Answered step by step

Verified Expert Solution

Question

1 Approved Answer

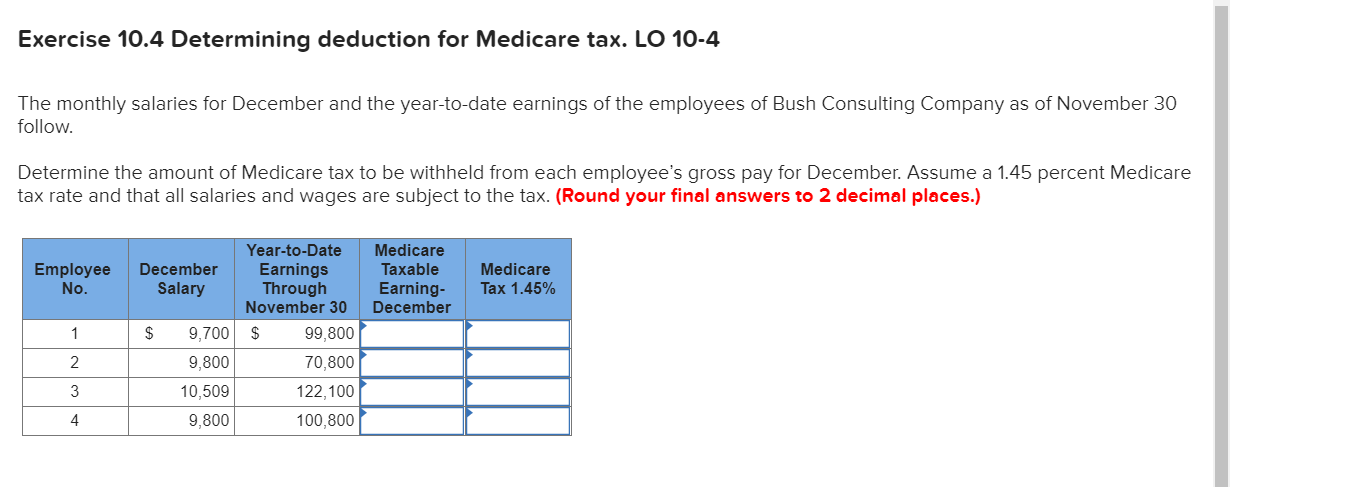

. Exercise 10.4 Determining deduction for Medicare tax. LO 10-4 The monthly salaries for December and the year-to-date earnings of the employees of Bush Consulting

.

