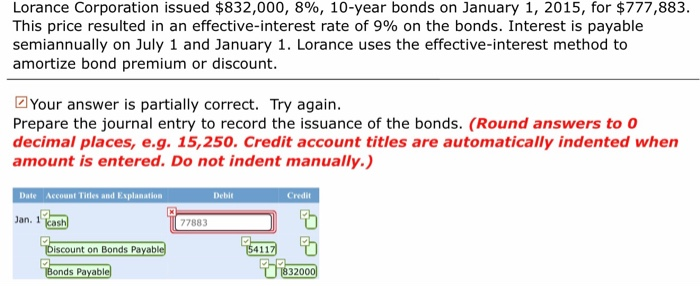

| Exercise 10-18 Lorance Corporation issued $832,000, 8%, 10-year bonds on January 1, 2015, for $777,883. This price resulted in an effective-interest rate of 9% on the bonds. Interest is payable semiannually on July 1 and January 1. Lorance uses the effective-interest method to amortize bond premium or discount. |

|

| |

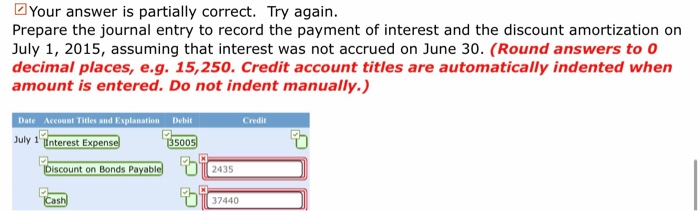

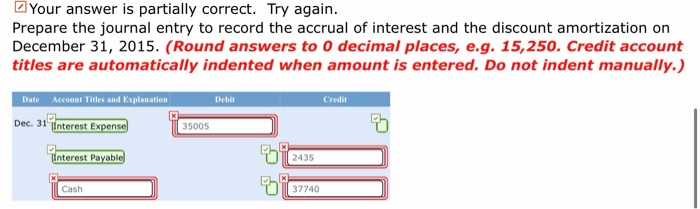

Lorance Corporation issued $832,000, 8%, 10-year bonds on January 1, 2015, for $777,883. This price resulted in an effective-interest rate of 9% on the bonds. Interest is payable semiannually on July 1 and January 1. Lorance uses the effective-interest method to amortize bond premium or discount. Your answer is partially correct. Try again. Prepare the journal entry to record the issuance of the bonds. (Round answers to O decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 1 kash 77883 Discount on Bonds Payable 154117 ) Bonds Payable 18320001 Your answer is partially correct. Try again. Prepare the journal entry to record the payment of interest and the discount amortization on July 1, 2015, assuming that interest was not accrued on June 30. (Round answers to o decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Credit Date Account Titles and Explanation Debit July 1 Interest Expense 135005) Discount on Bonds Payable 2435 Cash 537440 Your answer is partially correct. Try again. Prepare the journal entry to record the accrual of interest and the discount amortization on December 31, 2015. (Round answers to o decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation Dec. 31 Interest Expense 35005 Tinterest Payable 2435 Cash 37740 Lorance Corporation issued $832,000, 8%, 10-year bonds on January 1, 2015, for $777,883. This price resulted in an effective-interest rate of 9% on the bonds. Interest is payable semiannually on July 1 and January 1. Lorance uses the effective-interest method to amortize bond premium or discount. Your answer is partially correct. Try again. Prepare the journal entry to record the issuance of the bonds. (Round answers to O decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 1 kash 77883 Discount on Bonds Payable 154117 ) Bonds Payable 18320001 Your answer is partially correct. Try again. Prepare the journal entry to record the payment of interest and the discount amortization on July 1, 2015, assuming that interest was not accrued on June 30. (Round answers to o decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Credit Date Account Titles and Explanation Debit July 1 Interest Expense 135005) Discount on Bonds Payable 2435 Cash 537440 Your answer is partially correct. Try again. Prepare the journal entry to record the accrual of interest and the discount amortization on December 31, 2015. (Round answers to o decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation Dec. 31 Interest Expense 35005 Tinterest Payable 2435 Cash 37740