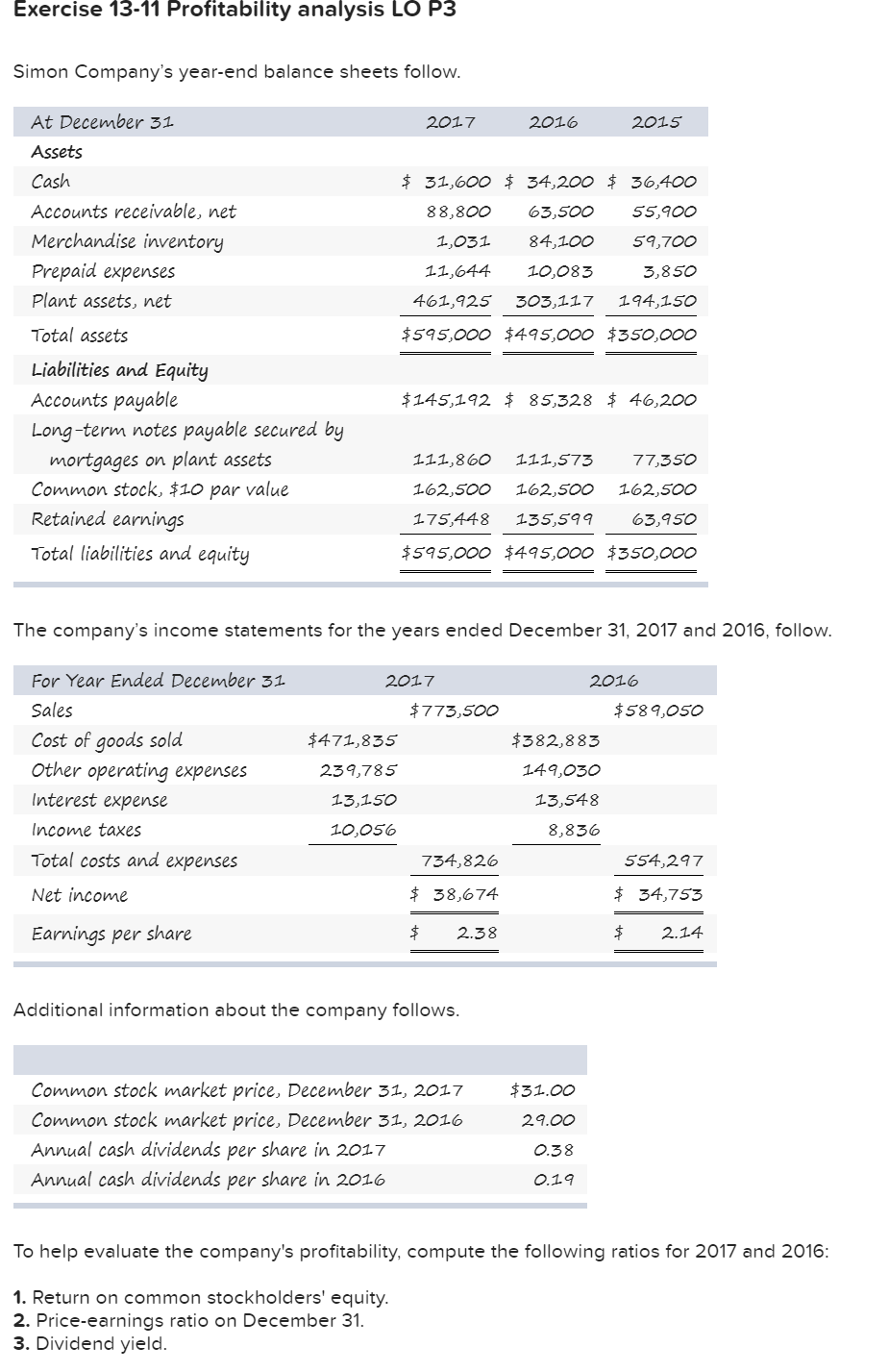

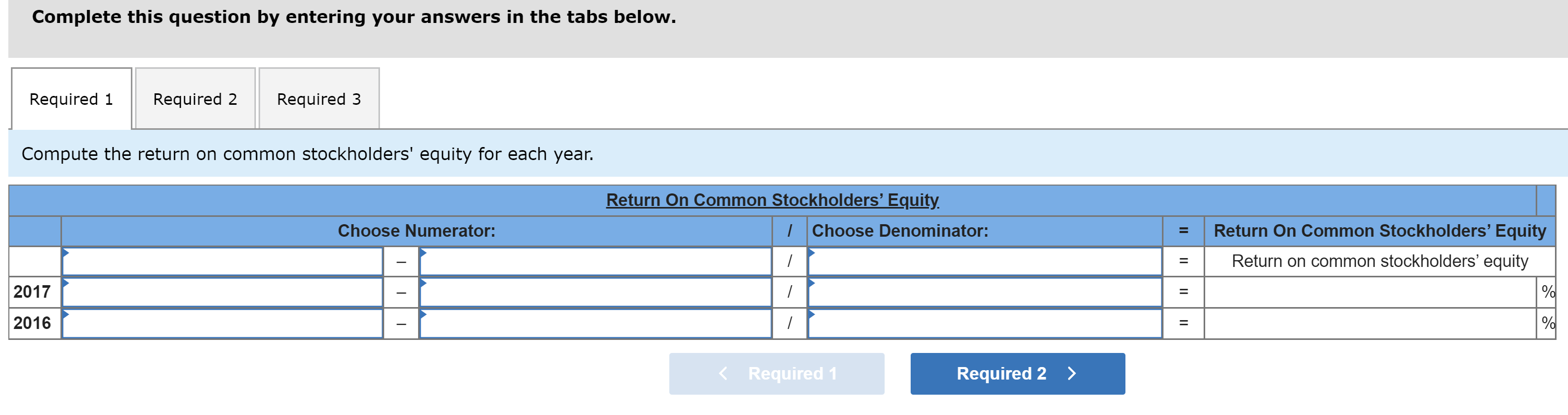

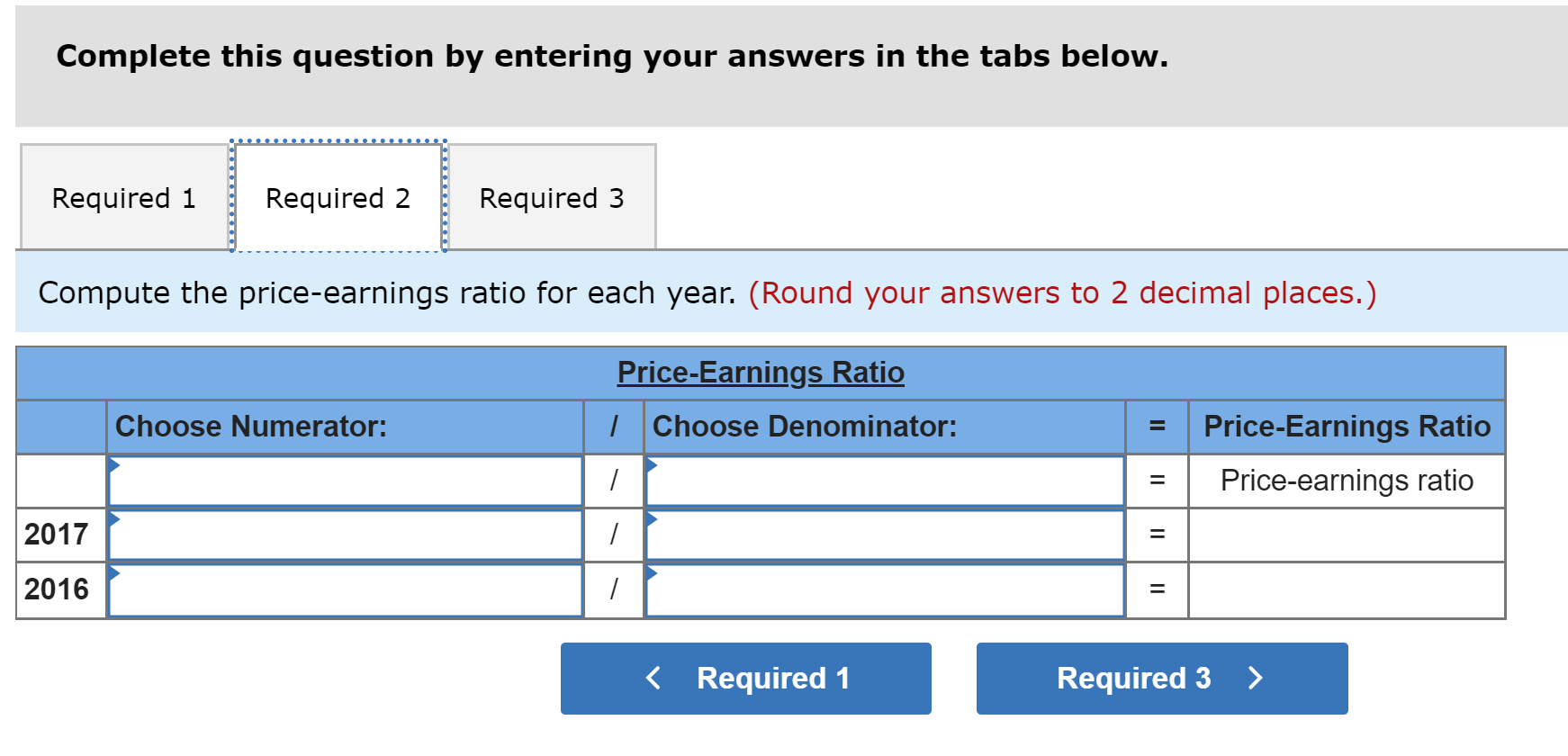

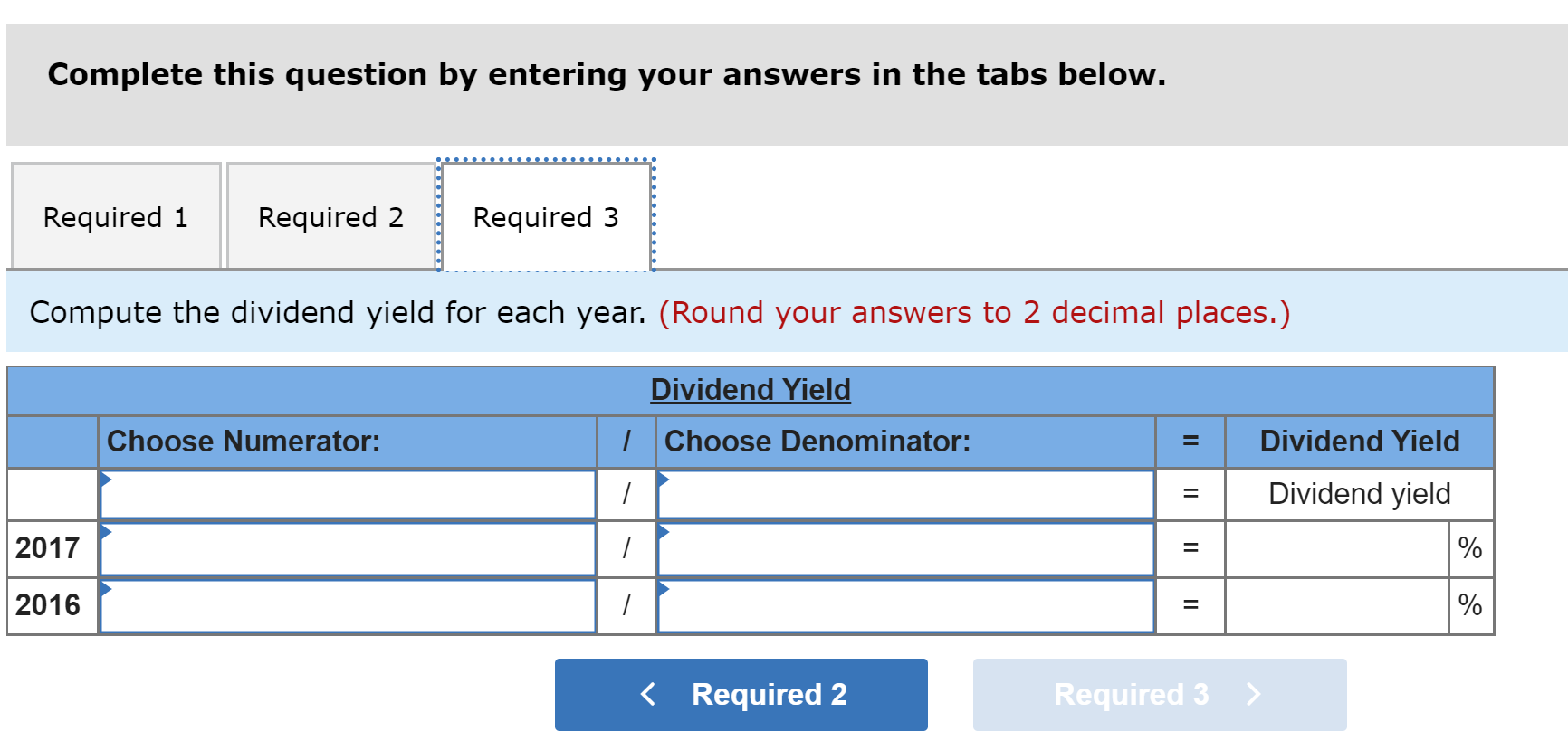

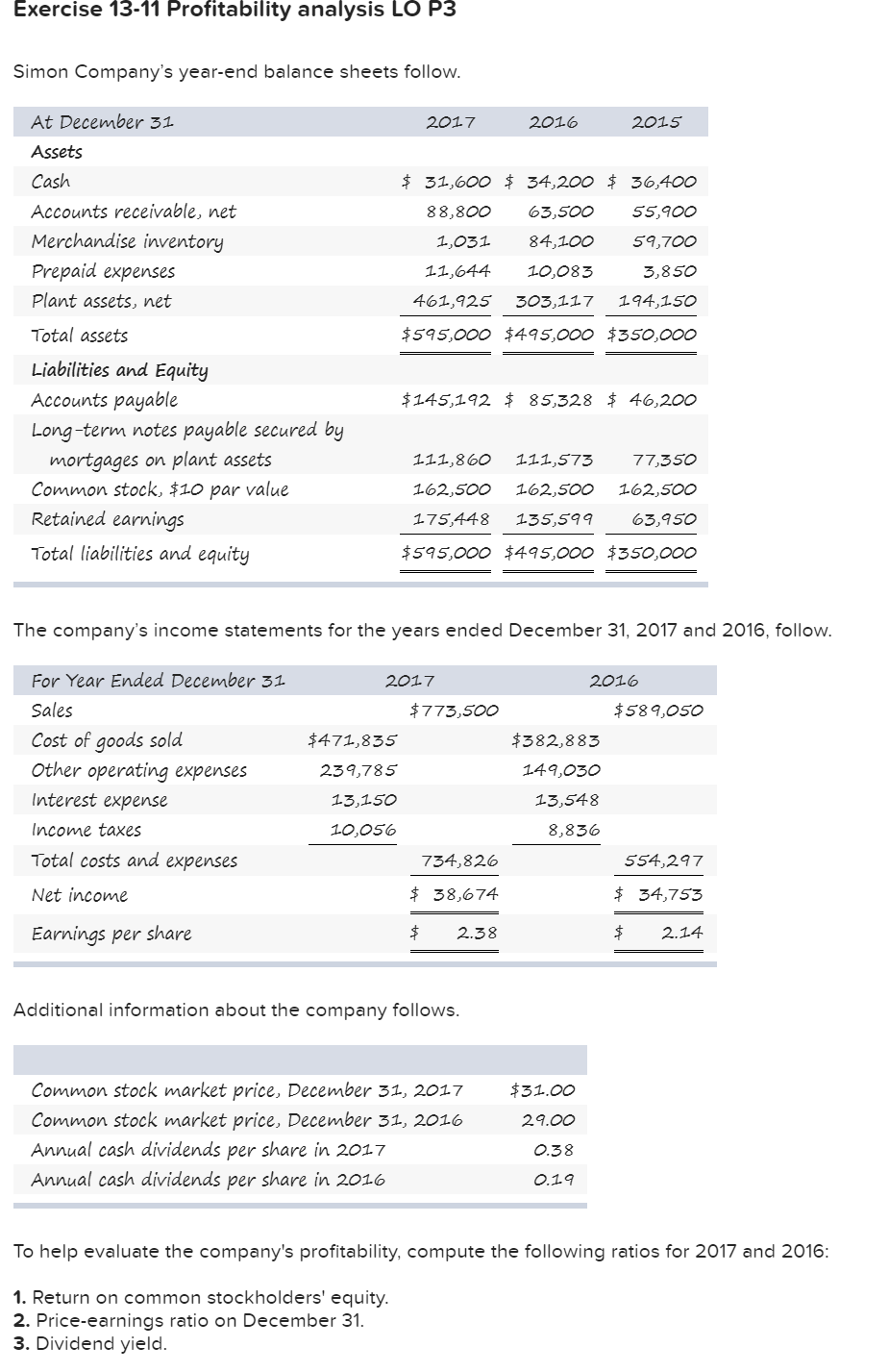

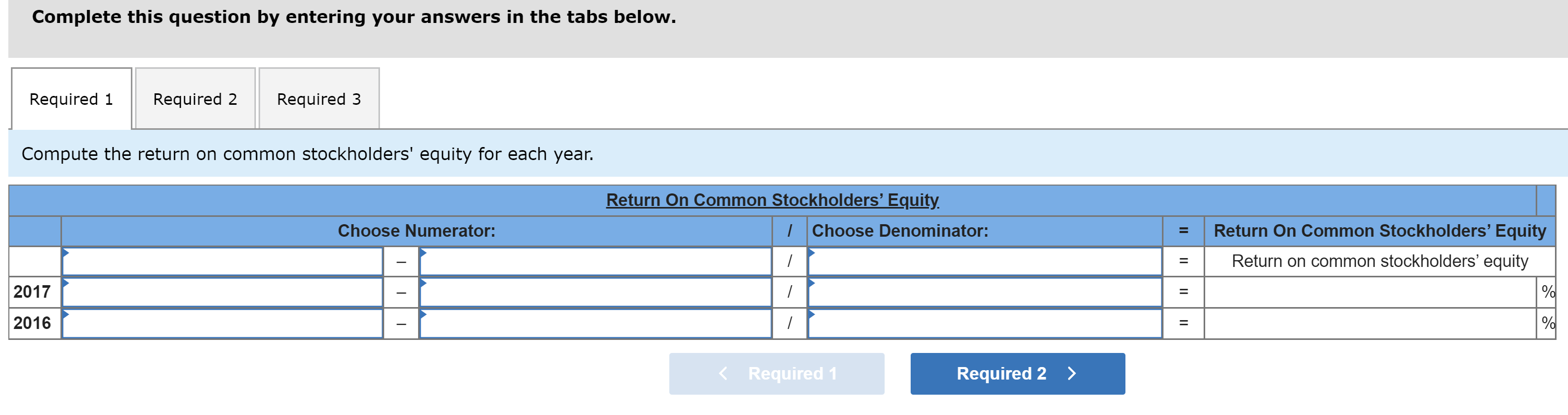

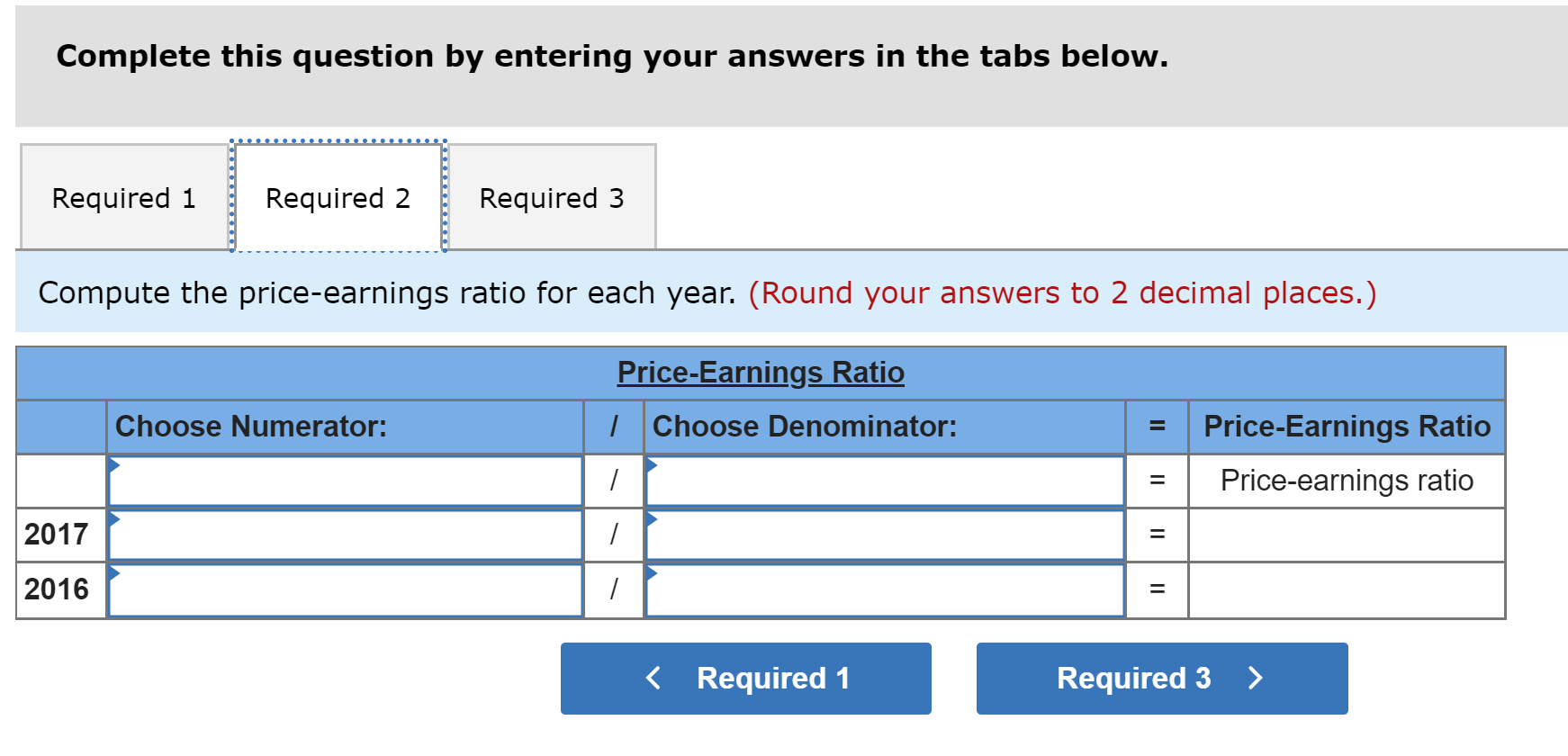

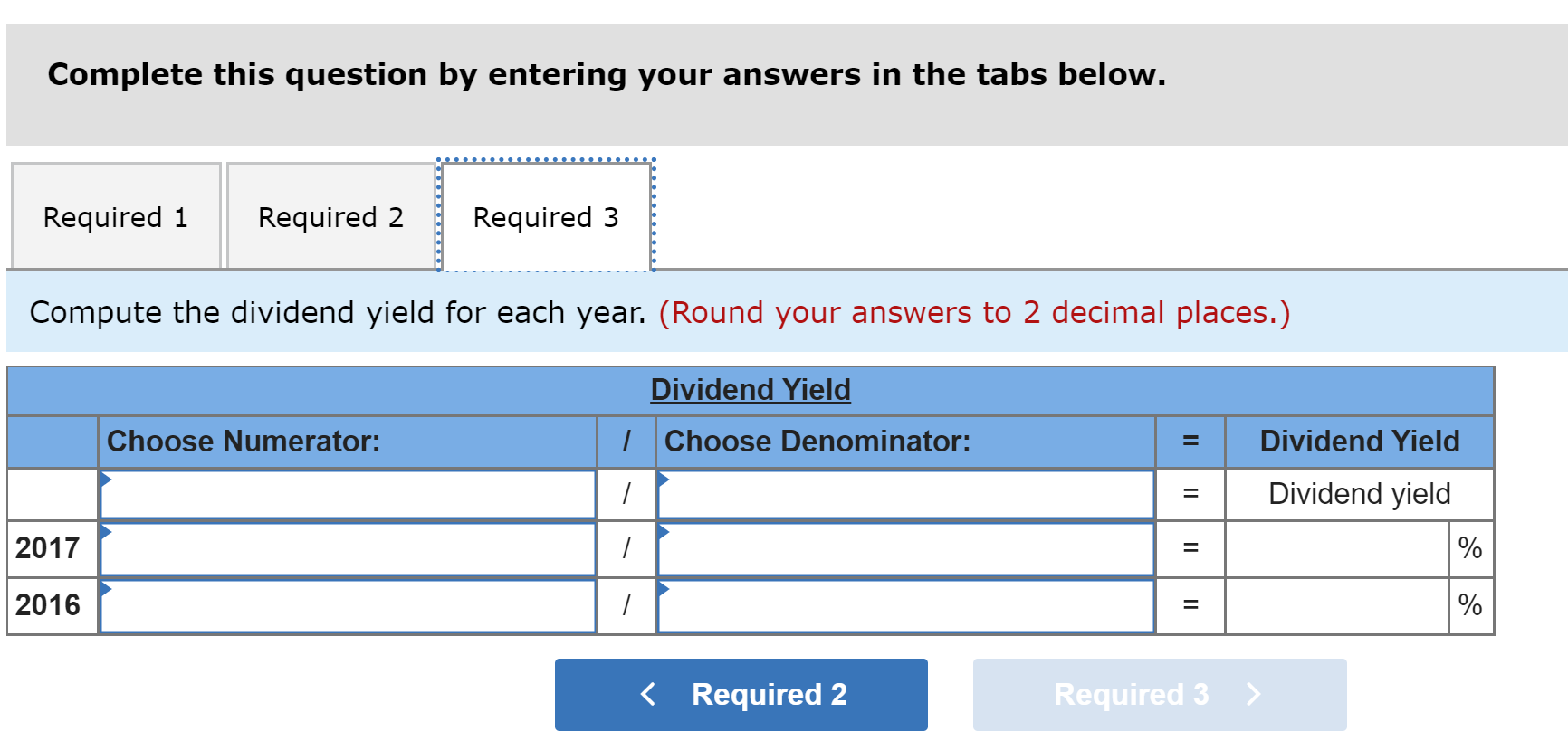

