Excel spreadsheet format

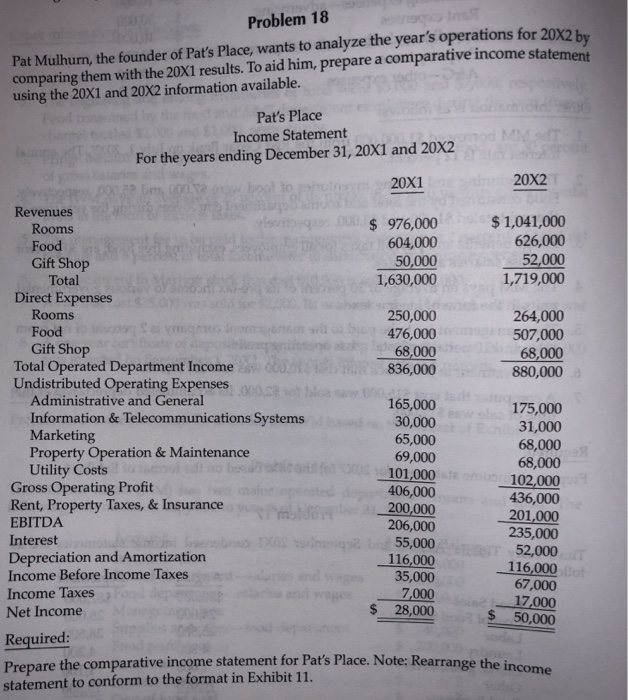

Problem 18 Pat Mulhurn, the founder of Pat's Place, wants to analyze the year's operations for 20X2 hr comparing them with the 20X1 results. To aid him, prepare a comparative income statement using the 20X1 and 20X2 information available. Pat's Place Income Statement For the years ending December 31,20X1 and 20X2 20X1 20X2 Revenues $976,000 604,000 50,000 1,630,000 $1,041,000 626,000 52,000 1,719,000 Rooms Food Gift Shop Total Direct Expenses Rooms 250,000 476,000 68,000 836,000 264,000 507,000 68,000 880,000 Food Gift Shop Total Operated Department Income Undistributed Operating Expenses Administrative and General 165,000 30,000 65,000 69,000 101,000 406,000 200,000 206,000 55,000 116,000 35,000 7,000 $ 28,000 175,000 31,000 68,000 68,000 102,000 436,000 201,000 235,000 52,000 116,000 67,000 17,000 $50,000 Information & Telecommunications Systems Marketing Property Operation & Maintenance Utility Costs Gross Operating Profit Rent, Property Taxes, &Insurance EBITDA Interest Depreciation and Amortization Income Before Income Taxes Income Taxes Net Income Required: Prepare the comparative income statement for Pat's Place. Note: Rearrange the income statement to conform to the format in Exhibit 11 Problem 18 Pat Mulhurn, the founder of Pat's Place, wants to analyze the year's operations for 20X2 hr comparing them with the 20X1 results. To aid him, prepare a comparative income statement using the 20X1 and 20X2 information available. Pat's Place Income Statement For the years ending December 31,20X1 and 20X2 20X1 20X2 Revenues $976,000 604,000 50,000 1,630,000 $1,041,000 626,000 52,000 1,719,000 Rooms Food Gift Shop Total Direct Expenses Rooms 250,000 476,000 68,000 836,000 264,000 507,000 68,000 880,000 Food Gift Shop Total Operated Department Income Undistributed Operating Expenses Administrative and General 165,000 30,000 65,000 69,000 101,000 406,000 200,000 206,000 55,000 116,000 35,000 7,000 $ 28,000 175,000 31,000 68,000 68,000 102,000 436,000 201,000 235,000 52,000 116,000 67,000 17,000 $50,000 Information & Telecommunications Systems Marketing Property Operation & Maintenance Utility Costs Gross Operating Profit Rent, Property Taxes, &Insurance EBITDA Interest Depreciation and Amortization Income Before Income Taxes Income Taxes Net Income Required: Prepare the comparative income statement for Pat's Place. Note: Rearrange the income statement to conform to the format in Exhibit 11