Question

Exercise 2: Consider a financial institution, which has the same on-balance-sheet assets and liabilities as the financial institution in Exercise 1. In addition it has

Exercise 2:

Consider a financial institution, which has the same on-balance-sheet assets and liabilities as the financial institution in Exercise 1. In addition it has the following off-balance-sheet items:

20 AUD - Performance-related standby letters of credit 30 AUD - commercial letters of credit 60 AUD - 3-year fixed-floating interest rate swap and a replacement cost of -5 AUD

40 AUD - 6-year foreign exchange rate contracts with a replacement cost of 2 AUD

a) Calculate the Risk adjusted amount for the two off-balance-sheet commitments.

b) Calculate the Risk adjusted amount for the two off-balance-sheet derivatives.

c) Calculate the Common equity Tier I risk-based capital ratio, Tier I risk-based capital ratio, and Total risk-based capital ratio.

d) Is the financial institution well capitalized, adequately capitalized, undercapitalized, significantly undercapitalized, or critically undercapitalized?

Please help me to crack with Question 2, thank you!

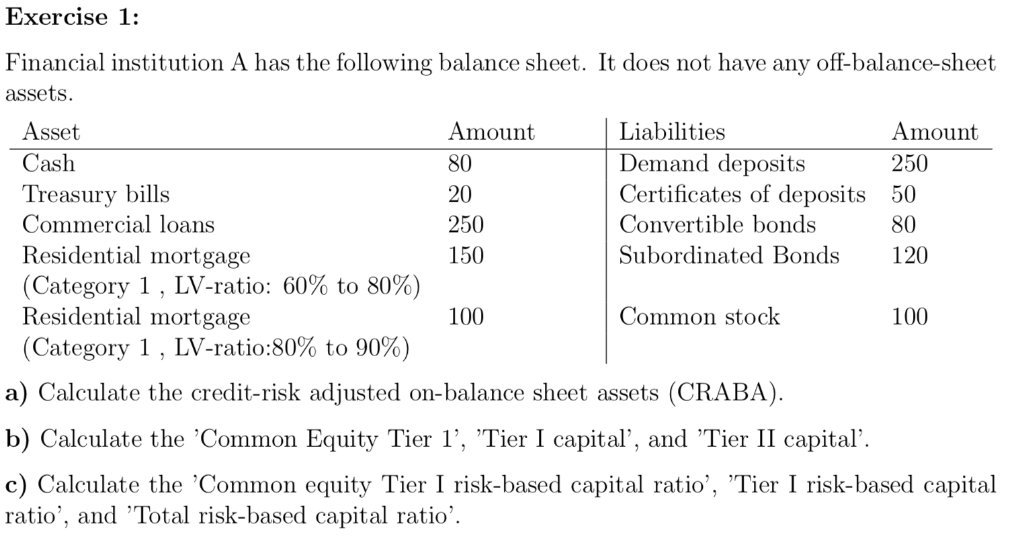

Exercise 1: Financial institution A has the following balance sheet. It does not have any off-balance-sheet assets Amount 80 20 250 150 Liabilities Demand deposits Certificates of deposits Convertible bonds Subordinated Bonds Amount 250 50 80 120 sset ash Treasury bills Commercial loans Residential mortgage (Category 1 , LV-ratio: 60% to 80%) Residential mortgage (Category 1 , LV-ratio:80% to 90%) 100 100 Common stock a) Calculate the credit-risk adjusted on-balance sheet assets (CRABA) b) Calculate the 'Common Equity Tier 1', 'Tier I capital', and 'Tier II capital'. c) Calculate the 'Common equity Tier I risk-based capital ratio', 'Tier I risk-based capital ratio', and 'Total risk-based capital ratio' Exercise 1: Financial institution A has the following balance sheet. It does not have any off-balance-sheet assets Amount 80 20 250 150 Liabilities Demand deposits Certificates of deposits Convertible bonds Subordinated Bonds Amount 250 50 80 120 sset ash Treasury bills Commercial loans Residential mortgage (Category 1 , LV-ratio: 60% to 80%) Residential mortgage (Category 1 , LV-ratio:80% to 90%) 100 100 Common stock a) Calculate the credit-risk adjusted on-balance sheet assets (CRABA) b) Calculate the 'Common Equity Tier 1', 'Tier I capital', and 'Tier II capital'. c) Calculate the 'Common equity Tier I risk-based capital ratio', 'Tier I risk-based capital ratio', and 'Total risk-based capital ratioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started