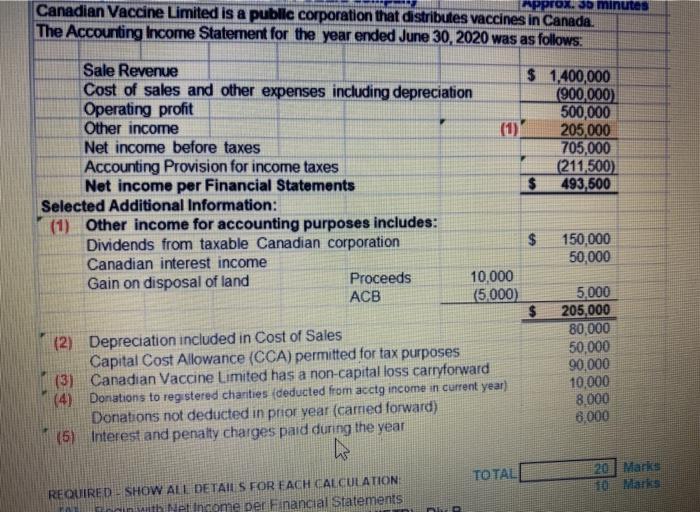

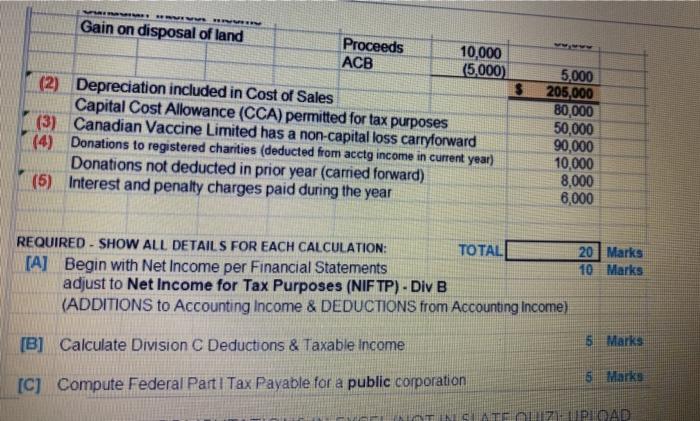

LAPPromo minutes Canadian Vaccine Limited is a public corporation that distributes vaccines in Canada. The Accounting Income Statement for the year ended June 30, 2020 was as follows: Sale Revenue $ 1,400,000 Cost of sales and other expenses including depreciation (900,000) Operating profit 500,000 Other income 205,000 Net income before taxes 705,000 Accounting Provision for income taxes (211,500) Net income per Financial Statements $ 493,500 Selected Additional Information: (1) Other income for accounting purposes includes: Dividends from taxable Canadian corporation $ 150,000 Canadian interest income 50,000 Gain on disposal of land Proceeds 10,000 ACB (5,000) 5.000 $ 205,000 80,000 (2) Depreciation included in Cost of Sales 50,000 Capital Cost Allowance (CCA) permitted for tax purposes 90,000 (3) Canadian Vaccine Limited has a non-capital loss carryforward 10,000 (4) Donations to registered chanties (deducted from acctg income in current year) Donations not deducted in prior year (cared forward) 6,000 (5) Interest and penalty charges paid during the year 8.000 TOTAL 20 Marks 10 Marks REQUIRED SHOW ALL DETAILS FOR EACH CALCULATION Born with Net Income per Financial Statements Gain on disposal of land Proceeds ACB 10,000 (5,000) $ (2) Depreciation included in Cost of Sales Capital Cost Allowance (CCA) permitted for tax purposes (3) Canadian Vaccine Limited has a non-capital loss carryforward (4) Donations to registered charities (deducted from acctg income in current year) Donations not deducted in prior year (carried forward) (5) Interest and penalty charges paid during the year 5,000 205,000 80,000 50,000 90,000 10,000 8,000 6,000 REQUIRED - SHOW ALL DETAILS FOR EACH CALCULATION: TOTAL [A] Begin with Net Income per Financial Statements adjust to Net Income for Tax Purposes (NIFTP) - Div B (ADDITIONS to Accounting Income & DEDUCTIONS from Accounting Income) 20 Marks 10 Marks [B] Calculate Division C Deductions & Taxable income 5. Marks [C] Compute Federal Parti Tax Payable for a public corporation 5 Marks AT NISLATE OU 171- UPLOAD LAPPromo minutes Canadian Vaccine Limited is a public corporation that distributes vaccines in Canada. The Accounting Income Statement for the year ended June 30, 2020 was as follows: Sale Revenue $ 1,400,000 Cost of sales and other expenses including depreciation (900,000) Operating profit 500,000 Other income 205,000 Net income before taxes 705,000 Accounting Provision for income taxes (211,500) Net income per Financial Statements $ 493,500 Selected Additional Information: (1) Other income for accounting purposes includes: Dividends from taxable Canadian corporation $ 150,000 Canadian interest income 50,000 Gain on disposal of land Proceeds 10,000 ACB (5,000) 5.000 $ 205,000 80,000 (2) Depreciation included in Cost of Sales 50,000 Capital Cost Allowance (CCA) permitted for tax purposes 90,000 (3) Canadian Vaccine Limited has a non-capital loss carryforward 10,000 (4) Donations to registered chanties (deducted from acctg income in current year) Donations not deducted in prior year (cared forward) 6,000 (5) Interest and penalty charges paid during the year 8.000 TOTAL 20 Marks 10 Marks REQUIRED SHOW ALL DETAILS FOR EACH CALCULATION Born with Net Income per Financial Statements Gain on disposal of land Proceeds ACB 10,000 (5,000) $ (2) Depreciation included in Cost of Sales Capital Cost Allowance (CCA) permitted for tax purposes (3) Canadian Vaccine Limited has a non-capital loss carryforward (4) Donations to registered charities (deducted from acctg income in current year) Donations not deducted in prior year (carried forward) (5) Interest and penalty charges paid during the year 5,000 205,000 80,000 50,000 90,000 10,000 8,000 6,000 REQUIRED - SHOW ALL DETAILS FOR EACH CALCULATION: TOTAL [A] Begin with Net Income per Financial Statements adjust to Net Income for Tax Purposes (NIFTP) - Div B (ADDITIONS to Accounting Income & DEDUCTIONS from Accounting Income) 20 Marks 10 Marks [B] Calculate Division C Deductions & Taxable income 5. Marks [C] Compute Federal Parti Tax Payable for a public corporation 5 Marks AT NISLATE OU 171- UPLOAD