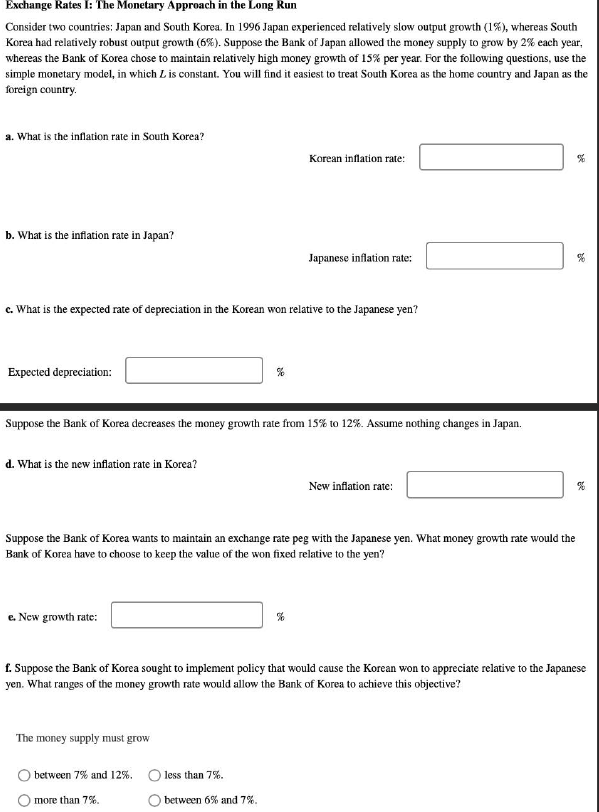

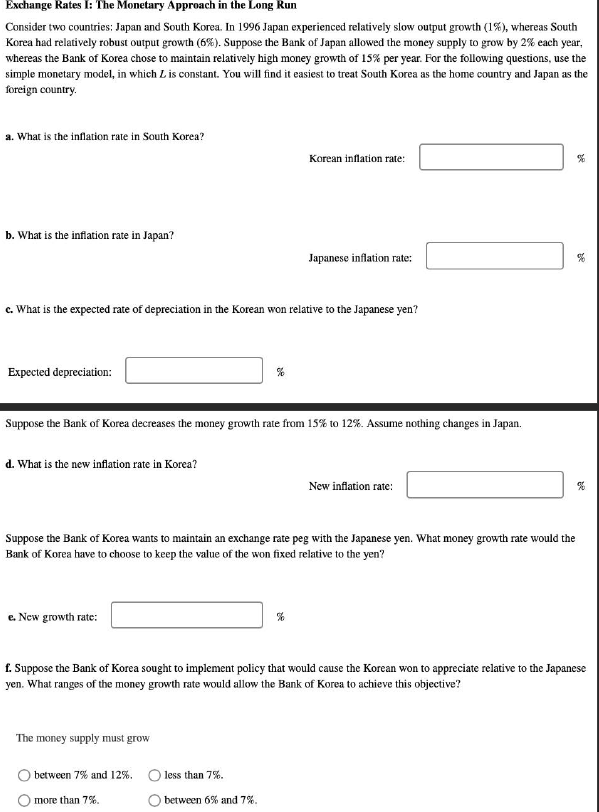

Exchange Rates I: The Monetary Approach in the Long Run Consider two countries: Japan and South Korea. In 1996 Japan experienced relatively slow output growth (1\%), whereas South Korea had relatively robust output growth (6%). Suppose the Bank of Japan allowed the money supply to grow by 2% each year, whereas the Bank of Korea chose to maintain relatively high money growth of 15% per year. For the following questions, use the simple monetary model, in which L is constant. You will find it easiest to treat South Korea as the home country and Japan as the foreign country. a. What is the inflation rate in South Korea? Korean inflation rate: % b. What is the inflation rate in Japan? Japanese inflation rate: % c. What is the expected rate of depreciation in the Korean won relative to the Japanese yen? Expected depreciation: \& Suppose the Bank of Korea decreases the money growth rate from 15% to 12%. Assume nothing changes in Japan. d. What is the new inflation rate in Korea? New inflation rate: % Suppose the Bank of Korea wants to maintain an exchange rate peg with the Japanese yen. What money growth rate would the Bank of Korea have to choose to keep the value of the won fixed relative to the yen? e. New growth rate: f. Suppose the Bank of Korea sought to implement policy that would cause the Korean won to appreciate relative to the Japanese yen. What ranges of the money growth rate would allow the Bank of Korea to achieve this objective? The money supply must grow between 7% and 12%, less than 7%. more than 7%. between 6% and 7%. Exchange Rates I: The Monetary Approach in the Long Run Consider two countries: Japan and South Korea. In 1996 Japan experienced relatively slow output growth (1\%), whereas South Korea had relatively robust output growth (6%). Suppose the Bank of Japan allowed the money supply to grow by 2% each year, whereas the Bank of Korea chose to maintain relatively high money growth of 15% per year. For the following questions, use the simple monetary model, in which L is constant. You will find it easiest to treat South Korea as the home country and Japan as the foreign country. a. What is the inflation rate in South Korea? Korean inflation rate: % b. What is the inflation rate in Japan? Japanese inflation rate: % c. What is the expected rate of depreciation in the Korean won relative to the Japanese yen? Expected depreciation: \& Suppose the Bank of Korea decreases the money growth rate from 15% to 12%. Assume nothing changes in Japan. d. What is the new inflation rate in Korea? New inflation rate: % Suppose the Bank of Korea wants to maintain an exchange rate peg with the Japanese yen. What money growth rate would the Bank of Korea have to choose to keep the value of the won fixed relative to the yen? e. New growth rate: f. Suppose the Bank of Korea sought to implement policy that would cause the Korean won to appreciate relative to the Japanese yen. What ranges of the money growth rate would allow the Bank of Korea to achieve this objective? The money supply must grow between 7% and 12%, less than 7%. more than 7%. between 6% and 7%