Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 16-22 Net operating loss carryback and carryforward [LO16-7] Wynn Sheet Metal reported an operating loss of $182,000 for financial reporting and tax purposes in

Exercise 16-22 Net operating loss carryback and carryforward [LO16-7]

| Wynn Sheet Metal reported an operating loss of $182,000 for financial reporting and tax purposes in 2016. The enacted tax rate is 40%. Taxable income, tax rates, and income taxes paid in Wynns first four years of operation were as follows: |

| Taxable Income | Tax Rates | Income Taxes Paid | ||||

| 2012 | $ | 71,000 | 30 | % | $ | 21,300 |

| 2013 | 81,000 | 30 | 24,300 | |||

| 2014 | 91,000 | 40 | 36,400 | |||

| 2015 | 71,000 | 45 | 31,950 | |||

| Required: |

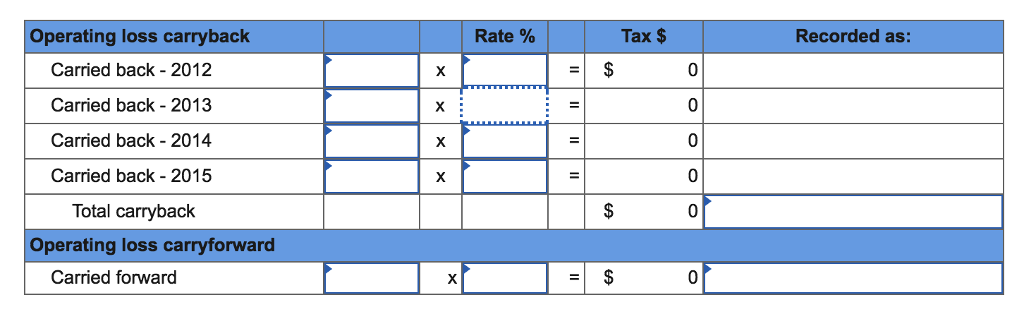

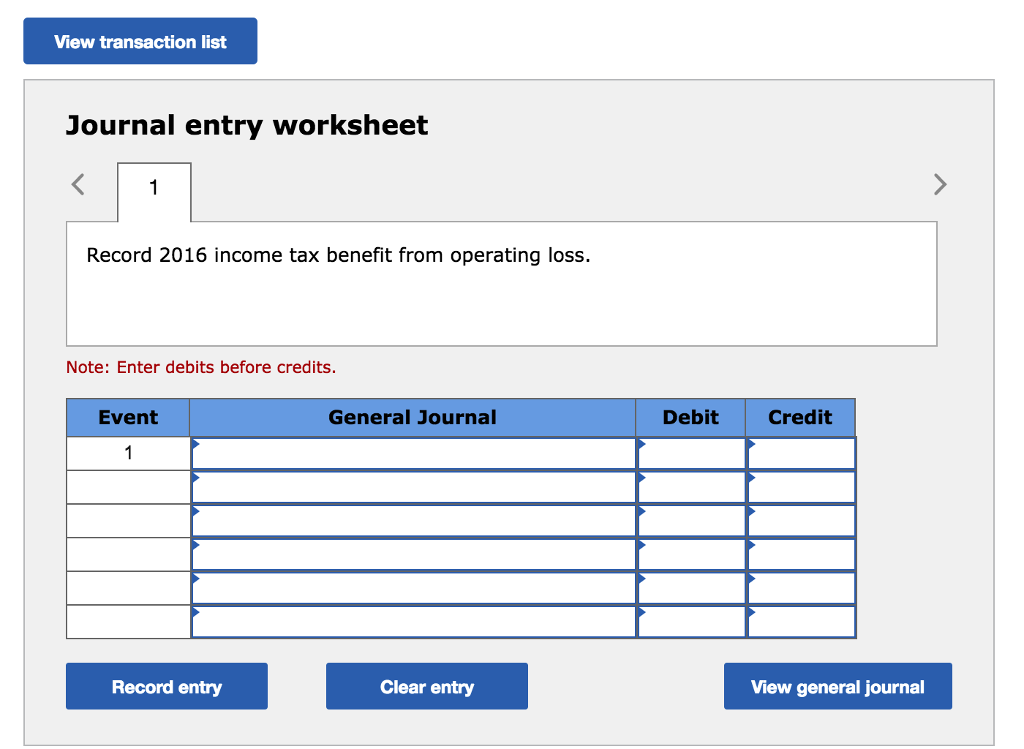

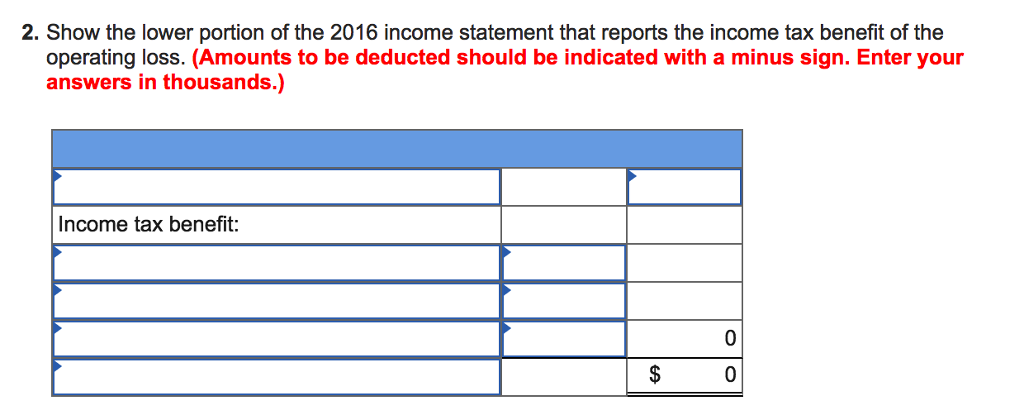

| 1. | Complete the following table given below and prepare the journal entry to recognize the income tax benefit of the operating loss. Wynn elects the carryback option. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started