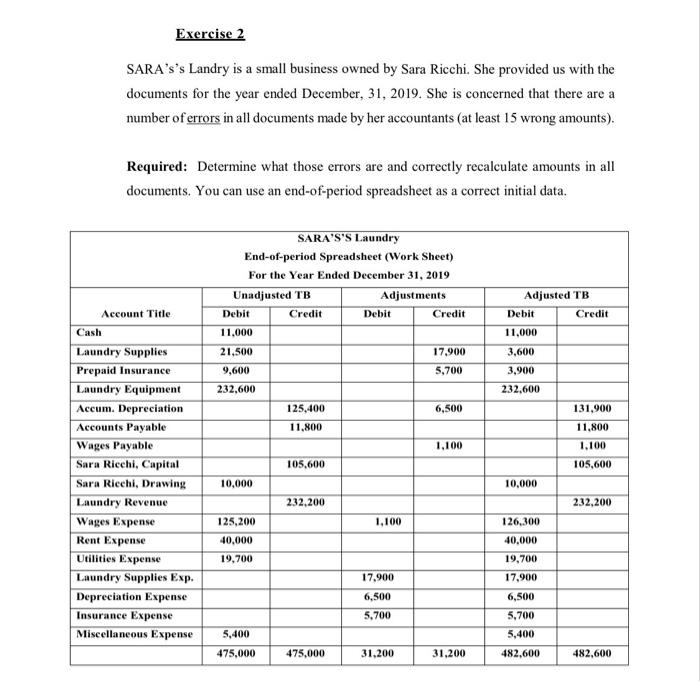

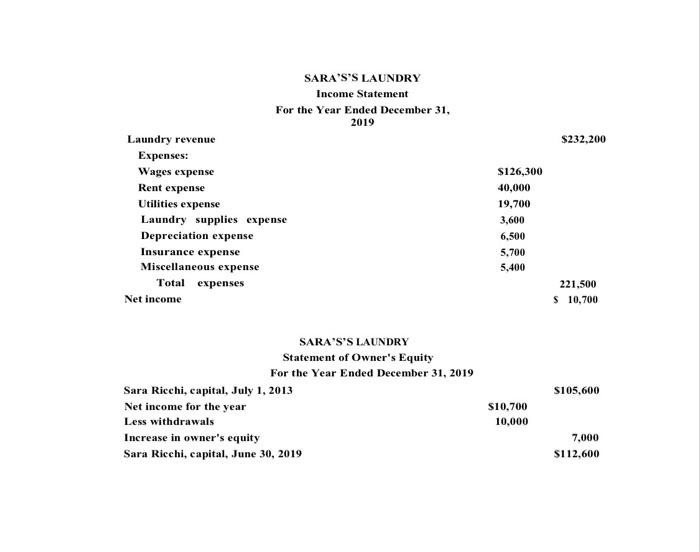

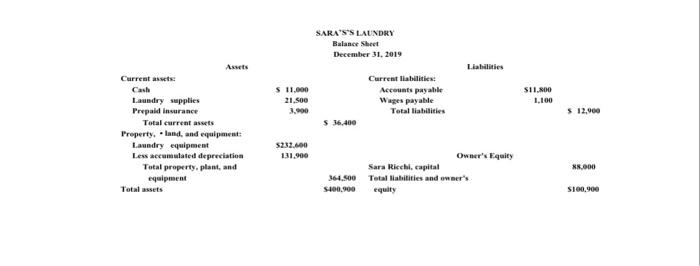

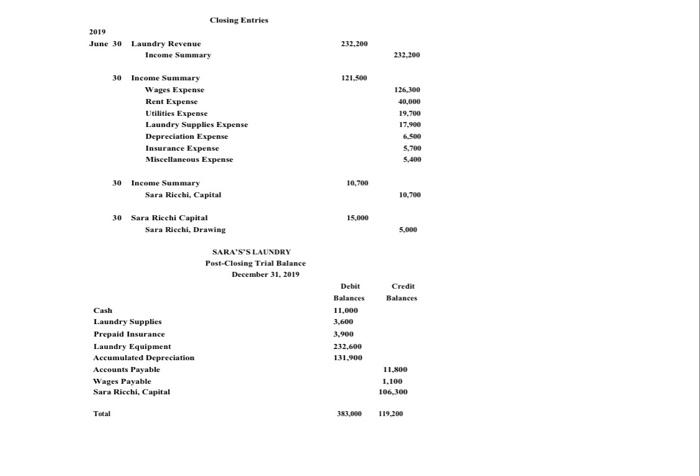

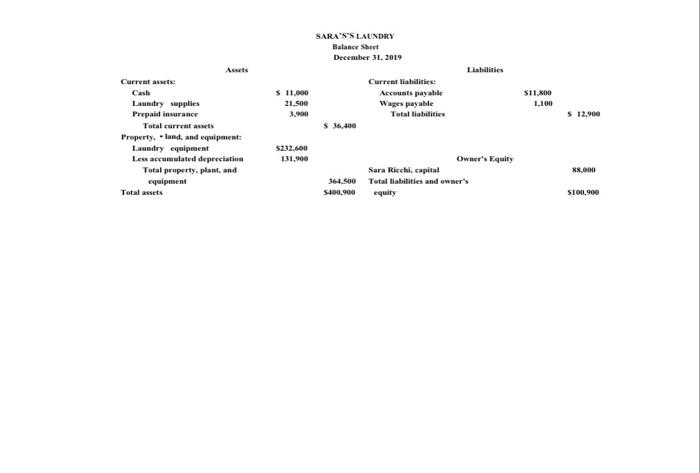

Exercise 2 SARA's's Landry is a small business owned by Sara Ricchi. She provided us with the documents for the year ended December 31, 2019. She is concerned that there are a number of errors in all documents made by her accountants (at least 15 wrong amounts). Required: Determine what those errors are and correctly recalculate amounts in all documents. You can use an end-of-period spreadsheet as a correct initial data. SARA'S'S Laundry End-of-period Spreadsheet (Work Sheet) For the Year Ended December 31, 2019 Unadjusted TB Adjustments Debit Credit Debit Credit 11,000 Account Title Adjusted TB Debit Credit 11,000 3,600 3,900 21,500 9,600 17,900 5,700 232,600 232,600 6,500 131,900 125,400 11.800 11.800 1,100 1.100 105,600 105,600 10,000 10,000 Laundry Supplies Prepaid Insurance Laundry Equipment Accum. Depreciation Accounts Payable Wages Payable Sara Riechi, Capital Sara Riechi, Drawing Laundry Revenue Wages Expense Rent Expense Utilities Expense Laundry Supplies Exp. Depreciation Expense Insurance Expense Miscellaneous Expense 232,200 232,200 1,100 125,200 40,000 19,700 126,300 40,000 19,700 17.900 17,900 6,500 6,500 5,700 5,700 5,400 5,400 475,000 475,000 31,200 31,200 482.600 482,600 S232.200 SARA'S'S LAUNDRY Income Statement For the Year Ended December 31, 2019 Laundry revenue Expenses: Wages expense Rent expense Utilities expense Laundry supplies expense Depreciation expense Insurance expense Miscellaneous expense Total expenses Net income S126,300 40,000 19,700 3,600 6,500 5.700 5.400 221,500 $ 10,700 SARA'S'S LAUNDRY Statement of Owner's Equity For the Year Ended December 31, 2019 Sara Ricchi, capital, July 