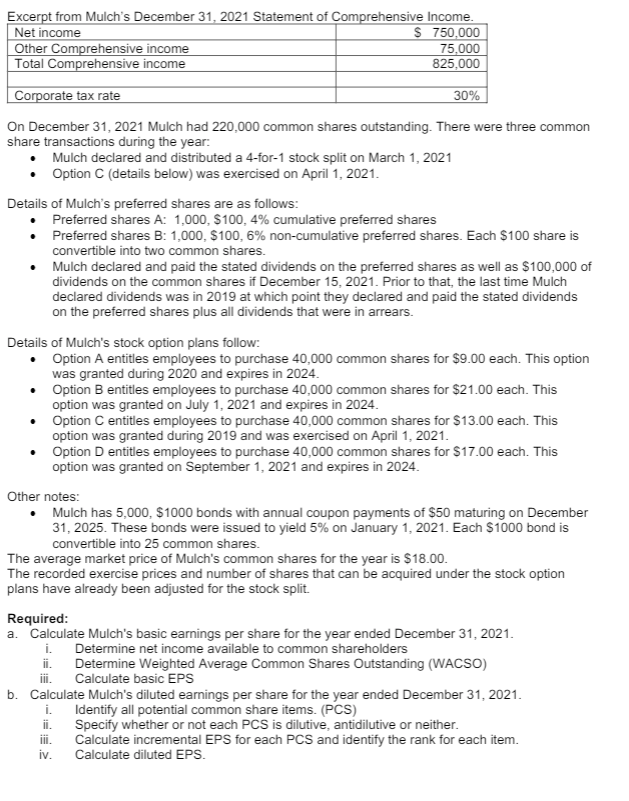

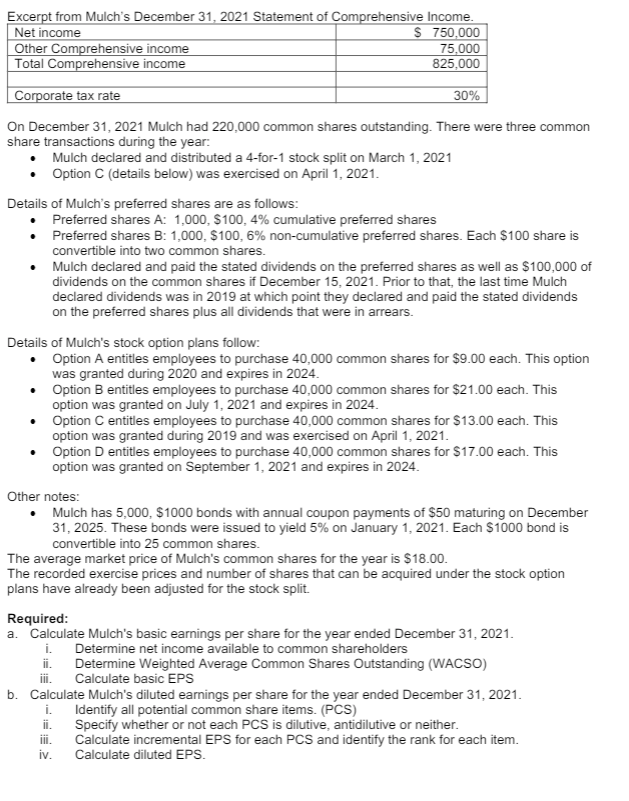

Excerpt from Mulch's December 31, 2021 Statement of Comprehensive Income. Net income $750,000 Other Comprehensive income 75,000 Total Comprehensive income 825,000 Corporate tax rate 30% On December 31, 2021 Mulch had 220.000 common shares outstanding. There were three common share transactions during the year: Mulch declared and distributed a 4-for-1 stock split on March 1, 2021 Option C (details below) was exercised on April 1, 2021. Details of Mulch's preferred shares are as follows: Preferred shares A: 1,000, S100, 4% cumulative preferred shares Preferred shares B: 1,000, $100, 6% non-cumulative preferred shares. Each $100 share is convertible into two common shares. Mulch declared and paid the stated dividends on the preferred shares as well as $100,000 of dividends on the common shares if December 15, 2021. Prior to that, the last time Mulch declared dividends was in 2019 at which point they declared and paid the stated dividends on the preferred shares plus all dividends that were in arrears. Details of Mulch's stock option plans follow: Option A entitles employees to purchase 40,000 common shares for $9.00 each. This option was granted during 2020 and expires in 2024. Option B entitles employees to purchase 40,000 common shares for $21.00 each. This option was granted on July 1, 2021 and expires in 2024. Option Centitles employees to purchase 40,000 common shares for $13.00 each. This option was granted during 2019 and was exercised on April 1, 2021. Option D entitles employees to purchase 40,000 common shares for $17.00 each. This option was granted on September 1, 2021 and expires in 2024. Other notes: Mulch has 5,000, $1000 bonds with annual coupon payments of $50 maturing on December 31, 2025. These bonds were issued to yield 5% on January 1, 2021. Each $1000 bond is convertible into 25 common shares. The average market price of Mulch's common shares for the year is $18.00. The recorded exercise prices and number of shares that can be acquired under the stock option plans have already been adjusted for the stock split. Required: a. Calculate Mulch's basic earnings per share for the year ended December 31, 2021. i. Determine net income available to common shareholders ii. Determine Weighted Average Common Shares Outstanding (WACSO) iii. Calculate basic EPS b. Calculate Mulch's diluted earnings per share for the year ended December 31, 2021. i. Identify all potential common share items. (PCS) ii. Specify whether or not each PCS is dilutive, antidilutive or neither. iii. Calculate incremental EPS for each PCS and identify the rank