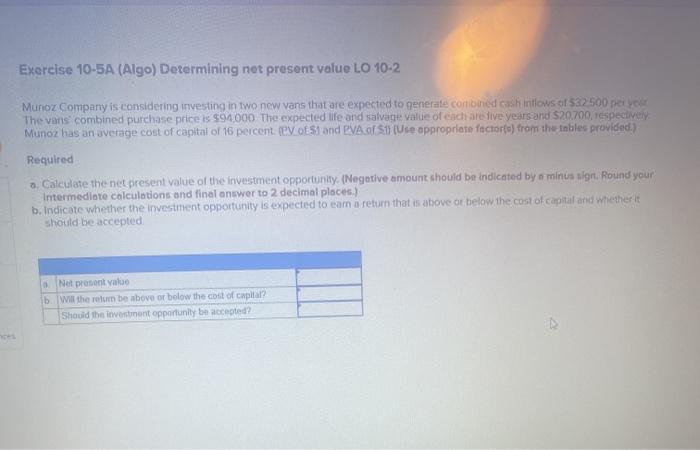

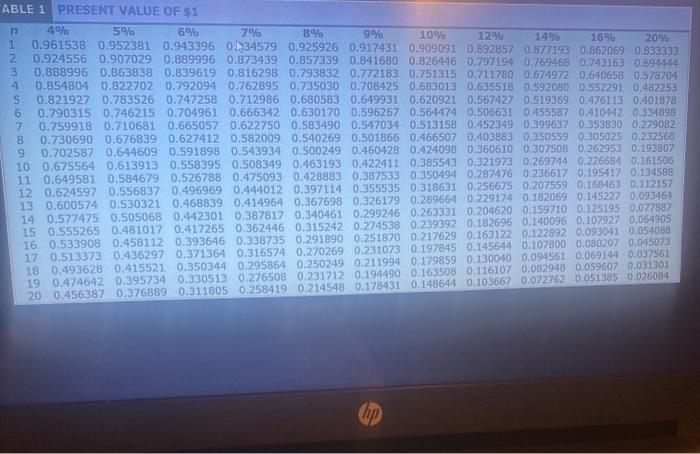

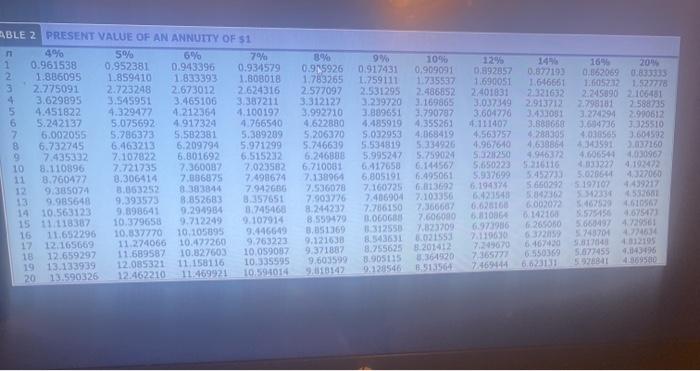

Exercise 10-5A (Algo) Determining net present value LO 10-2 Munoz Company is considering investing in two new vans that are expected to generate combined cash flows of 532.500 per your The vans combined purchase price is $94.000 The expected life and salvage value of each are five years and 520700, respectively Munoz has an average cost of capital of 16 percent (ey of S1 and PVA O 1 (Use appropriate factor(e) from the Inbles provided) Required a. Calculate the net present value of the investment opportunity. (Negative amount should be indicated by a minus sign. Round your Intermediate calculations and final answer to 2 decimal places.) b. Indicate whether the investment opportunity is expected to eam a return that is above or below the cost of capital and whether it should be accepted Net procent value b. Will the relum be above or below the cost of capital? Should the investment opportunity be accepted? ABLE 1 PRESENT VALUE OF $1 4% 5% 6% 7% 896 9% 1 10% 0.961538 0.952381 0.943396 0.134579 0.925926 0.917431 0.909091 0.892857 0.877193 0.862069 0.833333 12% 14% 16% 20% 2 0.924556 0.907029 0.889996 0.873439 0.857339 0.841680 0.826446 0.797194 0.769468 0.743163 0.694444 3 0.888996 0.863838 0.839619 0.816298 0.793832 0.772183 0.751315 0.711780 0.674972 0.640658 0.578704 4 0.854804 0.822702 0.792094 0.762895 0.735030 0.708425 0.683013 0.635518 0.592030 0.552291 0.482253 5 0.821927 0.783526 0.747258 0.712986 0.680583 0.649931 0.620921 0.567427 0.519369 0.476113 0:401878 6 0.790315 0.746215 0.704961 0.666342 0.630170 0.596267 0,564474 0.506631 0.455587 0.410442 0,334898 0.759918 0.710681 0.665057 0.622750 0.583490 0.547034 0.513158 0.452349 0.399637 0.353830 0.279082 0.730690 0.6768390.627412 0.582009 0.540269 0.501866 0.466507 0.403883 0,350559 0.305025 0.232568 9 0.702587 0.644609 0.591898 0.543934 0.500249 0.460428 0.424098 0.360610 0.30750B 0.252953 0.193807 10 0.675564 0.613913 0.558395 0.508349 0.463193 0.422411 0.385543 0.321973 0.269744 0.226584 0.161506 11 0.649581 0.584679 0.526788 0.475093 0.428883 0.387533 0.350494 0.287476 0.236617 0.195417 0.134588 12 0.624597 0.556837 0.496969 0.444012 0.397114 0.355535 0.318631 0.256675 0.2075590.168463 0.112157 13 0.600574 0.530321 0.468839 0.414964 0.367698 0.3261790.289664 0.229174 0.182069 0.145227 0.09346 14 0.577475 0.505068 0.442301 0.387817 0.340461 0.299246 0.263331 0.204620 0.159710 0.125195 0.077887 15 0.555265 