & & & $ & $ & 0 & $ \\ \hline Net income & & & & & & & & & & \\ \hline Totals & $340,380 & $340,380 & $ & $ & $ & $ & $ & $ & $ & $ \\ \hline \end{tabular}

Excalibur Corporation sells video games for personal computers. The unadjusted trial balance as of December 31, 2024, appears below. December 31 is the company's reporting year-end. The company uses the perpetual inventory system. \begin{tabular}{|c|c|c|} \hline Account Title & Debits & Credits \\ \hline Cash & $46,105 & \\ \hline Accounts receivable & 21,500 & \\ \hline Supplies & 2,400 & \\ \hline Prepaid rent & 18,000 & \\ \hline Inventory & 49,500 & \\ \hline Office equipment & 61,000 & \\ \hline Accumulated depreciation & & $7,930 \\ \hline Accounts payable & & 23,300 \\ \hline Salaries payable & & 2,600 \\ \hline Notes payable (long-term) & & 27,900 \\ \hline Common stock & & 65,000 \\ \hline Retained earnings & & 13,650 \\ \hline Dividends & 4,875 & \\ \hline Sales revenue & & 200,00 \\ \hline Cost of goods sold & 105,000 & \\ \hline Interest expense & & \\ \hline Salaries expense & 27,550 & \\ \hline Rent expense & & \\ \hline Supplies expense & & \\ \hline Utility expense & 4,450 & \\ \hline Totals & $340,380 & $340,380 \\ \hline \end{tabular} Information necessary to prepare the year-end adjusting entries appears below. 1. The office equipment was purchased in 2022 and is being depreciated using the straight-line method over an eight-year useful life with no residual value. 2. Accrued salaries at year-end should be $3,900. 3. The company borrowed $27,900 on September 1,2024 . The principal is due to be repaid in 10 years. Interest is payable twice a year on each August 31 and February 28 at an annual rate of 10%. 4. The company debits supplies when supplies are purchased. Supplies on hand at year-end cost $360. 5. Prepaid rent expired during the period is $13,400. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[t]{2}{*}{ Account Title } & \multicolumn{2}{|c|}{\begin{tabular}{l} Unadjusted Irial \\ Balance \end{tabular}} & \multicolumn{2}{|c|}{ Adjusting Entries } & \multicolumn{2}{|c|}{\begin{tabular}{l} Adjusted Irial \\ Balance \end{tabular}} & \multicolumn{2}{|c|}{ Income Statement } & \multicolumn{2}{|c|}{ Balance Sheet } \\ \hline & Debit & Credit & Debit & Credit & Debit & Credit & Debit & Credit & Debit & Credit \\ \hline Cash & $46,105 & & P & & & & & & & \\ \hline Accounts receivable & 21,500 & & p & & & & & & & \\ \hline Supplies & 2,400 & & p & & & & & & & \\ \hline Prepaid rent & 18,000 & & P & & & & & & & \\ \hline Inventory & 49,500 & & P & & & & & & & \\ \hline Office equipment & 61,000 & & p & & & & & & & \\ \hline Accumulated depreciation & & $7,930 & P & & & & & & & \\ \hline Accounts payable & & 23,300 & p & & & & & & & \\ \hline Salaries payable & & 2,600 & P & & & & & & & \\ \hline Notes payable (long-term) & & 27,900 & p & & & & & & & \\ \hline Interest payable & & 0 & & & & & & & & \\ \hline Common stock & & 65,000 & p & & & & & & & \\ \hline Retained earnings & & 13,650 & p & & & & & & & \\ \hline Dividends & 4,875 & & P & & & & & & & \\ \hline Sales revenue & & 200,000 & & & & & & & & \\ \hline Cost of goods sold & 105,000 & & p & & & & & & & \\ \hline Interest expense & & & P & & & & & & & \\ \hline Salaries expense & 27,550 & & P & & & & & & & \\ \hline Rent expense & & & P & & & & & & & \\ \hline Supplies expense & & & p & & & & & & & \\ \hline Utilities Expense & 4,450 & & P & & & & & & & \\ \hline Depreciation expense & & & & & & & & & & \\ \hline & & & & & & & $ & $ & 0 & $ \\ \hline Net income & & & & & & & & & & \\ \hline Totals & $340,380 & $340,380 & $ & $ & $ & $ & $ & $ & $ & $ \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started