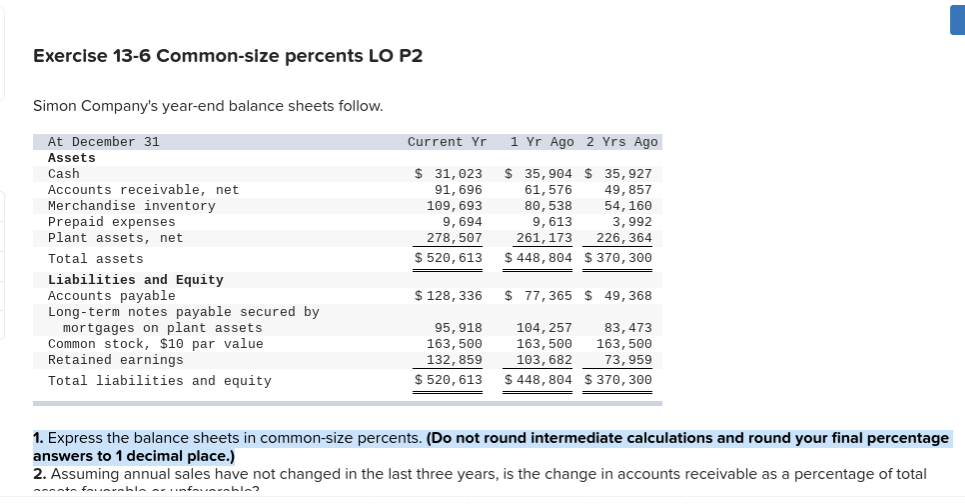

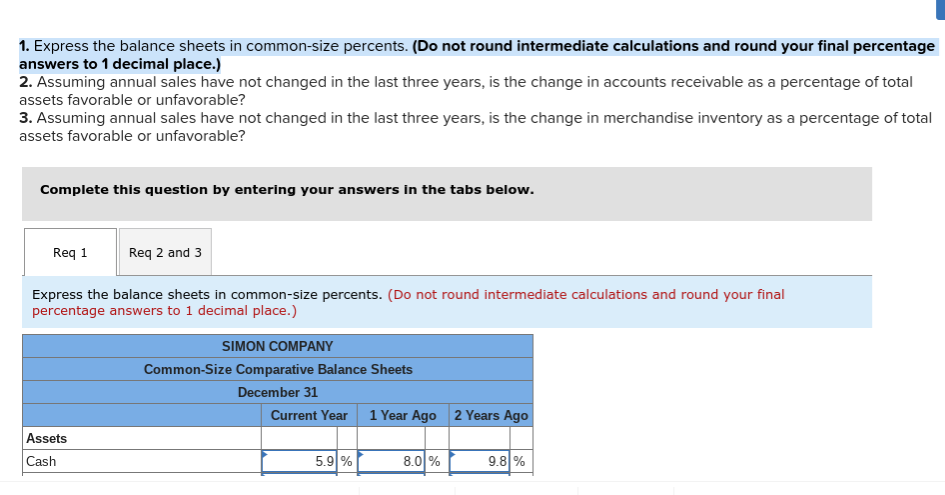

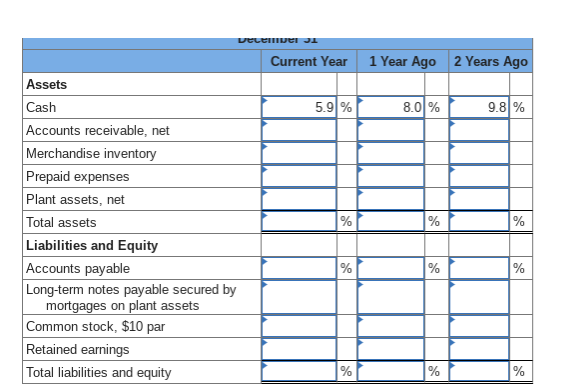

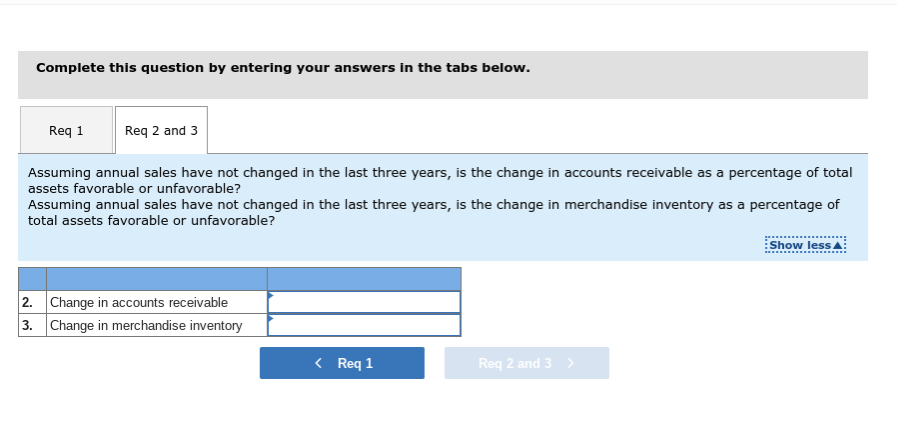

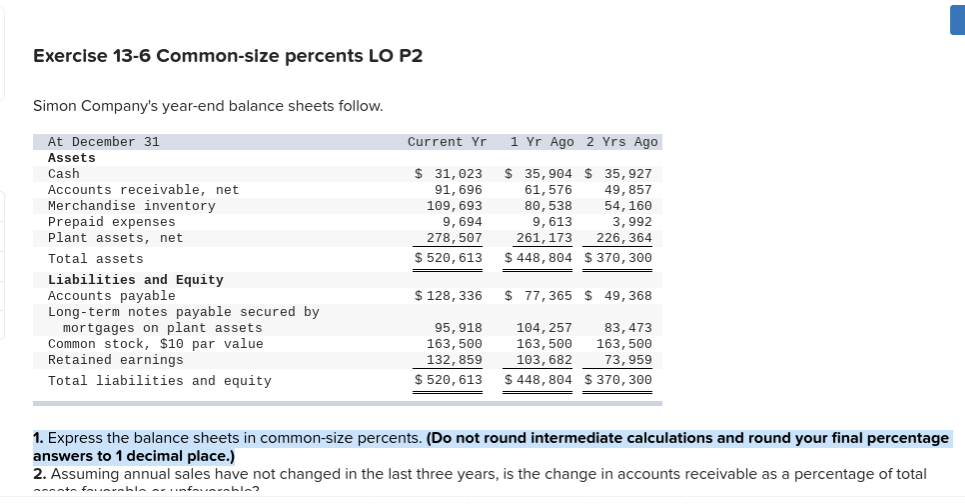

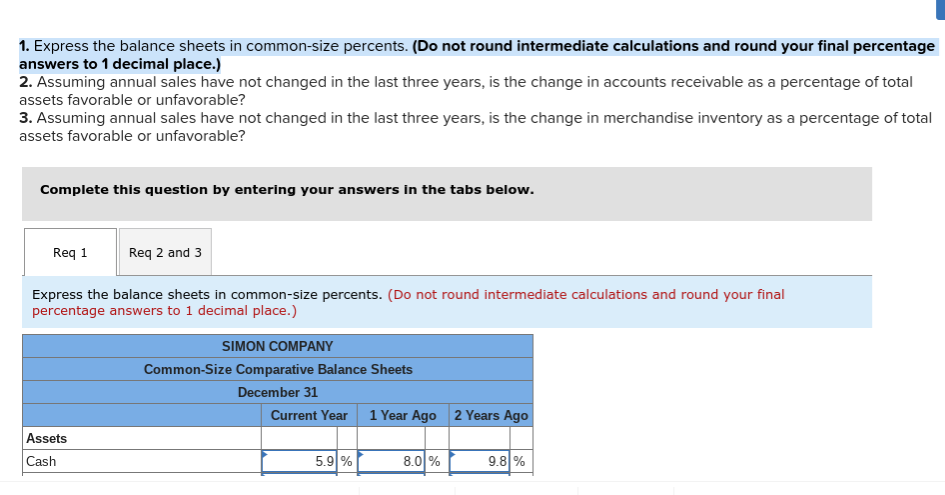

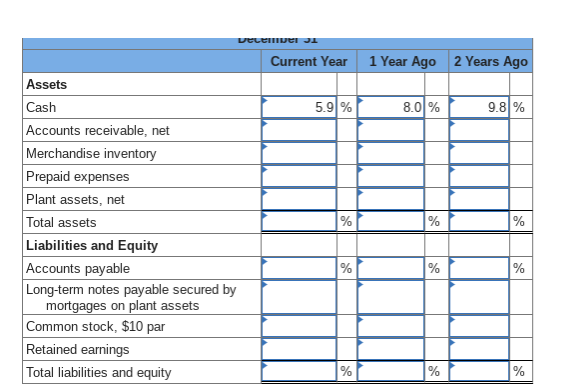

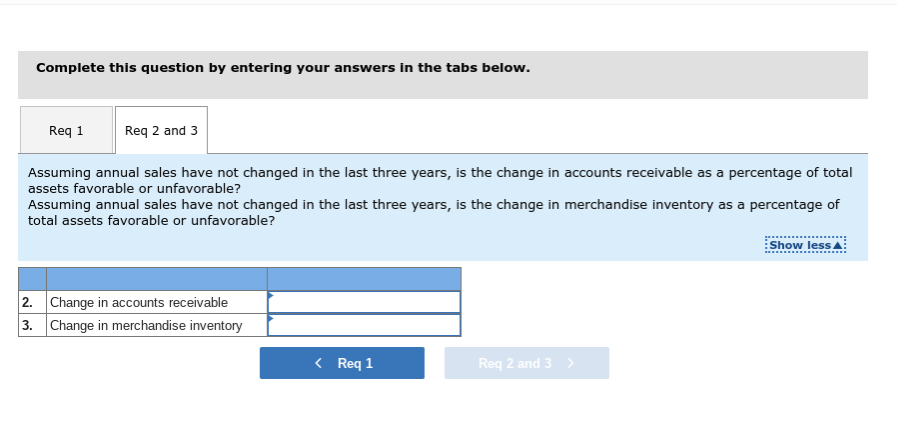

Exercise 13-6 Common-size percents LO P2 Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 31, 023 91,696 109,693 9,694 278,507 $ 520, 613 $ 35,904 $ 35, 927 61,576 49,857 80,538 54,160 9,613 3,992 261,173 226,364 $ 448,804 $ 370, 300 $ 128,336 $77, 365 $ 49, 368 95,918 163,500 132,859 $ 520, 613 104, 257 83,473 163,500 163,500 103,682 73,959 $ 448,804 $ 370, 300 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total ante farvebla facevable? 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) SIMON COMPANY Common-Size Comparative Balance Sheets December 31 Current Year 1 Year Ago 2 Years Ago Assets Cash 5.9%! 8.0% 9.8% veluti Current Year 1 Year Ago 2 Years Ago 5.9 % 8.01% 9.81% % % Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par Retained earnings Total liabilities and equity % Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Show less A 2. 3. Change in accounts receivable Change in merchandise inventory