Answered step by step

Verified Expert Solution

Question

1 Approved Answer

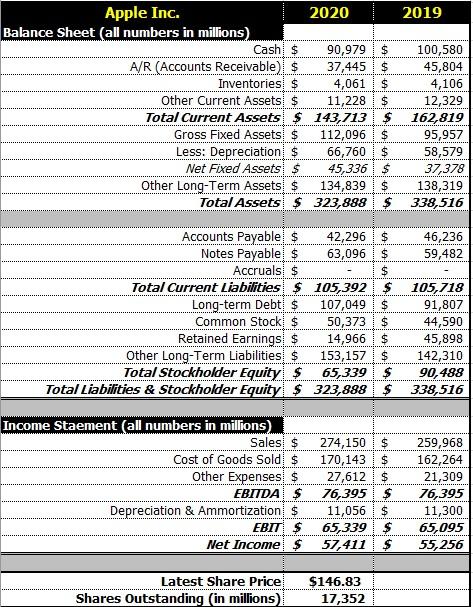

Excel templates are not needed to answer this question. Latest financial data for Apple Inc. is provided below. What was the company's most-recent Return on

- Excel templates are not needed to answer this question.

- Latest financial data for "Apple Inc." is provided below.

What was the company's most-recent "Return on Assets (ROA)"?

Enter your answer in the following format: 0.12

Hint: ROA is between 0.10 and 0.20

2019 Apple Inc. 2020 Balance Sheet (all numbers in millions) Cash $ 90,979 $ A/R (Accounts Receivable) $ 37,445 / $ Inventories! $ 4,061 $ Other Current Assets $ 11,228 $ Total Current Assets $ 143,713 $ Gross Fixed Assets $ 112,096 $ Less: Depreciation $ 66,760 $ Net Fixed Assets $ 45,336 $ Other Long-Term Assets $ 134,839 $ Total Assets $ 323,888 $ 100,580 45,804 4,106 12,329 162,819 95,957 58,579 37,378 138,319 338,516 ului 46,236 59,482 Accounts Payable $ 42,296 $ Notes Payable $ 63,096 $ Accruals! $ $ Total Current Liabilities $ 105,392 $ Long-term Debt $ 107,049 $ Common Stock $ 50,373 $ Retained Earnings$ 14,966 $ Other Long-Term Liabilities $ 153,157 $ Total Stockholder Equity $ 65,339 $ Total Liabilities & Stockholder Equity $ 323,888 $ 105,718 91,807 44,590 45,898 142,310 90,488 338,516 Income Staement (all numbers in millions) Sales $ Cost of Goods Sold! $ Other Expenses $ EBITDA $ Depreciation & Ammortization $ EBITS Net Income $ 274,150 $ 170,143 $ 27,612 | $ 76,395 $ 11,056 $ 65,339 $ 57,411 $ 259,968 162,264 21,309 76,395 11,300 65,095 55, 256 Latest Share Price Shares Outstanding (in millions) $146.83 17,352Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started