Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exchange rates: $/JPY $/Won $/CAD S/GRP S/AUS S/ZAR Current borrowing interest rates on loans USA Japan South Korea Canada UK Australia South Africe 1

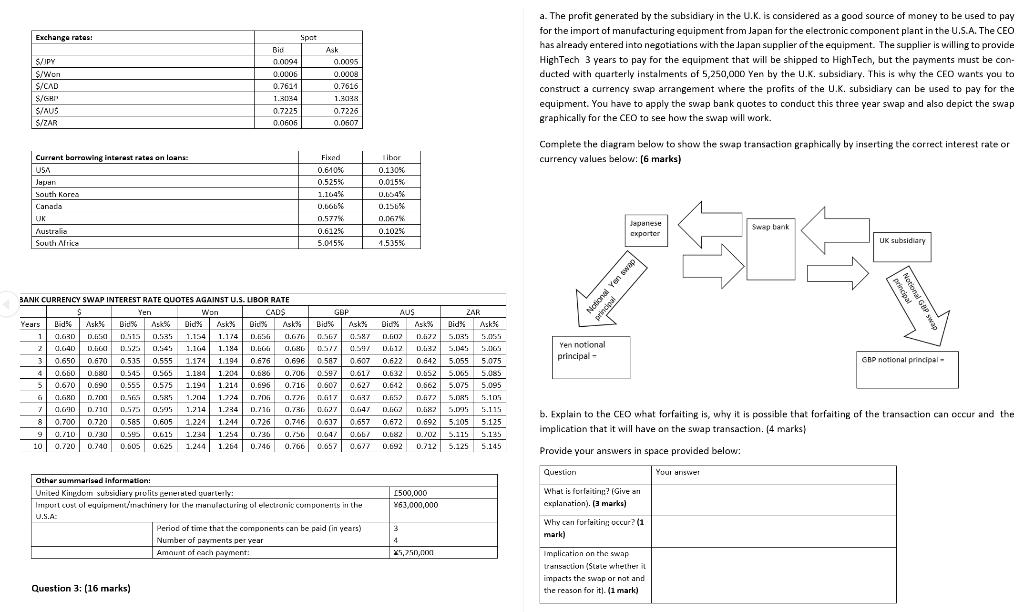

Exchange rates: $/JPY $/Won $/CAD S/GRP S/AUS S/ZAR Current borrowing interest rates on loans USA Japan South Korea Canada UK Australia South Africe 1 2 3 Big 0.0094 0.0006 0.7611 1.3034 0.7225 0.0606 Spot Question 3: (16 marks) Ask 0.0095 0.0008 0.7616 1.3038 0.7226 0.0507 Fixed 0.6-10% 0.525% 1.169% 0.66b% 0.577% 0.61250 5.0-15% BANK CURRENCY SWAP INTEREST RATE QUOTES AGAINST U.S. LIBOR RATE Yen Won CADS S AUS ZAR Bid% Ask 4 Years Bid% Ask Bid% Ask Did% Ask% Bid% Ask% Bid% Ask% Did% 0.630 D.650 0.513 0.535 1.154 1.174 D.656 0.676 0.567 0.587 D.G07 0.622 5.035 5.055 0.640 D.GGO 0.525 0.545 1.164 1.184 D.GGG 0.686 0.577 0.597 0.612 0.432 5.045 5.0005 0.650 0.670 0.535 0.555 1.174 1.194 0.676 0.696 0.587 0.607 0.622 0.642 5.055 5.075 0.660 0.680 0.545 0.565 1.184 1.204 0.685 0.706 0.597 0.617 0.632 0.552 5.065 5.085 0.670 0.690 0.555 0.575 1.194 1.214 0.696 0.716 0.607 0.627 0.642 01.680 0.700 0.569 0.585 1.204 1.774 D.706 0.776 0.617 0.647 D.657 0.677 5.085 5.105 0.690 D.710 0.575 0.595 1.214 1.234 D.716 0.736 0.627 0.647 D.EGZ D.687 5.095 5.115 0.700 0.720 0.585 0.605 1.224 1.244 0.726 0.746 0.637 0.657 0.672 0.692 5.105 5.125 0./10 0.730 0.595 0.615 1.234 1.254 0.736 0.756 0.647 0.667 0.682 0./02 5.115 5.135 10 0.720 0.740 0.605 0.625 1.244 1.264 0.746 0.766 0.657 0.677 5 0.662 5.075 5.095 G 7 8 9 0.692 0.712 5.125 5.145 GBP Other summarised information: United Kingdom subsidiary profits generated quarterly: Import cost of equipment/machinery for the manufacturing of electronic components in the U.S.A: Tibor 0.130% 0.015% 0.004% 0.156% 0.067% 0.102% 1.535% Period of time that the components can be paid (in years) Number of payments per year Amount of each payment: 500,000 X63,000,000 3 4 25,750,000 a. The profit generated by the subsidiary in the U.K. is considered as a good source of money to be used to pay for the import of manufacturing equipment from Japan for the electronic component plant in the U.S.A. The CEO has already entered into negotiations with the Japan supplier of the equipment. The supplier is willing to provide HighTech 3 years to pay for the equipment that will be shipped to HighTech, but the payments must be con- ducted with quarterly instalments of 5,250,000 Yen by the U.K. subsidiary. This is why the CEO wants you to construct a currency swap arrangement where the profits of the U.K. subsidiary can be used to pay for the equipment. You have to apply the swap bank quotes to conduct this three year swap and also depict the swap graphically for the CEO to see how the swap will work. Complete the diagram below to show the swap transaction graphically by inserting the correct interest rate or currency values below: (6 marks) Yen notional principal - www. Japanese exporter National Yen swap principal Question What is forfaiting? (Give an explanation). (3 marks) Why can forfaiting occur? (1 mark) Swap bank Implication on the swap transaction (State whether impacts the swap or not and the reason for it). (1 mark) UK subsidiary b. Explain to the CEO what forfaiting is, why it is possible that forfaiting of the transaction can occur and the implication that it will have on the swap transaction. (4 marks) Provide your answers in space provided below: Your answer principal National GBP swap GBP notional principal-

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a To construct the currency swap arrangement we need to determine the exchange rates and interest rates involved Based on the information provided the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started