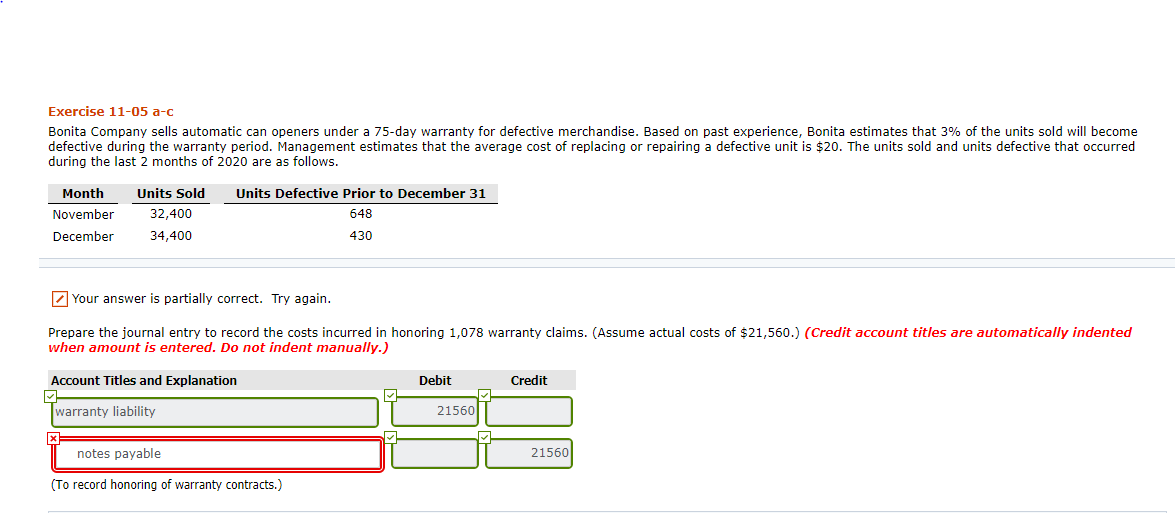

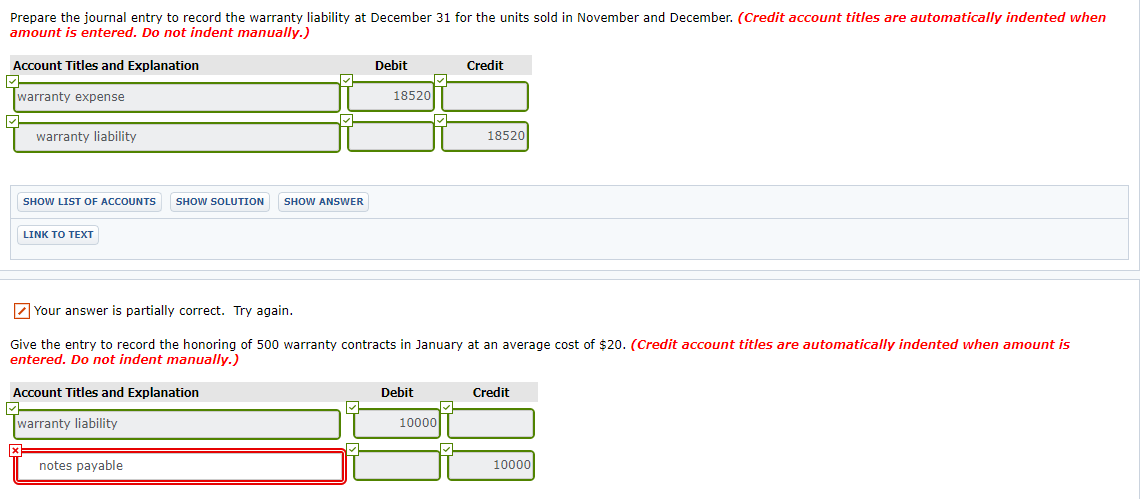

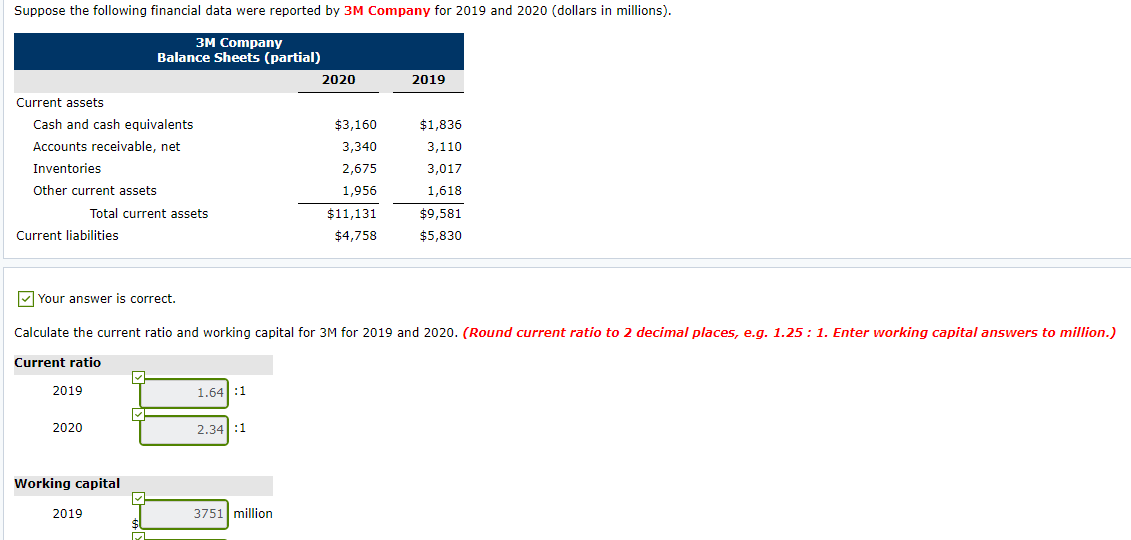

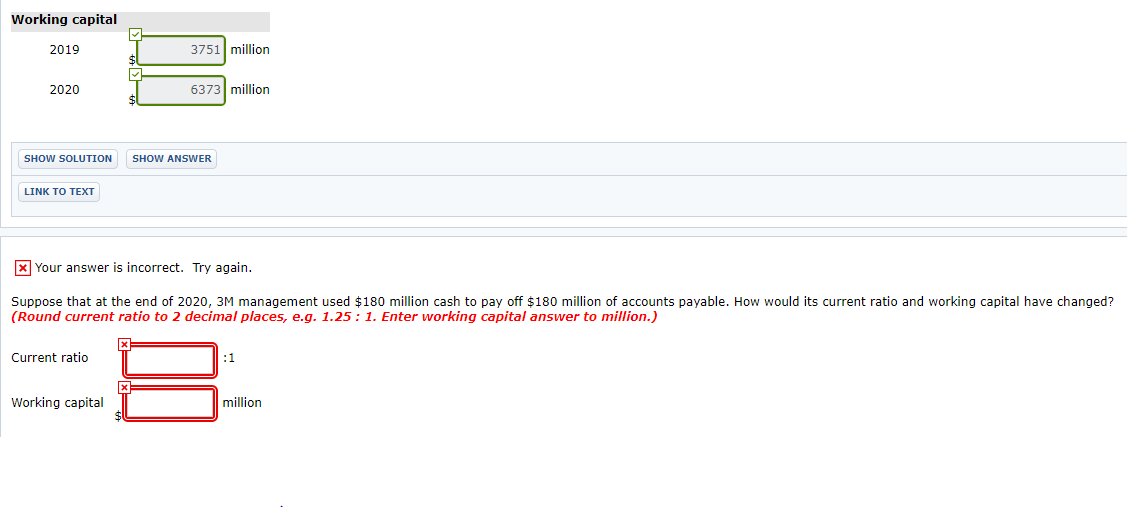

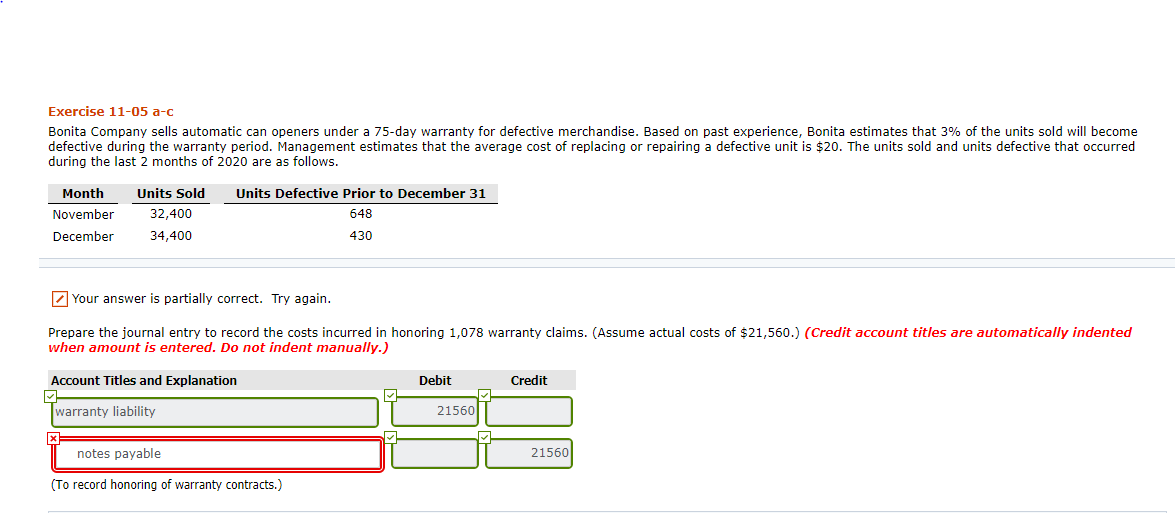

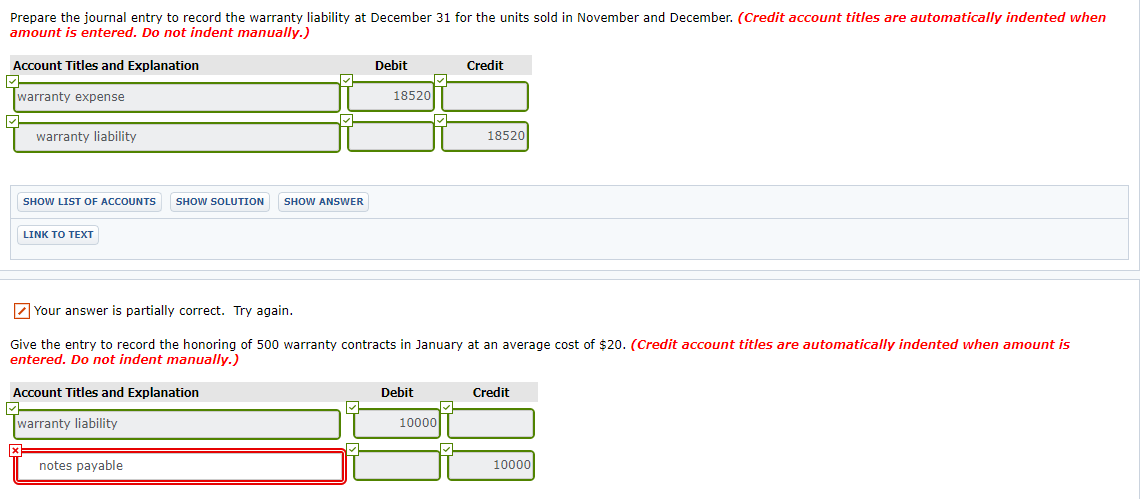

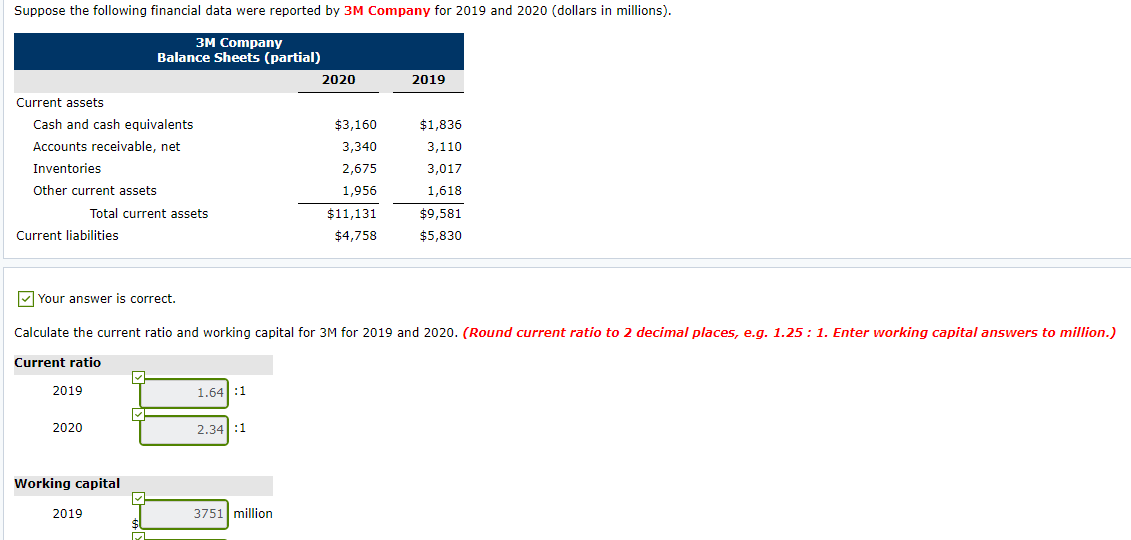

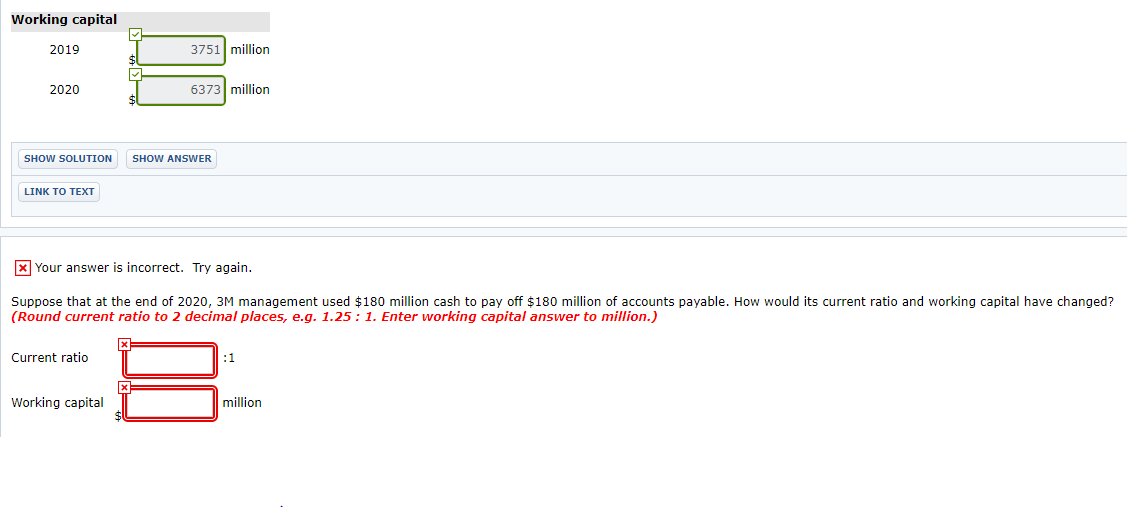

Exercise 11-05 a-c Bonita Company sells automatic can openers under a 75-day warranty for defective merchandise. Based on past experience, Bonita estimates that 3% of the units sold will become defective during the warranty period. Management estimates that the average cost of replacing or repairing a defective unit is $20. The units sold and units defective that occurred during the last 2 months of 2020 are as follows. Month November December Units Sold 32,400 34,400 Units Defective Prior to December 31 648 430 Your answer is partially correct. Try again. Prepare the journal entry to record the costs incurred in honoring 1,078 warranty claims. (Assume actual costs of $21,560.) (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit warranty liability 21560 notes payable 21560 (To record honoring of warranty contracts.) Prepare the journal entry to record the warranty liability at December 31 for the units sold in November and December. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit warranty expense 185201 warranty liability 18520 SHOW LIST OF ACCOUNTS SHOW SOLUTION SHOW ANSWER LINK TO TEXT Your answer is partially correct. Try again. Give the entry to record the honoring of 500 warranty contracts in January at an average cost of $20. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit warranty liability 10000 x notes payable 10000 Suppose the following financial data were reported by 3M Company for 2019 and 2020 (dollars in millions). 3M Company Balance Sheets (partial) 2020 2019 Current assets Cash and cash equivalents Accounts receivable, net Inventories Other current assets Total current assets Current liabilities $3,160 3,340 2,675 1,956 $11,131 $4,758 $1,836 3,110 3,017 1,618 $9,581 $5,830 Your answer is correct. Calculate the current ratio and working capital for 3M for 2019 and 2020. (Round current ratio to 2 decimal places, e.g. 1.25: 1. Enter working capital answers to million.) Current ratio 2019 1.64:1 2020 2.34): 1 Working capital 2019 3751 million Working capital 2019 3751 million 2020 6373 million SHOW SOLUTION SHOW ANSWER LINK TO TEXT X Your answer is incorrect. Try again. Suppose that at the end of 2020, 3M management used $180 million cash to pay off $180 million of accounts payable. How would its current ratio and working capital have changed? (Round current ratio to 2 decimal places, e.g. 1.25: 1. Enter working capital answer to million.) Current ratio x Working capital million