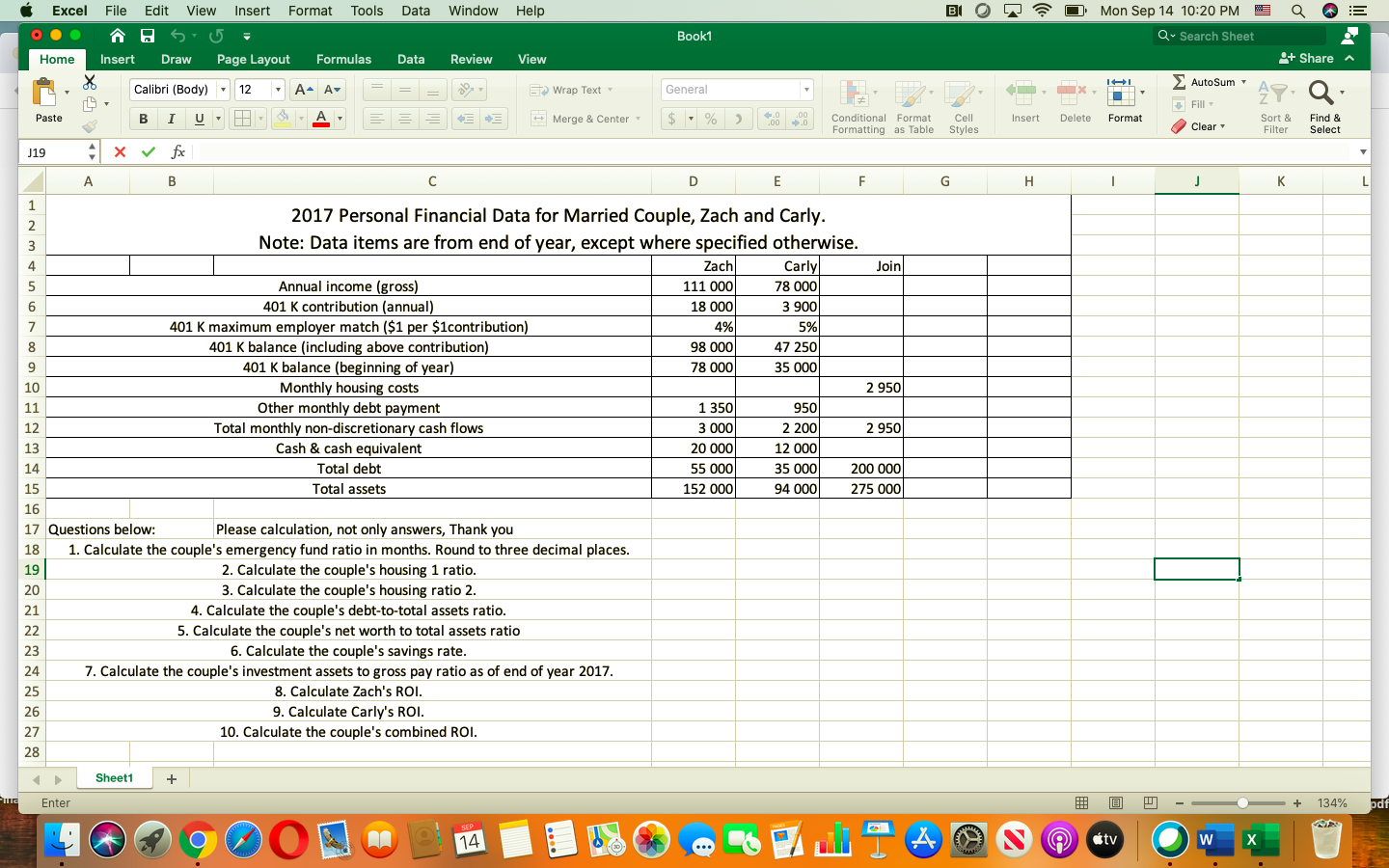

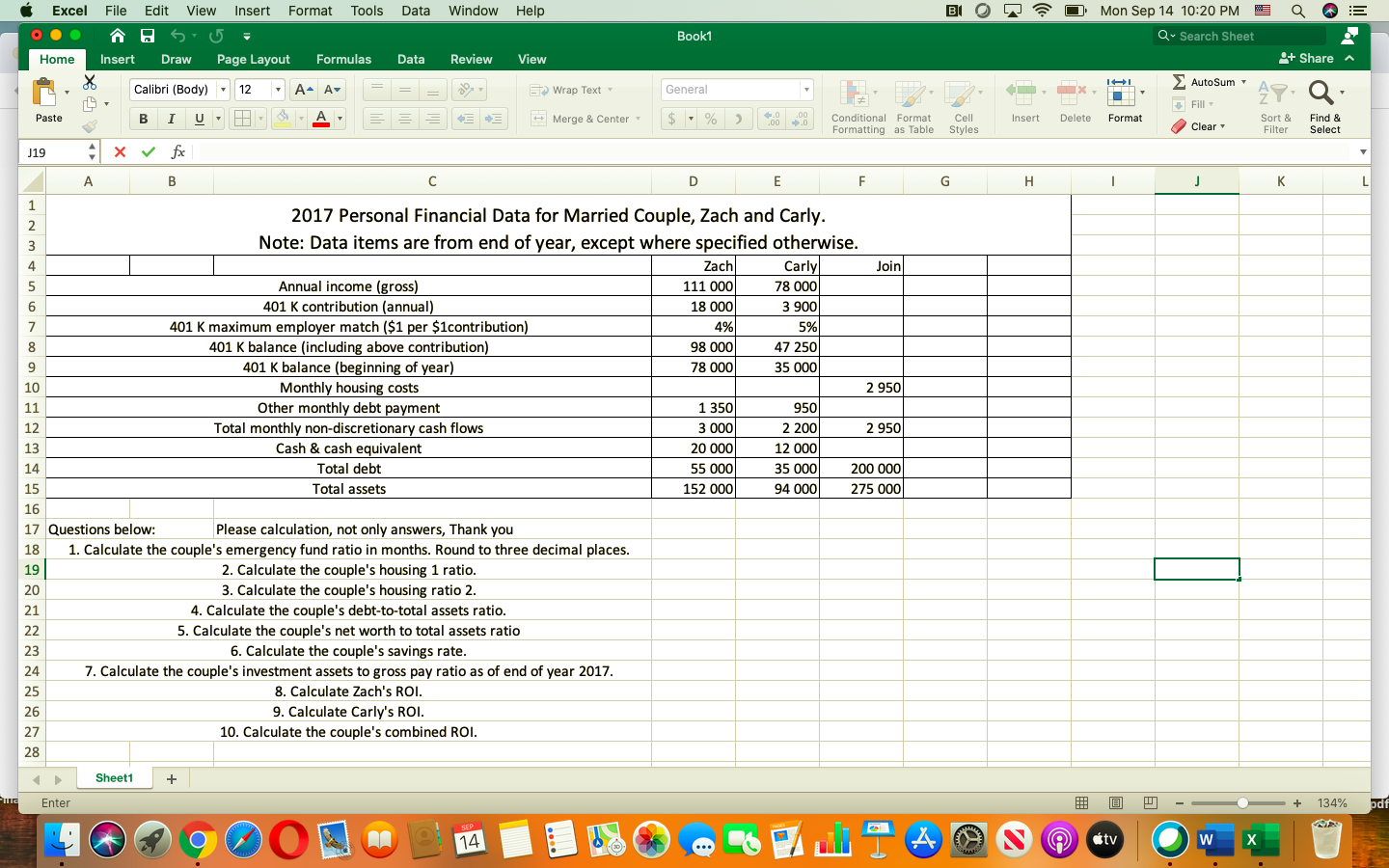

Excel File Edit View Insert Format Tools Data Window Help Mon Sep 14 10:20 PM W a ! Book1 Q- Search Sheet Home Insert Draw Page Layout Formulas Data Review View + Share a AutoSum Calibri (Body) - 12 A- A Wrap Text General 49. Q L - Fill Paste B I A Merge & Center $ % od 20 Insert Delete Format Conditional Format Cell Formatting as Table Styles Clear Sort & Filter Find & Select J19 X fx B D E F G H J K L 1 2017 Personal Financial Data for Married couple, Zach and Carly. 2 3 Note: Data items are from end of year, except where specified otherwise. 4. Zach Carly Join 5 Annual income (gross) 111 000 78 000 6 401 K contribution (annual) 18 000 3 900 7 401 k maximum employer match ($1 per $1contribution) 4% 5% 8 401 K balance (including above contribution) 98 000 47 250 9 401 K balance (beginning of year) 78 000 35 000 10 Monthly housing costs 2 950 11 Other monthly debt payment 1 350 9501 12 Total monthly non-discretionary cash flows 3 000 2 200 2 9501 13 Cash & cash equivalent 20 000 12 000 14 Total debt 55 000 35 000 200 000 15 Total assets 152 000 94 000 275 000 16 17 Questions below: Please calculation, not only answers, Thank you 18 1. Calculate the couple's emergency fund ratio in months. Round to three decimal places. 19 2. Calculate the couple's housing 1 ratio. 20 3. Calculate the couple's housing ratio 2. 21 4. Calculate the couple's debt-to-total assets ratio. 22 5. Calculate the couple's net worth to total assets ratio 23 6. Calculate the couple's savings rate. 24 7. Calculate the couple's investment assets to gross pay ratio as of end of year 2017. 25 8. Calculate Zach's ROI. 26 9. Calculate Carly's ROI. 27 10. Calculate the couple's combined ROI. 28 Sheet1 + mg Enter 134% pdf M 14 (tv W Excel File Edit View Insert Format Tools Data Window Help Mon Sep 14 10:20 PM W a ! Book1 Q- Search Sheet Home Insert Draw Page Layout Formulas Data Review View + Share a AutoSum Calibri (Body) - 12 A- A Wrap Text General 49. Q L - Fill Paste B I A Merge & Center $ % od 20 Insert Delete Format Conditional Format Cell Formatting as Table Styles Clear Sort & Filter Find & Select J19 X fx B D E F G H J K L 1 2017 Personal Financial Data for Married couple, Zach and Carly. 2 3 Note: Data items are from end of year, except where specified otherwise. 4. Zach Carly Join 5 Annual income (gross) 111 000 78 000 6 401 K contribution (annual) 18 000 3 900 7 401 k maximum employer match ($1 per $1contribution) 4% 5% 8 401 K balance (including above contribution) 98 000 47 250 9 401 K balance (beginning of year) 78 000 35 000 10 Monthly housing costs 2 950 11 Other monthly debt payment 1 350 9501 12 Total monthly non-discretionary cash flows 3 000 2 200 2 9501 13 Cash & cash equivalent 20 000 12 000 14 Total debt 55 000 35 000 200 000 15 Total assets 152 000 94 000 275 000 16 17 Questions below: Please calculation, not only answers, Thank you 18 1. Calculate the couple's emergency fund ratio in months. Round to three decimal places. 19 2. Calculate the couple's housing 1 ratio. 20 3. Calculate the couple's housing ratio 2. 21 4. Calculate the couple's debt-to-total assets ratio. 22 5. Calculate the couple's net worth to total assets ratio 23 6. Calculate the couple's savings rate. 24 7. Calculate the couple's investment assets to gross pay ratio as of end of year 2017. 25 8. Calculate Zach's ROI. 26 9. Calculate Carly's ROI. 27 10. Calculate the couple's combined ROI. 28 Sheet1 + mg Enter 134% pdf M 14 (tv W