Answered step by step

Verified Expert Solution

Question

1 Approved Answer

excel format Required information [The following information applies to the questions displayed below] Cane Company manufactures two products called Alpha and Beta that sell for

excel format

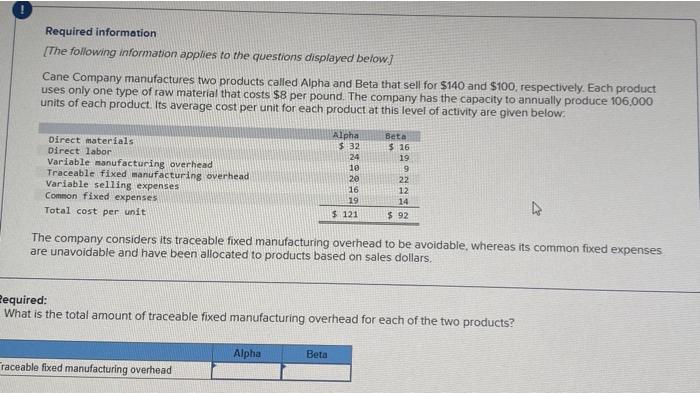

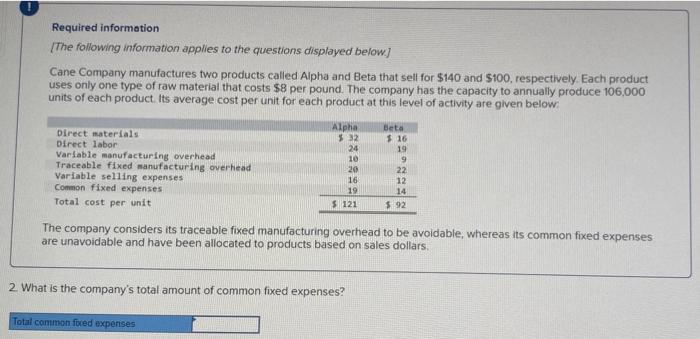

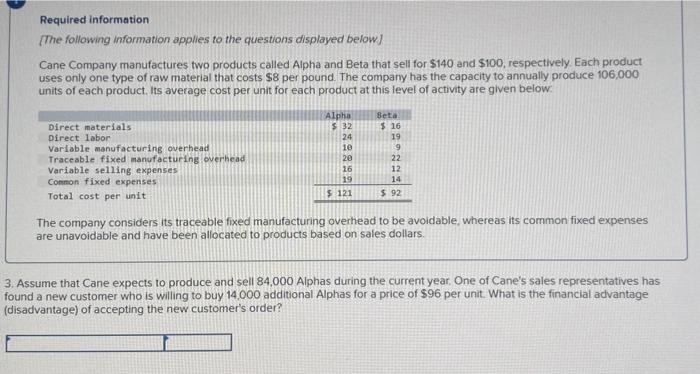

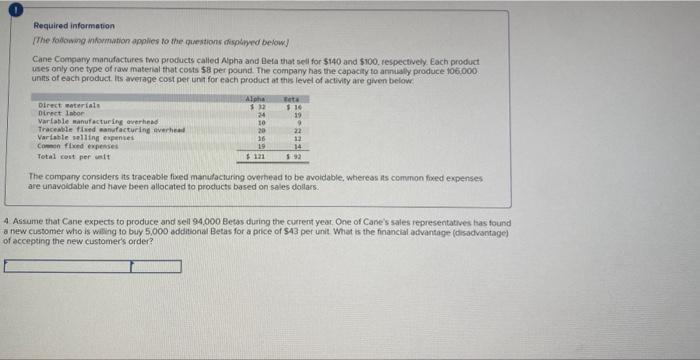

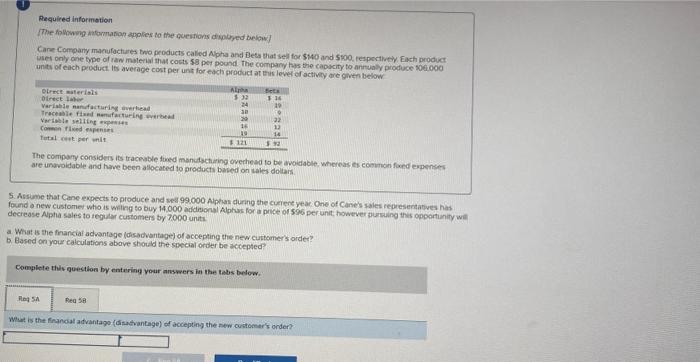

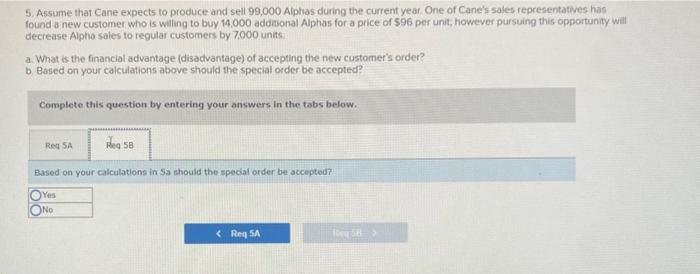

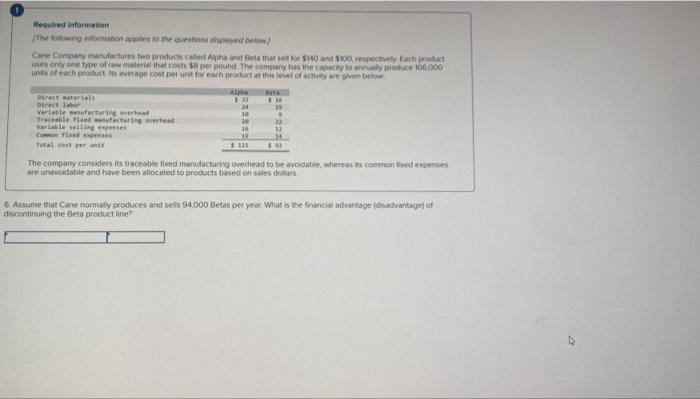

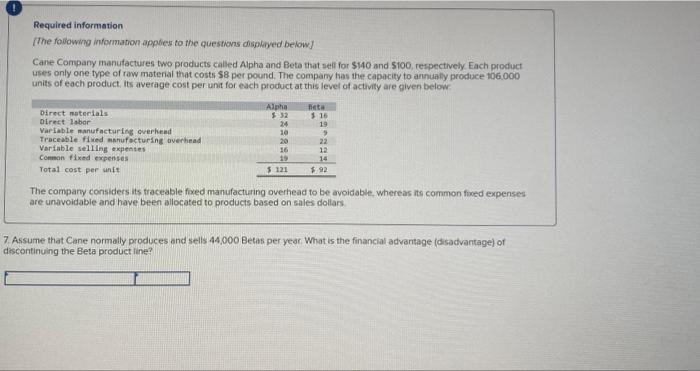

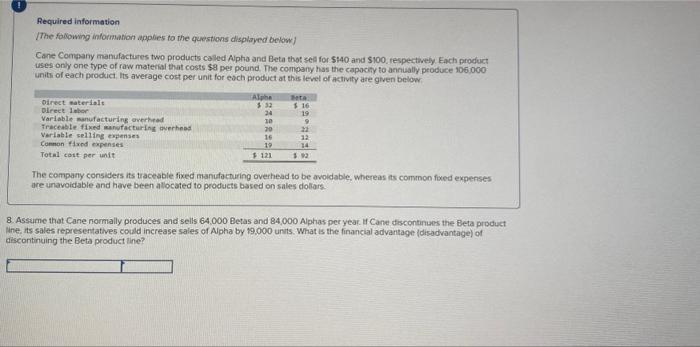

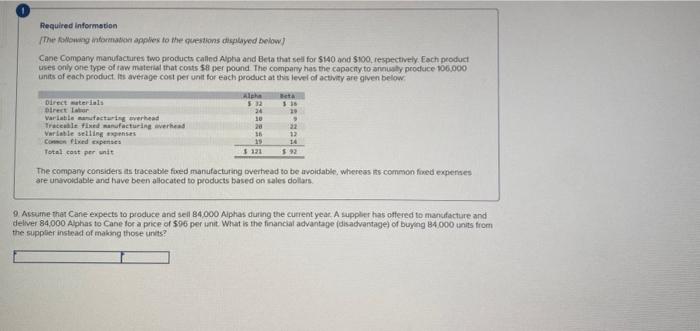

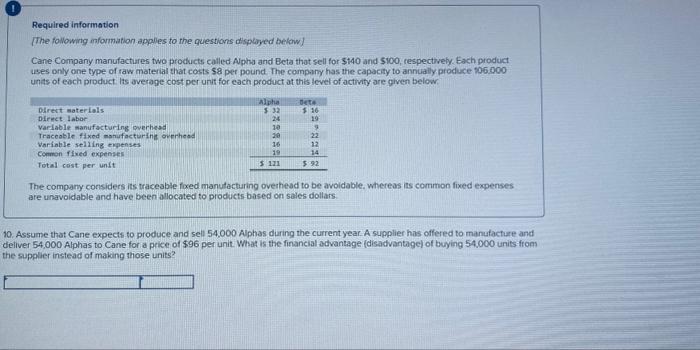

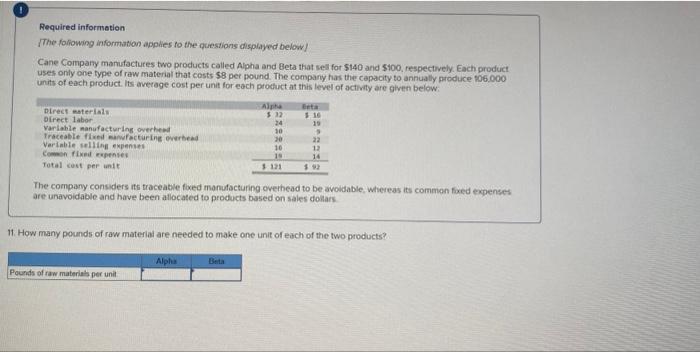

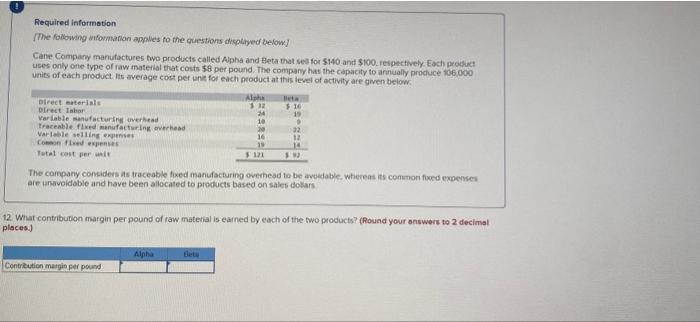

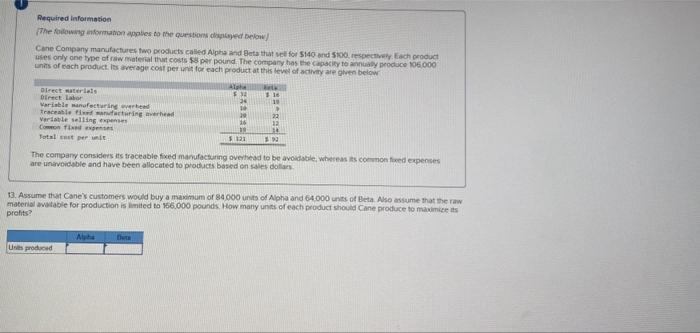

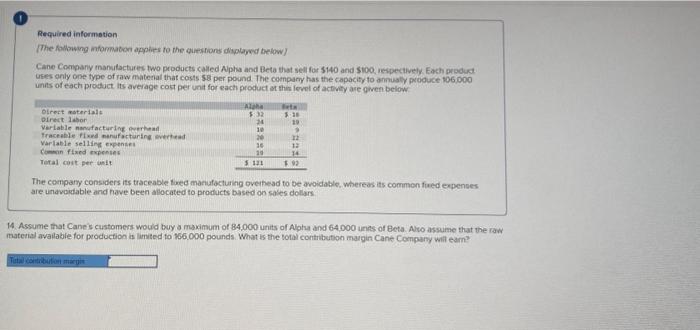

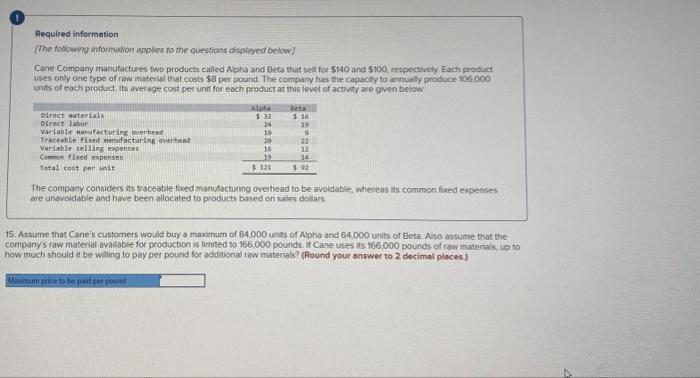

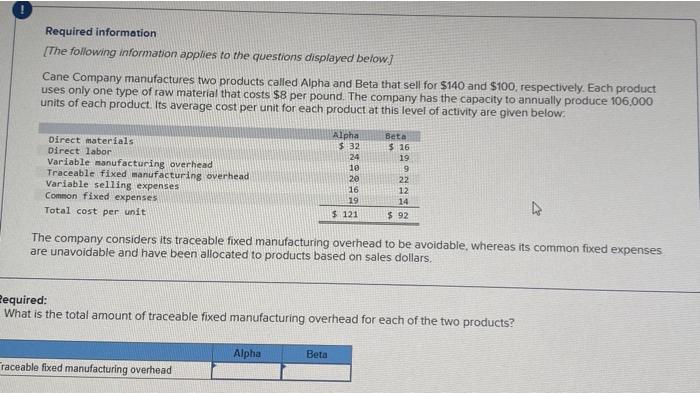

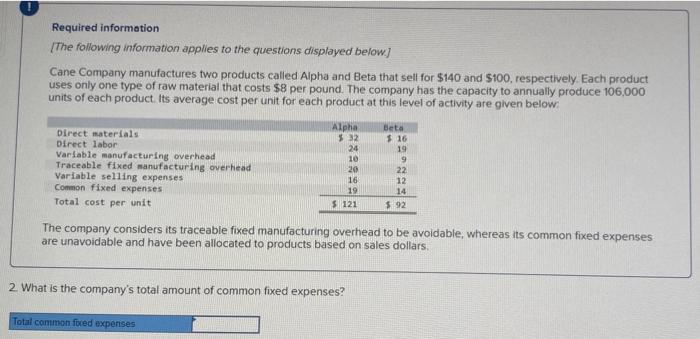

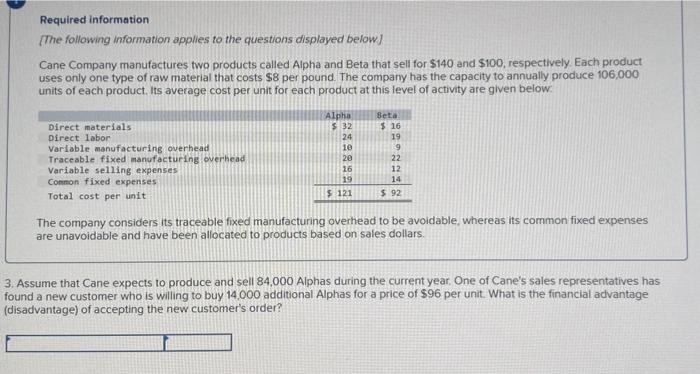

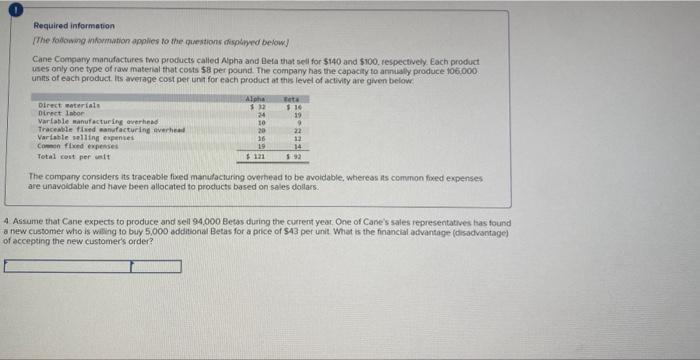

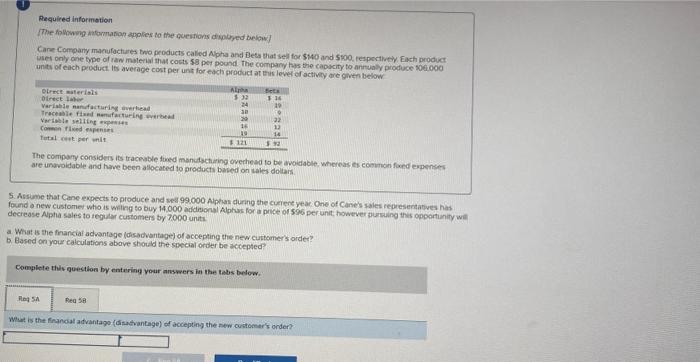

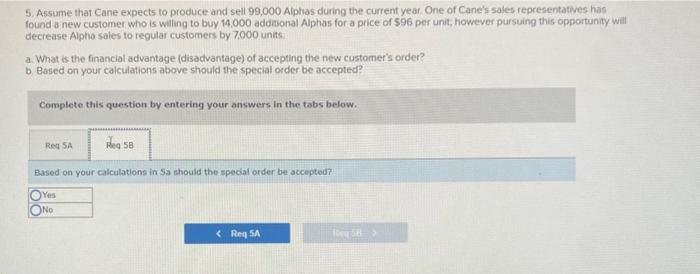

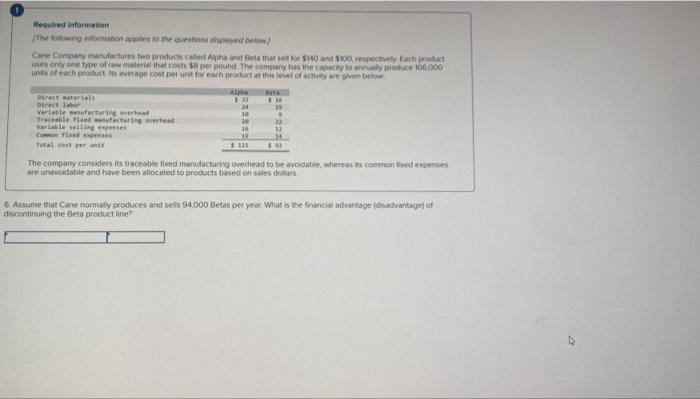

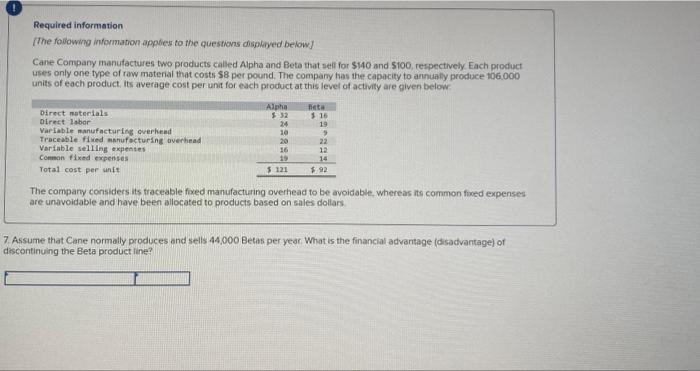

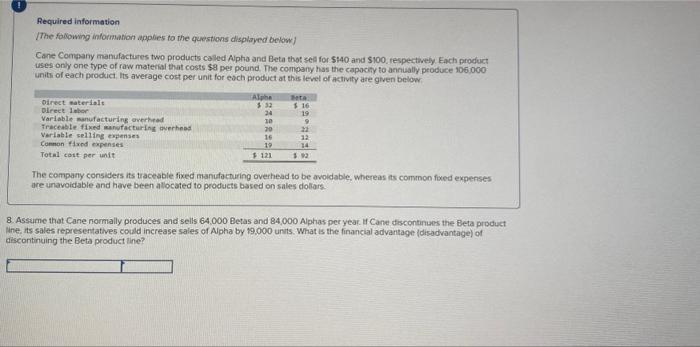

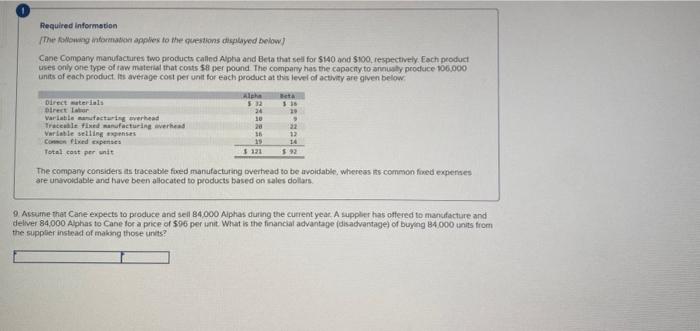

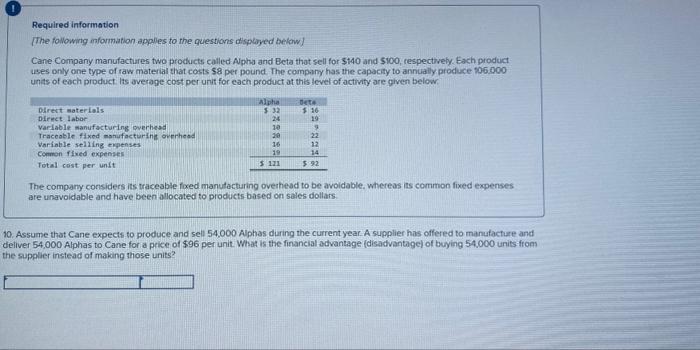

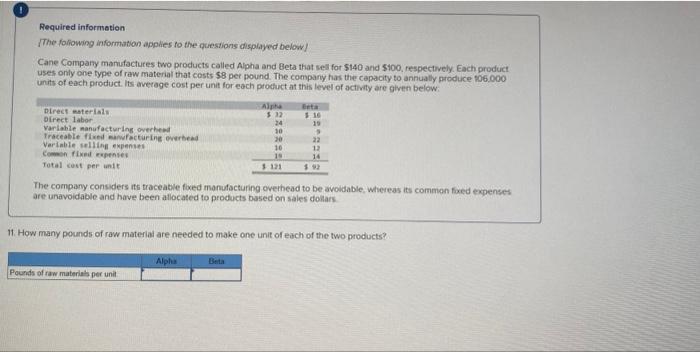

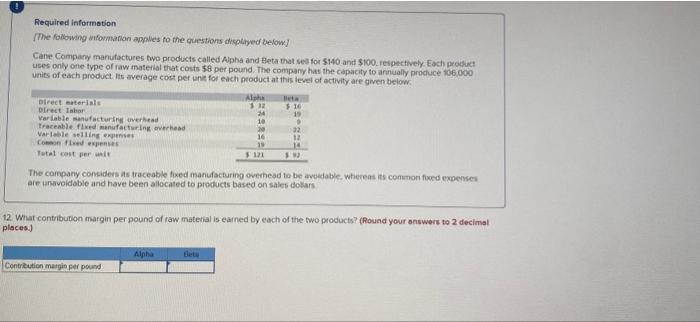

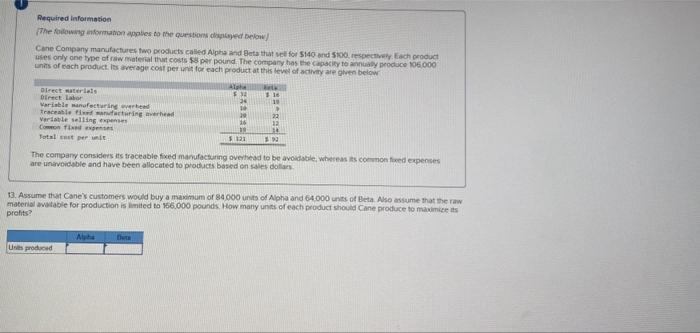

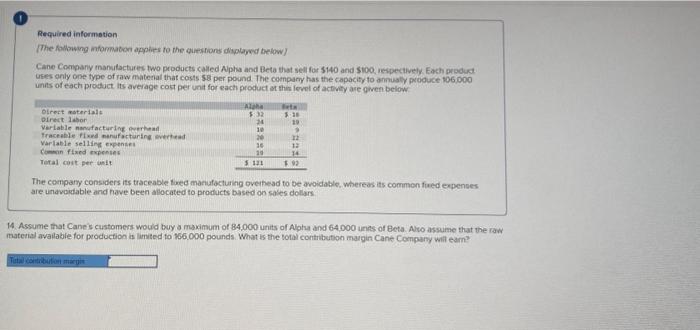

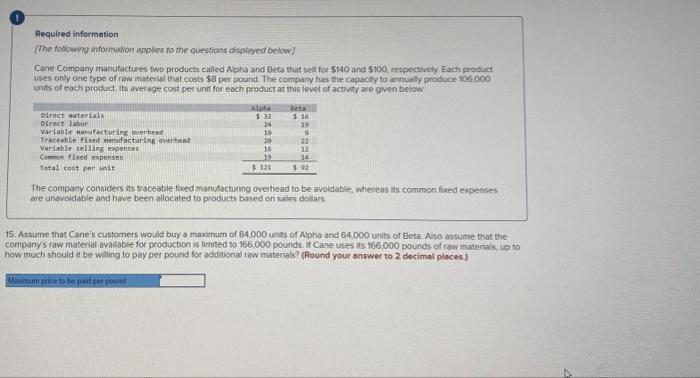

