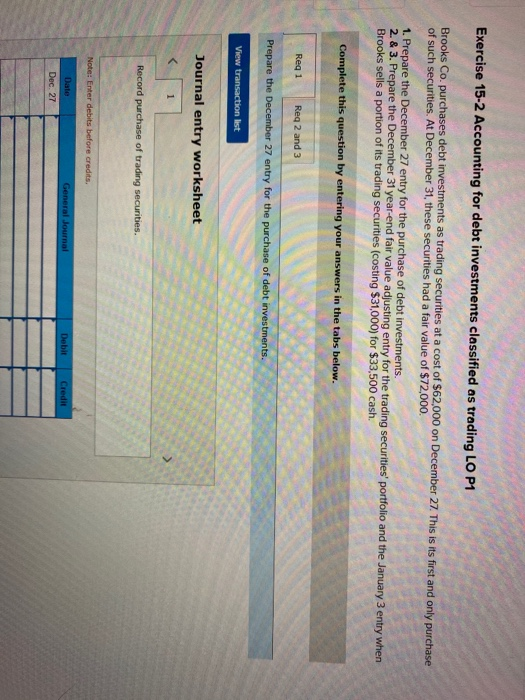

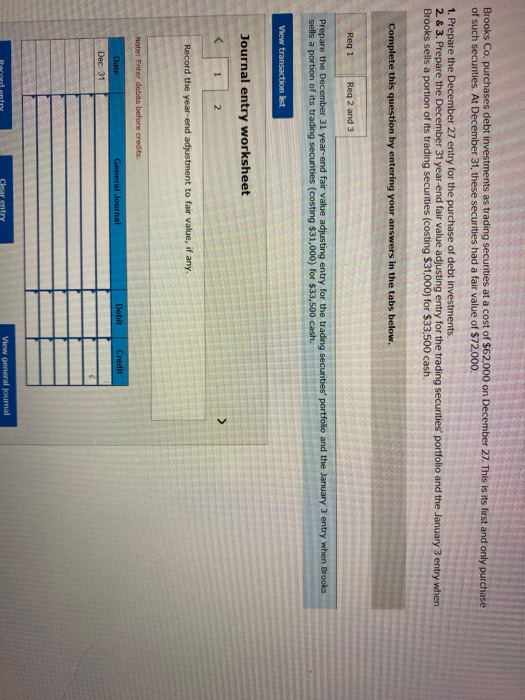

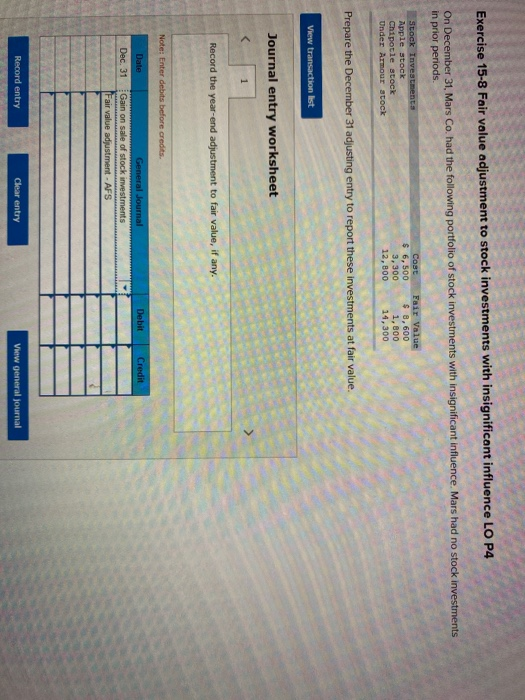

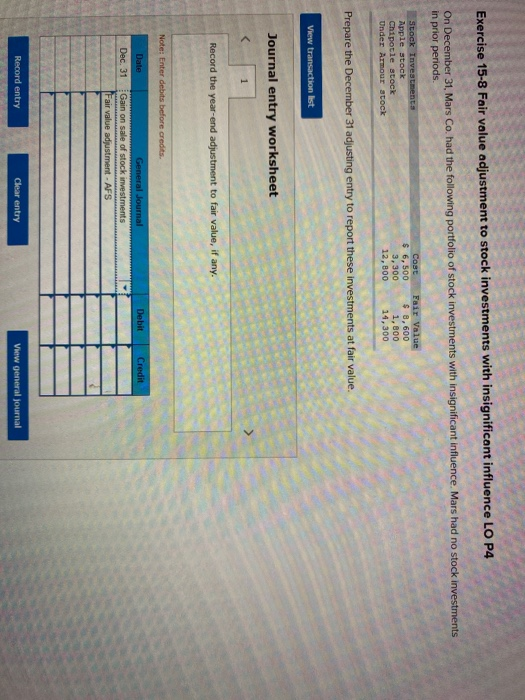

Exercise 15-2 Accounting for debt investments classified as trading LO P1 Brooks Co. purchases debt investments as trading securities at a cost of $62,000 on December 27. This is its first and only purchase of such securities. At December 31, these securities had a fair value of $72,000. 1. Prepare the December 27 entry for the purchase of debt investments. 2. & 3. Prepare the December 31 year-end fair value adjusting entry for the trading securities' portfolio and the January 3 entry when Brooks sells a portion of its trading securities (costing $31,000) for $33,500 cash. Complete this question by entering your answers in the tabs below. Reg 1 Req 2 and 3 Prepare the December 27 entry for the purchase of debt investments. View transaction list Journal entry worksheet 1 Record purchase of trading securities. Note: Enter debits before credits Date General Journal Debit Credit Dec. 27 Brooks Co. purchases debt investments as trading securities at a cost of $62,000 on December 27. This is its first and only purchase of such securities. At December 31, these securities had a fair value of $72,000. 1. Prepare the December 27 entry for the purchase of debt investments, 2. & 3. Prepare the December 31 year-end fair value adjusting entry for the trading securities' portfolio and the January 3 entry when Brooks sells a portion of its trading securities (costing $31,000) for $33,500 cash. Complete this question by entering your answers in the tabs below. Reg 1 Req 2 and 3 Prepare the December 31 year-end fair value adjusting entry for the trading securities' portfolio and the January 3 entry when Brooks sells a portion of its trading securities (costing $31,000) for $33,500 cash. View transaction list Journal entry worksheet Record the year-end adjustment to fair value, if any, Note: Enter debits before credits General Journal Debit Credit Date Dec. 31 Clear View General journal Exercise 15-8 Fair value adjustment to stock investments with insignificant influence LO P4 On December 31, Mars Co. had the following portfolio of stock investments with insignificant influence. Mars had no stock investments in prior periods. Stock Investments Apple stock Chipotle stock Under Armour stock Cost $ 6,500 3,300 12,800 Fair Value $ 8,600 1,800 14,300 Prepare the December 31 adjusting entry to report these investments at fair value. View transaction list Journal entry worksheet 1 Record the year-end adjustment to fair value, if any. Note: Enter debits before credits Debit Credit Date Dec. 31 General Journal Gain on sale of stock investments Fair value adjustment - AFS Record entry Clear entry View general journal