Answered step by step

Verified Expert Solution

Question

1 Approved Answer

excel template excel income statement and balance sheet for number 3, and 4 3 This is going to be your Income Statement page. Using the

excel template

excel template

excel income statement and balance sheet for number 3, and 4

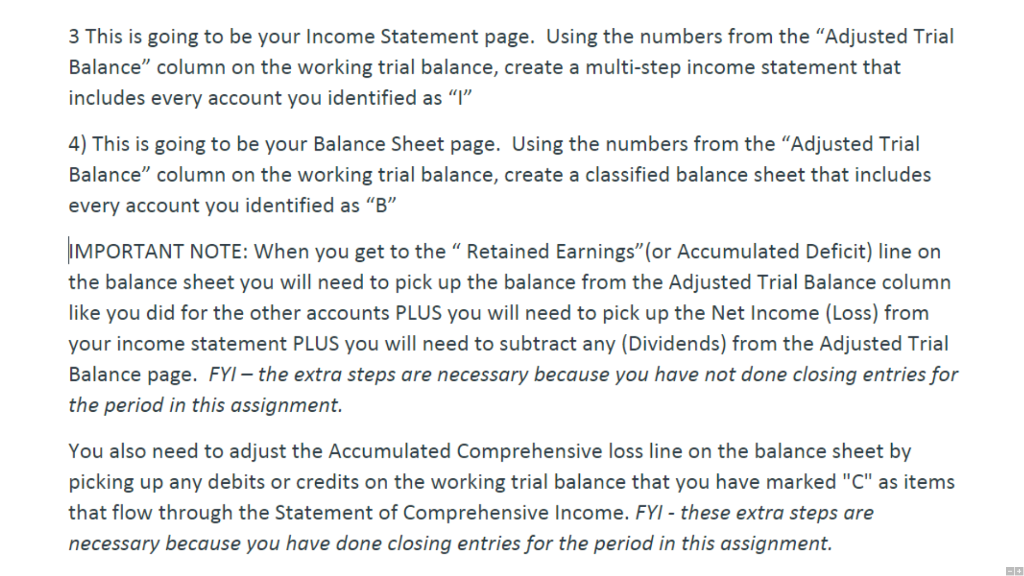

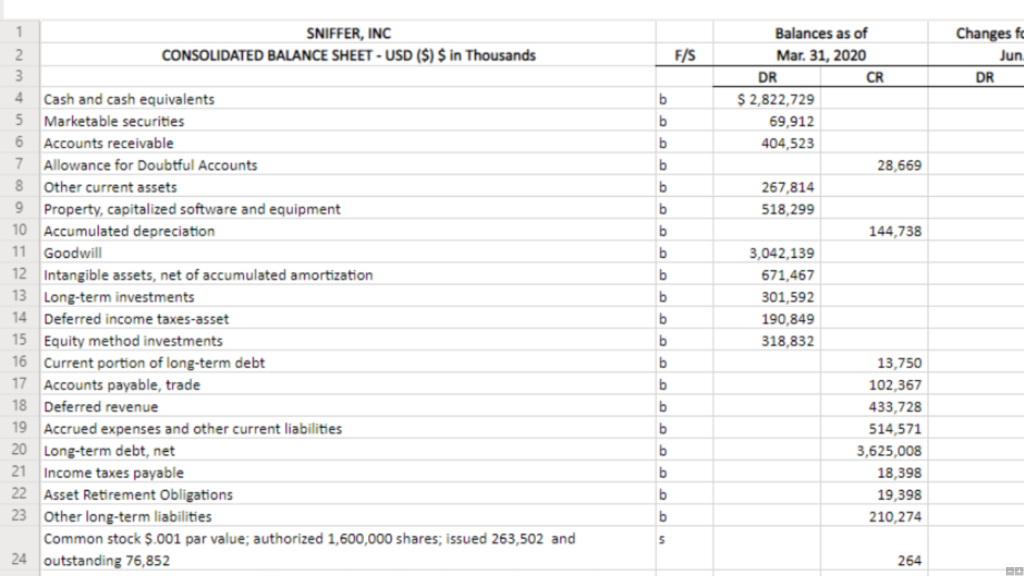

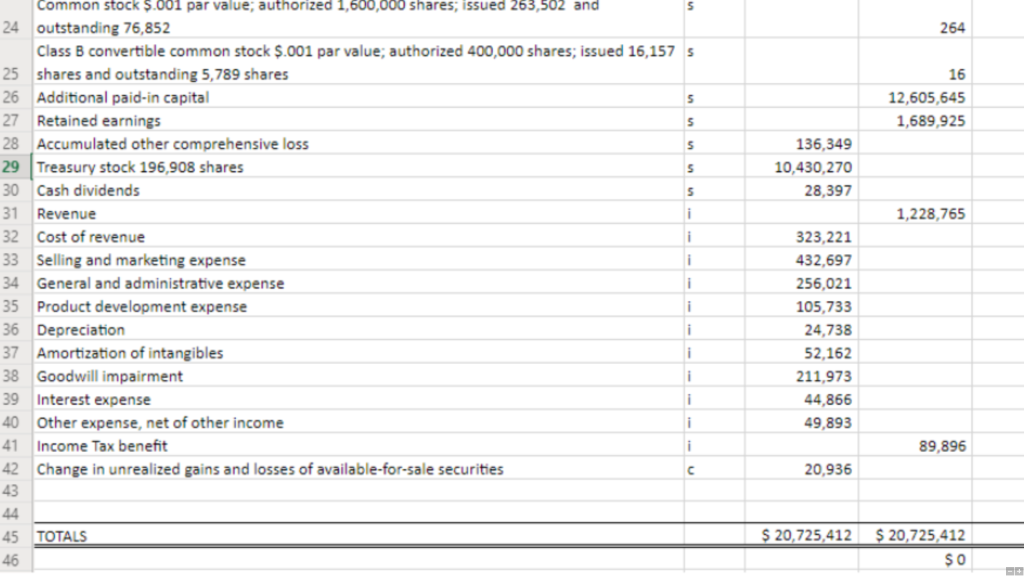

3 This is going to be your Income Statement page. Using the numbers from the Adjusted Trial Balance column on the working trial balance, create a multi-step income statement that includes every account you identified as 1 4) This is going to be your Balance Sheet page. Using the numbers from the Adjusted Trial Balance column on the working trial balance, create a classified balance sheet that includes every account you identified as "B" IMPORTANT NOTE: When you get to the Retained Earnings (or Accumulated Deficit) line on the balance sheet you will need to pick up the balance from the Adjusted Trial Balance column like you did for the other accounts PLUS you will need to pick up the Net Income (Loss) from your income statement PLUS you will need to subtract any (Dividends) from the Adjusted Trial Balance page. FYI the extra steps are necessary because you have not done closing entries for the period in this assignment. You also need to adjust the Accumulated Comprehensive loss line on the balance sheet by picking up any debits or credits on the working trial balance that you have marked "C" as items that flow through the Statement of Comprehensive Income. FYI - these extra steps are necessary because you have done closing entries for the period in this assignment. -+ F/S Changes fc Jun DR b b b b b b b b b 1 SNIFFER, INC 2. CONSOLIDATED BALANCE SHEET - USD ($) $ in Thousands 3 4 Cash and cash equivalents 5 Marketable securities 6 Accounts receivable 7 Allowance for Doubtful Accounts 8 Other current assets 9 Property, capitalized software and equipment 10 Accumulated depreciation 11 Goodwill 12 Intangible assets, net of accumulated amortization 13 Long-term investments 14 Deferred income taxes-asset 15 Equity method investments 16 Current portion of long-term debt 17 Accounts payable, trade 18 Deferred revenue 19 Accrued expenses and other current liabilities 20 Long-term debt, net 21 