Required information [The following information applies to the questions displayed below] Cane Company manufactures two products called Alpha and Beta that sell for $140 and $100, respectively. Each product uses only one type of raw material that costs $8 per pound. The company has the capacity to annually produce 106,000 units of each product. Its average cost per unit for each product at this level of activity are given below: The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. equired: What is the total amount of traceable fixed manufacturing overhead for each of the two products? Required informetion [The following information applies to the questions displayed below] Cane Company manufactures two products called Alpha and Beta that sell for $140 and $100, respectively. Each product uses only one type of raw material that costs $8 per pound. The company has the capacity to annually produce 106,000 units of each product. Its average cost per unit for each product at this level of activity are given below: The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. 2. What is the company's total amount of common fixed expenses? Required information [The following information applies to the questions displayed below] Cane Company manufactures two products called Alpha and Beta that sell for $140 and $100, respectively. Each product uses only one type of raw material that costs $8 per pound. The company has the capacity to annually produce 106,000 units of each product. Its average cost per unit for each product at this level of activity are given below: The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. Assume that Cane expects to produce and sell 84,000 Alphas during the current year, One of Cane's sales representatives has ound a new customer who is willing to buy 14.000 additional Alphas for a price of $96 per unit. What is the financial advantage lisadvantage) of accepting the new customer's order? Required information [The fodowng nifomation applles to the puestions dispdinco bekow] Cane Company manufactures two products called Nphaand Qela that sell for 5140 and 5100 . respectively. Each product uses only one type of raw material that costs $8 per pound. The company has the capacity to annalily produce 106.000 unts of each product. its average cost per una for each proffuct at the level of activity are given below: The compary considers its traceable fixed manufacturing overhead to be avoidable, whereas ats common fored expenses are unavoidable and have been allocated to products based on sales dollars. 4. Assume that Cane expects to produce and sell 94,000 Betas during the current yeat, One of Cane's sales representatives tuas found a new customer who is wiling to buy 5,000 additional Betas for a price of 543 per unit. What is the financial actiantage (disadvantage) of accepting the new customer's order? Required inforimstion Care Company mucufachures bwa products caled Apha and Bets that sel for $140 and 550 . resperthey Each product units of each product. Its average coct per unt for edch prodict at this lever ef activey are given below: The compary considers its traceable fued manctscturing overhead to be avoldable. whereas ts comrion faced expenses. are unavoidable and have been alocated to products babed on waks dolats 5. Assume that Cane expects to produce and sed 99.000 Aptan durhe the cuetere year One of Canels sales representatives has found a new customet who is waing so buy 14,000 addingal Aphas for a pace of 596 per unit, however pursuing thes oppertianity wit. decrease Apha sales to segilar customers by 7000 unit. a What is the francial advantage ldisadvantagel of accepting the new cuitcmer's order? b. Based on your calculations abave shoudd the special order be iccepted? Complete this question by entaring vour answers in the tabs bedow. Whet is the franosal advantapo (disastantage) of accepting the new oustomar's orden? 