Exercise 13-11 Profitability analysis LO P3 Simon Company's year-end balance sheets follow. 2017 2016 2015 $ 31,600 $ 34,200 $ 36,400 At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses plant assets, net 88,800 63,500 55,900 1,031 84,100 59,700 11,644 10,083 3,850 461,925 303,1-17 194,150 $595,000 $495,000 $350,000 $145,192 $ 85,328 $ 46,200 Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity 1 1 1,860 1 11,573 77,350 162,500 162,500 175,448 162,500 135,599 63,950 $595,000 $495,000 $350,000 The company's income statements for the years ended December 31, 2017 and 2016, follow. 2017 2016 $589,050 $773,500 $471,835 $382,883 For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income taxes Total costs and expenses 239,785 149,030 13,150 13,548 10,056 8,836 734,826 554,297 Net income $ 38,674 $ 34,753 Earnings per share $ 2.38 $ 2.14 Additional information about the company follows. $31.00 29.00 Common stock market price, December 31, 2017 Common stock market price, December 31, 2016 Annual cash dividends per share in 2017 Annual cash dividends per share in 2016 0.38 0.19 To help evaluate the company's profitability, compute the following ratios for 2017 and 2016: 1. Return on common stockholders' equity. 2. Price-earnings ratio on December 31. 3. Dividend yield. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the return on common stockholders' equity for each year. Return On Common Stockholders' Equity. | Choose Denominator: Choose Numerator: = Return On Common Stockholders' Equity Return on common stockholders' equity - 2017 - = % 2016 - 11 % Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the price-earnings ratio for each year. (Round your answers to 2 decimal places.) Price-Earnings Ratio | Choose Denominator: Choose Numerator: = Price-Earnings Ratio Price-earnings ratio = 2017 - 2016 - Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the dividend yield for each year. (Round your answers to 2 decimal places.) Dividend Yield Choose Numerator: | Choose Denominator: = Dividend Yield - = Dividend yield 2017 - = % 2016 - = %