1, 2013 Net income for the year Less withdrawals Increase in owner's equity Sara Ricchi, capital, June 30, 2019 S105,600 $10,700 10,000 100 $112,600 SARA'SS LAUNDRY Balance Sheet December 31, 2019 Liabilities $ 11.000 21.500 Current liabilities: Accounts payable Wages payable Total liabilities 511.00 1.100 $ 12,900 S 36.400 Current assets Cash Laundry supplies Prepaid insurance Total current assets Property. land, and equipment: Laundry equipment Less accumulated depreciation Total property, plant, and equipment Total assets 5233.000 131.900 *3.000 Owner's Equity Sara Ricchi, capital 364.500 Total Habilities and owner's $400,900 equity S100,900 Closing Entries 2019 June 30 Laundry Revenue Income Summary 232.200 232.200 121.500 30 Income Summary Wages Expense Rent Expense Utilities Expense Laundry Supplies Expense Depreciation Expense Insurance Expense Miscellaneous Expense 126,300 40,000 19,700 17.900 5.700 5.400 10,700 30 Income Summary Sara Ricchi, Capital 10,700 15.000 30 Sara Ricchi Capital Sara Riechi. Drawing 5.000 SARA'S'S LAUNDRY Post-Closing Trial Balance December 31, 2019 Debit Balances 11,000 Credit Balances Cash Laundry Supplies Prepaid Insurance Laundry Equipment Accumulated Depreciation Accounts Payable Wages Payable Sara Ricchi, Capital 3.900 232,600 131.900 11.NO 1.100 106.300 383.000 119.300 SARA'S'S LAUNDRY Balance Sheet December 31, 2019 Liabilities $ 11.000 21.500 Current liabilities: Accounts payable Wages payable Total liabilities $11.00 1.100 $ 12.900 $36,400 Ausets Current are Cash Laundry supplies Prepaid insurance Total current assets Property, land, and equipment: Laundry equipment Les accumulated depreciation Total property, plant, and equipment Total assets 5232.600 131.900 88.000 Owner's Equity Sara Ricchi, capital 364.900 Total Habilities and owner's $400,900 equity S100,900