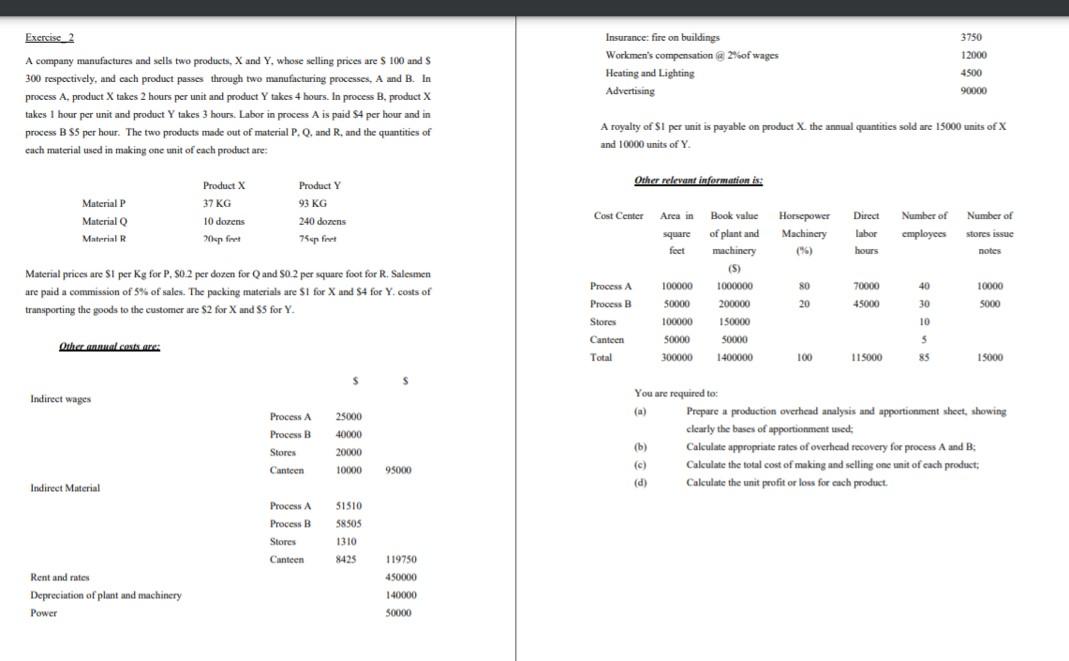

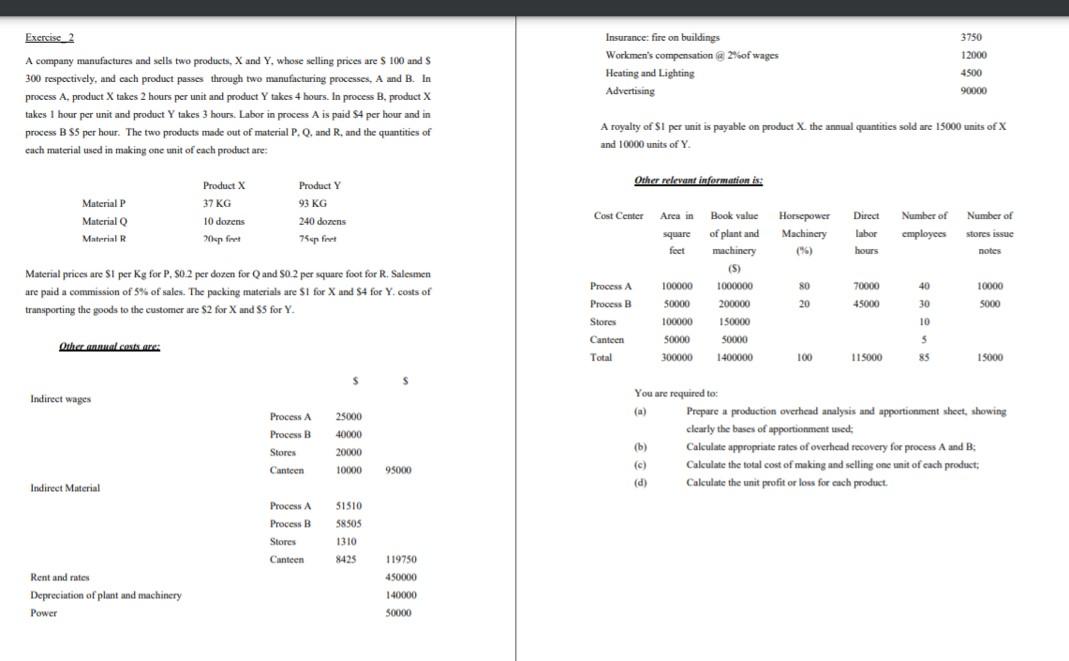

Exercise 2 Insurance: fire on buildings Workmen's compensation of wages Heating and Lighting Advertising 3750 12000 4500 90000 A company manufactures and sells two products, X and Y, whose selling prices are $ 100 and $ 300 respectively, and cach product passes through two manufacturing processes, A and B. In process A, product X takes 2 hours per unit and product Y takes 4 hours. In process B, product X takes 1 hour per unit and product Y takes 3 hours. Labor in process A is paid S4 per hour and in process BSS per hour. The two products made out of material P., and R, and the quantities of each material used in making one unit of each product are: A royalty of Si per unit is payable on product X the annual quantities sold are 15000 units of X and 10000 units of Y. Other relevant information is: Material P Material Material R Product X 37 KG 10 dozens up fret Product Y 93 KG 240 dozens 76p front Horsepower Machinery (%) Direct labor hours Number of employees Number of stores issue notes Cost Center Area in Book value square of plant and fost machinery (S) Process A 100000 1000000 Process B 50000 200000 Stores 100000 150000 Canteen 50000 50000 Total 300000 1400000 70000 40 Material prices are St per kg for P. 90.2 per dozen for Q and SO2 per square foot for R. Salesmen are paid a commission of 5% of sales. The packing materials are SI for X and S4 for Y costs of transporting the goods to the customer are $2 for X and S5 for Y 10000 80 20 45000 30 5000 10 5 Other annual costs are: 100 115000 85 15000 $ s Indirect wages 25000 40000 Process A Process B B Stores Canteen You are required to: Prepare a production overhead analysis and apportionment sheet, showing clearly the bases of apportionment used: (b) Calculate appropriate rates of overhead recovery for process A and B: (c) Calculate the total cost of making and selling one unit of cach product: (d) Calculate the unit profit or loss for each product 20000 10000 95000 Indirect Material Process A Process B Stores Canteen 51510 58505 1310 8425 Rent and rates Depreciation of plant and