Income taxes payable 22 Asset Retirement Obligations 23 Other long-term liabilities Common stock $.001 par value; authorized 1,600,000 shares; issued 263,502 and 24 outstanding 76,852 Balances as of Mar. 31, 2020 DR CR $ 2,822,729 69,912 404,523 28,669 267,814 518,299 144,738 3,042,139 671,467 301,592 190,849 318,832 13,750 102,367 433,728 514,571 3,625,008 18,398 19,398 210,274 b b b b b b b b b b b 5 264 s 264 16 12,605,645 1,689,925 136,349 10,430,270 28,397 s 1,228,765 Common stock $.001 par value; authorized 1,600,000 shares, issued 263,502 and 24 outstanding 76,852 Class B convertible common stock $.001 par value; authorized 400,000 shares; issued 16,157 5 25 shares and outstanding 5,789 shares 26 Additional paid-in capital 5 27 Retained earnings 5 28 Accumulated other comprehensive loss 5 29 Treasury stock 196,908 shares 5 30 Cash dividends 31 Revenue i 32 Cost of revenue i 33 Selling and marketing expense i 34 General and administrative expense i 35 Product development expense i 36 Depreciation 37 Amortization of intangibles 38 Goodwill impairment i 39 Interest expense 40 Other expense, net of other income i 41 Income Tax benefit i 42 Change in unrealized gains and losses of available-for-sale securities 43 44 45 TOTALS 46 323,221 432,697 256,021 105,733 24,738 52,162 211,973 44,866 49,893 89,896 20.936 $ 20,725,412 $ 20,725,412 SO 3 This is going to be your Income Statement page. Using the numbers from the Adjusted Trial Balance column on the working trial balance, create a multi-step income statement that includes every account you identified as 1 4) This is going to be your Balance Sheet page. Using the numbers from the Adjusted Trial Balance column on the working trial balance, create a classified balance sheet that includes every account you identified as "B" IMPORTANT NOTE: When you get to the Retained Earnings (or Accumulated Deficit) line on the balance sheet you will need to pick up the balance from the Adjusted Trial Balance column like you did for the other accounts PLUS you will need to pick up the Net Income (Loss) from your income statement PLUS you will need to subtract any (Dividends) from the Adjusted Trial Balance page. FYI the extra steps are necessary because you have not done closing entries for the period in this assignment. You also need to adjust the Accumulated Comprehensive