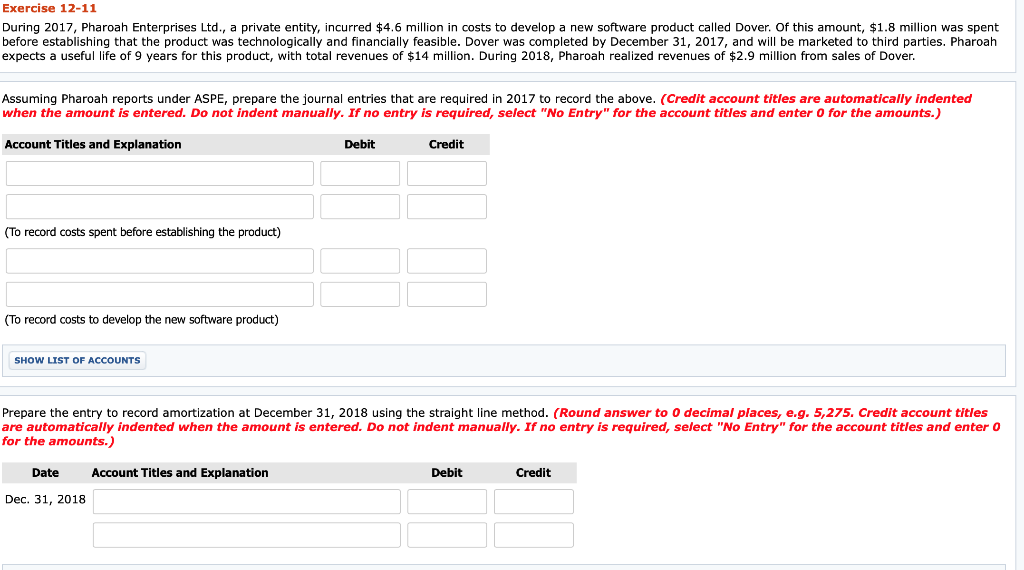

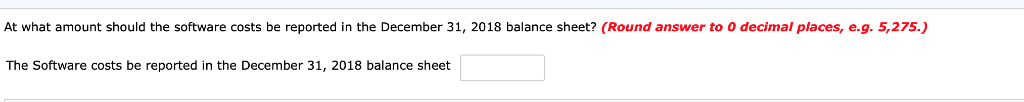

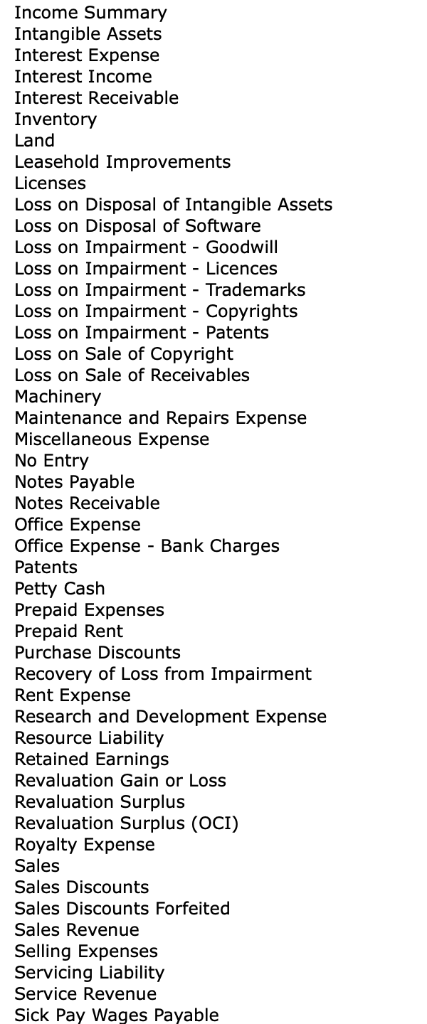

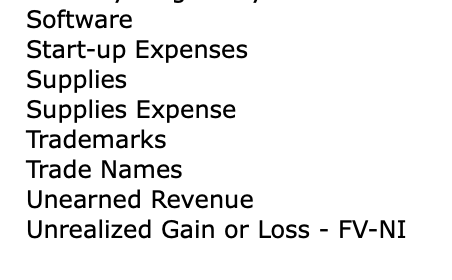

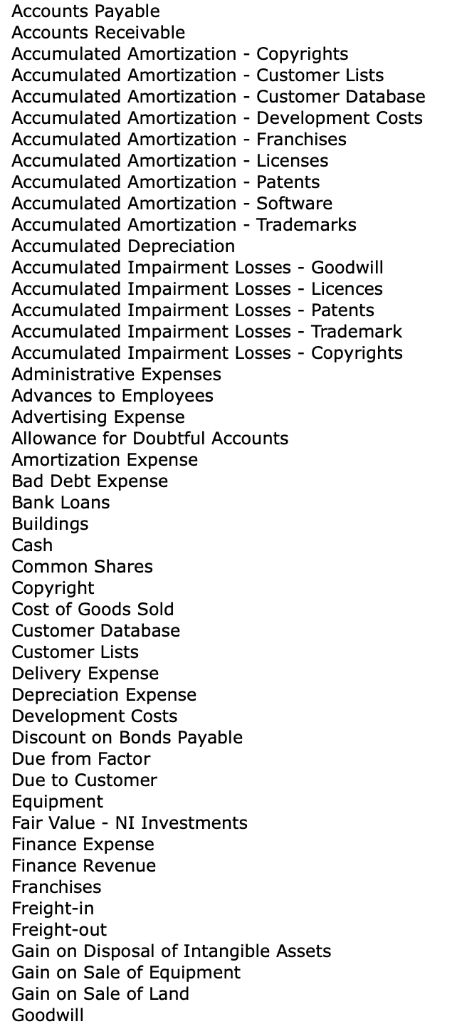

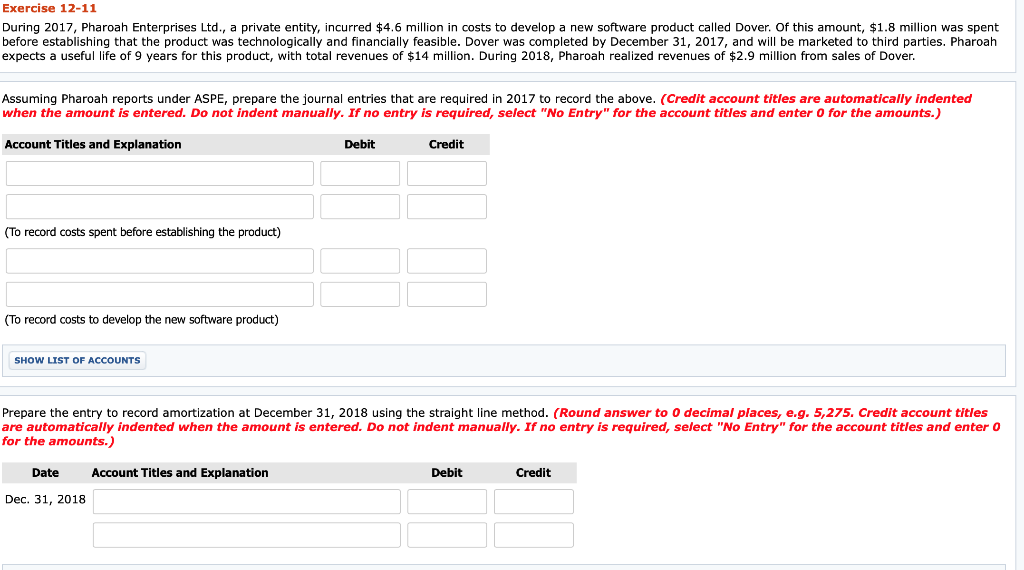

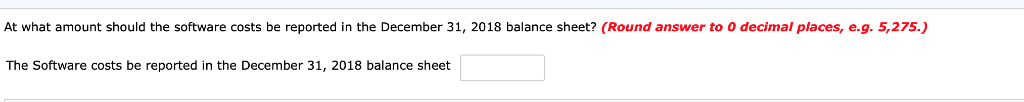

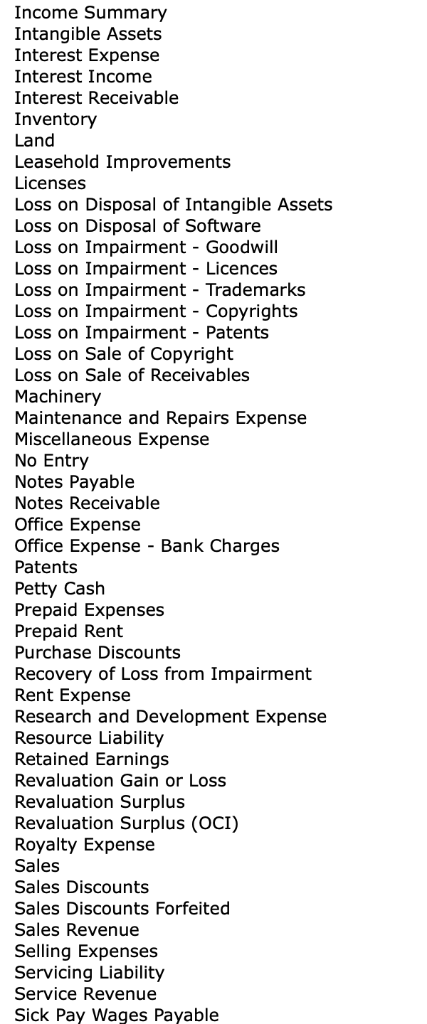

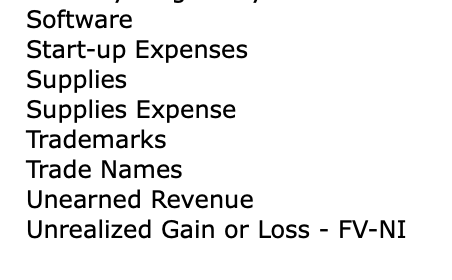

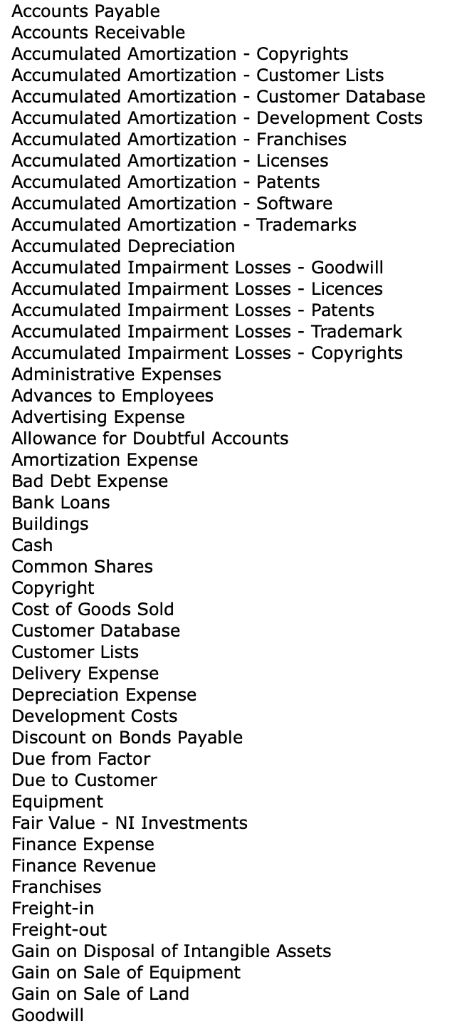

Exercise 12-11 During 2017, Pharoah Enterprises Ltd., a private entity, incurred $4.6 million in costs to develop a new software product called Dover. Of this amount, $1.8 million was spent before establishing that the product was technologically and financially feasible. Dover was completed by December 31, 2017, and will be marketed to third parties. Pharoah expects a useful life of 9 years for this product, with total revenues of $14 million. During 2018, Pharoah realized