Question

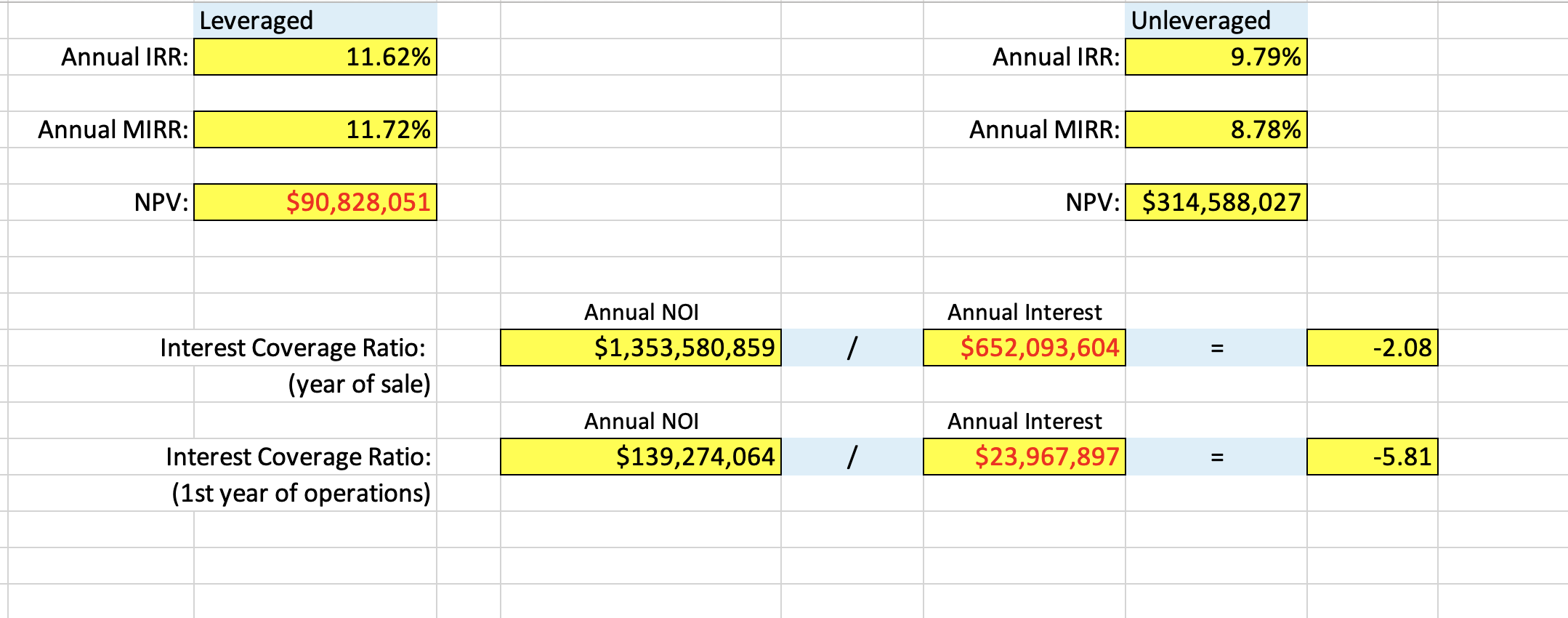

Executive summary This is a 500 - 700-word summary of your analysis. The summary must discuss your evaluation of the equity (leveraged) and projects (unleveraged)

Executive summary This is a 500 - 700-word summary of your analysis. The summary must discuss your evaluation of the equity (leveraged) and projects (unleveraged) returns and performance ratios in terms of financial viability (you dont need to define the various investment terms, e.g. textbook definitions of IRR, NPV etc). Assess your propertys performance against returns that can be achieved on similar property types and alternative investments (e.g. other types of properties, stocks, term deposits, etc.). Keep in mind that space in the building will be available only after construction is completed. Therefore, your discussion must reflect the timing of project completion and future market conditions. The subject property is located in Auckland CBD and is a prime-grade office accommodation. Although typically rents in Auckland are on a net basis, in this assignment, the assumption is that the leases in the building are gross (i.e. landlord covers the expenses from rental income). When comparing rents make adjustments for operating expenses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started