Answered step by step

Verified Expert Solution

Question

1 Approved Answer

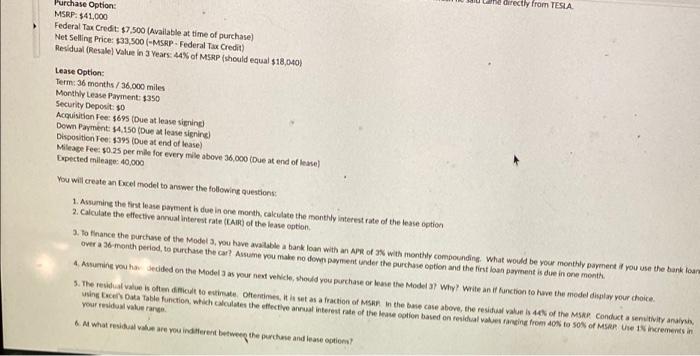

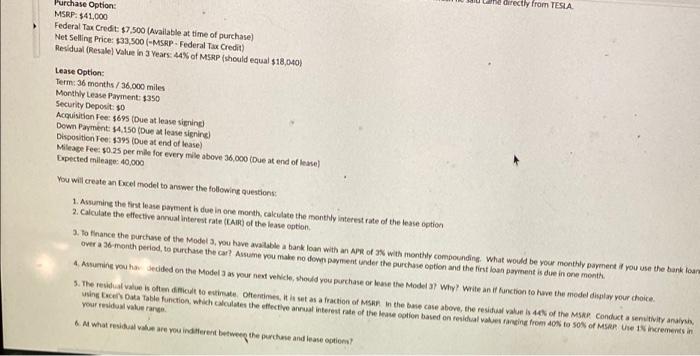

excel MSRP: $41,000 Federal Tar Credit $7,500 (Avalable at time of purchase) Net Selling Price: 833,500 (-MSRP- Federal Tax Credit) Residual (Resalel Value in 3

excel

MSRP: \$41,000 Federal Tar Credit $7,500 (Avalable at time of purchase) Net Selling Price: 833,500 (-MSRP- Federal Tax Credit) Residual (Resalel Value in 3 Years 44% of MSPP (shcoild equal $18,040 ) Lease Option: Term: 36 months /36,000 miles Monthly Lease Payment: $350 Security Deposit: 10 Acruisitian fee: $695 (Due at lease vignine) Dewn Payment \$4.150 (Due at leave signine) Disooition Tee: 1395 (Due at end of lease) Mileabe Fee: 30.25 per mile for every mike above 36,000 (Due at end of lease) Lopected mileage: 40.000 Vou will create an Cucel model to anwer the followine questions: 1. Assumine the fiss lease parment h due in one month, calculate the monthly interest rate of the lease option 2. Calculate the effective annual interest rate (CAIT) of the lease option. over a 26 month period, to surchue the car? Assume you mabe no down payment under the purchure option and the firut loan pawnent is dive in one month. 4. Atsumine vou hav sedided on the Model a as your nest veNcle, should you prechase or lease the Model ar Why? Wite an if function to hwre the medel disular rour choice. vour residum Yalue rarne. 6. A what fevidual value are you inditerent batweep the purchowe and lease ootions? MSRP: \$41,000 Federal Tar Credit $7,500 (Avalable at time of purchase) Net Selling Price: 833,500 (-MSRP- Federal Tax Credit) Residual (Resalel Value in 3 Years 44% of MSPP (shcoild equal $18,040 ) Lease Option: Term: 36 months /36,000 miles Monthly Lease Payment: $350 Security Deposit: 10 Acruisitian fee: $695 (Due at lease vignine) Dewn Payment \$4.150 (Due at leave signine) Disooition Tee: 1395 (Due at end of lease) Mileabe Fee: 30.25 per mile for every mike above 36,000 (Due at end of lease) Lopected mileage: 40.000 Vou will create an Cucel model to anwer the followine questions: 1. Assumine the fiss lease parment h due in one month, calculate the monthly interest rate of the lease option 2. Calculate the effective annual interest rate (CAIT) of the lease option. over a 26 month period, to surchue the car? Assume you mabe no down payment under the purchure option and the firut loan pawnent is dive in one month. 4. Atsumine vou hav sedided on the Model a as your nest veNcle, should you prechase or lease the Model ar Why? Wite an if function to hwre the medel disular rour choice. vour residum Yalue rarne. 6. A what fevidual value are you inditerent batweep the purchowe and lease ootions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started