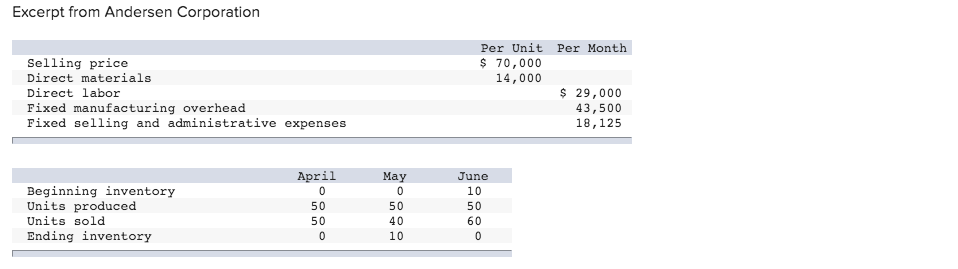

Excerpt from Andersen Corporation Selling price Direct materials Direct labor Fixed manufacturing overhead Fixed selling and administrative expenses Beginning inventory Units produced Units sold

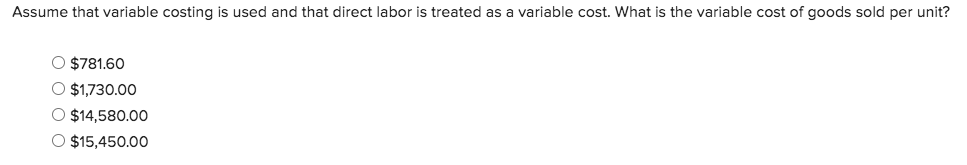

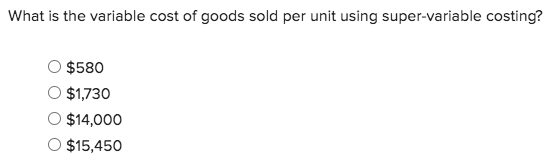

Excerpt from Andersen Corporation Selling price Direct materials Direct labor Fixed manufacturing overhead Fixed selling and administrative expenses Beginning inventory Units produced Units sold Ending inventory Per Unit Per Month $ 70,000 14,000 $ 29,000 April May June 0 0 10 50 50 50 50 40 60 0 10 0 43,500 18,125 Assume that variable costing is used and that direct labor is treated as a variable cost. What is the variable cost of goods sold per unit? $781.60 $1,730.00 $14,580.00 $15,450.00 What is the variable cost of goods sold per unit using super-variable costing? $580 $1,730 $14,000 $15,450 What is the difference between the super-variable costing and variable costing net operating incomes in May? Super-variable costing net operating income is $5,800 less than variable costing net operating income. Super-variable costing net operating income is $5,800 greater than variable costing net operating income. Super-variable costing net operating income is $29,000 less than variable costing net operating income. Super-variable costing net operating income is $29,000 greater than variable costing net operating income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve the questions we need to break down the costs provided and calculate accordingly Question 1 Variable Cost of Goods Sold COGS per Unit The var...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started