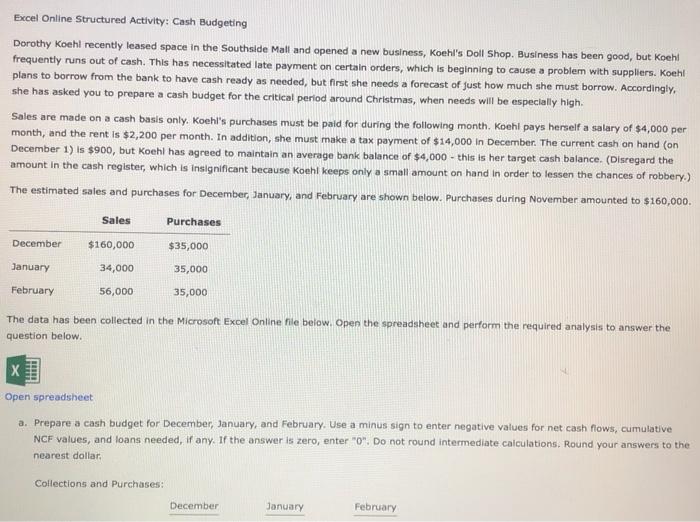

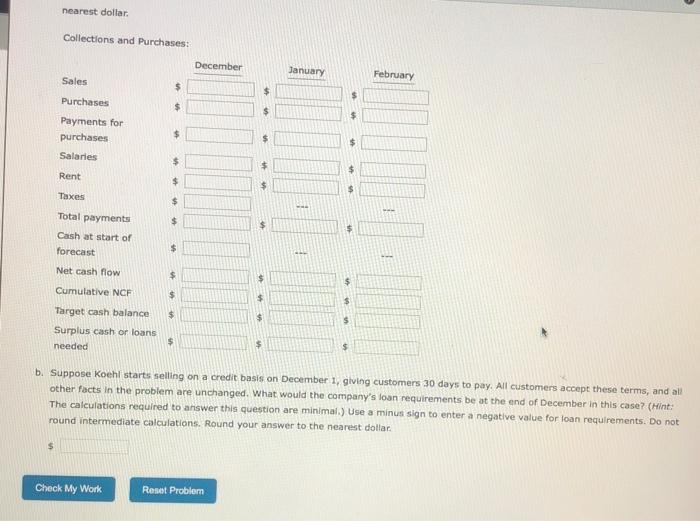

Excel Online Structured Activity: Cash Budgeting Dorothy Koehl recently leased space in the Southside Mall and opened a new business, Koehl's Doll Shop. Business has been good, but Koehl frequently runs out of cash. This has necessitated late payment on certain orders, which is beginning to cause a problem with suppliers. Koeht plans to borrow from the bank to have cash ready as needed, but first she needs a forecast of just how much she must borrow. Accordingly, she has asked you to prepare a cash budget for the critical period around Christmas, when needs will be especially high. Sales are made on a cash basis only. Koehl's purchases must be paid for during the following month, Koehl pays herself a salary of $4,000 per month, and the rent is $2,200 per month. In addition, she must make a tax payment of $14,000 in December. The current cash on hand (on December 1) Is $900, but Koehl has agreed to maintain an average bank balance of $4,000 - this is her target cash balance. (Disregard the amount in the cash register, which is insignificant because Koehl keeps only a small amount on hand in order to lessen the chances of robbery.) The estimated sales and purchases for December, January, and February are shown below. Purchases during November amounted to $160,000. Sales Purchases December $160,000 $35,000 January 34,000 35,000 February 56,000 35,000 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet a. Prepare a cash budget for December, January, and February. Use a minus sign to enter negative values for net cash flows, cumulative NCF values, and loans needed, if any. If the answer is zero, enter "O". Do not round intermediate calculations. Round your answers to the nearest dollar Collections and Purchases: December January February nearest dollar Collections and Purchases: December January February Sales $ $ Purchases $ $ Payments for purchases Salaries $ $ $ $ $ $ Rent $ $ Taxes $ Total payments $ $ Cash at start of forecast $ 1 Net cash flow $ $ Cumulative NCF $ $ $ $ $ $ Target cash balance Surplus cash or loans needed $ $ $ b. Suppose Koehl starts selling on a credit basis on December 1, giving customers 30 days to pay. All customers accept these terms, and all other facts in the problem are unchanged. What would the company's loan requirements be at the end of December in this case? (Hint: The calculations required to answer this question are minimal.) Use a minus sign to enter a negative value for loan requirements. Do not round intermediate calculations. Round your answer to the nearest dollar $ Check My Work Reset