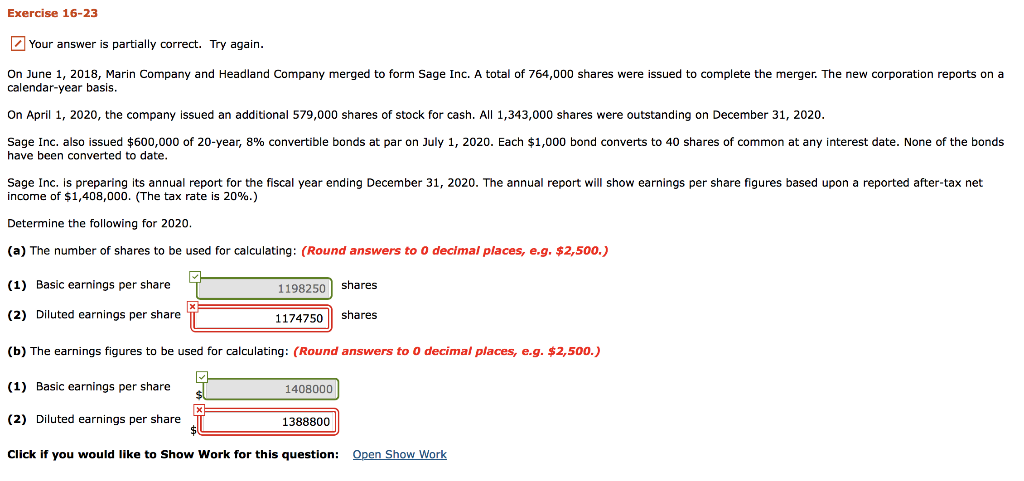

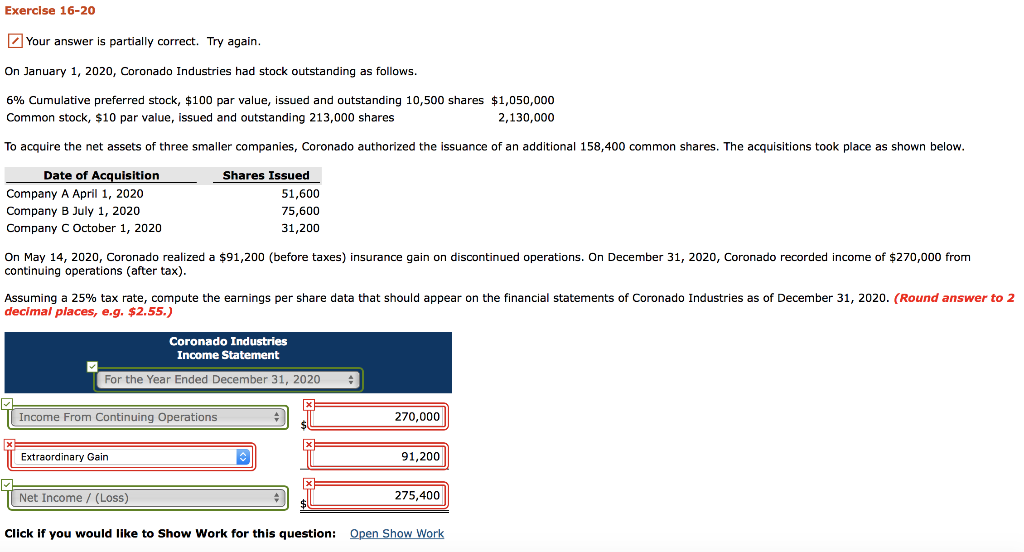

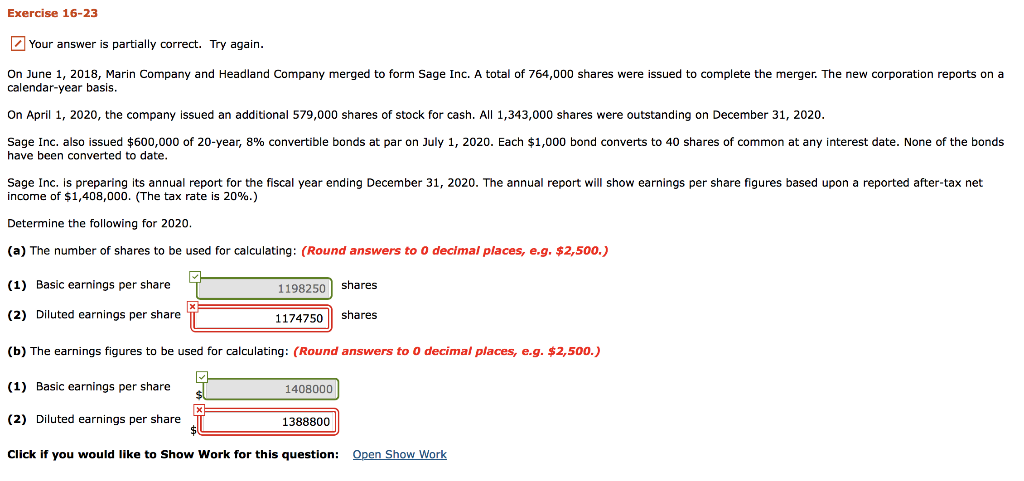

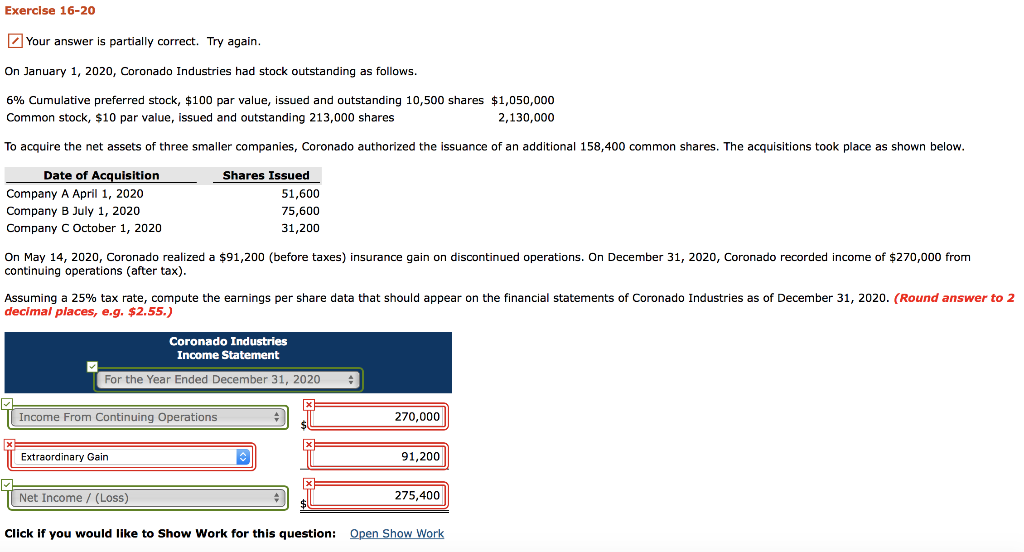

Exercise 16-23 Your answer is partially correct. Try again. On June 1, 2018, Marin Company and Headland Company merged to form Sage Inc. A total of 764,000 shares were issued to complete the merger. The new corporation reports on a calendar-year basis. On April 1, 2020, the company issued an additional 579,000 shares of stock for cash. All 1,343,000 shares were outstanding on December 31, 2020. Sage Inc. also issued $600,000 of 20-year, 8% convertible bonds at par on July 1, 2020. Each $1,000 bond converts to 40 shares of common at any interest date. None of the bonds have been converted to date. Sage Inc. is preparing its annual report for the fiscal year ending December 31, 2020. The annual report will show earnings per share figures based upon a reported after-tax net income of $1,408,000. (The tax rate is 20%.) Determine the following for 2020. (a) The number of shares to be used for calculating: (Round answers to o decimal places, e.g. $2,500.) (1) Basic earnings per share 1198250 shares (2) Diluted earnings per share 1174750 shares (b) The earnings figures to be used for calculating: (Round answers to 0 decimal places, e.g. $2,500.) (1) Basic earnings per share 1408000 (2) Diluted earnings per share 1388800 Click if you would like to Show Work for this question: Open Show Work Exercise 16-20 Your answer is partially correct. Try again. On January 1, 2020, Coronado Industries had stock outstanding as follows. 6% Cumulative preferred stock, $100 par value, issued and outstanding 10,500 shares $1,050,000 Common stock, $10 par value, issued and outstanding 213,000 shares 2,130,000 To acquire the net assets of three smaller companies, Coronado authorized the issuance of an additional 158,400 common shares. The acquisitions took place as shown below. Date of Acquisition Company A April 1, 2020 Company B July 1, 2020 Company C October 1, 2020 Shares Issued 51,600 75,600 31,200 On May 14, 2020, Coronado realized a $91,200 (before taxes) insurance gain on discontinued operations. On December 31, 2020, Coronado recorded income of $270,000 from continuing operations (after tax). Assuming a 25% tax rate, compute the earnings per share data that should appear on the financial statements of Coronado Industries as of December 31, 2020. (Round answer to 2 decimal places, e.g. $2.55.) Coronado Industries Income Statement For the Year Ended December 31, 2020 || Income From Continuing Operations 270,000 Extraordinary Gain DI 91,200 => Net Income / (Loss) 275,400 Click If you would like to Show Work for this question: Open Show Work