Answered step by step

Verified Expert Solution

Question

1 Approved Answer

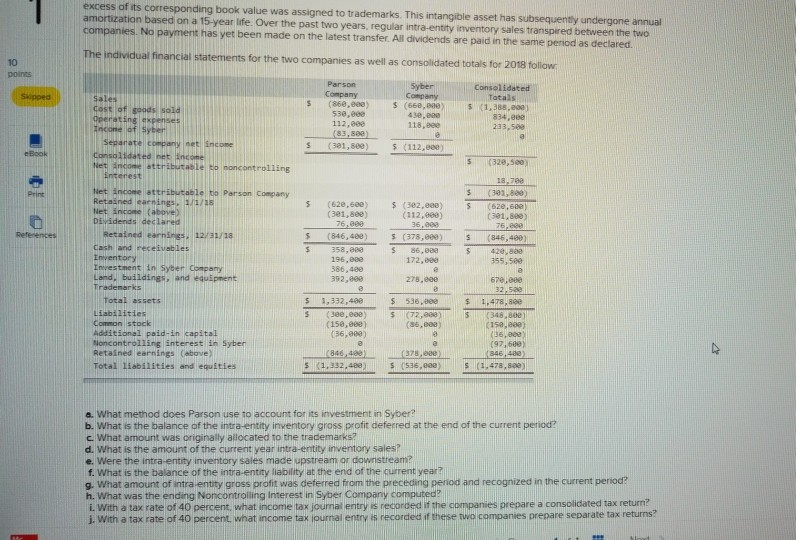

excess of its corresponding book value was assigned to trademarks. This intangible asset has subsequently undergone annual amortization based on a 15-year life. Over the