loss line on the balance sheet by picking up any debits or credits on the working trial balance that you have marked "C" as items that flow through the Statement of Comprehensive Income. FYI - these extra steps are necessary because you have done closing entries for the period in this assignment. -+ F/S Changes fc Jun DR b b b b b b b b b 1 SNIFFER, INC 2. CONSOLIDATED BALANCE SHEET - USD ($) $ in Thousands 3 4 Cash and cash equivalents 5 Marketable securities 6 Accounts receivable 7 Allowance for Doubtful Accounts 8 Other current assets 9 Property, capitalized software and equipment 10 Accumulated depreciation 11 Goodwill 12 Intangible assets, net of accumulated amortization 13 Long-term investments 14 Deferred income taxes-asset 15 Equity method investments 16 Current portion of long-term debt 17 Accounts payable, trade 18 Deferred revenue 19 Accrued expenses and other current liabilities 20 Long-term debt, net 21 Income taxes payable 22 Asset Retirement Obligations 23 Other long-term liabilities Common stock $.001 par value; authorized 1,600,000 shares; issued 263,502 and 24 outstanding 76,852 Balances as of Mar. 31, 2020 DR CR $ 2,822,729 69,912 404,523 28,669 267,814 518,299 144,738 3,042,139 671,467 301,592 190,849 318,832 13,750 102,367 433,728 514,571 3,625,008 18,398 19,398 210,274 b b b b b b b b b b b 5 264 s 264 16 12,605,645 1,689,925 136,349 10,430,270 28,397 s 1,228,765 Common stock $.001 par value; authorized 1,600,000 shares, issued 263,502 and 24 outstanding 76,852 Class B convertible common stock $.001 par value; authorized 400,000 shares; issued 16,157 5 25 shares and outstanding 5,789 shares 26 Additional paid-in capital 5 27 Retained earnings 5 28 Accumulated other comprehensive loss 5 29 Treasury stock 196,908 shares 5 30 Cash dividends 31 Revenue i 32 Cost of revenue i 33 Selling and marketing expense i 34 General and administrative expense i 35 Product development expense i 36 Depreciation 37 Amortization of intangibles 38 Goodwill impairment i 39 Interest expense 40 Other expense, net of other income i 41 Income Tax benefit i 42 Change in unrealized gains and losses of available-for-sale securities 43 44 45 TOTALS 46 323,221 432,697 256,021 105,733 24,738 52,162 211,973 44,866 49,893 89,896 20.936 $ 20,725,412 $ 20,725,412 SOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started