Answered step by step

Verified Expert Solution

Question

1 Approved Answer

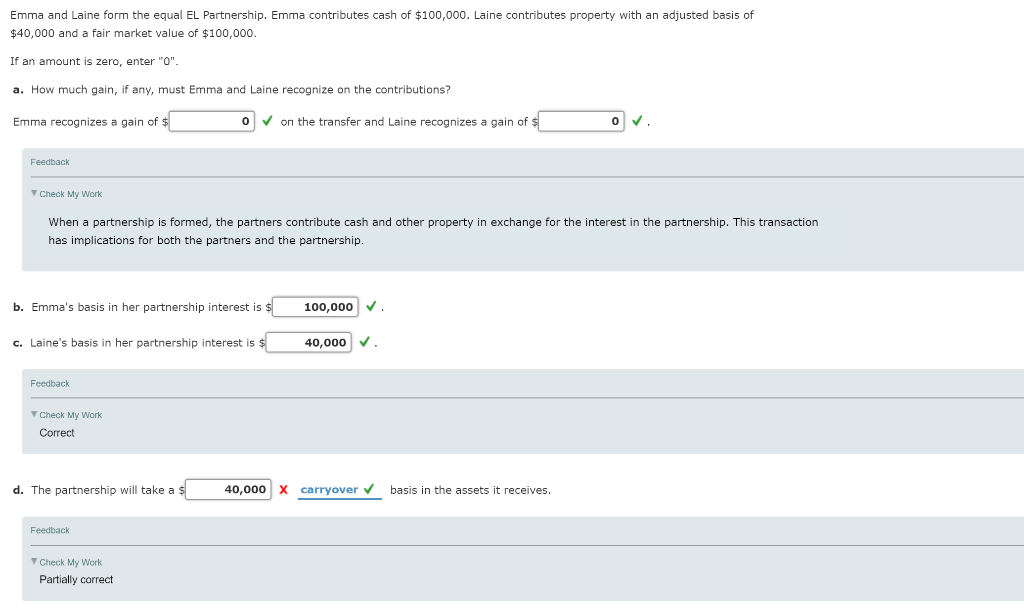

Please help me slove D i have tried $100,000 and $40,000 they are both wrong Emma and Laine form the equal EL Partnership. Emma contributes

Please help me slove D i have tried $100,000 and $40,000 they are both wrong

Emma and Laine form the equal EL Partnership. Emma contributes cash of $100,000. Laine contributes property with an adjusted basis of $40,000 and a fair market value of $100,000. If an amount is zero, enter "0". a. How much gain, if any, must Emma and Laine recognize on the contributions? Emma recognizes a gain of $ 0 on the transfer and Laine recognizes a gain of $ 0 Feedback Check My Work When a partnership is formed, the partners contribute cash and other property in exchange for the interest in the partnership. This transaction has implications for both the partners and the partnership. b. Emma's basis in her partnership interest is $ 100,000 C. Laine's basis in her partnership interest is $ 40,000 Feedback Check My Work Correct d. The partnership will take a $ 40,000 X carryover basis in the assets it receives. Feedback Check My Work Partially correctStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started