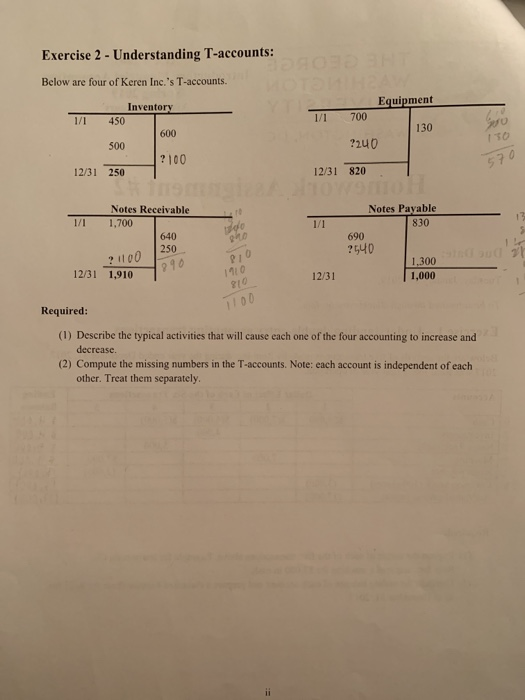

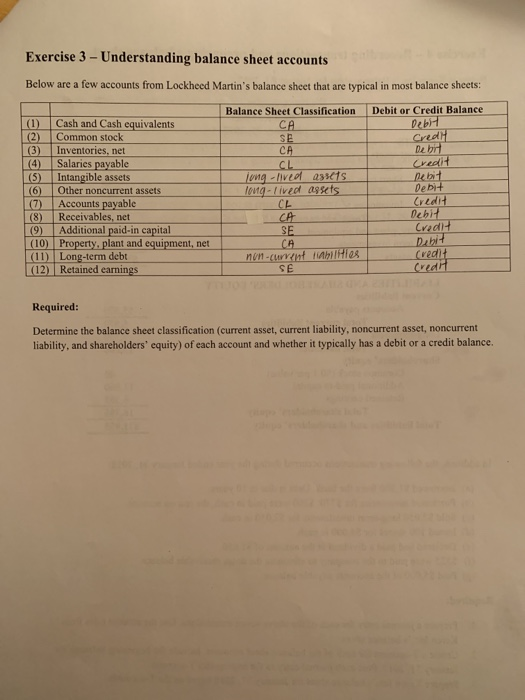

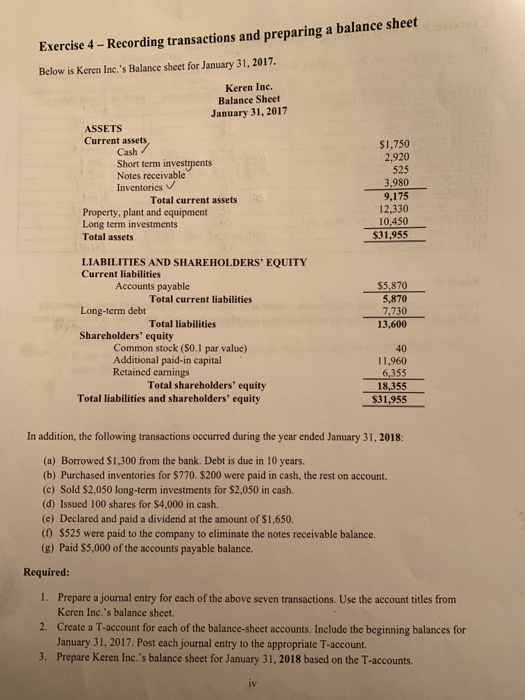

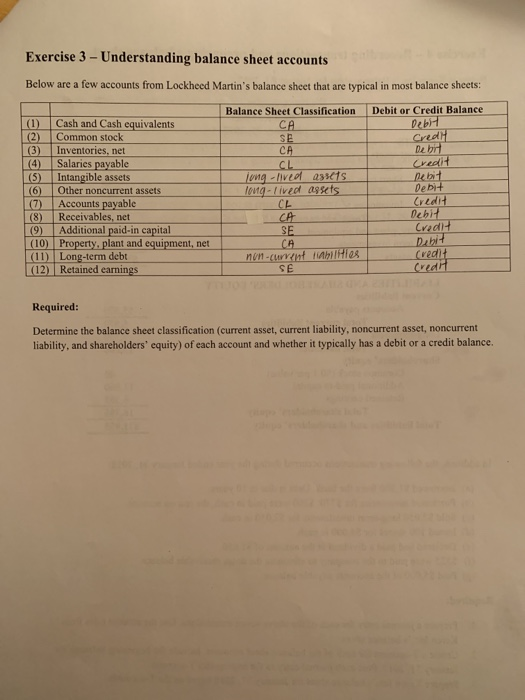

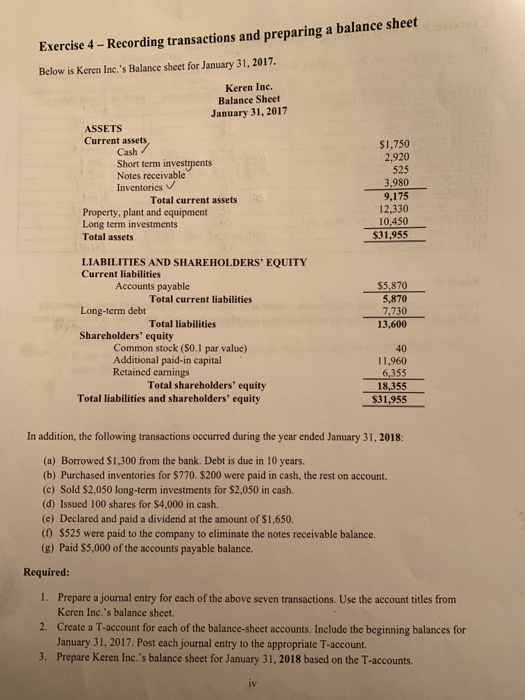

Exercise 2 - Understanding T-accounts: Below are four of Keren Inc.'s T-accounts. Equipment 130 Inventory 1/1 450 1/1 700 500 600 22u0 t ?100 12/31 250 12/31 820 Notes Receivable Notes Payable 1/1 1,700 830 640 690 25,40 21100 250 2 90 12/31 1,910 1,300 1,000 1110 12/31 Required: (1) Describe the typical activities that will cause each one of the four accounting to increase and decrease. (2) Compute the missing numbers in the T-accounts. Note: each account is independent of each other. Treat them separately Exercise 3-Understanding balance sheet accounts Below are a few accounts from Lockheed Martin's balance sheet that are typical in most balance sheets: Balance Sheet Classification Debit or Credit Balance () Cash and Cash equivalents (2) Common stock (3) Inventories, net (4) Salaries payable (5) Intangible assets (6) Other noncurrent assets Deb SE CL ong-Livedt assts Debi Accounts payable CL 8) Receivables, net (9) Additional paid-in capital (10) Property, plant and equipment, net (1) Long-term debt (12) Retained earnings Debi Credi Dabi nin-cwreint iahiliHles SE Required Determine the balance sheet classification (current asset, current liability, noncurrent asset, noncurrent liability, and shareholders equity) of each account and whether it typically has a debit or a credit balance Exercise 4 - Recording transactions and preparing a balance sheet Below is Keren Inc.'s Balance sheet for January 31, 2017. Keren Inc Balance Sheet January 31, 2017 ASSETS Current assets $1,750 2,920 525 3,980 9,175 12,330 10,450 $31,955 Cash Short term investpents Notes receivable Inventories Total current assets Property, plant and equipment Long term investments