Exercise 21A-3 a-g Tamarisk Company leases an automobile with a fair value of $19,465 from John Simon Motors, Inc., on the following terms:

1. Non-cancelable term of 50 months. 2. Rental of $400 per month (at the beginning of each month). (The present value at 0.5% per month is $17,746.) 3. Tamarisk guarantees a residual value of $1,720 (the present value at 0.5% per month is $1,340). Tamarisk expects the probable residual value to be $1,720 at the end of the lease term. 4. Estimated economic life of the automobile is 60 months. 5. Tamarisks incremental borrowing rate is 6% a year (0.5% a month). Simons implicit rate is unknown

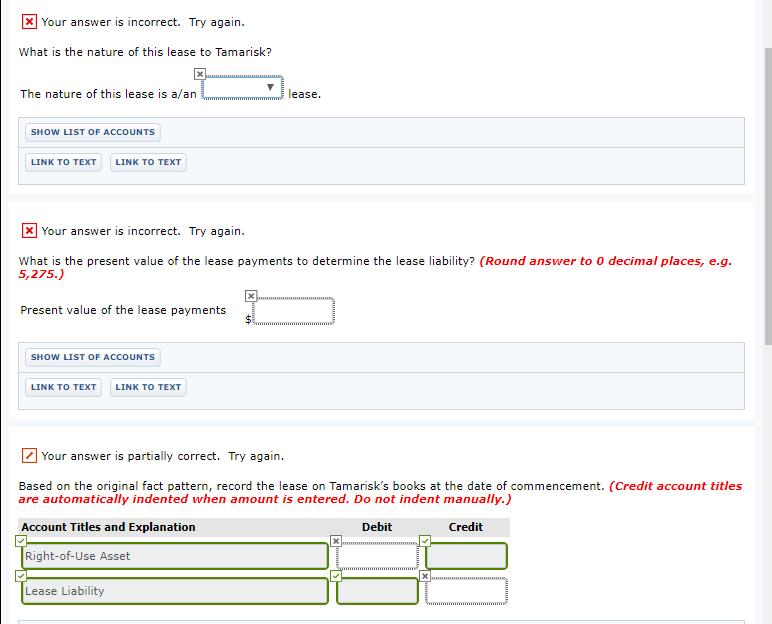

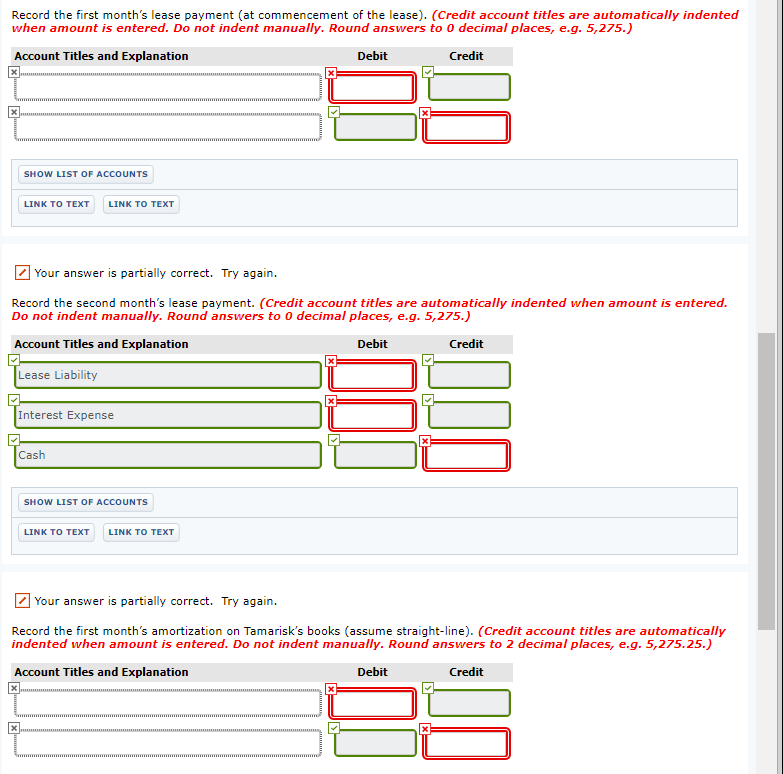

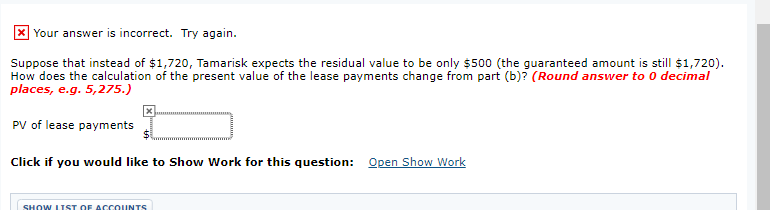

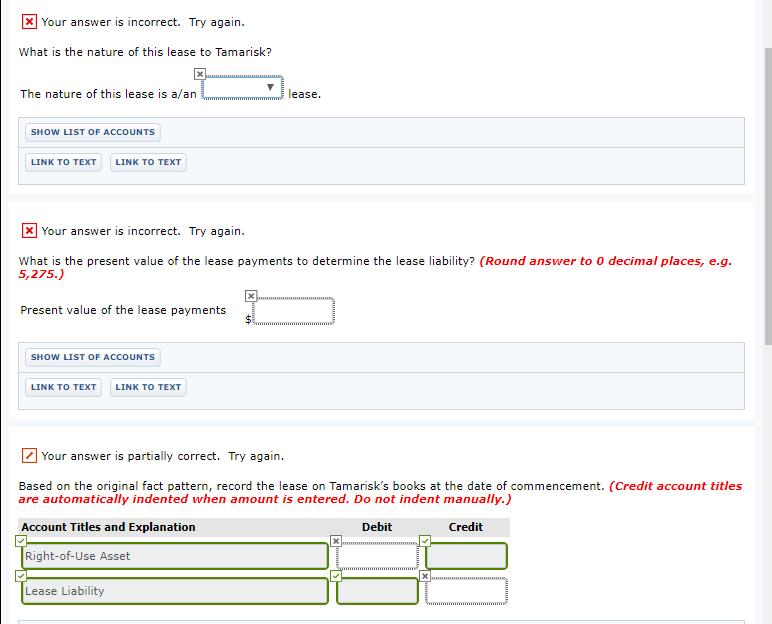

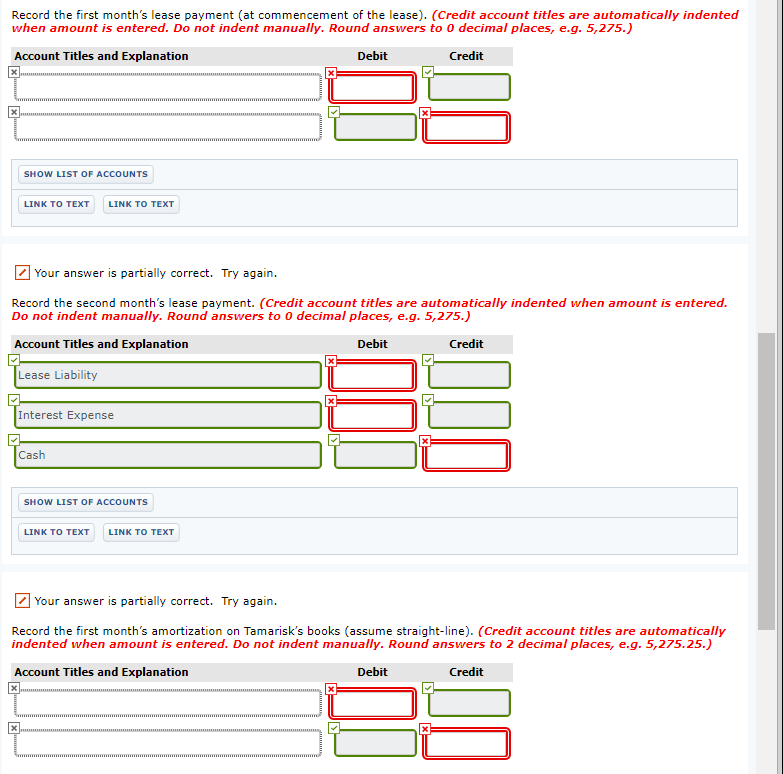

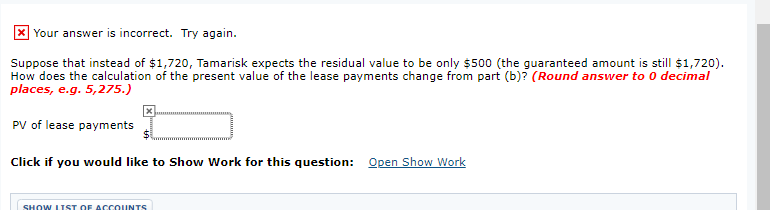

* Your answer is incorrect. Try again. What is the nature of this lease to Tamarisk? The nature of this lease is a/an L lease. SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT x Your answer is incorrect. Try again. What is the present value of the lease payments to determine the lease liability? (Round answer to o decimal places, e.g. 5,275.) Present value of the lease payments SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Your answer is partially correct. Try again. Based on the original fact pattern, record the lease on Tamarisk's books at the date of commencement. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Right-of-Use Asset Lease Liability Record the first month's lease payment (at commencement of the lease). (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to o decimal places, e.g. 5,275.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Your answer is partially correct. Try again. Record the second month's lease payment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to o decimal places, e.g. 5,275.) Account Titles and Explanation Debit Credit Lease Liability Interest Expense Cash SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Your answer is partially correct. Try again. Record the first month's amortization on Tamarisk's books (assume straight-line). (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 5,275.25.) Account Titles and Explanation Debit Credit x your answer is incorrect. Try again. Suppose that instead of $1,720, Tamarisk expects the residual value to be only $500 (the guaranteed amount is still $1,720). How does the calculation of the present value of the lease payments change from part (b)? (Round answer to o decimal places, e.g. 5,275.) X PV of lease payments Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS