Question

Exercise 14-6 Prepare a Statement of Cash Flows; Free Cash Flow [LO14-1, LO14-2, LO14-3] Comparative financial statement data for Carmono Company follow: This Year Last

Exercise 14-6 Prepare a Statement of Cash Flows; Free Cash Flow [LO14-1, LO14-2, LO14-3]

Comparative financial statement data for Carmono Company follow:

| This Year | Last Year | ||||

| Assets | |||||

| Cash | $ | 14.50 | $ | 28.00 | |

| Accounts receivable | 78.00 | 71.00 | |||

| Inventory | 127.50 | 115.60 | |||

| Total current assets | 220.00 | 214.60 | |||

| Property, plant, and equipment | 273.00 | 222.00 | |||

| Less accumulated depreciation | 56.80 | 42.60 | |||

| Net property, plant, and equipment | 216.20 | 179.40 | |||

| Total assets | $ | 436.20 | $ | 394.00 | |

| Liabilities and Stockholders Equity | |||||

| Accounts payable | $ | 76.50 | $ | 60.00 | |

| Common stock | 174.00 | 133.00 | |||

| Retained earnings | 185.70 | 201.00 | |||

| Total liabilities and stockholders equity | $ | 436.20 | $ | 394.00 | |

For this year, the company reported net income as follows:

| Sales | $ | 1,550.00 |

| Cost of goods sold | 930.00 | |

| Gross margin | 620.00 | |

| Selling and administrative expenses | 600.00 | |

| Net income | $ | 20.00 |

This year Carmono declared and paid a cash dividend. There were no sales of property, plant, and equipment during this year. The company did not repurchase any of its own stock this year.

Required:

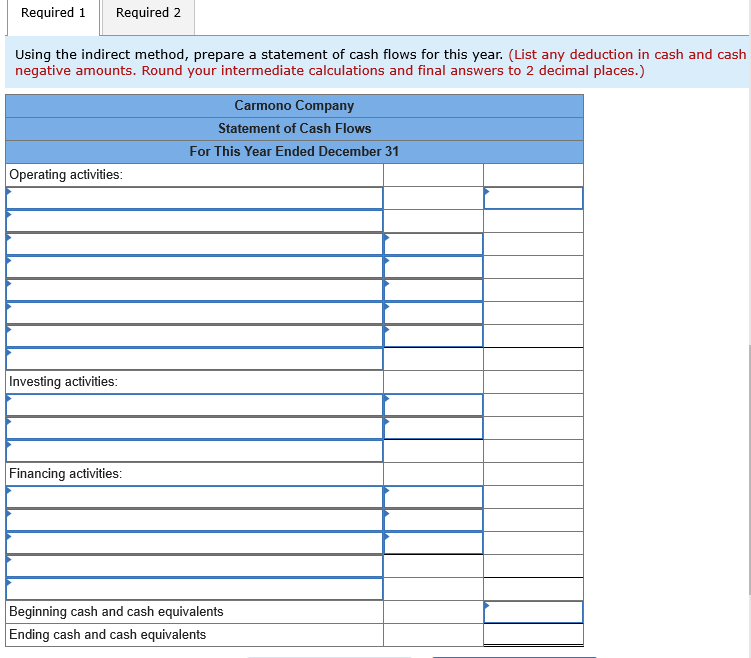

1. Using the indirect method, prepare a statement of cash flows for this year.

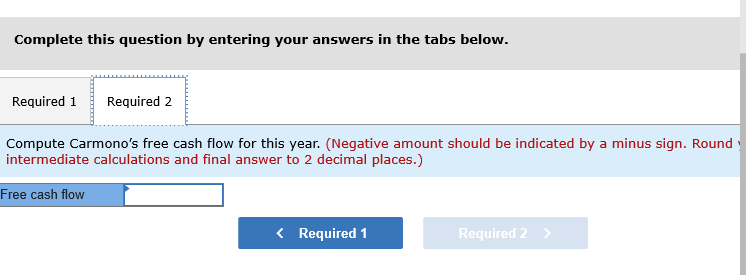

2. Compute Carmonos free cash flow for this year.

follows: Sales $ 1,550.00 Cost of goods sold 930.00 Gross margin 620.00 Selling and administrative expenses 600.00 Net income $ 20.00 This year Carmono declared and paid a cash dividend. There were no sales of property, plant, and equipment during this year. The company did not repurchase any of its own stock this year. Required: 1. Using the indirect method, prepare a statement of cash flows for this year. 2. Compute Carmonos free cash flow for this year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started