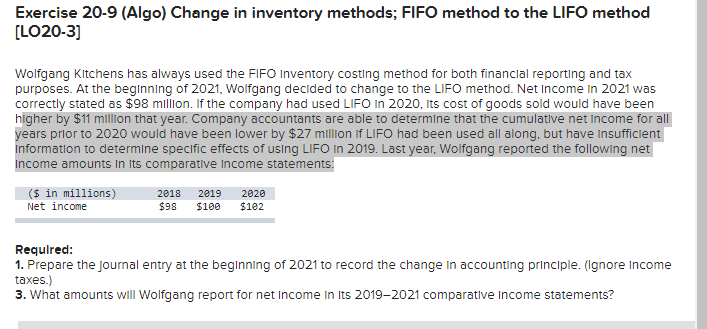

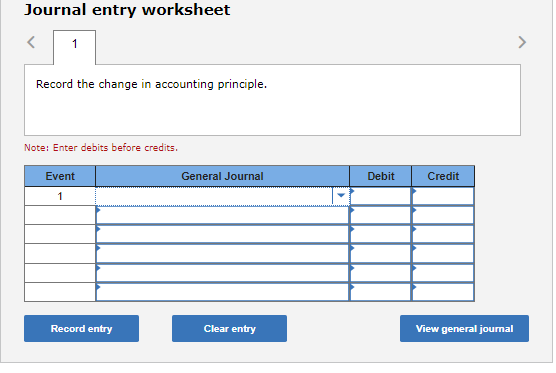

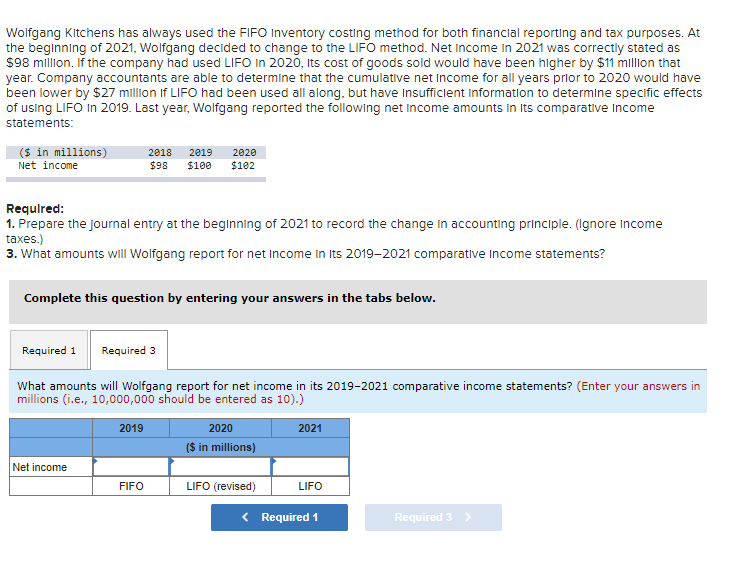

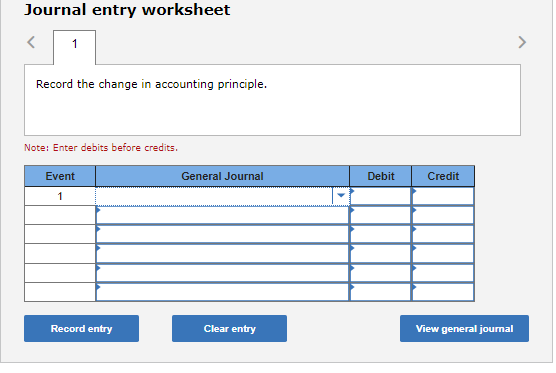

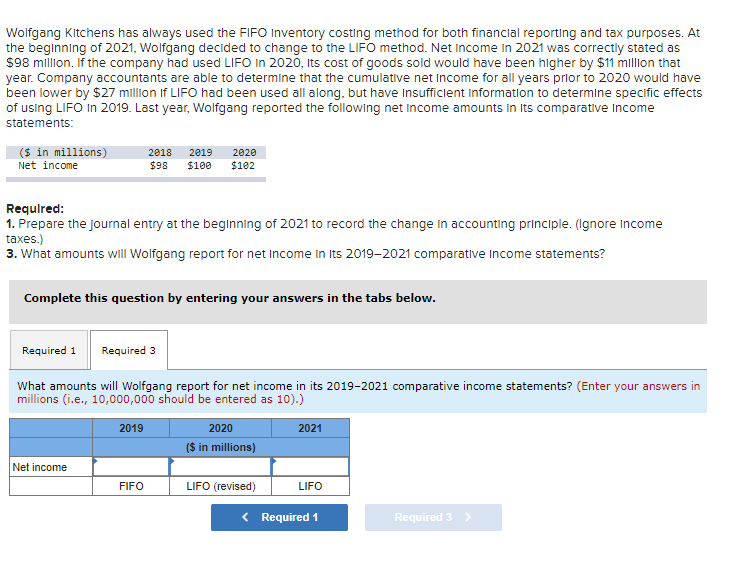

Exercise 20-9 (Algo) Change in inventory methods; FIFO method to the LIFO method [LO203] Wolfgang KItchens has always used the FIFO Inventory costIng method for both financlal reporting and tax purposes. At the begInning of 2021, Wolfgang decided to change to the LIFO method. Net Income In 2021 was correctly stated as $98 million. If the company had used LIFO in 2020, Its cost of goods sold would have been higher by $11 million that year. Company accountants are able to determine that the cumulative net income for all years prior to 2020 would have been lower by $27 million If LIFO had been used all along, but have Insufficlent informatlon to determine speclfic effects of using LIFO in 2019. Last year, Wolfgang reported the following net Income amounts in its comparative income statements: Required: 1. Prepare the journal entry at the beginning of 2021 to record the change in accounting principle. (lgnore income taxes.) 3. What amounts will Wolfgang report for net Income in its 2019-2021 comparative Income statements? Journal entry worksheet Record the change in accounting principle. Note: Enter debits before credits. Wolfgang KItchens has always used the FIFO Inventory costIng method for both financlal reporting and tax purposes. At the beginning of 2021 , Wolfgang decided to change to the LIFO method. Net Income In 2021 was correctly stated as $98 million. If the company had used LIFO In 2020 , Its cost of goods sold would have been higher by $11 million that year. Company accountants are able to determine that the cumulative net Income for all years prior to 2020 would have been lower by $27 million If LIFO had been used all along, but have Insufficlent Information to determine specific effects of using LIFO In 2019. Last year, Wolfgang reported the following net Income amounts in Its comparatlve Income statements: Required: 1. Prepare the journal entry at the beginning of 2021 to record the change in accounting principle. (lgnore Income taxes.) 3. What amounts will Wolfgang report for net Income in Its 2019-2021 comparatlve Income statements? Complete this question by entering your answers in the tabs below. What amounts will Wolfgang report for net income in its 2019-2021 comparative income statements? (Enter your answers in millions (i.e., 10,000,000 should be entered as 10).)