Answered step by step

Verified Expert Solution

Question

1 Approved Answer

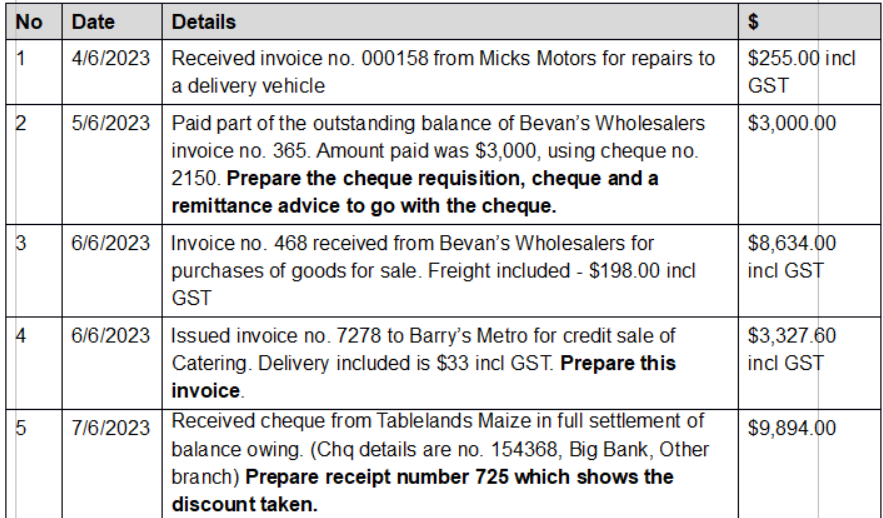

When creating a general journal do I include invoices where no money has been paid or received? Such as in transaction 1 and 3 in

When creating a general journal do I include invoices where no money has been paid or received? Such as in transaction 1 and 3 in the images included. If I do include them, how would I go about formatting them?

No Date 1 2 3 4 5 Details 4/6/2023 Received invoice no. 000158 from Micks Motors for repairs to a delivery vehicle 5/6/2023 Paid part of the outstanding balance of Bevan's Wholesalers invoice no. 365. Amount paid was $3,000, using cheque no. 2150. Prepare the cheque requisition, cheque and a remittance advice to go with the cheque. 6/6/2023 Invoice no. 468 received from Bevan's Wholesalers for purchases of goods for sale. Freight included - $198.00 incl GST 6/6/2023 Issued invoice no. 7278 to Barry's Metro for credit sale of Catering. Delivery included is $33 incl GST. Prepare this invoice. 7/6/2023 Received cheque from Tablelands Maize in full settlement of balance owing. (Chq details are no. 154368, Big Bank, Other branch) Prepare receipt number 725 which shows the discount taken. $ $255.00 incl GST $3,000.00 $8,634.00 incl GST $3,327.60 incl GST $9,894.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In general journal entries you should include all transactions including those where no money has be...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started