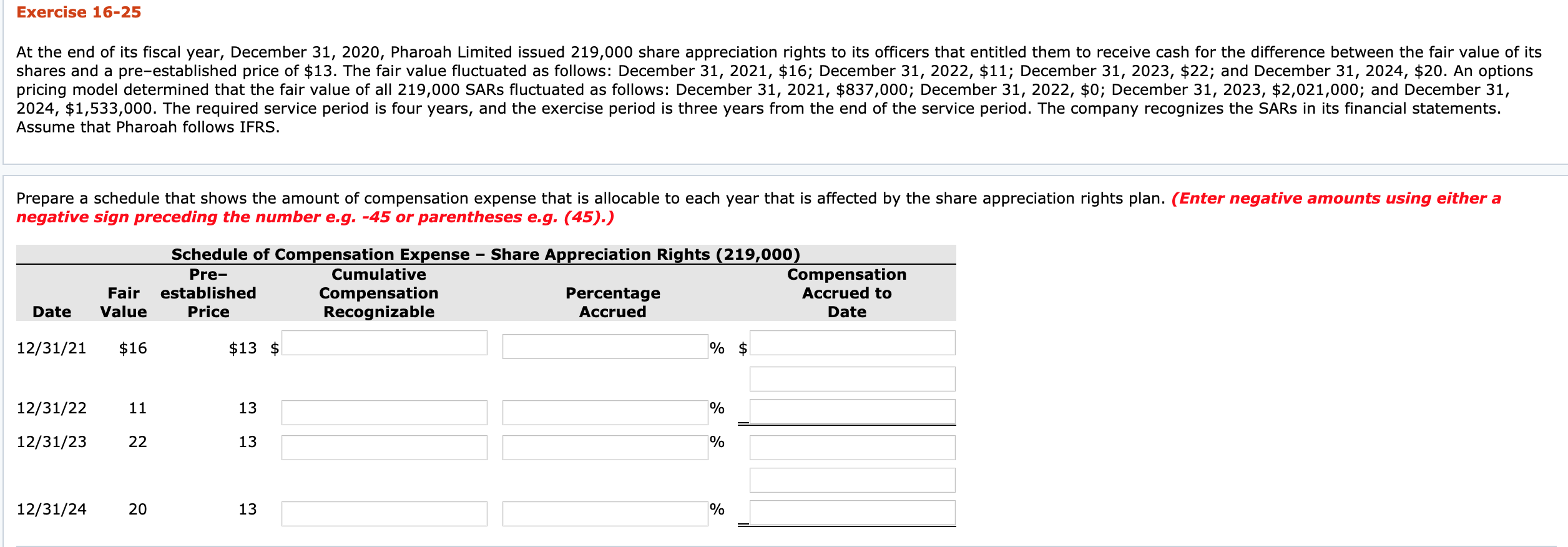

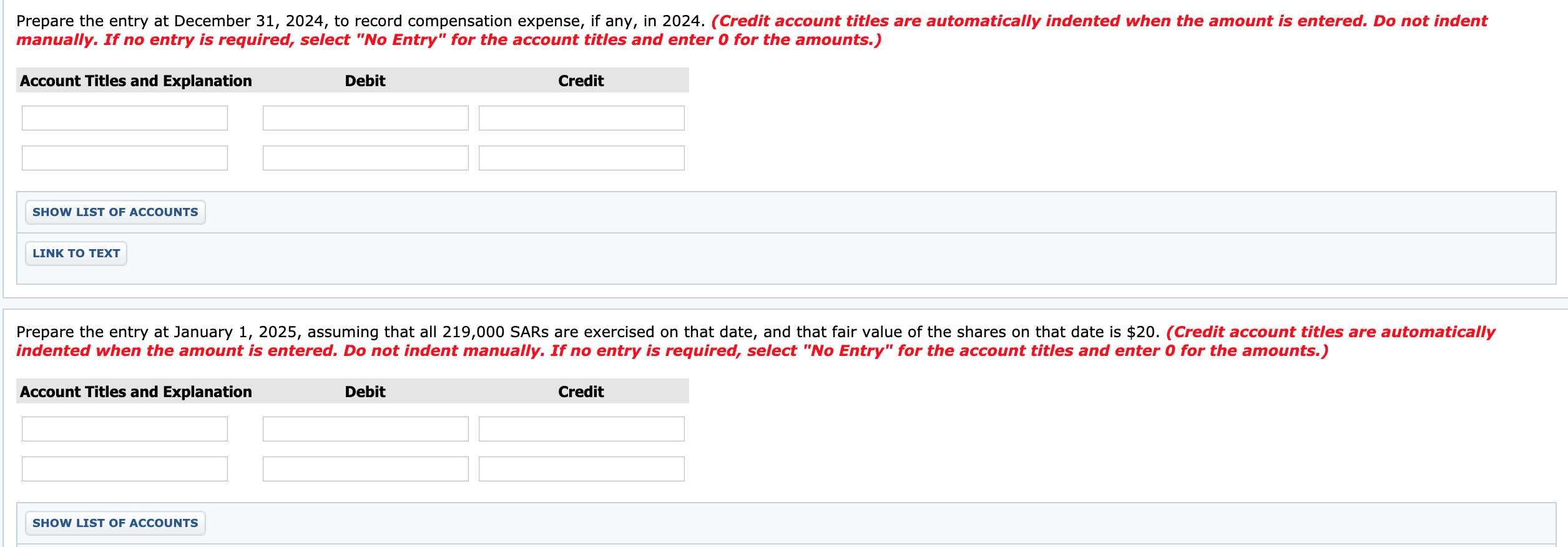

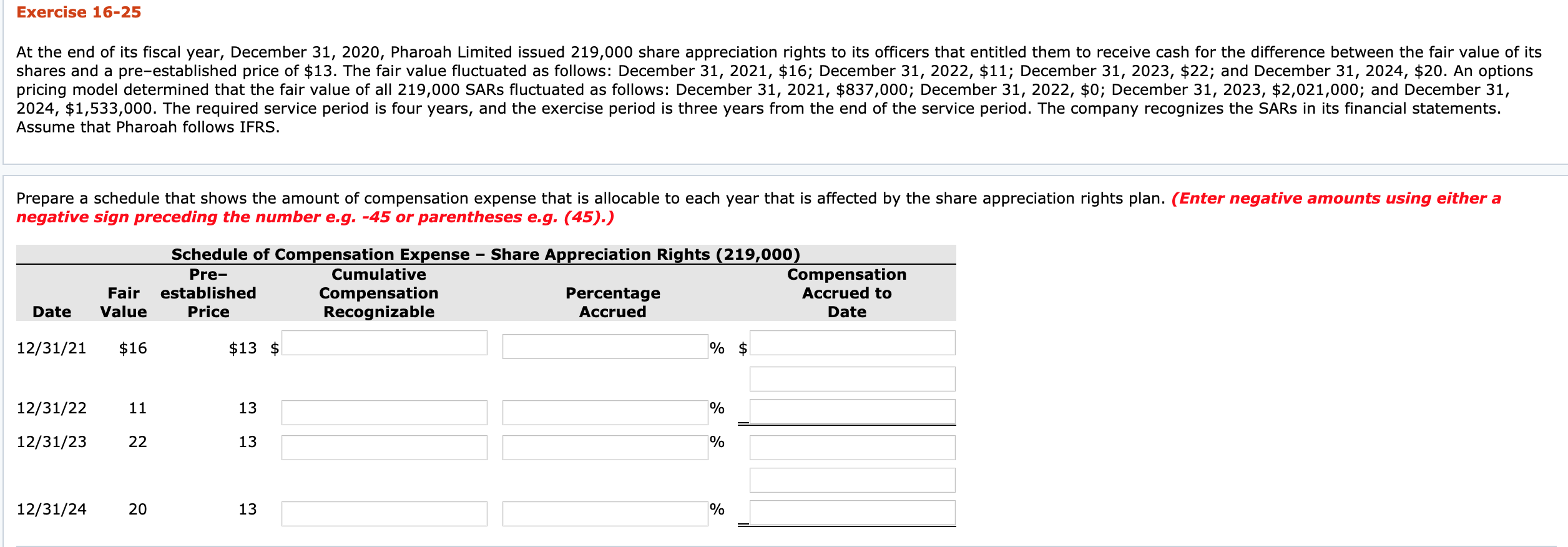

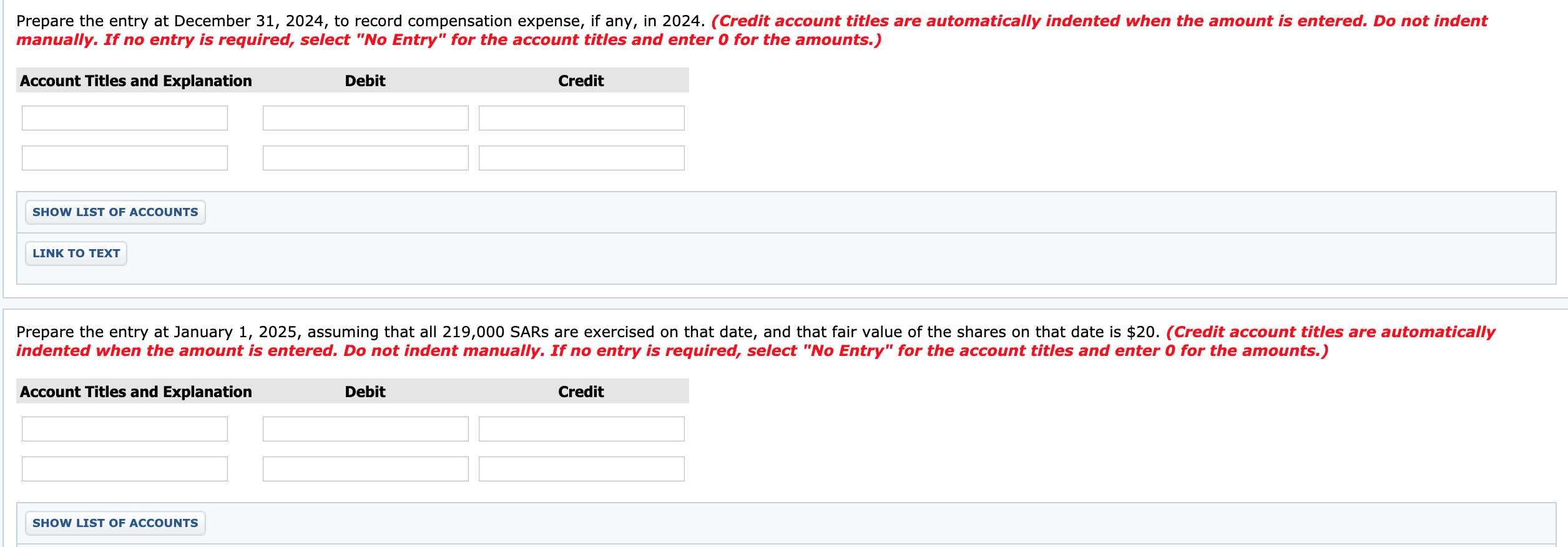

Exercise 16-25 At the end of its fiscal year, December 31, 2020, Pharoah Limited issued 219,000 share appreciation rights to its officers that entitled them to receive cash for the difference between the fair value of its shares and a pre-established price of $13. The fair value fluctuated as follows: December 31, 2021, $16; December 31, 2022, $11; December 31, 2023, $22; and December 31, 2024, $20. An options pricing model determined that the fair value of all 219,000 SARs fluctuated as follows: December 31, 2021, $837,000; December 31, 2022, $0; December 31, 2023, $2,021,000; and December 31, 2024, $1,533,000. The required service period is four years, and the exercise period is three years from the end of the service period. The company recognizes the SARS in its financial statements. Assume that Pharoah follows IFRS. 2023, $22; and December 31, 2024, $20. An options Prepare a schedule that shows the amount of compensation expense that is allocable to each year that is affected by the share appreciation rights plan. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Schedule of Compensation Expense Share Appreciation Rights (219,000) Pre- Cumulative Compensation established Compensation Percentage Accrued to Price Recognizable Accrued Date Fair Value Date 12/31/21 $16 $13 $ 12/31/22 11 12/31/23 22 12/31/24 20 Prepare the entry at December 31, 2024, to record compensation expense, if any, in 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare the entry at January 1, 2025, assuming that all 219,000 SARs are exercised on that date, and that fair value of the shares on that date is $20. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS Exercise 16-25 At the end of its fiscal year, December 31, 2020, Pharoah Limited issued 219,000 share appreciation rights to its officers that entitled them to receive cash for the difference between the fair value of its shares and a pre-established price of $13. The fair value fluctuated as follows: December 31, 2021, $16; December 31, 2022, $11; December 31, 2023, $22; and December 31, 2024, $20. An options pricing model determined that the fair value of all 219,000 SARs fluctuated as follows: December 31, 2021, $837,000; December 31, 2022, $0; December 31, 2023, $2,021,000; and December 31, 2024, $1,533,000. The required service period is four years, and the exercise period is three years from the end of the service period. The company recognizes the SARS in its financial statements. Assume that Pharoah follows IFRS. 2023, $22; and December 31, 2024, $20. An options Prepare a schedule that shows the amount of compensation expense that is allocable to each year that is affected by the share appreciation rights plan. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Schedule of Compensation Expense Share Appreciation Rights (219,000) Pre- Cumulative Compensation established Compensation Percentage Accrued to Price Recognizable Accrued Date Fair Value Date 12/31/21 $16 $13 $ 12/31/22 11 12/31/23 22 12/31/24 20 Prepare the entry at December 31, 2024, to record compensation expense, if any, in 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare the entry at January 1, 2025, assuming that all 219,000 SARs are exercised on that date, and that fair value of the shares on that date is $20. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS