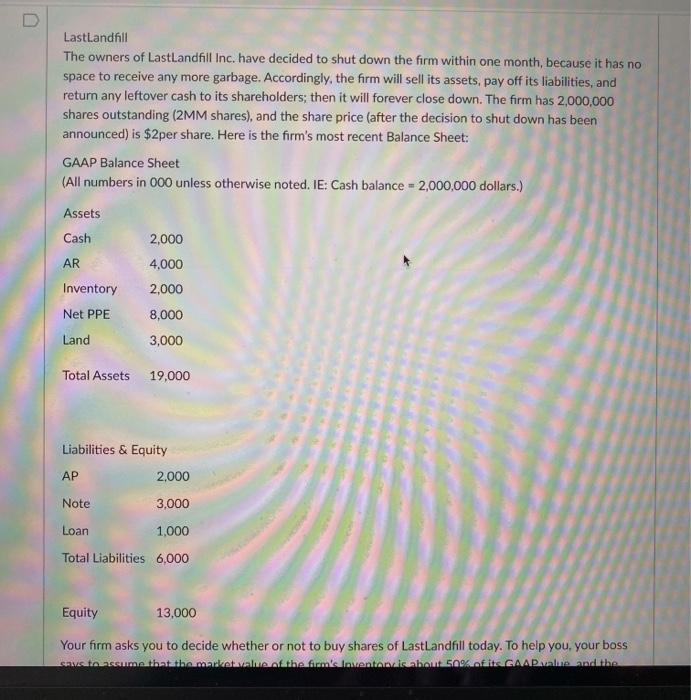

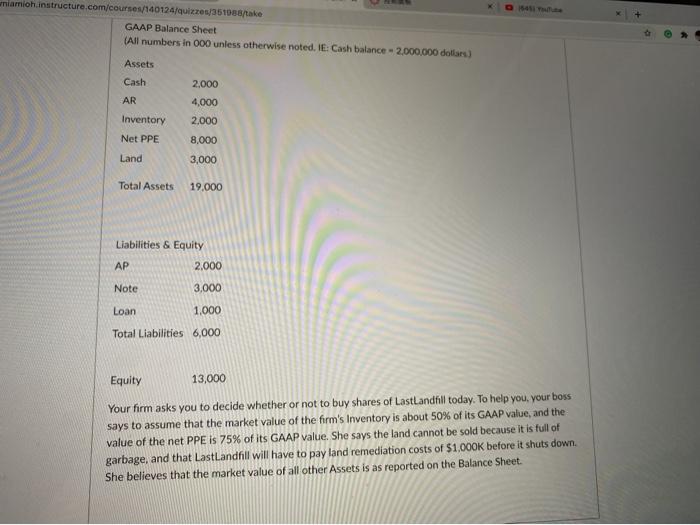

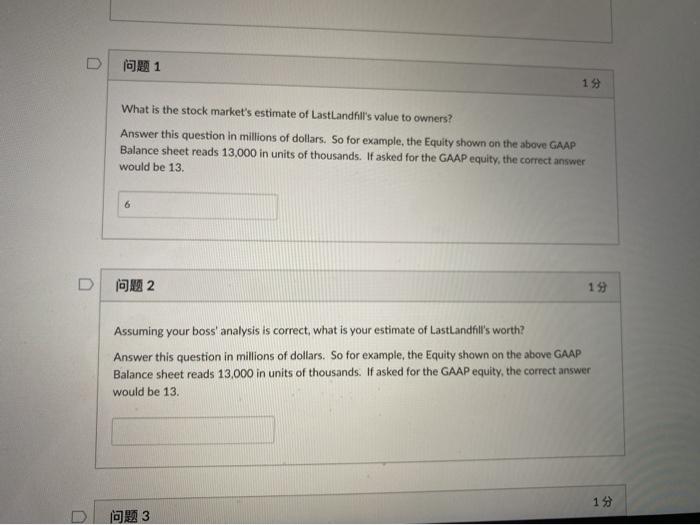

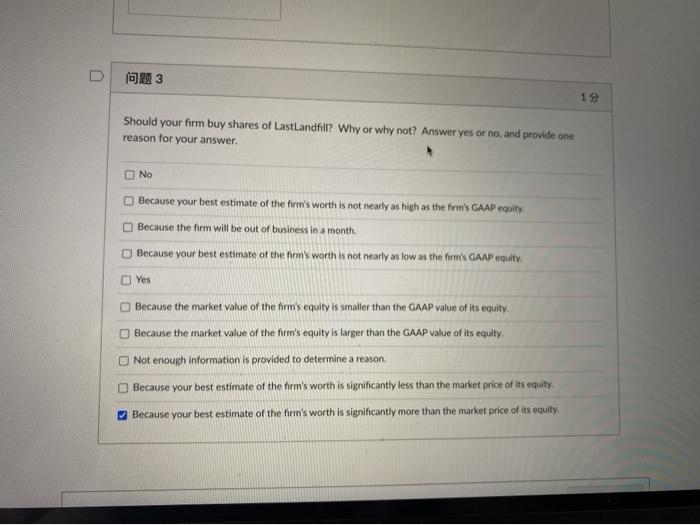

LastLandfill The owners of Lastlandfill Inc. have decided to shut down the firm within one month, because it has no space to receive any more garbage. Accordingly, the firm will sell its assets, pay off its liabilities, and return any leftover cash to its shareholders; then it will forever close down. The firm has 2,000,000 shares outstanding (2MM shares), and the share price (after the decision to shut down has been announced) is $2per share. Here is the firm's most recent Balance Sheet: GAAP Balance Sheet (All numbers in 000 unless otherwise noted. IE: Cash balance - 2,000,000 dollars.) Assets Cash 2,000 AR 4.000 Inventory Net PPE Land 2,000 8,000 3,000 Total Assets 19.000 Liabilities & Equity 2,000 AP Note 3,000 Loan 1,000 Total Liabilities 6.000 Equity 13,000 Your firm asks you to decide whether or not to buy shares of LastLandfill today. To help you, your boss het sommes that the market value of the firmk Inventar about 50 ft CAADaalne nadithe wniamich instructure.com/courses/140124/quizzes/251988/take GAAP Balance Sheet (All numbers in 000 unless otherwise noted. IE: Cash balance - 2.000.000 dollars) Assets Cash 2,000 4,000 AR Inventory Net PPE 2.000 8,000 3,000 Land Total Assets 19.000 Liabilities & Equity AP 2.000 Note 3,000 Loan 1.000 Total Liabilities 6,000 Equity 13,000 Your firm asks you to decide whether or not to buy shares of LastLandfill today. To help you, your boss says to assume that the market value of the firm's Inventory is about 50% of its GAAP value, and the value of the net PPE is 75% of its GAAP value. She says the land cannot be sold because it is full of garbage, and that LastLandfill will have to pay land remediation costs of $1,000K before it shuts down. She believes that the market value of all other Assets is as reported on the Balance Sheet. D 101 15 What is the stock market's estimate of LastLandfill's value to owners? Answer this question in millions of dollars. So for example, the Equity shown on the above GAAP Balance sheet reads 13,000 in units of thousands. If asked for the GAAP equity, the correct answer would be 13. 2 19 Assuming your boss' analysis is correct, what is your estimate of LastLandfill's worth? Answer this question in millions of dollars. So for example, the Equity shown on the above GAAP Balance sheet reads 13,000 in units of thousands. If asked for the GAAP equity, the correct answer would be 13. 19 003 1993 19 Should your firm buy shares of LastLandfill? Why or why not? Answer yes or no, and provide one reason for your answer. No Because your best estimate of the firm's worth is not nearly as high as the firm's GAAP equity Because the firm will be out of business in a month. Because your best estimate of the firm's worth is not nearly as low as the firm's GAAP equity Yes Because the market value of the hrm's equity is smaller than the GAAP value of its equity. D Because the market value of the firm's equity is larger than the GAAP value of its equity, Not enough information is provided to determine a reason Because your best estimate of the firm's worth is significantly less than the market price of its equity Because your best estimate of the firm's worth is significantly more than the market price of its equity LastLandfill The owners of Lastlandfill Inc. have decided to shut down the firm within one month, because it has no space to receive any more garbage. Accordingly, the firm will sell its assets, pay off its liabilities, and return any leftover cash to its shareholders; then it will forever close down. The firm has 2,000,000 shares outstanding (2MM shares), and the share price (after the decision to shut down has been announced) is $2per share. Here is the firm's most recent Balance Sheet: GAAP Balance Sheet (All numbers in 000 unless otherwise noted. IE: Cash balance - 2,000,000 dollars.) Assets Cash 2,000 AR 4.000 Inventory Net PPE Land 2,000 8,000 3,000 Total Assets 19.000 Liabilities & Equity 2,000 AP Note 3,000 Loan 1,000 Total Liabilities 6.000 Equity 13,000 Your firm asks you to decide whether or not to buy shares of LastLandfill today. To help you, your boss het sommes that the market value of the firmk Inventar about 50 ft CAADaalne nadithe wniamich instructure.com/courses/140124/quizzes/251988/take GAAP Balance Sheet (All numbers in 000 unless otherwise noted. IE: Cash balance - 2.000.000 dollars) Assets Cash 2,000 4,000 AR Inventory Net PPE 2.000 8,000 3,000 Land Total Assets 19.000 Liabilities & Equity AP 2.000 Note 3,000 Loan 1.000 Total Liabilities 6,000 Equity 13,000 Your firm asks you to decide whether or not to buy shares of LastLandfill today. To help you, your boss says to assume that the market value of the firm's Inventory is about 50% of its GAAP value, and the value of the net PPE is 75% of its GAAP value. She says the land cannot be sold because it is full of garbage, and that LastLandfill will have to pay land remediation costs of $1,000K before it shuts down. She believes that the market value of all other Assets is as reported on the Balance Sheet. D 101 15 What is the stock market's estimate of LastLandfill's value to owners? Answer this question in millions of dollars. So for example, the Equity shown on the above GAAP Balance sheet reads 13,000 in units of thousands. If asked for the GAAP equity, the correct answer would be 13. 2 19 Assuming your boss' analysis is correct, what is your estimate of LastLandfill's worth? Answer this question in millions of dollars. So for example, the Equity shown on the above GAAP Balance sheet reads 13,000 in units of thousands. If asked for the GAAP equity, the correct answer would be 13. 19 003 1993 19 Should your firm buy shares of LastLandfill? Why or why not? Answer yes or no, and provide one reason for your answer. No Because your best estimate of the firm's worth is not nearly as high as the firm's GAAP equity Because the firm will be out of business in a month. Because your best estimate of the firm's worth is not nearly as low as the firm's GAAP equity Yes Because the market value of the hrm's equity is smaller than the GAAP value of its equity. D Because the market value of the firm's equity is larger than the GAAP value of its equity, Not enough information is provided to determine a reason Because your best estimate of the firm's worth is significantly less than the market price of its equity Because your best estimate of the firm's worth is significantly more than the market price of its equity