Question

Exercise 12-4 Cash Dividends with Dividends in Arrears Rutherford Corporation has 20,000 shares of its $100 par value, 7 percent cumulative preferred stock outstanding and

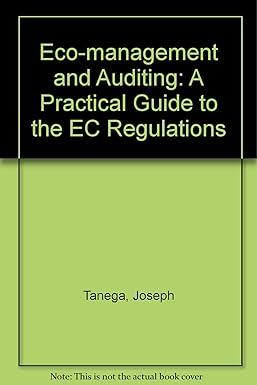

Exercise 12-4 Cash Dividends with Dividends in Arrears

Rutherford Corporation has 20,000 shares of its $100 par value, 7 percent cumulative preferred stock outstanding and 100,000 shares of its $1 par value common stock outstanding. In Rutherford's first four years of operation, its board of directors paid the following cash dividends: 2011, none; 2012, $240,000; 2013, $280,000; 2014, $280,000.

Determine the dividends per share and total cash dividends paid to the preferred and common stockholders during each of the four years. If an amount is zero, enter "0". If required, round your answers to the nearest cent.

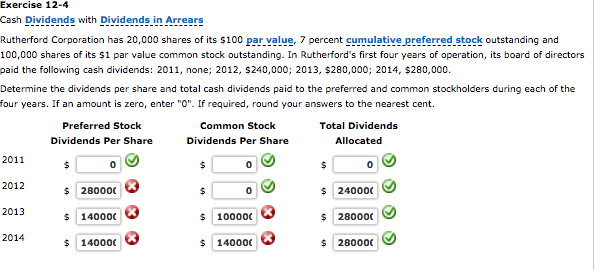

Stock Entries Using T Accounts; Stockholders' Equity

Gormanus Corporation was organized in 2014. It was authorized to issue 400,000 shares of no-par common stock with a stated value of $5 per share, and 80,000 shares of $100 par value, 6 percent noncumulative preferred stock. On March 1, the company issued 120,000 shares of its common stock for $15 per share and 16,000 shares of its preferred stock for $100 per share.

2. Prepare the stockholders' equity section of Gormanus Corporation's balance sheet as it would appear immediately after the company issued the common and preferred stock. If an amount is zero, enter "0".

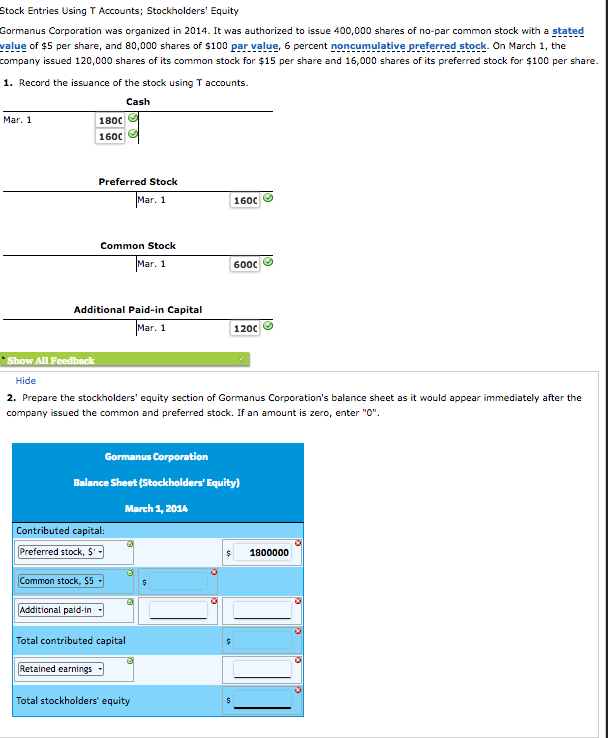

7 Issuance of Stock

Sussex Company is authorized to issue 100,000 shares of common stock. On August 1, the company issued 5,000 shares at $25 per share.

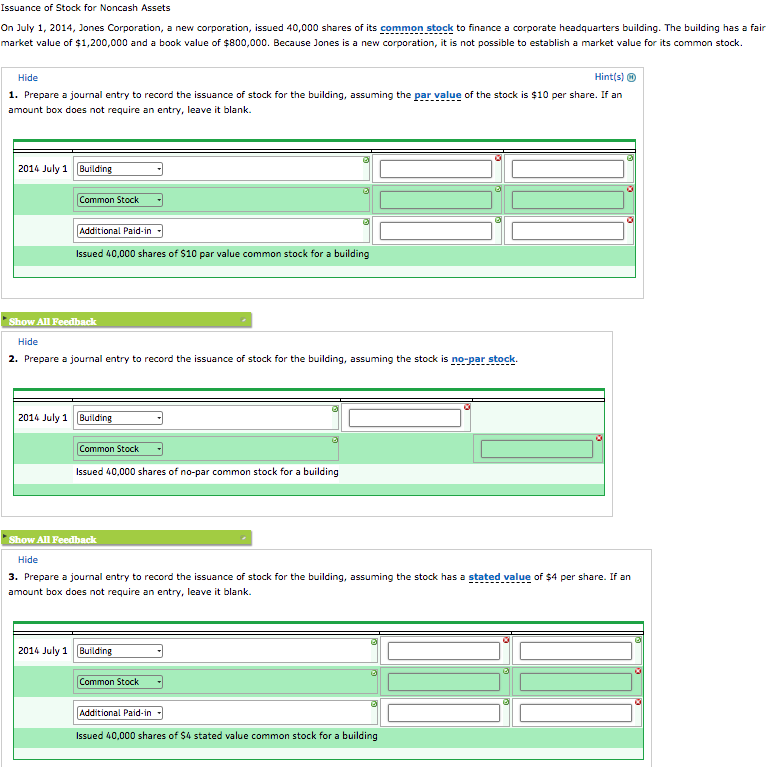

8 Issuance of Stock for Noncash Assets

On July 1, 2014, Jones Corporation, a new corporation, issued 40,000 shares of its common stock to finance a corporate headquarters building. The building has a fair market value of $1,200,000 and a book value of $800,000. Because Jones is a new corporation, it is not possible to establish a market value for its common stock.

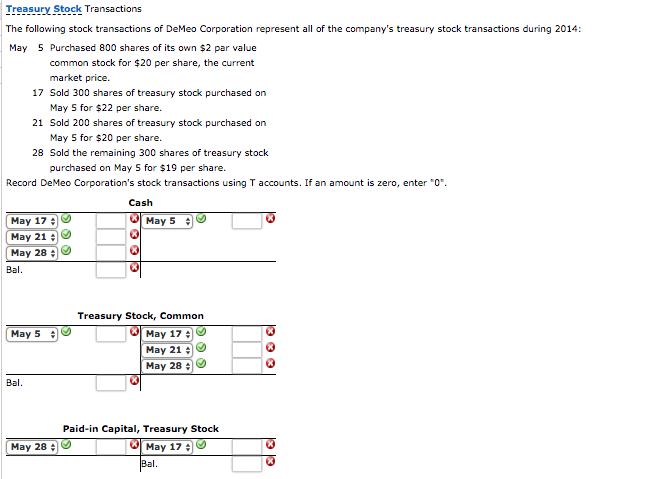

Treasury Stock Transactions

The following stock transactions of DeMeo Corporation represent all of the company's treasury stock transactions during 2014:

| May | 5 | Purchased 800 shares of its own $2 par value common stock for $20 per share, the current market price. |

| 17 | Sold 300 shares of treasury stock purchased on May 5 for $22 per share. | |

| 21 | Sold 200 shares of treasury stock purchased on May 5 for $20 per share. | |

| 28 | Sold the remaining 300 shares of treasury stock purchased on May 5 for $19 per share. |

Record DeMeo Corporation's stock transactions using T accounts. If an amount is zero, enter "0".

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started