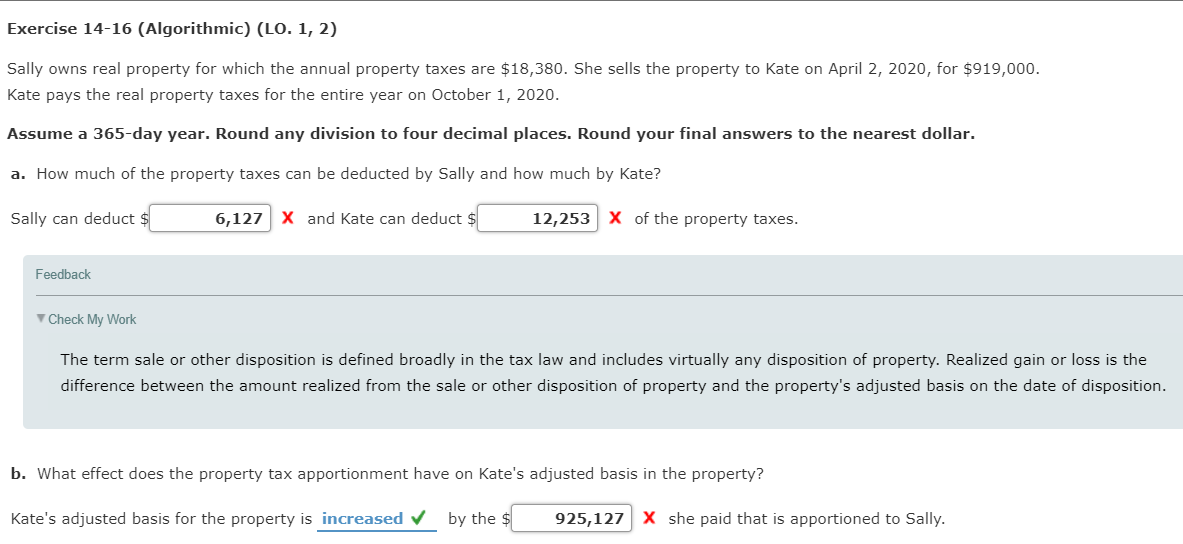

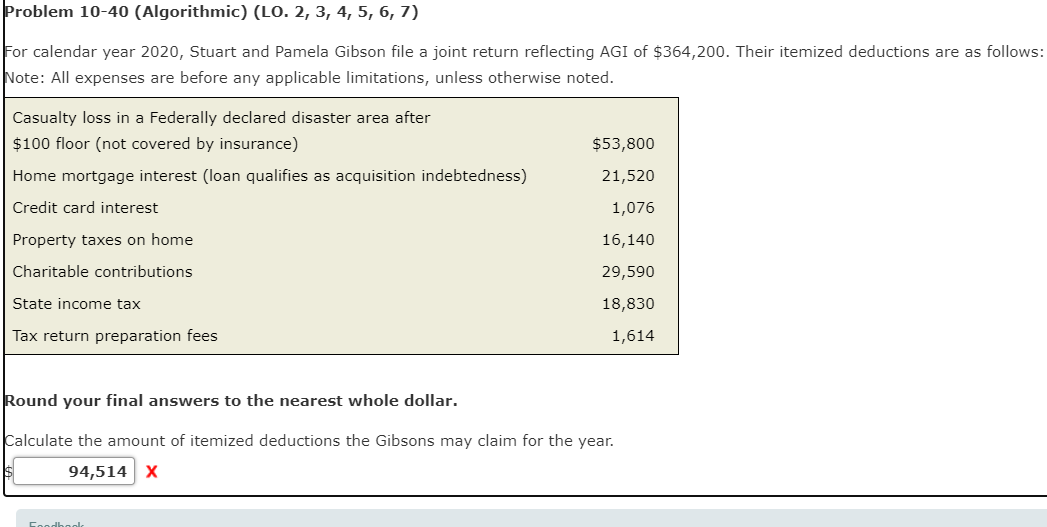

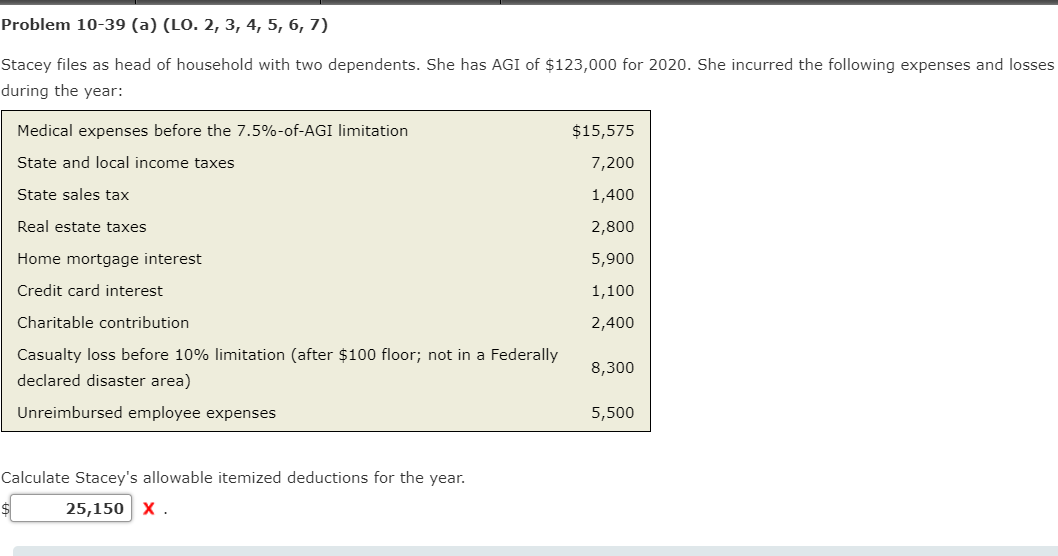

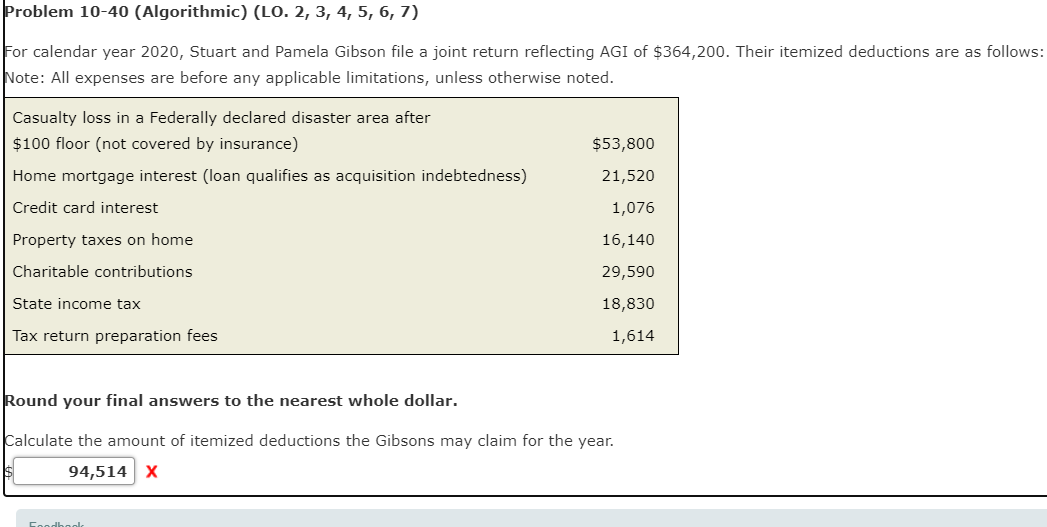

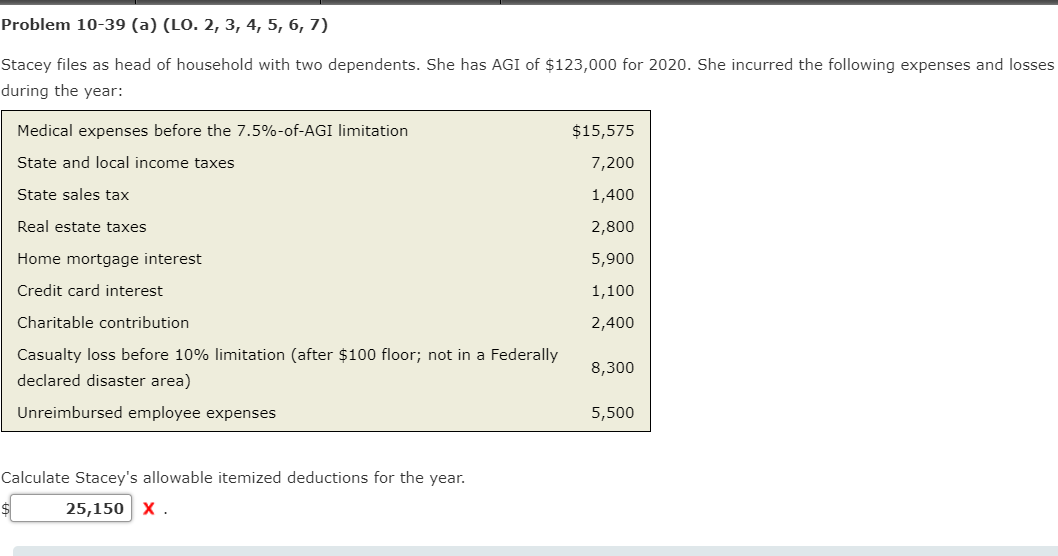

Exercise 14-16 (Algorithmic) (LO. 1, 2) Sally owns real property for which the annual property taxes are $18,380. She sells the property to Kate on April 2, 2020, for $919,000. Kate pays the real property taxes for the entire year on October 1, 2020. Assume a 365-day year. Round any division to four decimal places. Round your final answers to the nearest dollar. a. How much of the property taxes can be deducted by Sally and how much by Kate? Sally can deduct $ 6,127 X and Kate can deduct $ 12,253 X of the property taxes. Feedback Check My Work The term sale or other disposition is defined broadly in the tax law and includes virtually any disposition of property. Realized gain or loss is the difference between the amount realized from the sale or other disposition of property and the property's adjusted basis on the date of disposition. b. What effect does the property tax apportionment have on Kate's adjusted basis in the property? Kate's adjusted basis for the property is increased by the $ 925,127 X she paid that is apportioned to Sally. Problem 10-40 (Algorithmic) (LO. 2, 3, 4, 5, 6, 7) For calendar year 2020, Stuart and Pamela Gibson file a joint return reflecting AGI of $364,200. Their itemized deductions are as follows: Note: All expenses are before any applicable limitations, unless otherwise noted. Casualty loss in a Federally declared disaster area after $100 floor (not covered by insurance) Home mortgage interest (loan qualifies as acquisition indebtedness) Credit card interest Property taxes on home $53,800 21,520 1,076 16,140 29,590 Charitable contributions State income tax 18,830 Tax return preparation fees 1,614 Round your final answers to the nearest whole dollar. Calculate the amount of itemized deductions the Gibsons may claim for the year. 94,514 X Problem 10-39 (a) (LO. 2, 3, 4, 5, 6, 7) Stacey files as head of household with two dependents. She has AGI of $123,000 for 2020. She incurred the following expenses and losses during the year: Medical expenses before the 7.5%-of-AGI limitation $15,575 State and local income taxes 7,200 State sales tax 1,400 Real estate taxes 2,800 5,900 Home mortgage interest Credit card interest 1,100 Charitable contribution 2,400 Casualty loss before 10% limitation (after $100 floor; not in a Federally declared disaster area) 8,300 Unreimbursed employee expenses 5,500 Calculate Stacey's allowable itemized deductions for the year. $ 25,150 X