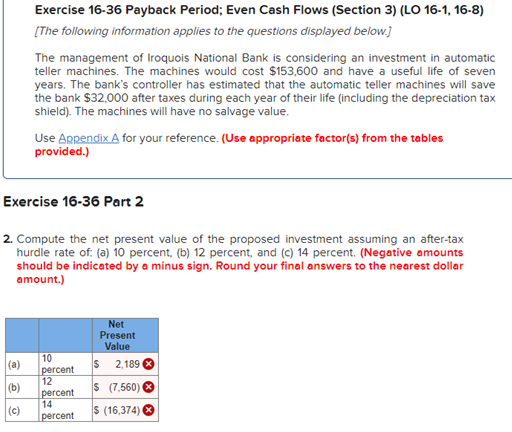

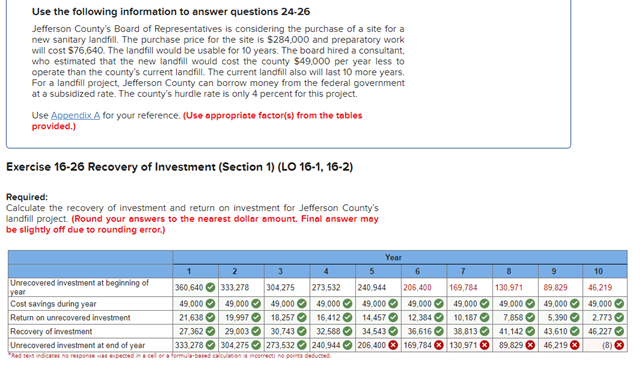

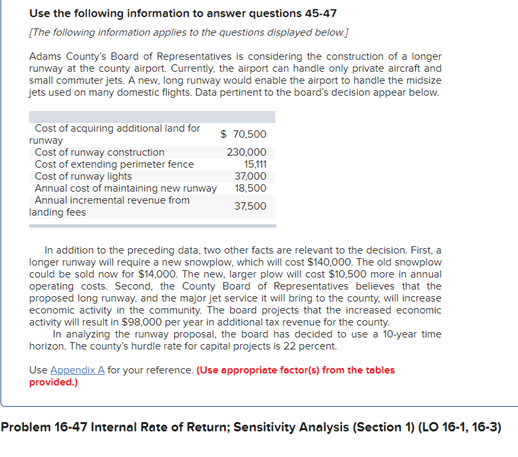

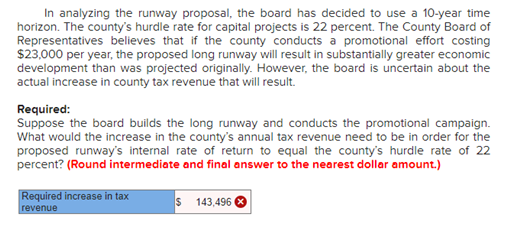

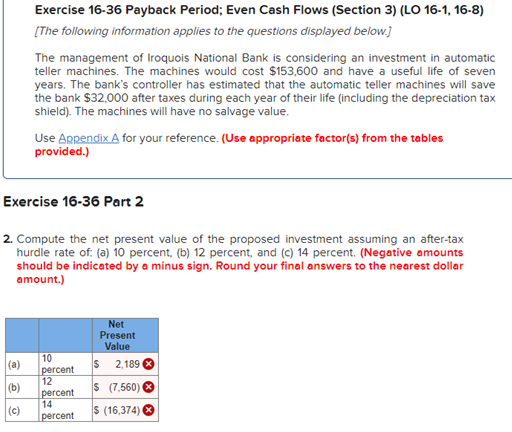

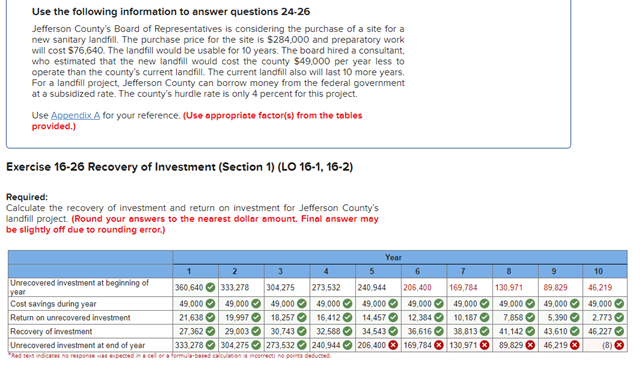

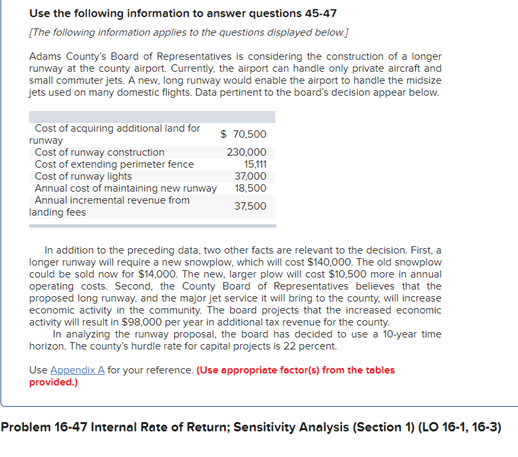

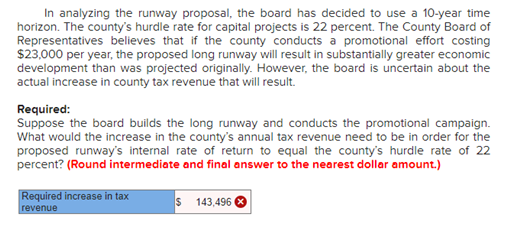

Exercise 16-36 Payback Period; Even Cash Flows (Section 3) (LO 16-1, 16-8) (The following information applies to the questions displayed below.) The management of Iroquois National Bank is considering an investment in automatic teller machines. The machines would cost $153,600 and have a useful life of seven years. The bank's controller has estimated that the automatic teller machines will save the bank $32,000 after taxes during each year of their life (including the depreciation tax shield). The machines will have no salvage value. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Exercise 16-36 Part 2 2. Compute the net present value of the proposed investment assuming an after-tax hurdle rate of: (a) 10 percent, (b) 12 percent, and (c) 14 percent. (Negative amounts should be indicated by a minus sign. Round your final answers to the nearest dollar amount.) (a) Net Present Value $ 2.189 $ (7,560) $ (16,374) 10 percent 12 percent 14 percent (b) (c) Use the following information to answer questions 24-26 Jefferson County's Board of Representatives is considering the purchase of a site for a new sanitary landfill. The purchase price for the site is $284,000 and preparatory work will cost $76,640. The landfill would be usable for 10 years. The board hired a consultant, who estimated that the new landfill would cost the county $49.000 per year less to operate than the county's current landfill. The current landfill also will last 10 more years. For a landfill project, Jefferson County can borrow money from the federal government at a subsidized rate. The county's hurdle rate is only 4 percent for this project. Use Arpendix A for your reference. (Use appropriate factor(s) from the tables provided.) Exercise 16-26 Recovery of Investment (Section 1) (LO 16-1, 16-2) Required: Calculate the recovery of investment and return on investment for Jefferson County's landfill project. (Round your answers to the nearest dollar amount. Final answer may be slightly off due to rounding error.) Year 5 6 7 8 9 10 Unrecovered investment at beginning of 360,640333278 304 275 273,532 year 240.944 206,400 169,784 130.971 89.829 46.219 Cost savings during year 49,000 49.000 49.000 49.000 49.000 49.000 49.000 49.000 49.000 49.000 Return on unrecovered investment 21.638 19.997 18,257 16.412 14.457 12,384 10.187 7.858 5.390 2.773 Recovery of investment 27.36229.003 30,743 32.588 34.543 36,616 38,813 