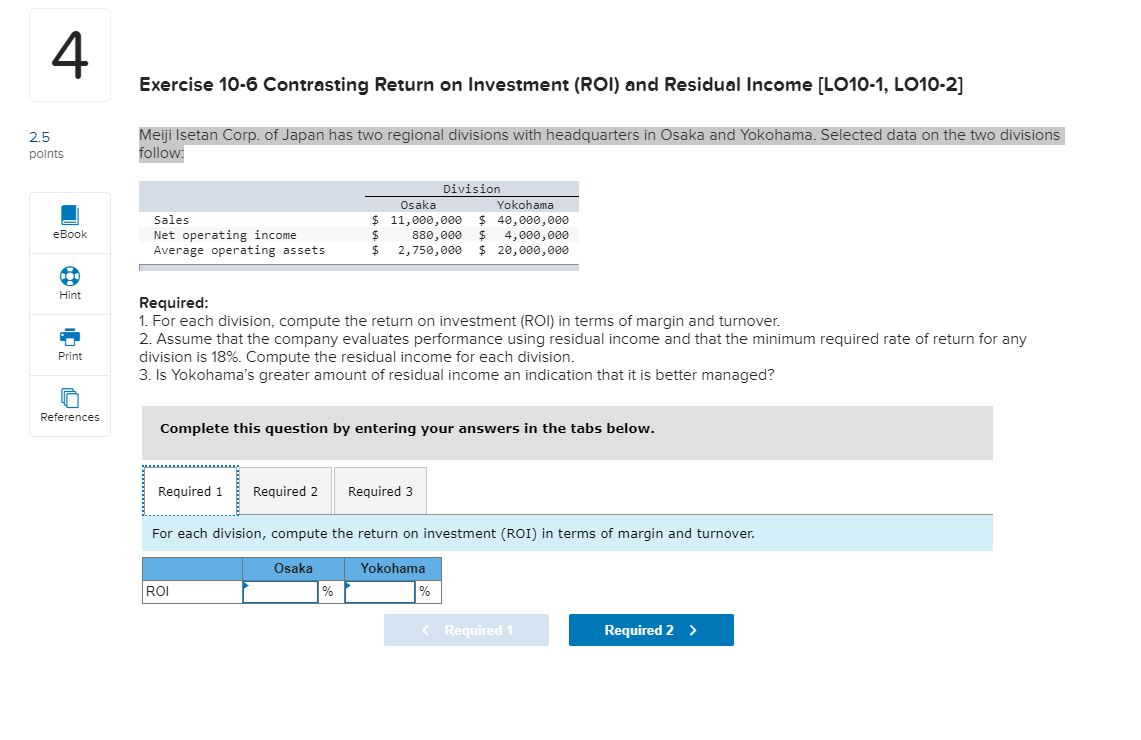

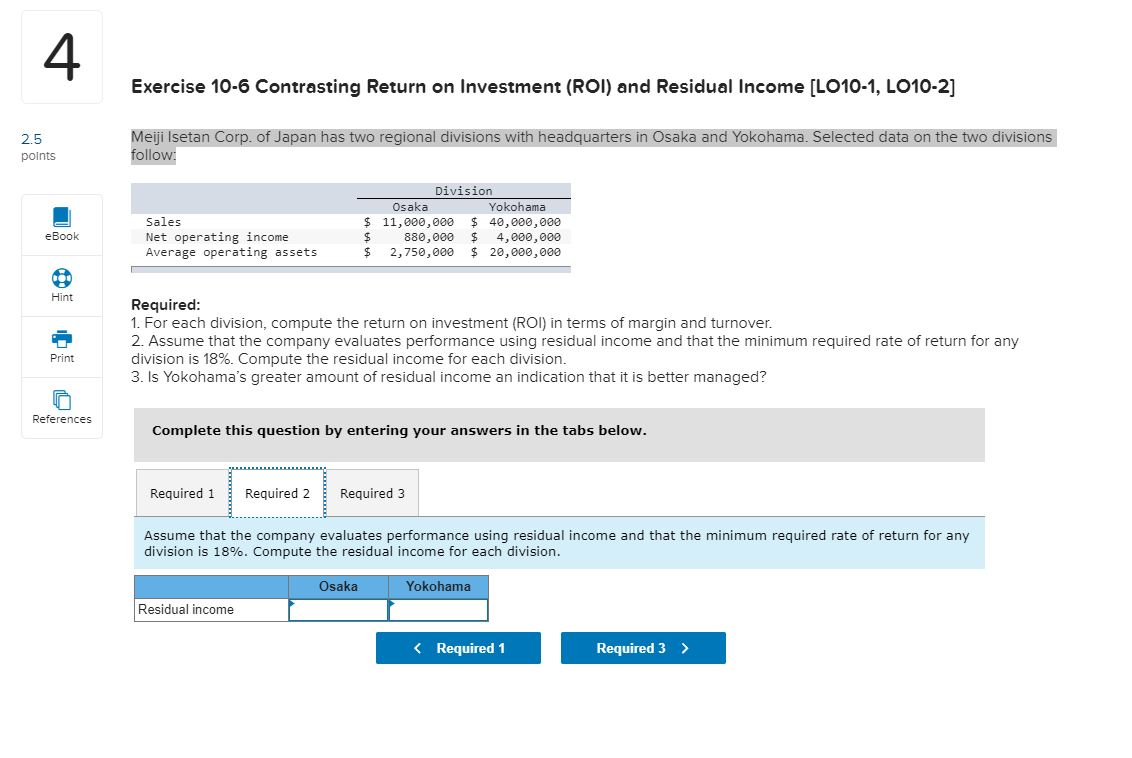

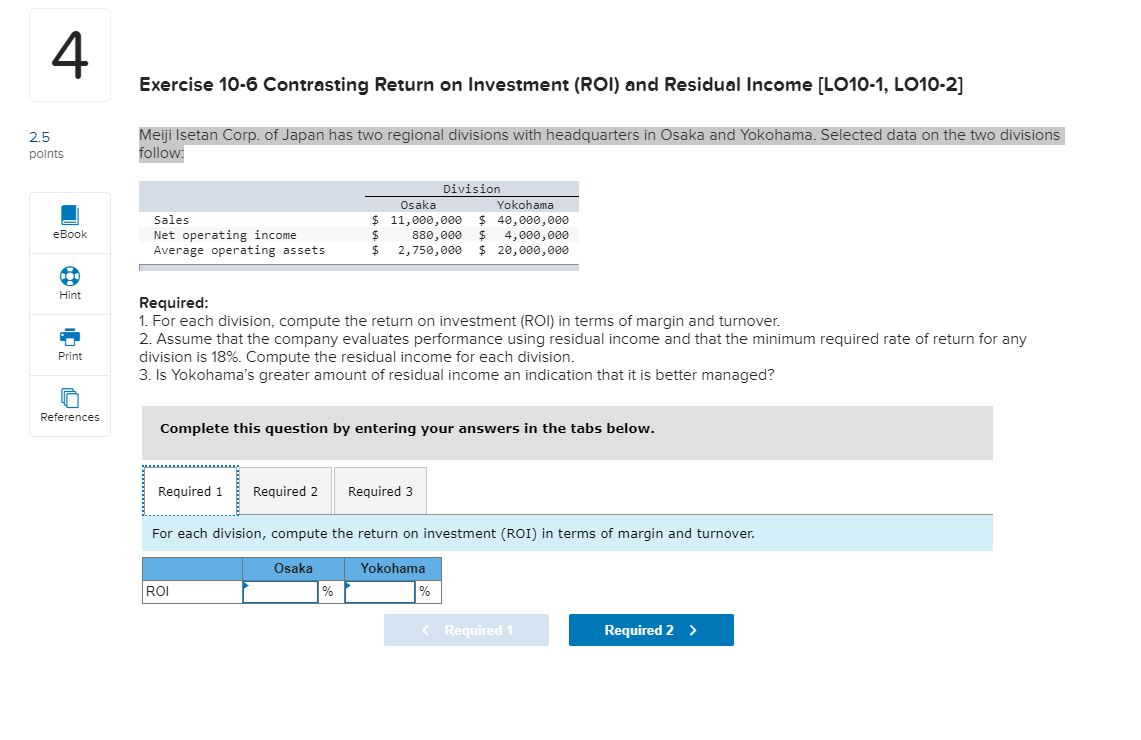

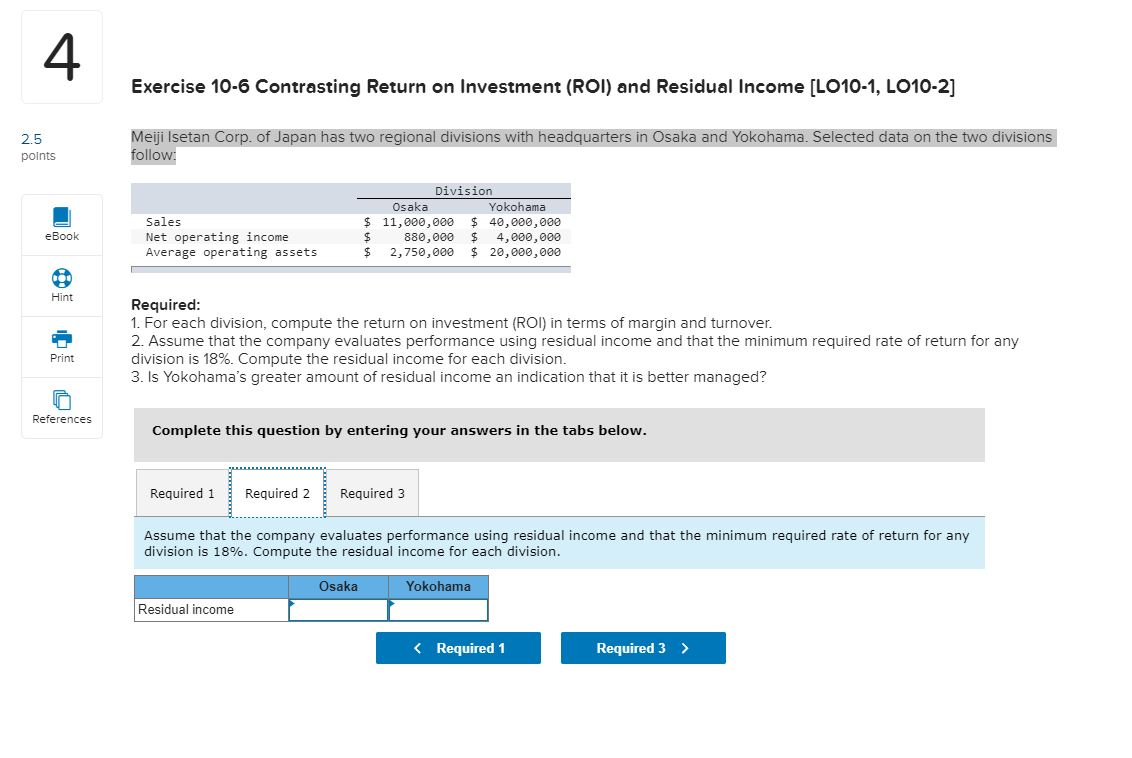

Exercise 10-6 Contrasting Return on Investment (ROI) and Residual Income [LO10-1, LO10-2] 2.5 points Meiji Isetan Corp. of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow: Division Osaka Yokohama $ 11,000,000 $ 40,000,000 $ 880,000 $ 4,000,000 $ 2,750,000 $20,000,000 Sales Net operating income Average operating assets eBook Hint Required: 1. For each division, compute the return on investment (ROI) in terms of margin and turnover. 2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 18%. Compute the residual income for each division. 3. Is Yokohama's greater amount of residual income an indication that it is better managed? Print References Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 For each division, compute the return on investment (ROI) in terms of margin and turnover. Osaka Yokohama ROI % Exercise 10-6 Contrasting Return on Investment (ROI) and Residual Income [LO10-1, LO10-2] 2.5 points Meiji Isetan Corp. of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow: Division Osaka Yokohama $ 11,000,000 $40,000,000 $ 880,000 $ 4,000,000 $ 2,750,000 $ 20,000,000 Sales Net operating income Average operating assets eBook Hint Required: 1. For each division, compute the return on investment (ROI) in terms of margin and turnover. 2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 18%. Compute the residual income for each division. 3. Is Yokohama's greater amount of residual income an indication that it is better managed? Print References Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 18%. Compute the residual income for each division. Osaka Yokohama Residual income