Total assets LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities $5,870 5,870 7,730 13,600 Accounts payable Total current liabilities Long-term debt Total liabilities Shareholders' equity Common stock (S0.1 par value) Additional paid-in capital Retained carnings 40 11,960 6,355 18,355 S31,955 Total shareholders' equity Total liabilities and shareholders' equity In addition, the following transactions occurred during the year ended January 31, 2018: (a) Borrowed $1,300 from the bank. Debt is due in 10 years. (b) Purchased inventories for $770. $200 were paid in cash, the rest on account (c) Sold $2,050 long-term investments for $2,050 in cash. (d) Issued 100 shares for $4,000 in cash. (e) Declared and paid a dividend at the amount of $1,650. (0 S525 were paid to the company to eliminate the notes receivable balance. (g) Paid S5,000 of the accounts payable balance. Required 1. Prepare a journal entry for each of the above seven transactions. Use the account titles from Keren Inc.'s balance sheet. Create a T-account for each of the balance-sheet accounts. Include the beginning balances for January 31, 2017. Post each journal entry to the appropriate T-account. Prepare Keren Inc.'s balance sheet for January 31, 2018 based on the T-accounts. 2. 3. iV Hands-on Exercise 1. Use the following link to download Google's (Alphabet) 2016 10K report https/labexyzinvestor/pd02016 8oogle annual report.pf 2. Locate Google's balance sheet and answer the following questions: What is Google's largest asset (in dollar value) as of December 31,2016? What does this asset represent? Do you think it is good for Google to hold so much money in such an asset? What is the amount of Google's accounts-payable as of December 31, 2016? Within what time window Google is required to repay this liability? What is the value of Google's retained earnings as of December 31, 2016? a. b. c