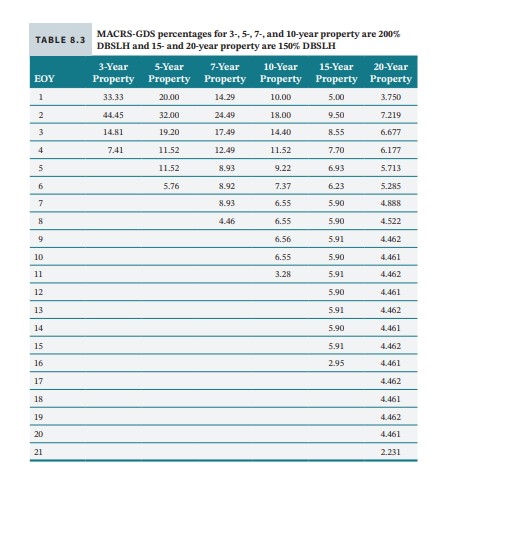

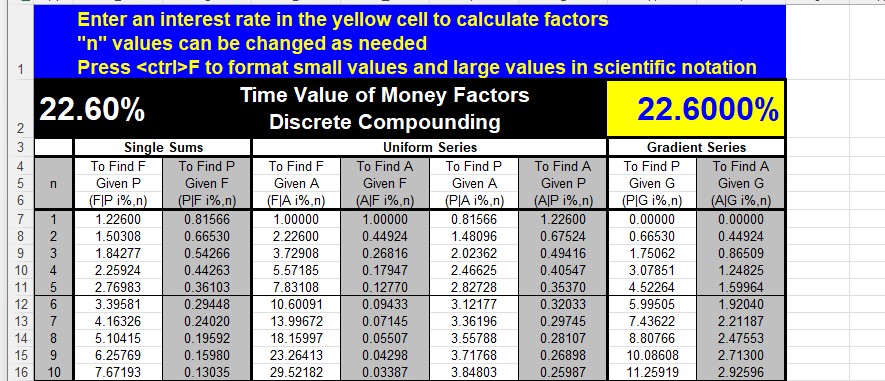

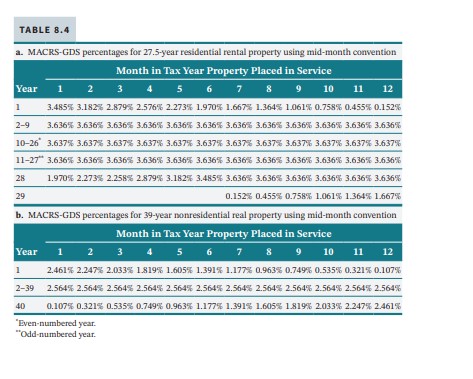

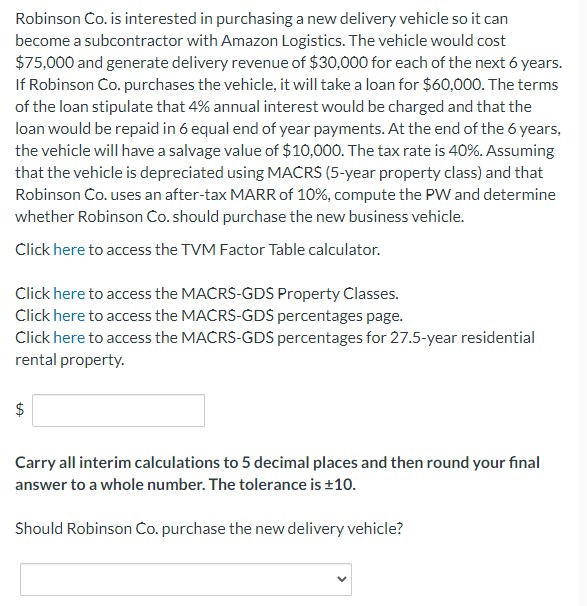

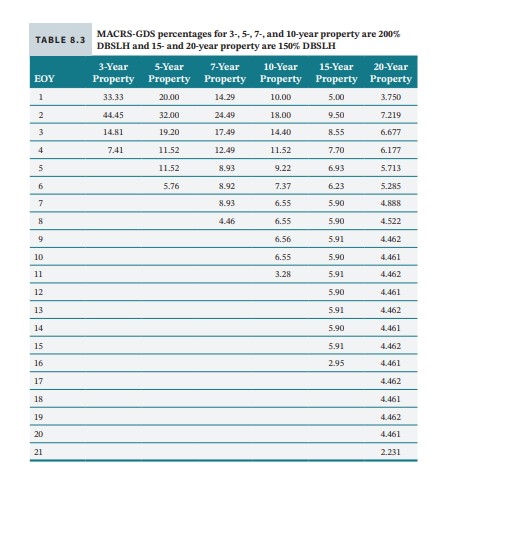

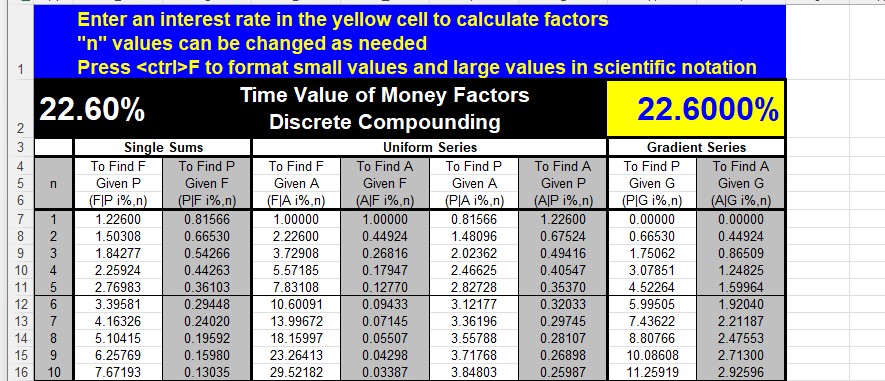

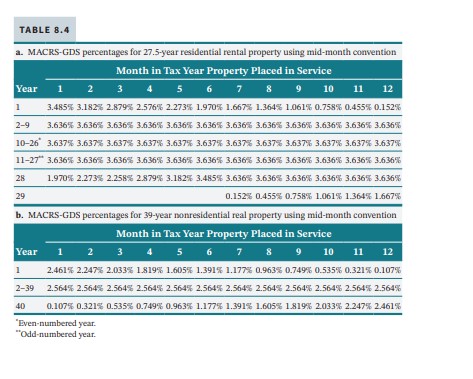

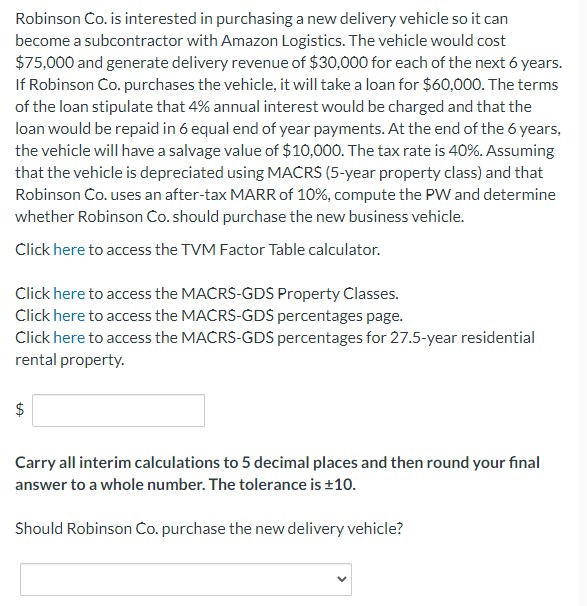

MACRS-GDS percentages for 3-, 5-, 7-, and 10-year property are 200% Enter an interest rate in the yellow cell to calculate factors " n " values can be changed as needed Drece ectrlbE th format cmallvaluecandlarme valuecin ccientific notation TABLE 8.4 a. MACRS-GDS percentages for 27.5-year residential rental property using mid-month convention b. MACRS-GDS percentages for 39-year nonresidential real property using mid-month convention "Even-numbered year. "Odd-numbered year. Robinson Co. is interested in purchasing a new delivery vehicle so it can become a subcontractor with Amazon Logistics. The vehicle would cost $75,000 and generate delivery revenue of $30,000 for each of the next 6 years. If Robinson Co. purchases the vehicle, it will take a loan for $60,000. The terms of the loan stipulate that 4% annual interest would be charged and that the loan would be repaid in 6 equal end of year payments. At the end of the 6 years, the vehicle will have a salvage value of $10,000. The tax rate is 40%. Assuming that the vehicle is depreciated using MACRS (5-year property class) and that Robinson Co. uses an after-tax MARR of 10%, compute the PW and determine whether Robinson Co. should purchase the new business vehicle. Click here to access the TVM Factor Table calculator. Click here to access the MACRS-GDS Property Classes. Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-year residential rental property. \$ Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is \pm 10 . Should Robinson Co. purchase the new delivery vehicle? MACRS-GDS percentages for 3-, 5-, 7-, and 10-year property are 200% Enter an interest rate in the yellow cell to calculate factors " n " values can be changed as needed Drece ectrlbE th format cmallvaluecandlarme valuecin ccientific notation TABLE 8.4 a. MACRS-GDS percentages for 27.5-year residential rental property using mid-month convention b. MACRS-GDS percentages for 39-year nonresidential real property using mid-month convention "Even-numbered year. "Odd-numbered year. Robinson Co. is interested in purchasing a new delivery vehicle so it can become a subcontractor with Amazon Logistics. The vehicle would cost $75,000 and generate delivery revenue of $30,000 for each of the next 6 years. If Robinson Co. purchases the vehicle, it will take a loan for $60,000. The terms of the loan stipulate that 4% annual interest would be charged and that the loan would be repaid in 6 equal end of year payments. At the end of the 6 years, the vehicle will have a salvage value of $10,000. The tax rate is 40%. Assuming that the vehicle is depreciated using MACRS (5-year property class) and that Robinson Co. uses an after-tax MARR of 10%, compute the PW and determine whether Robinson Co. should purchase the new business vehicle. Click here to access the TVM Factor Table calculator. Click here to access the MACRS-GDS Property Classes. Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-year residential rental property. \$ Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is \pm 10 . Should Robinson Co. purchase the new delivery vehicle