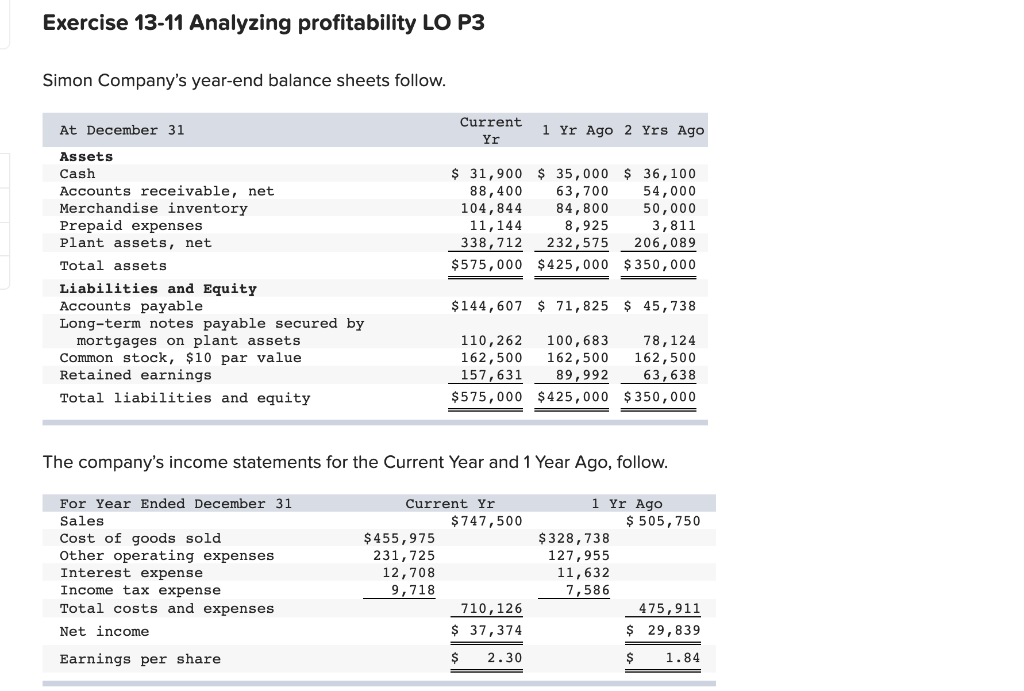

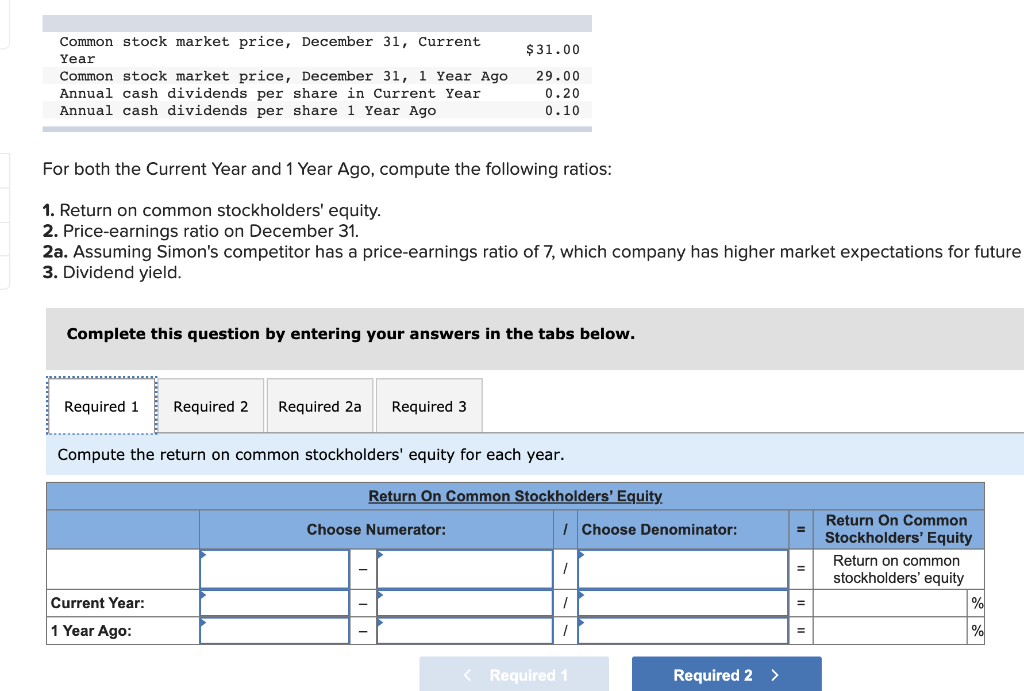

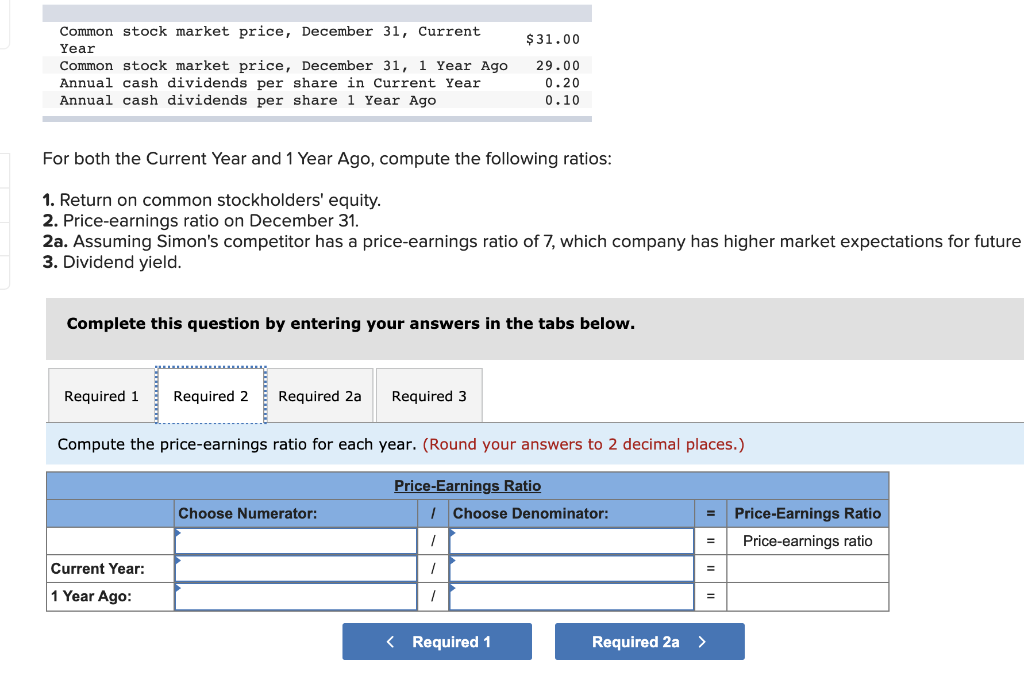

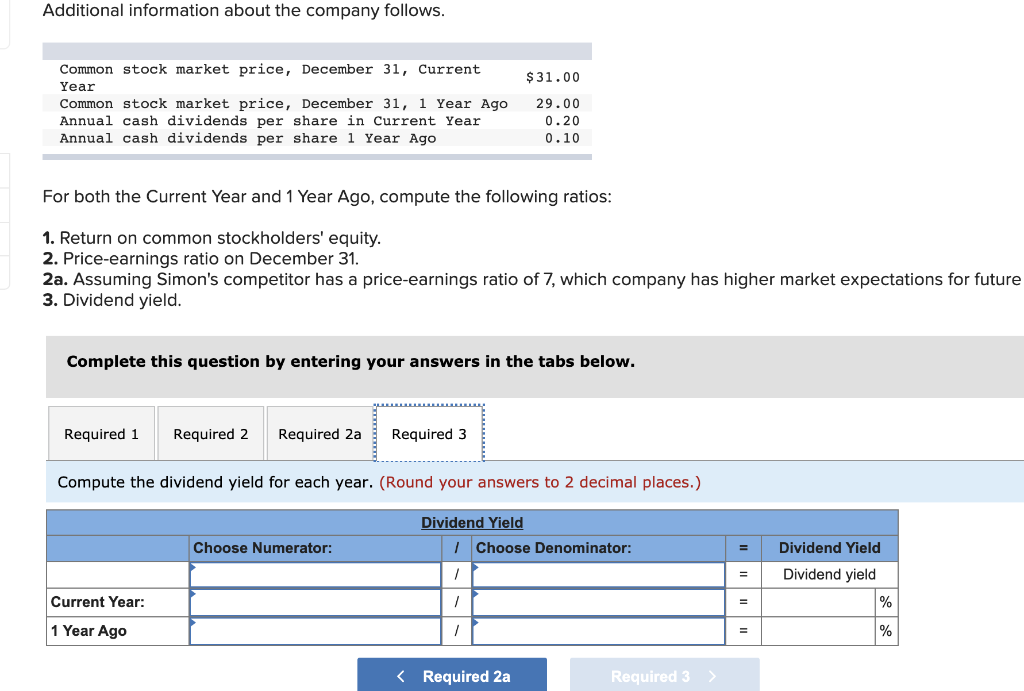

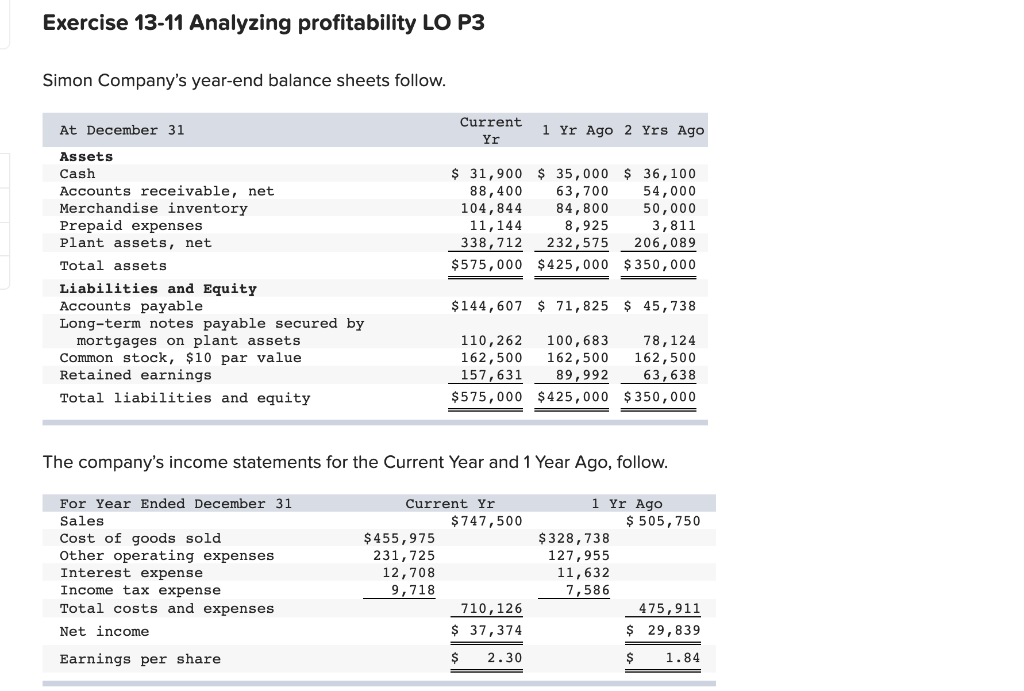

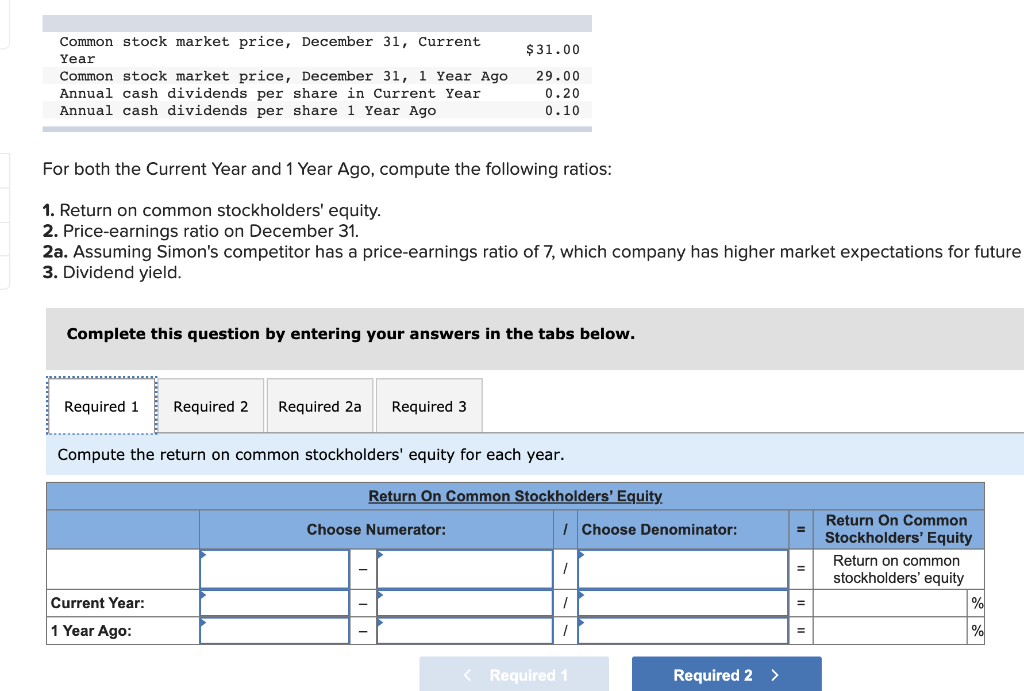

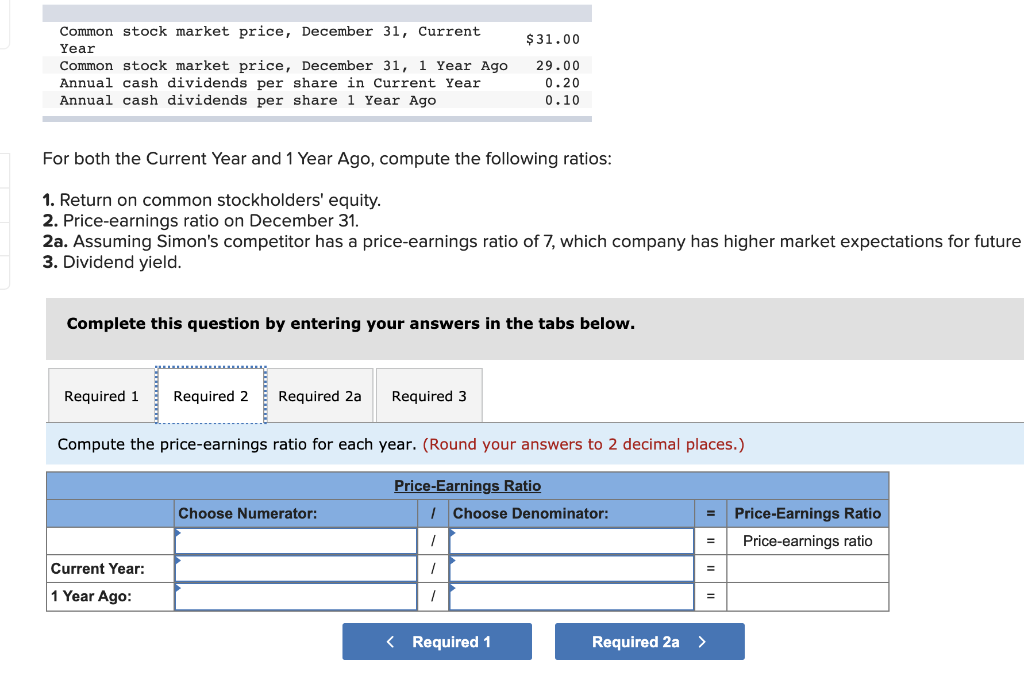

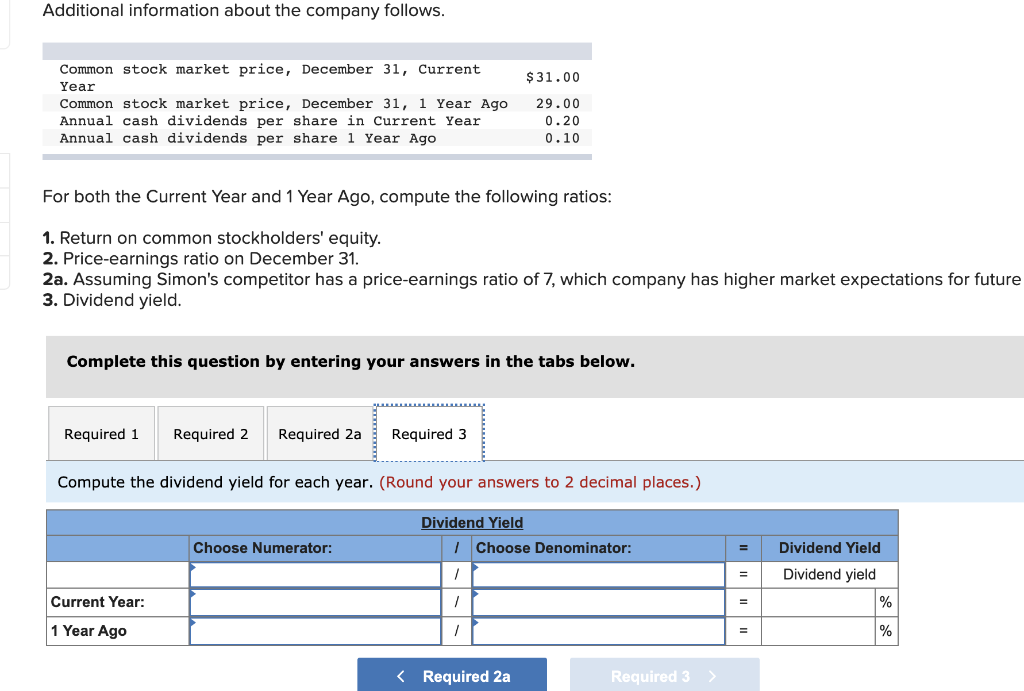

Exercise 13-11 Analyzing profitability LO P3 Simon Company's year-end balance sheets follow. At December 31 Current Yr 1 Yr Ago 2 Yrs Ago $ 31,900 $ 35,000 $ 36,100 88, 400 63,700 54,000 104, 844 84,800 50,000 11,144 8,925 3,811 338,712 232,575 206,089 $575,000 $425,000 $350,000 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $144,607 $ 71,825 $ 45,738 110,262 100,683 78,124 162,500 162,500 162,500 157,631 89,992 63,638 $575,000 $425,000 $350,000 The company's come statements for the Current Year and 1 Year Ago, follow. 1 Yr Ago $ 505, 750 For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Current Yr $ 747,500 $ 455,975 231,725 12,708 9,718 710, 126 $ 37, 374 $328,738 127,955 11,632 7,586 475, 911 $ 29,839 Earnings per share $ 2.30 $ 1.84 $31.00 Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago 29.00 0.20 0.10 For both the Current Year and 1 Year Ago, compute the following ratios: 1. Return on common stockholders' equity. 2. Price-earnings ratio on December 31. 2a. Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations for future 3. Dividend yield. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 2a Required 3 Compute the return on common stockholders' equity for each year. Return On Common Stockholders' Equity Choose Numerator: 1 Choose Denominator: Return On Common Stockholders' Equity Return on common stockholders' equity % 1 Current Year: 1 1 Year Ago: 1 % Required 1 Required 2 > $31.00 Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago 29.00 0.20 0.10 For both the Current Year and 1 Year Ago, compute the following ratios: 1. Return on common stockholders' equity. 2. Price-earnings ratio on December 31. 2a. Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations for future 3. Dividend yield. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 2a Required 3 Compute the price-earnings ratio for each year. (Round your answers to 2 decimal places.) Price-Earnings Ratio 1 Choose Denominator: Choose Numerator: Price-Earnings Ratio Price-earnings ratio 1 Current Year: 1 = 1 Year Ago: Additional information about the company follows. $31.00 Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago 29.00 0.20 0.10 For both the Current Year and 1 Year Ago, compute the following ratios: 1. Return on common stockholders' equity. 2. Price-earnings ratio on December 31. 2a. Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations for future 3. Dividend yield. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 2a Required Compute the dividend yield for each year. (Round your answers to 2 decimal places.) Dividend Yield Choose Numerator: 1 Choose Denominator: Dividend Yield Dividend yield Current Year: / = % 1 Year Ago / %