5. Assume that Cane expects to produce and sell 99,000 Alphas during the currem year. One of Cane's sales representatives has found a new customer who is wilting to buy 14,000 addisonal Alphas for a price of 596 per unit, however pursuing this opportunity will decrease Alpho sales to regular customers by 7,000 units a. What is the financial advantage (disadvantage) of accepting the new customer's order? b. Based on your calculations above should the special order be accepted? Complete this question by entering your answers in the tabs below. Based on your calculations in 5 a should the special order be accepted? Revured informmelon Cane Consary manufactures two products raled Apha and fleta thn ses for s4o and 5100 respectively Each yodect The company considers its treceable fored manufacturing owetiead to be avoidable. whereas ita cammon fised espenises are unmoidable and have been aliocated to arcoducts based on sales dothas. 6. Assume that Cane normay produces and sels 94.000 Betas per yeor What is the financial advartage fosadvantages of discontinuing the Beta product line? Required information [The foubowing information appliess to the questions disployed below]. Cane Company manufactures two products called Alpha and Beta that setl for $140 and $100, respectively. Each proctuct uses only one type of raw material that costs $8 per pound. The conpany has the capacity to annually produce 106.000 units of each product. Its average cost per unit for each product at this level of activity are given below. The compary considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fived expenses are unavoidabie and have been allocated to products based on sales dollars. 