0.481017 0.417265 0.362446 0.315242 0.274538 0.239392 0.182696 0.140096 0.107927 0.064905 0.054088 16 0.533908 0.458112 0.393646 0.338735 0.291890 0.251870 0.217629 0.163122 0.122892 0.09304 17 0.513373 0.436297 0.371364 0.316574 0.270269 0.231073 0.197845 0.145644 0.107800 0.080207 0.045073 18 0.493628 0.415521 0.350344 0.295864 0.250249 0.211994 0.179859 0.130040 0.094561 0.069144 0.037561 19 0.474642 0.395734 0.330513 0.276508 0.231212 0.194490 0.1635080.116107 0.082948 0.059607 0.031301 20 0.456387 0.376889 0.311805 0.258419 0.214548 0.178431 0.148644 0.103667 0.072762 0.051385 0.026084 Gap BLE 2 PRESENT VALUE OF AN ANNUITY OF $1 4% 5% 6% 7% 1 0.961538 0.952381 0.943396 0,934579 2 1.886095 1.859410 1.833393 1.808018 3 2.775091 2.723248 22673012 2.624316 3.629895 3.545951 3.465106 3.387211 5 4.451822 4.329477 4.212364 6 4.100197 5.242137 5:075692 4.917324 4.766540 7 6.002055 5.786373 5.582381 5.389209 8 6.732745 6.463213 6.209794 5.971299 9 7.435332 7.107822 6.801692 6.515232 10 8.110896 7.721735 7.36000 2.023582 3.760477 8.306414 7.386875 7:498674 12 9.385074 3.053252 3383844 7.94266 9.985648 9.393573 3.852683 8.357651 10.563123 9.898641 0.294934 01745468 1511118387 10.379658 9.712249 9.107914 16 11,652296 10.837770 10.105895 9.446649 17 12 165669 11.274066 10.477260 91763223 18 12.659297 11.689587 10.827603 10.059087 19 13.133939 12.085321 11.158116 10.339595 20 13.590326 12.462210 11.469921 10.594014 8% 0.95926 1.783265 2.577097 3.312122 3.992210 4.622880 5.206370 5.746639 6.246388 6.710031 7.138964 7.536078 7.90376 8.244232 8.55420 3.351369 9.12163B 9.371887 9.603599 9,18142 9% 1090 0.917431 0.909091 1.759111 1.735537 2.531295 2.486652 3.239720 169865 3.889651 3.790787 4.4485919 4.355261 5.032953 4.068419 5.594819 5.334926 5.995247 5.759024 6417658 6.144567 6,805191 6.495051 7.160735613693 7.406904 7.103356 7.706150 2.366667 BOLOGBE 7.606090 0.312550 7.823709 8.543531 0.0215 8.755625 201412 3.0D5135 364920 9.128546 129 14 169 2014 0.892857 0.872193 0.8620690.833333 1,690051 1.646651 1.00 2/401831 2321632 2.2450902106451 3.037349 2.913712 2.798181 2.588735 3.604770 3.4303 3.274294 2.990612 111407 3.888666 3.684736 25510 4.563797 4.288305 4,078565 3.604502 4.967640 4.63986 343591 037160 57321250 4.94637 4.610651 1.030967 5,650223 403322 192422 5.937699 5.45273 5.020641 1322060 6. 194344 5660292 5197102 443921 5340 55 0021 6.00207 462 5.103 142160 5.57545 4.67547 0.97980 265050 5660192 11000 3725 5740704 72070 5.17 7365777 6550369 5.677455 4.143496 7469444 6.6231371 5841 OTS DZOR