Answered step by step

Verified Expert Solution

Question

1 Approved Answer

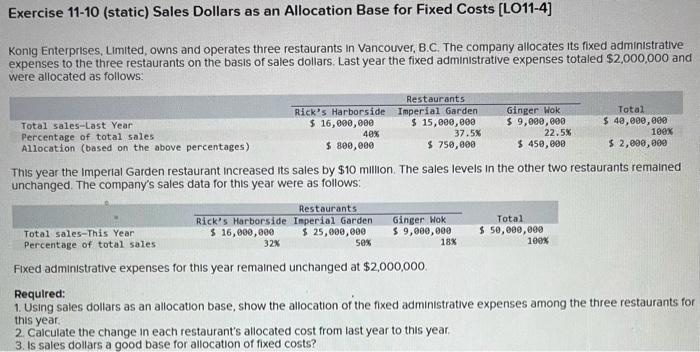

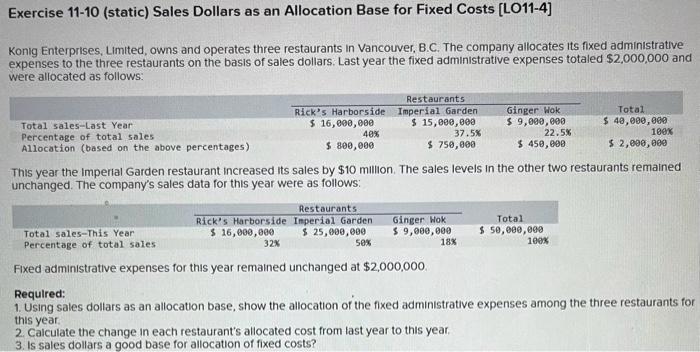

Exercise 11-10 (static) Sales Dollars as an Allocation Base for Fixed Costs [LO11-4] Konig Enterprises, Limited, owns and operates three restaurants in Vancouver, B.C. The

Exercise 11-10 (static) Sales Dollars as an Allocation Base for Fixed Costs [LO11-4] Konig Enterprises, Limited, owns and operates three restaurants in Vancouver, B.C. The company allocates Its fixed administrative expenses to the three restaurants on the basis of sales dollars. Last year the fixed administrative expenses totaled $2,000,000 and were allocated as follows: Total sales-Last Year Percentage of total sales Allocation (based on the above percentages) Rick's Harborside $ 16,000,000 Rick's Harborside $ 16,000,000 40% 32% $ 800,000 Restaurants Imperial Garden $ 25,000,000 Restaurants Imperial Garden $ 15,000,000 50% Total sales-This Year Percentage of total sales Fixed administrative expenses for this year remained unchanged at $2,000,000. 37.5% $750,000 Ginger Wok $ 9,000,000 This year the Imperial Garden restaurant increased its sales by $10 million. The sales levels in the other two restaurants remained unchanged. The company's sales data for this year were as follows: Ginger Wok $ 9,000,000 18% 22.5% $ 450,000 Total $50,000,000 Total $ 40,000,000 $ 2,000,000 100% 100% Required: 1. Using sales dollars as an allocation base, show the allocation of the fixed administrative expenses among the three restaurants for this year. 2. Calculate the change in each restaurant's allocated cost from last year to this year. 3. Is sales dollars a good base for allocation of fixed costs?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started