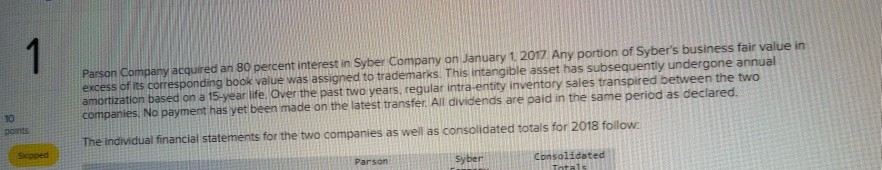

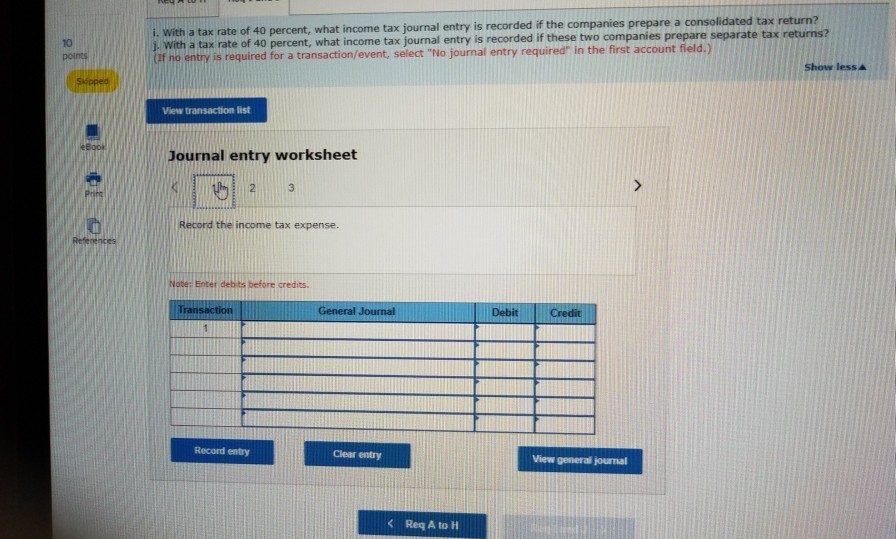

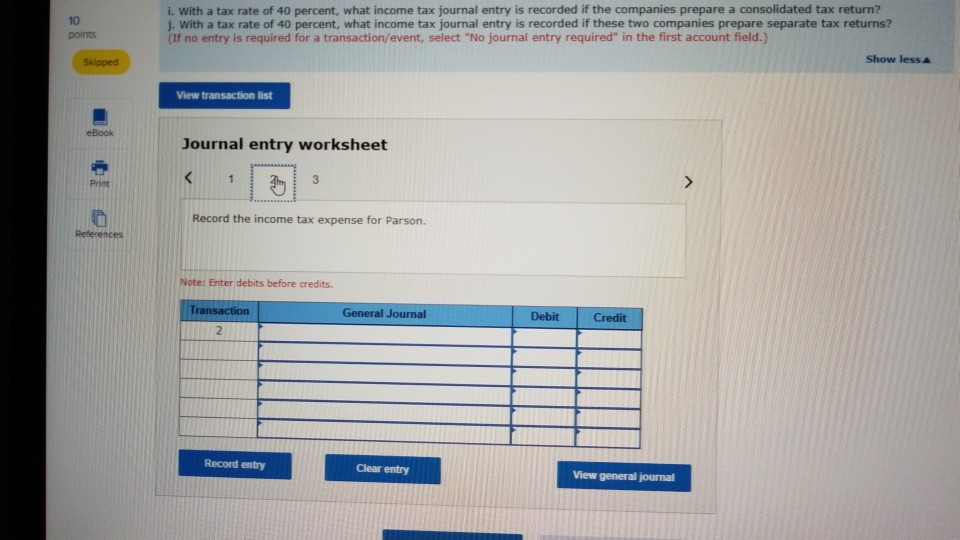

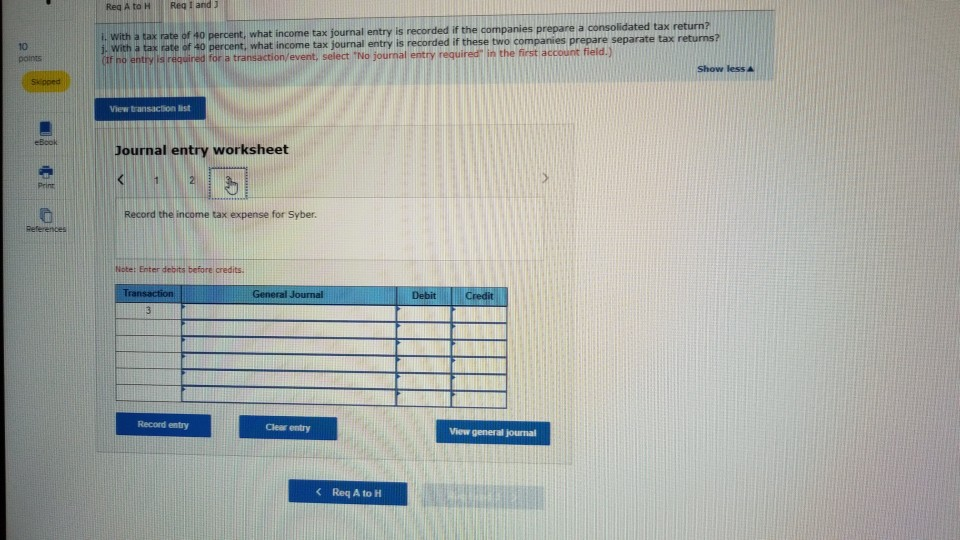

excess of its corresponding book value was assigned to trademarks. This intangible asset has subsequently undergone annual amortization based on a 15-year life. Over the past two years, reqular intra-entity inventory sales transpired between the two companies. No payment has yet been made on the latest transfer All dividends are paid in the same period as declared. The individual financial statements for the two companies as well as consolidated totals for 2018 follow 1C points Parson Syber Company $ (66e,e00) Consolidated Totals s (1,388.e00 Company (860,e00) Siipped Sales Cost of goods sold Operating expenses tncone of svber 530.000 43e,eae 118,800 834,000 112.000 233,500 (83,800) Separate company net income S (301,800) $ (112,000) eBook Consoltidated hetincone Net incone attributable to noncontrolling Enterest s (320,See) 18,780 Net incone attributaele to Parson Company Retained earnings 1/1/18 Net incone (above) Dividends declared Retained earnings 12/31/18 (301,800) Print $ (302,e00) (112,0007 (62e,60e) (301,8ee) (62e,680) (301.800 76,000 36,a00 76,ee0 Refenences (846,400) s (378,000) (846,400) 429,80e 355,s00 Cash and receivables Inventory Investment in Syber Company Land, buildings, and equipment Tradenarks 86,e8a 358,000 196,eee 386,480 392,000 172,eee 278,eee 67e eee 32,sae total assets $ 536,8ee s 1,332,400 s 1,478,80e Liabilities (3ee,eee) (158,eee) (36,e00 (72,000) (86,e00) (348,800) (15a,ee0) (b6,000) (97,600) (846,480) Common stock Additional peid-in capital Noncontrolling interest in Syber Retained earnings (aboe) (846,488 s (1,332,48e (378,e0) Total liabilities and equities s (536,e00) s (1,478,80ey a. What method does Parson use to account for its investment in Syber? b. What is the balance of the intra-entity inventory gross profit deferred at the end of the current period? C What a d. What is the amount of the current year intra-entity inventory sales? e. Were the intra-entity inventory sales made upstream or downstream? f. What is the balance of the intra-entity liability at the end of the current year? g. What amount of intra entity gross profit was deferred from the preceding period and recognized in the current period? h. What was the ending Noncontrolling Interest in Syber Company computed? i. With a tax rate of 40 percent, what income tax journal entry is recorded if the companies prepare a consolidated tax return? j. With a tax rate of 40 percent, what income tax jpurnal entry is recorded if these two companies prepare separate tax returns was originally allocated to the trademarks? 1 Parson Company acquired an 80 percent interest in Syber Company on January 1, 2017 Any portion of Syber's business fair value in excess of its corresponding book value was assigned to trademarks. This intangible asset has subsequently undergone annual amortization based on a 15-year life. Over the past two years, reqular intra-entity inventory sales transpired between the two companies No payment has vet been made on the latest transfer. All dividends are paid in the same period as declared 10 points The individual financial statements for the two companies as well as consolidated totals for 2018 foillow Parson Syber Consolidated Tatals i. With a tax rate of 40 percent, what income tax journal entry is recorded if the companies prepare a consolidated tax return? 1With a tax rate of 40 percent, what income tax journal entry is recorded if these two companies prepare separate tax returns? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 10 polnts Show lessA Sipped View transaction list eBook Journal entry worksheet 2 3 Pritt Record the income tax expense. Refenences Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started