7. Assume that Cane normally produces and sells 44,000 Betas per year. What is the financial advantage (disadvantage) of discontinuing the Beta product Ine? Required information The followng information applies to the questions displayed bekov) Cane Company manufactures two products caled Apha and Beta thot sell for $140 and $100, respectively. Each product uses only one type of raw matechal that costs $8 pes pound. The company has the capocity to annially peoduce 106000 units of each product. its average cost per unit for each product at this level of activity are given below. The company considets its traceable fixed manufacturing overhead to be avoidable, whereas ts common fixed expenses are unavoidable and haye been allocated to products based on sales dollars. 8. Assume that Cane normally produces and sells 64,000 Betas and 84,000 Aphas per year. If Cane discontinues the Beta product ine, its sales representative 5 coudd increase sales of Apha by $9,000 units. What is the financial advantage (disadvantage) of Aiscontinuing the Beta product tine? Required informstion [The fullawing intorataten apples to the euestions dispilaynd below] Cane Compary manufactures two products called Apha and Beta that sell for 5140 aod $100, respectively. Each product uses only one type of taw material that coss $8 per pound The cocnpany has the capacity to annusty produce 766000 units of each product is average cost per unit for each product at this level of activify are given below. The compary considers as traceable fixed manufacturing overtead to be avoidable, whereas is common fored experses are univoidable and have been allocated to products based on sales dollars. 9. Assume that Cane expects to produce and seil 84,000 Aiphas during the current year. A suppler has ottered to manuifacture and delver 84,000 Aphas to Cane for a price of 596 per unit. What is the financial advantage (disachantage) of buyeng 84.000 units from the suppler instead of making those units? Required information [The following information applies to the questions dispired below] Cane Company manufactures two products called Apha and Beta that sell for $140 and $100, respectively. Each product uses only one type of raw material that costs 58 per pound. The company has the capacity to annually produce 706000 units of each product. Its average cost per unit for each product at this level of activity are given below: The compary considers its traceable fored manulacturing overhead to be avoidable. whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. 10. Assume that Cane expects to produce and sell 54,000 Aphas diring the current year. A supplier has offered to manufacture and deliver 54,000 Alphas to Cane for a price of $96 per unit. What is the financial advantage (disadvantage) of buying 54,000 units fron the supplier instead of making those units? Required information The following information apphies fo the questions displayed below? Cane Company manufactures two products called Alpha and Beta that sell for $140 and 5100 , respectively. Each product. uses only one type of raw material that costs $8 per pound. The company has the capacity to annually produce po6.000 units of each product. Its average cost per unit for each proctuct at this level of activity are given below. The company considers its traceatie foxed manufacturing overhead to be avoidable, whereas its comman fixed expenses are unavoidable and have been allocated to products bused on sales dollars. 