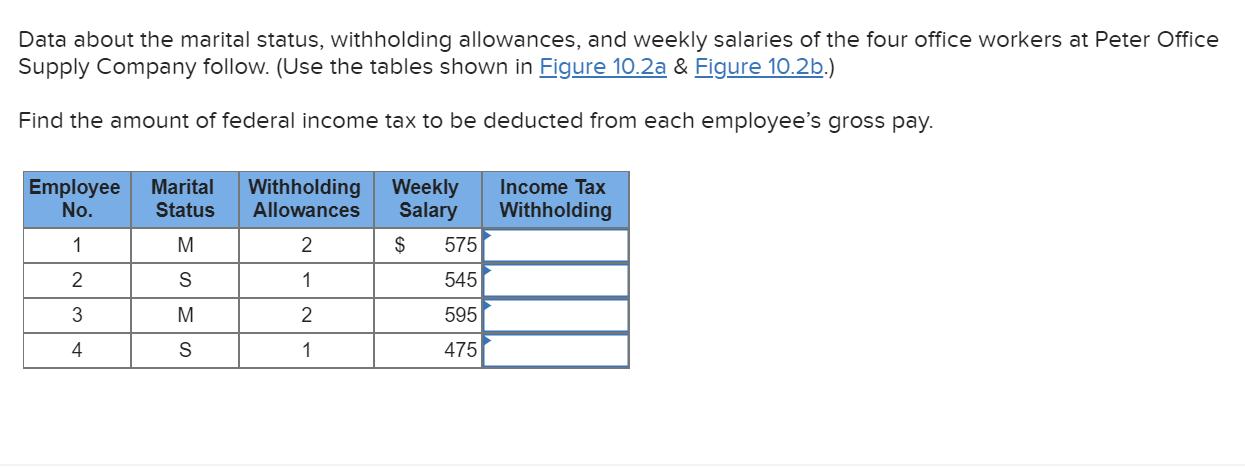

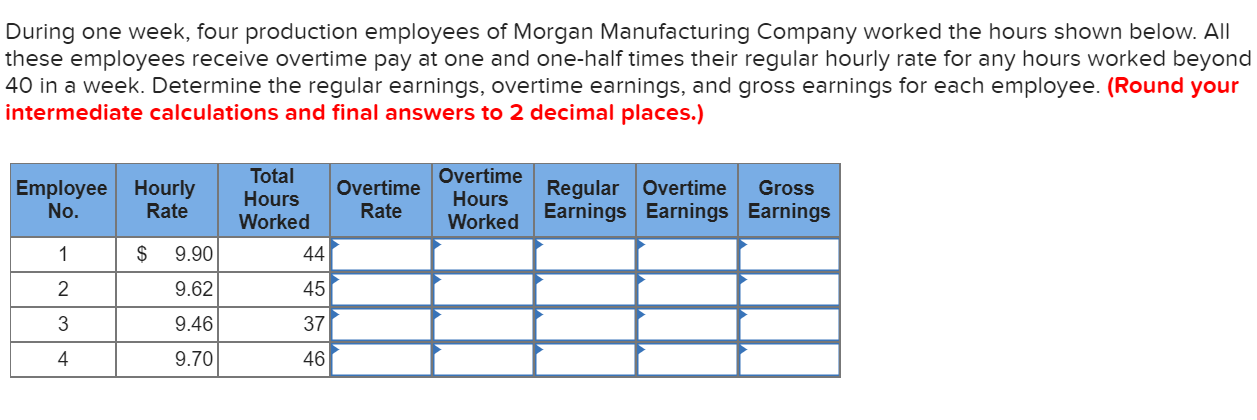

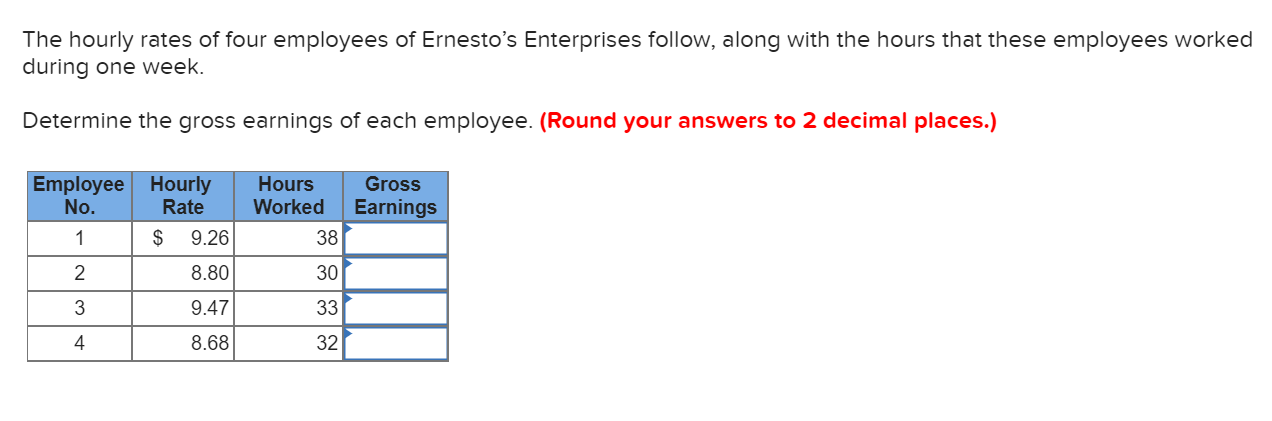

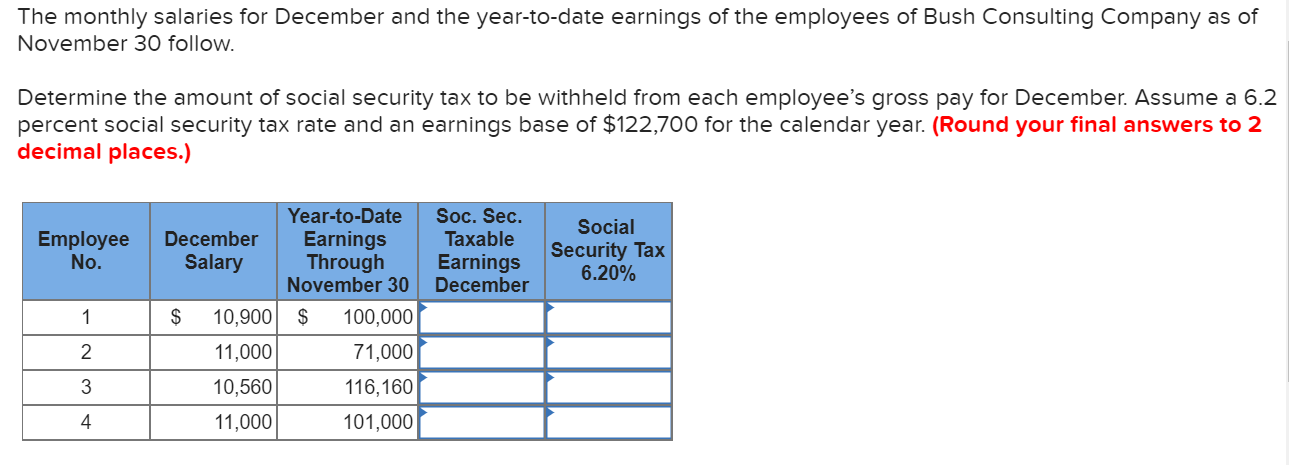

Exercise 10.4 Determining deduction for Medicare tax. LO 10-4 The monthly salaries for December and the year-to-date earnings of the employees of Bush Consulting Company as of November 30 follow. Determine the amount of Medicare tax to be withheld from each employee's gross pay for December. Assume a 1.45 percent Medicare tax rate and that all salaries and wages are subject to the tax. (Round your final answers to 2 decimal places.) Employee No. December Salary Year-to-Date Earnings Through November 30 $ 99,800 70.800 Medicare Taxable Earning- December Medicare Tax 1.45% 1 $ 9,700 9,800 10,509 9,800 122, 100 100,800 Data about the marital status, withholding allowances, and weekly salaries of the four office workers at Peter Office Supply Company follow. (Use the tables shown in Figure 10.2a & Figure 10.2b.) Find the amount of federal income tax to be deducted from each employee's gross pay. Employee No. Withholding Allowances Income Tax Withholding 1 2 3 4 Marital Status M. S M S 1 2 1 Weekly Salary $ 575 545 595 L 475 During one week, four production employees of Morgan Manufacturing Company worked the hours shown below. All these employees receive overtime pay at one and one-half times their regular hourly rate for any hours worked beyond 40 in a week. Determine the regular earnings, overtime earnings, and gross earnings for each employee. (Round your intermediate calculations and final answers to 2 decimal places.) Total Overtime Employee No. Hourly Rate Overtime e Regular Overtime Gross Worked Earnings Earnings Earnings Hours Worked Hours Rate $ 44 1 2 45 9.90 9.62 9.46 9.70 46 The hourly rates of four employees of Ernesto's Enterprises follow, along with the hours that these employees worked during one week. Determine the gross earnings of each employee. (Round your answers to 2 decimal places.) Hours Worked Gross Earnings Employee Hourly No. Rate 1 $ 9.26 - 2 8.80 3 4 8.68 9.47 327 The monthly salaries for December and the year-to-date earnings of the employees of Bush Consulting Company as of November 30 follow. Determine the amount of social security tax to be withheld from each employee's gross pay for December. Assume a 6.2 percent social security tax rate and an earnings base of $122,700 for the calendar year. (Round your final answers to 2 decimal places.) Employee No. December Salary Social Security Tax 6.20% $ 10,900 11,000 10,560 11,000 Year-to-Date Soc. Sec. Earnings Taxable Through Earnings November 30 December $ 100,000 71,000 116,160 101,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started