41.142 43.610 46 227 Unrecovered investment at end of year 333 278 304 275 273,532 240,944 206.400 169,784 130.971 89 829 46,219 (8) "Rad text indicates no response was expected in a celor atomus-based actions incorrect no points deducted Use the following information to answer questions 45-47 [The following information applies to the questions displayed below.) Adams County's Board of Representatives is considering the construction of a longer runway at the county airport. Currently, the airport can handle only private aircraft and small commuter jets. A new, long runway would enable the airport to handle the midsize jets used on many domestic flights. Data pertinent to the board's decision appear below. Cost of acquiring additional land for $ 70,500 runway Cost of runway construction 230,000 Cost of extending perimeter fence 15,111 Cost of runway lights 37.000 Annual cost of maintaining new runway 18,500 Annual incremental revenue from 37,500 landing fees In addition to the preceding data, two other facts are relevant to the decision. First, a longer runway will require a new snowplow, which will cost $140,000. The old snowplow could be sold now for $14,000. The new larger plow will cost $10.500 more in annual operating costs. Second, the County Board of Representatives believes that the proposed long runway, and the major jet service it will bring to the county, will increase economic activity in the community. The board projects that the increased economic activity will result in $98,000 per year in additional tax revenue for the county. In analyzing the runway proposal, the board has decided to use a 10-year time horizon. The county's hurdle rate for capital projects is 22 percent. Use Arpendix A for your reference. (Use appropriate factor(s) from the tables provided.) Problem 16-47 Internal Rate of Return; Sensitivity Analysis (Section 1) (LO 16-1, 16-3) In analyzing the runway proposal, the board has decided to use a 10-year time horizon. The county's hurdle rate for capital projects is 22 percent. The County Board of Representatives believes that if the county conducts a promotional effort costing $23,000 per year, the proposed long runway will result in substantially greater economic development than was projected originally. However, the board is uncertain about the actual increase in county tax revenue that will result. Required: Suppose the board builds the long runway and conducts the promotional campaign. What would the increase in the county's annual tax revenue need to be in order for the proposed runway's internal rate of return to equal the county's hurdle rate of 22 percent? (Round intermediate and final answer to the nearest dollar amount.) Required increase in tax revenue $ 143,496