11. How many pounds of raw materiad are needed to make one unit of each of the two products? Required informetion [The foldowing informarian appiles to the cuestions aticplobed beiow] Cane Compary manutactures two products called Apha and Heta that sed for 5140 and $100. respectively Each prodiuct uces only ofte type of raw material that costs $9 per pound. The company has the capacity to arnualy proctuce 466.000. unibs of each product. Its average cost per unit for each peoduct at this level of activity are given below. The campany conciders its traceable fixed manufacturing everhead to be avedable. whereas its conmon fixed experses are arwivoidable and have been allocated to prodticts based on sales dokars 12. What contribubion margin per pound of raw matetial is earned by each of the two products? (Rocind your answers to 2 decimal places. Required information Cene Company manufacturec two products caled Apts and Eets that ver for $140 and 5 tal respectiveiy. fach oroduct The compary considers its traceable fixed manufacturing overhead to be avoigabie, wheneas its coennon fored expenses. are unevericeble end have been allocated to products based en s4les dollan. 13. Assume thit Cane's customers would bay a masinum of 84000 unts of Apha and 64.000 unts ef Beta. Aso assume that the raw matenial watable for preduction is izited to 156.000 pounds. How many unts of each product should Cane produce to mavimier is prohits? Required informetion [The folbwing infomabon appires to the questions alspolaywd tellow] Cane Coxpany manutactures two products called Apha and Beta that seli for $140 and $100 iespectively Each pesouxt. uses anly ope type of raw matenal that costs 58 per pound The company has the capacify to annualy produce 106 opo units of each product its average cost per unit for each product at the ierol of acfity are gren below. The cempary considers its traceable twed manufacturing oveihead to be avoidable. whereos its commen fiaed expenses are unaviuable and have been allocated to products based on sales dollars 4. Assume that Cane is customers would buy a maximum of 84,000 units of Aloha dnd 64.000 units of Beta. Aro assume that the raw aterial availabie for peodoction is limited to *56.000 pounds. What is the total contributbon maggin Cane Company wili earn? Required informotion [The tollowing information appies to the questions displored belows Cane Company manifactiees two products called Alpha and Beta that sell for 5140 and 5100 , respectively. Each product uses anly one type of raw miterisf that costs 58 per pound. The compary has the capacity to annualy produce 106,000 units of each product its average cost pet uni for each product at this level of activity are given below The company consides its traceable foxed manufacturing ovethead to be avoidable, whereas its common fured expenses are unavoidable and have been allocated to products based on saies dollars. 15. Assume that Cane's customers would bury a maximum of 84,000 unas of Alpha and 64.000 units of Beta Aso assume that the companys raw materiat avaicable for production is limited to $66,000 pounds. Ir Cane uses its 106,000 pounds of raw materlais. up to now much should it be wiling to pay per pound for additional raw matenals? (Round your answer to 2 decimai ploces)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started