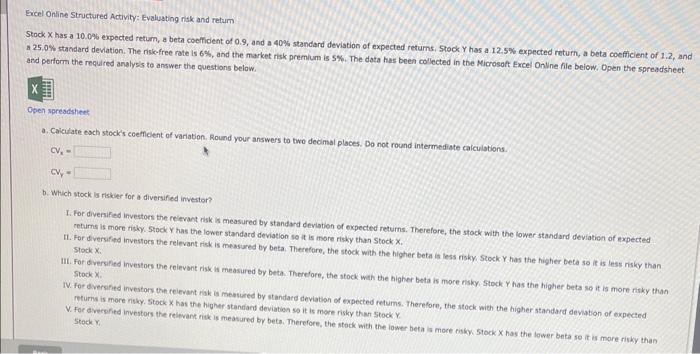

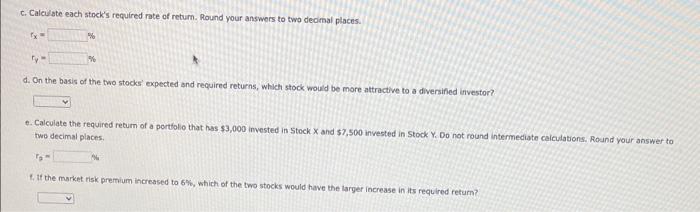

Excel Ontine Structured Activity: Evalusting risk and return Stock X has a 10.0% expected retum, a beta coeficient of 0.9, and a 40% standard deviation of expected returns, 5 tock y has a 12.5% expected return, a beta coefficient of 1.2, and A 25.0% standard deviation. The risk-free rate is 6%, and the market risk premium is 5%. The data has been collected in the Microsoft Excel OnVine file below. Open the spreadsheet and perform the required analysis te anawer the cuestions below. Dpel npresdsheet a. Caiculate esch stock's coeflient of variation. Round your answers to two decimal places. Do not round intermediate calculations. CVs= CVy= b. Which stock is riskier for a diversified investor? T. For divenifed investoes the reievant risk is measured by standard deviation of expected retums. Therefore, the stock with the lower standard deviation of expected returns is more risky. Stock y has the lower standard deviation se it is more risky than Stock x. I1. For diverufied investocs the relevant riek is measured by beta. Therefore, the stock with the higher beta is less risky, Stock Y has the higher beta so it is less risky than Stock x1 III. For dversified investons the celevant risk is measured by beta. Therefore, the stock wath the bigher beta is more nisky. Stock. Y has the higher beta so it is more risky than Stock x1 IV. for dversified investors the celevant risk is meatiared by standard deviation of expected retums. Therefore, the stock with the higher standard devation of oxpected returns is more risky. Stock X has the higher stantiand deviatien so it is more risky than 5 tock Y. V. For dvecpited investors the relivine risk is meatured by beta. Therefore, the stock with the lower beta is more risky 5 tock has the lower beta so it is more risky than stock yi c. Calcilate each stock's required rate of retum. Round your answers to two decimal places. d. On the basis of the two stocks' expected and required returns, which stock would be more attractive to a diversified investor? 6. Calculate the required return of a portfolio that has $3,000 invested in 5 tock and $7,500 invested in 5 tock Y. Do not round intermediate calculations. Round your answer to two decimal places. rg= 4. If the market risk premium increased to 6%, which of the two stocks would have the larger increase in its required return