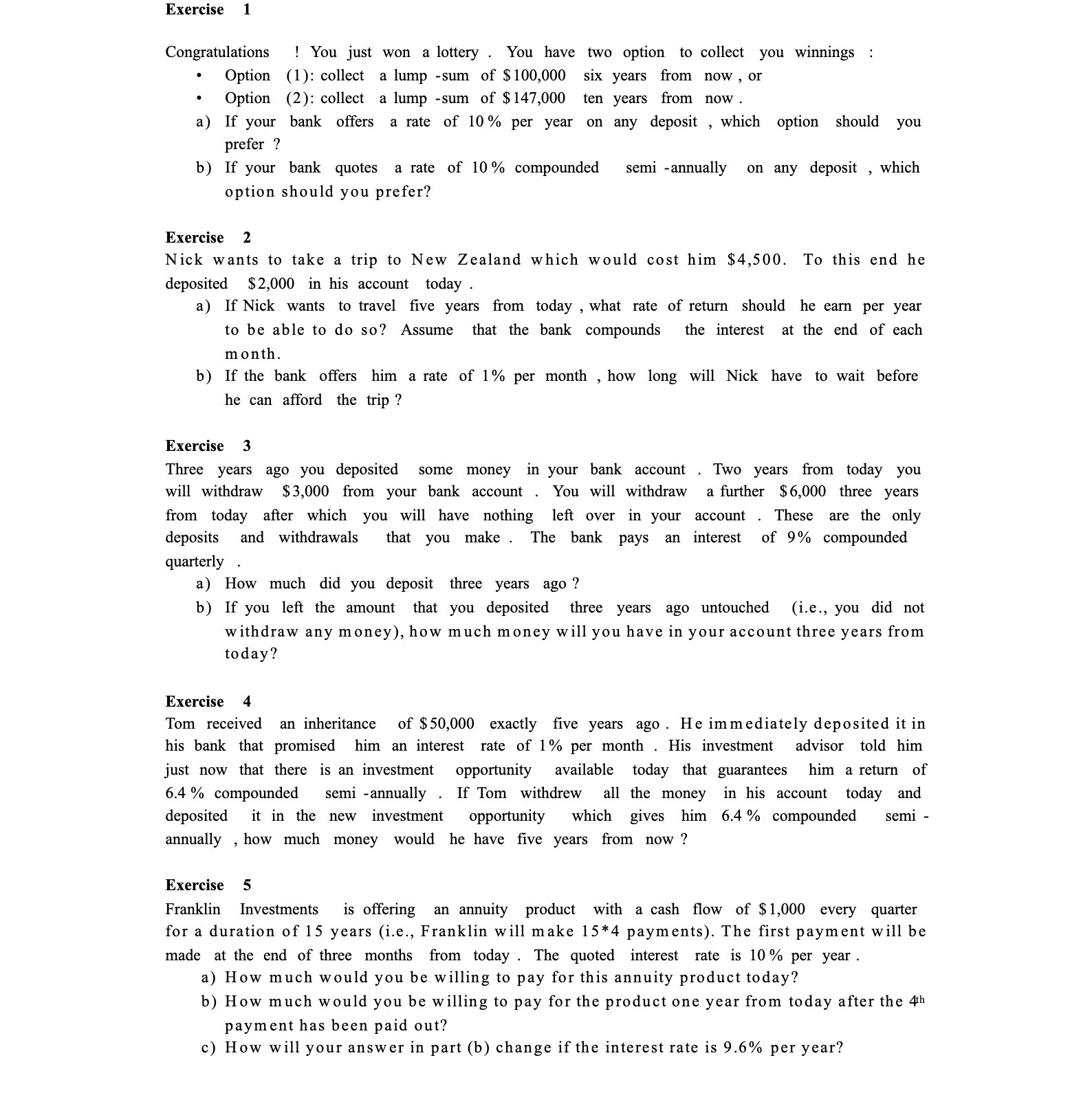

Exercise 1 Congratulations I You just won a lottery . You have two option to collect you winnings - Option (1): collect a lump -sum of $100,000 six years om now , or - Option (2): collect a lump -sum of $147,000 ten years from now. a) If your bank offers a rate of 10% per year on any deposit , which option should you prefer ? b) If your bank quotes a rate of 10% compounded semi -annually on any deposit , which option should you prefer? Exercise 2 Nick wants to take a trip to New Zealand which would cost him $4,500. To this end he deposited $2,000 in his account today. a) If Nick wants to travel ve years om today , what rate of return should he earn per year to be able to do so? Assume that the bank compounds the interest at the end of each month. b) If the bank offers him a rate of 1% per month , how long will Nick have to wait before he can afford the trip ? Exercise 3 Three years ago you deposited some money in your bank account . Two years from today you will withdraw $3,000 from your bank account . You will withdraw a lrther $6,000 three years from today aer which you will have nothing left over in your account . These are the only deposits and withdrawals that you make. The bank pays an interest of 9% compounded quarterly . a) How much did you deposit three years ago ? b) If you le the amount that you deposited three years ago untouched (i.e., you did not withdraw any money), how much money will you have in your account three years from today? Exercise 4 Tom received an inheritance of $50,000 exactly ve years ago. He immediately deposited it in his bank that promised him an interest rate of 1% per month . His investment advisor told him just now that there is an investment opportunity available today that guarantees him a return of 6.4% compounded semi -annually . If Tom withdrew all the money in his account today and deposited it in the new investment opportunity which gives him 6.4 % compounded semi - annually , how much money would he have ve years from now ? Exercise 5 Franklin Investments is offering an annuity product with a cash ow of $1,000 every quarter for a duration of 15 years (i.e., Franklin will make 15*4 payments). The first payment will be made at the end of three months from today. The quoted interest rate is 10% per year . a) How much would you be willing to pay for this annuity product today? b) How much would you be willing to pay for the product one year from today after the 4\"1 payment has been paid out? c) How will your answer in part (b) change if the interest rate is 9.6% per year