for each item. Calculate diluted EPS. iv. Excerpt from Mulch's December 31, 2021 Statement of Comprehensive Income. Net income $750,000 Other Comprehensive income 75,000 Total Comprehensive income 825,000 Corporate tax rate 30% On December 31, 2021 Mulch had 220.000 common shares outstanding. There were three common share transactions during the year: Mulch declared and distributed a 4-for-1 stock split on March 1, 2021 Option C (details below) was exercised on April 1, 2021. Details of Mulch's preferred shares are as follows: Preferred shares A: 1,000, S100, 4% cumulative preferred shares Preferred shares B: 1,000, $100, 6% non-cumulative preferred shares. Each $100 share is convertible into two common shares. Mulch declared and paid the stated dividends on the preferred shares as well as $100,000 of dividends on the common shares if December 15, 2021. Prior to that, the last time Mulch declared dividends was in 2019 at which point they declared and paid the stated dividends on the preferred shares plus all dividends that were in arrears. Details of Mulch's stock option plans follow: Option A entitles employees to purchase 40,000 common shares for $9.00 each. This option was granted during 2020 and expires in 2024. Option B entitles employees to purchase 40,000 common shares for $21.00 each. This option was granted on July 1, 2021 and expires in 2024. Option Centitles employees to purchase 40,000 common shares for $13.00 each. This option was granted during 2019 and was exercised on April 1, 2021. Option D entitles employees to purchase 40,000 common shares for $17.00 each. This option was granted on September 1, 2021 and expires in 2024. Other notes: Mulch has 5,000, $1000 bonds with annual coupon payments of $50 maturing on December 31, 2025. These bonds were issued to yield 5% on January 1, 2021. Each $1000 bond is convertible into 25 common shares. The average market price of Mulch's common shares for the year is $18.00. The recorded exercise prices and number of shares that can be acquired under the stock option plans have already been adjusted for the stock split. Required: a. Calculate Mulch's basic earnings per share for the year ended December 31, 2021. i. Determine net income available to common shareholders ii. Determine Weighted Average Common Shares Outstanding (WACSO) iii. Calculate basic EPS b. Calculate Mulch's diluted earnings per share for the year ended December 31, 2021. i. Identify all potential common share items. (PCS) ii. Specify whether or not each PCS is dilutive, antidilutive or neither. iii. Calculate incremental EPS for each PCS and identify the rank for each item. Calculate diluted EPS. iv