machinery Power 119750 450000 140000 50000 Exercise 2 Insurance: fire on buildings Workmen's compensation of wages Heating and Lighting Advertising 3750 12000 4500 90000 A company manufactures and sells two products, X and Y, whose selling prices are $ 100 and $ 300 respectively, and cach product passes through two manufacturing processes, A and B. In process A, product X takes 2 hours per unit and product Y takes 4 hours. In process B, product X takes 1 hour per unit and product Y takes 3 hours. Labor in process A is paid S4 per hour and in process BSS per hour. The two products made out of material P., and R, and the quantities of each material used in making one unit of each product are: A royalty of Si per unit is payable on product X the annual quantities sold are 15000 units of X and 10000 units of Y. Other relevant information is: Material P Material Material R Product X 37 KG 10 dozens up fret Product Y 93 KG 240 dozens 76p front Horsepower Machinery (%) Direct labor hours Number of employees Number of stores issue notes Cost Center Area in Book value square of plant and fost machinery (S) Process A 100000 1000000 Process B 50000 200000 Stores 100000 150000 Canteen 50000 50000 Total 300000 1400000 70000 40 Material prices are St per kg for P. 90.2 per dozen for Q and SO2 per square foot for R. Salesmen are paid a commission of 5% of sales. The packing materials are SI for X and S4 for Y costs of transporting the goods to the customer are $2 for X and S5 for Y 10000 80 20 45000 30 5000 10 5 Other annual costs are: 100 115000 85 15000 $ s Indirect wages 25000 40000 Process A Process B B Stores Canteen You are required to: Prepare a production overhead analysis and apportionment sheet, showing clearly the bases of apportionment used: (b) Calculate appropriate rates of overhead recovery for process A and B: (c) Calculate the total cost of making and selling one unit of cach product: (d) Calculate the unit profit or loss for each product 20000 10000 95000 Indirect Material Process A Process B Stores Canteen 51510 58505 1310 8425 Rent and rates Depreciation of plant and machinery Power 119750 450000 140000 50000