revenues of $2.9 million from sales of Dover Assuming Pharoah reports under ASPE, prepare the journal entries that are required in 2017 to record the above. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit (To record costs spent before establishing the product) To record costs to develop the new software product) SHOW LIST OF ACCOUNTS Prepare the entry to record amortization at December 31, 2018 using the straight line method. (Round answer to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2018 At what amount should the software costs be reported in the December 31, 2018 balance sheet? (Round answer to 0 decimal places, e.g. 5,275.) The Software costs be reported in the December 31, 2018 balance sheet Income Summary Intangible Assets Interest Expense Interest Income Interest Receivable Inventory Land Leasehold Improvements Licenses Loss on Disposal of Intangible Assets Loss on Disposal of Software Loss on Impairment - Goodwill Loss on Impairment Licences Loss on Impairment Trademarks Loss on Impairment Copyrights Loss on Impairment Patents Loss on Sale of Copyright Loss on Sale of Receivables Machinery Maintenance and Repairs Expense Miscellaneous Expense No Entry Notes Payable Notes Receivable Office Expense Office Expense - Bank Charges Patents Petty Cash Prepaid Expenses Prepaid Rent Purchase Discounts Recovery of Loss from Impairment Rent Expense Research and Development Expense Resource Liability Retained Earnings Revaluation Gain or Loss Revaluation Surplus Revaluation Surplus (OCI) Royalty Expense Sales Sales Discounts Sales Discounts Forfeited Sales Revenue Selling Expenses Servicing Liability Service Revenue Sick Pay Wages Payable Softwaree Start-up Expenses Supplies Supplies Expense Trademarks Trade Names Unearned Revenue Unrealized Gain or Loss - FV-NI